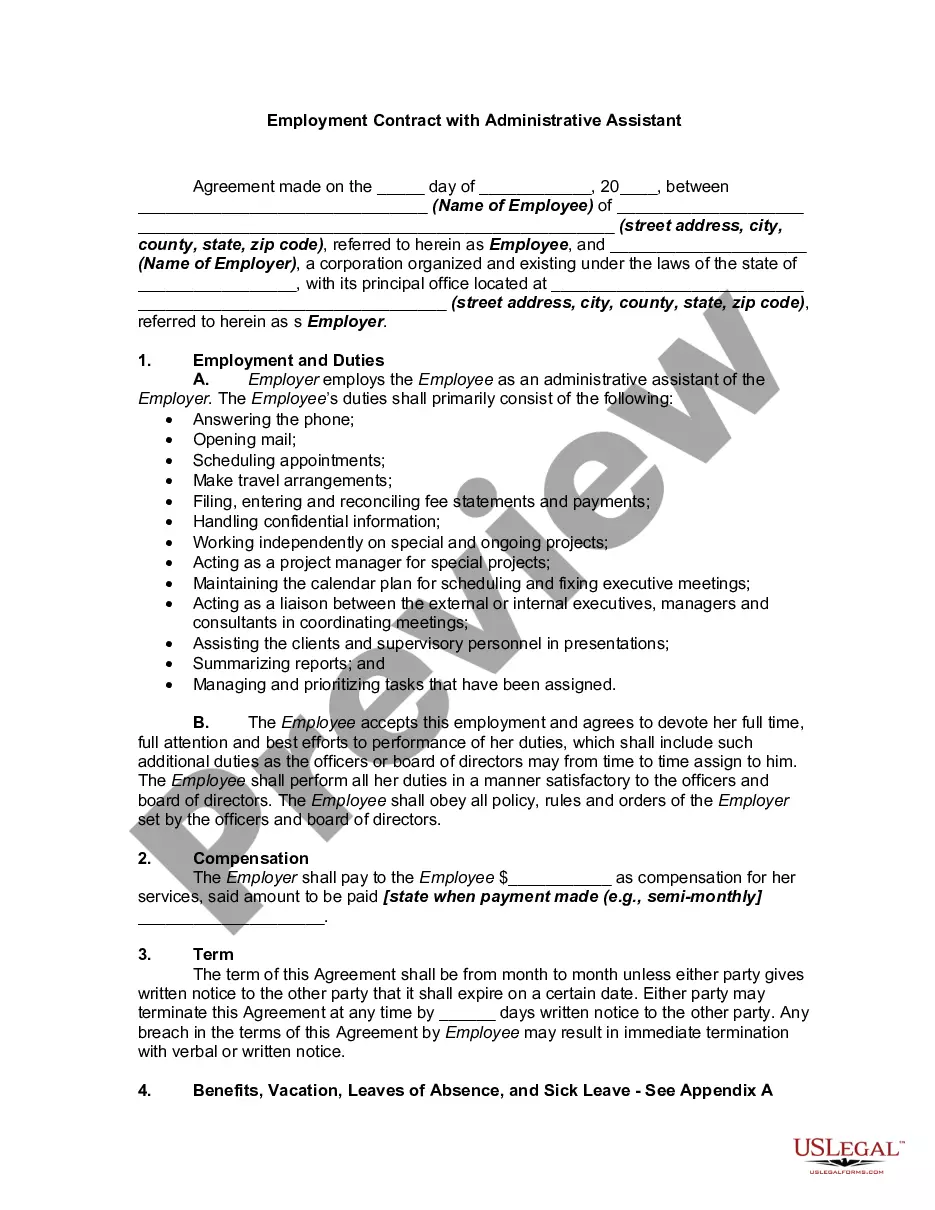

Title: Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: A Comprehensive Guide Introduction: In Carmel, Indiana, individuals seeking exemption from filing an inheritance tax return have the option to petition for a waiver. This article provides an in-depth overview of the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return, explaining its purpose, process, eligibility criteria, and potential variations. 1. What is the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return? The Carmel Indiana Petition to Waive Filing of Inheritance Tax Return is a legal document that allows eligible beneficiaries or heirs to request an exemption from filing an inheritance tax