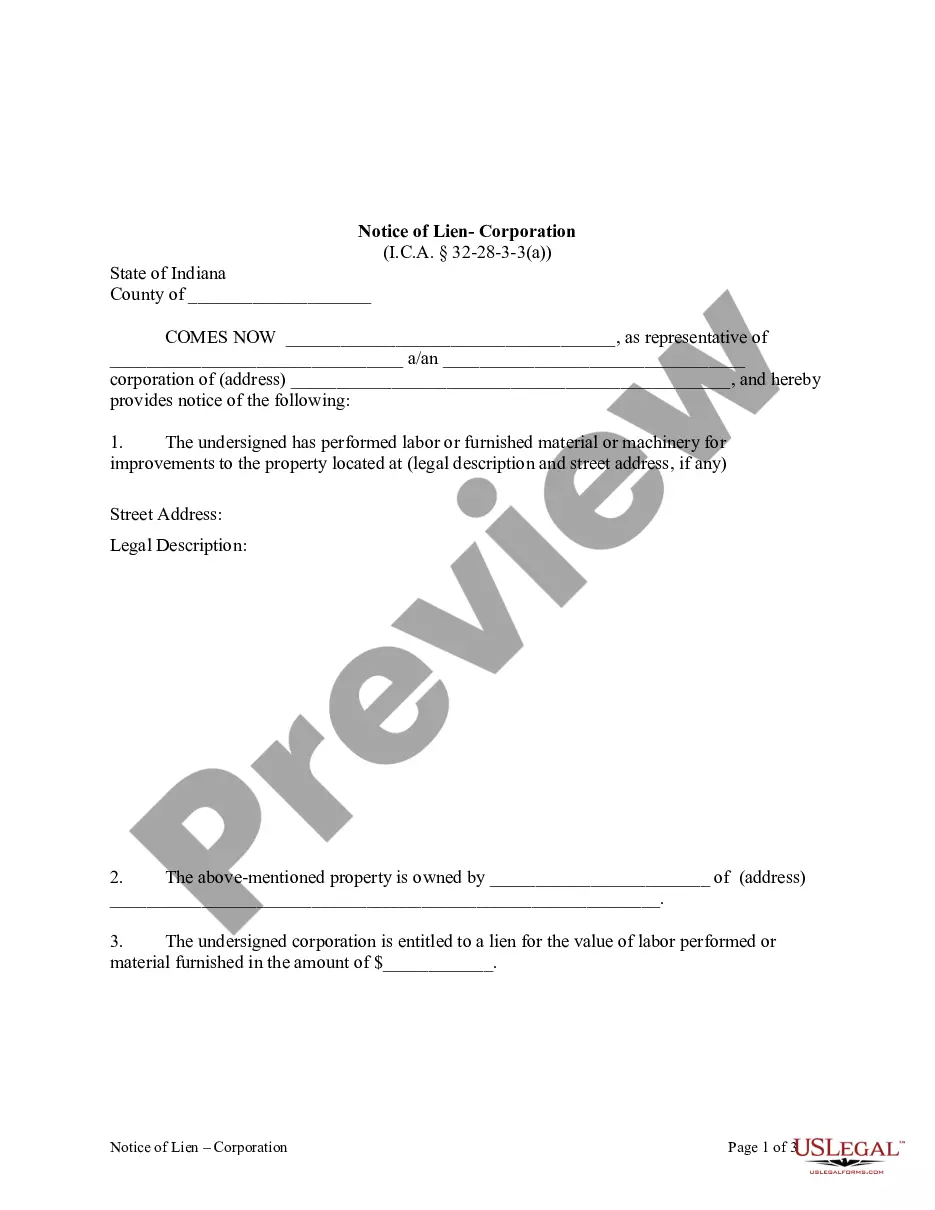

This form is used to officially record a lien. It must be filed in duplicate in the recorder's office within ninety (90) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note that a different form is used for Class 2 structures.

The Indianapolis Indiana Notice of Lien — Corporation or LLC is a legal document that establishes a claim, typically by a creditor, against the assets of a corporation or limited liability company (LLC) located in the city of Indianapolis, Indiana. This notice serves as a formal notification to the public and potential parties interested in doing business with the corporation or LLC that there is an existing debt or obligation. The purpose of the Indianapolis Indiana Notice of Lien — Corporation or LLC is to protect the rights of creditors and ensure that they have a legal claim against the assets of the business entity in the event of default or non-payment. By placing a lien on the corporation or LLC's assets, creditors have a legal stake in the business and may be able to recover their debt through the seizure or sale of these assets. There may be different types of Indianapolis Indiana Notice of Lien — Corporation or LLC that can be filed depending on the nature of the debt or obligation. Some of these types may include: 1. Tax Liens: These are filed by government entities, such as the Internal Revenue Service (IRS) or Indiana Department of Revenue, in cases where the corporation or LLC has failed to pay its taxes. Tax liens have priority over other types of liens and can negatively impact the business's ability to obtain credit or sell its assets. 2. Judgment Liens: These are filed by creditors who have obtained a legal judgment against the corporation or LLC through a court proceeding. Judgment liens can be placed on the business's real estate, personal property, or other assets to secure the debt owed. 3. Mechanic's or Material man's Liens: These are filed by contractors, subcontractors, or suppliers who have not been paid for work or materials provided to the corporation or LLC in construction or improvement projects. Mechanic's or material man's liens can be placed on the specific property that the work or materials were provided for and can result in foreclosure if not satisfied. The Indianapolis Indiana Notice of Lien — Corporation or LLC serves as a public record and is typically filed with the Indiana Secretary of State's office or other relevant county offices where the business is located. It is important for corporations and LCS to be aware of any outstanding liens against their assets as it may affect their ability to borrow funds, transfer or sell assets, or engage in other business transactions.The Indianapolis Indiana Notice of Lien — Corporation or LLC is a legal document that establishes a claim, typically by a creditor, against the assets of a corporation or limited liability company (LLC) located in the city of Indianapolis, Indiana. This notice serves as a formal notification to the public and potential parties interested in doing business with the corporation or LLC that there is an existing debt or obligation. The purpose of the Indianapolis Indiana Notice of Lien — Corporation or LLC is to protect the rights of creditors and ensure that they have a legal claim against the assets of the business entity in the event of default or non-payment. By placing a lien on the corporation or LLC's assets, creditors have a legal stake in the business and may be able to recover their debt through the seizure or sale of these assets. There may be different types of Indianapolis Indiana Notice of Lien — Corporation or LLC that can be filed depending on the nature of the debt or obligation. Some of these types may include: 1. Tax Liens: These are filed by government entities, such as the Internal Revenue Service (IRS) or Indiana Department of Revenue, in cases where the corporation or LLC has failed to pay its taxes. Tax liens have priority over other types of liens and can negatively impact the business's ability to obtain credit or sell its assets. 2. Judgment Liens: These are filed by creditors who have obtained a legal judgment against the corporation or LLC through a court proceeding. Judgment liens can be placed on the business's real estate, personal property, or other assets to secure the debt owed. 3. Mechanic's or Material man's Liens: These are filed by contractors, subcontractors, or suppliers who have not been paid for work or materials provided to the corporation or LLC in construction or improvement projects. Mechanic's or material man's liens can be placed on the specific property that the work or materials were provided for and can result in foreclosure if not satisfied. The Indianapolis Indiana Notice of Lien — Corporation or LLC serves as a public record and is typically filed with the Indiana Secretary of State's office or other relevant county offices where the business is located. It is important for corporations and LCS to be aware of any outstanding liens against their assets as it may affect their ability to borrow funds, transfer or sell assets, or engage in other business transactions.