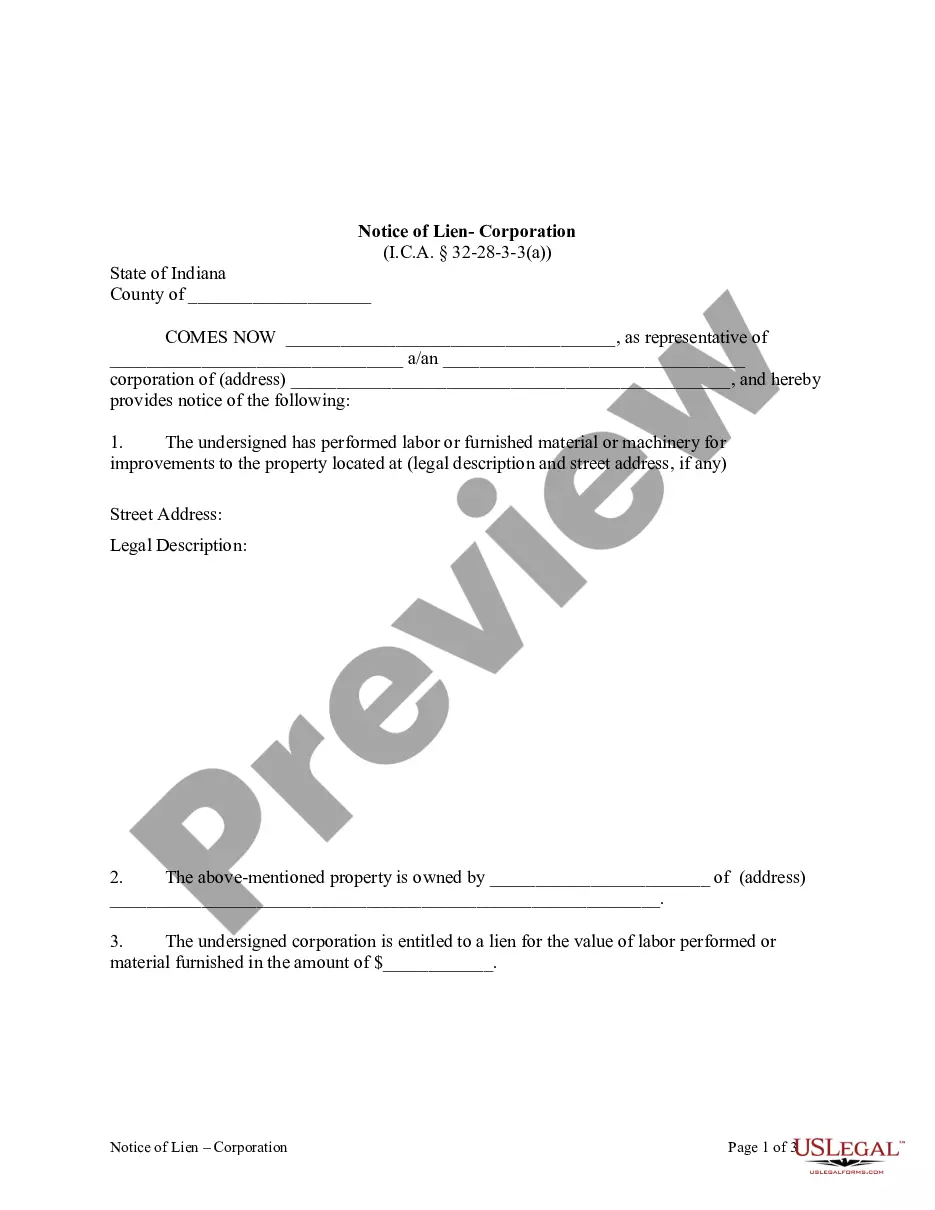

This form is used to officially record a lien. It must be filed in duplicate in the recorder's office within ninety (90) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note that a different form is used for Class 2 structures.

Title: Understanding the South Bend Indiana Notice of Lien — Corporation or LLC Introduction: In South Bend, Indiana, if a corporation or limited liability company (LLC) fails to meet its financial obligations, a Notice of Lien may be filed against the entity. This legal document serves as a public notice to potential creditors, informing them of a lien placed on the assets of the corporation or LLC. This article will provide a detailed description of the South Bend Indiana Notice of Lien — Corporation or LLC, its purpose, and different types that may apply. Key Points: 1. What is a Notice of Lien: A Notice of Lien is a legal document filed by a creditor to assert their right to claim the debtor entity's assets as collateral for unpaid debts or obligations. It is a crucial step for creditors to protect their interests and ensure they will be compensated. 2. Purpose of the Notice of Lien: The primary goal of filing a Notice of Lien is to alert other potential creditors of the existing lien, thereby preventing the debtor corporation or LLC from obtaining additional loans, credit, or financing until the lien is satisfied. It serves as a warning that any assets the debtor entity may dispose of will still be subject to the lien holder's claim. 3. Filing a Notice of Lien — Corporation or LLC: To file a Notice of Lien against a corporation or LLC in South Bend, Indiana, the creditor must submit a completed lien form to the appropriate government entity, usually the County Recorder's Office. The form must include the debtor entity's legal name, address, tax identification number (TIN), and the amount owed. 4. Different Types of South Bend Indiana Notice of Lien — Corporation or LLC: a) General Lien: This is the most common type of lien, which encompasses all the debtor's current and future assets. It is filed when the creditor is uncertain of the specific assets they may need to claim to satisfy the debt. b) Specific Lien: A specific lien is filed when the creditor specifically identifies certain assets that will be subject to the lien. This type of lien is often used when the debtor entity owns substantial assets that can be easily identified and separated. c) Tax Lien: When a corporation or LLC fails to fulfill its tax obligations, the government may file a tax lien against the entity's assets. This lien gives the government priority in recovering the unpaid taxes from the debtor's assets. Conclusion: The South Bend Indiana Notice of Lien — Corporation or LLC is a vital legal document that protects the interests of creditors by notifying them of a debtor entity's outstanding obligations. By filing a Notice of Lien, creditors can ensure that any assets owned by the debtor entity will remain encumbered until the lien is resolved. Understanding the different types of liens, such as general, specific, and tax liens, is essential for both creditors and debtors operating in South Bend, Indiana.Title: Understanding the South Bend Indiana Notice of Lien — Corporation or LLC Introduction: In South Bend, Indiana, if a corporation or limited liability company (LLC) fails to meet its financial obligations, a Notice of Lien may be filed against the entity. This legal document serves as a public notice to potential creditors, informing them of a lien placed on the assets of the corporation or LLC. This article will provide a detailed description of the South Bend Indiana Notice of Lien — Corporation or LLC, its purpose, and different types that may apply. Key Points: 1. What is a Notice of Lien: A Notice of Lien is a legal document filed by a creditor to assert their right to claim the debtor entity's assets as collateral for unpaid debts or obligations. It is a crucial step for creditors to protect their interests and ensure they will be compensated. 2. Purpose of the Notice of Lien: The primary goal of filing a Notice of Lien is to alert other potential creditors of the existing lien, thereby preventing the debtor corporation or LLC from obtaining additional loans, credit, or financing until the lien is satisfied. It serves as a warning that any assets the debtor entity may dispose of will still be subject to the lien holder's claim. 3. Filing a Notice of Lien — Corporation or LLC: To file a Notice of Lien against a corporation or LLC in South Bend, Indiana, the creditor must submit a completed lien form to the appropriate government entity, usually the County Recorder's Office. The form must include the debtor entity's legal name, address, tax identification number (TIN), and the amount owed. 4. Different Types of South Bend Indiana Notice of Lien — Corporation or LLC: a) General Lien: This is the most common type of lien, which encompasses all the debtor's current and future assets. It is filed when the creditor is uncertain of the specific assets they may need to claim to satisfy the debt. b) Specific Lien: A specific lien is filed when the creditor specifically identifies certain assets that will be subject to the lien. This type of lien is often used when the debtor entity owns substantial assets that can be easily identified and separated. c) Tax Lien: When a corporation or LLC fails to fulfill its tax obligations, the government may file a tax lien against the entity's assets. This lien gives the government priority in recovering the unpaid taxes from the debtor's assets. Conclusion: The South Bend Indiana Notice of Lien — Corporation or LLC is a vital legal document that protects the interests of creditors by notifying them of a debtor entity's outstanding obligations. By filing a Notice of Lien, creditors can ensure that any assets owned by the debtor entity will remain encumbered until the lien is resolved. Understanding the different types of liens, such as general, specific, and tax liens, is essential for both creditors and debtors operating in South Bend, Indiana.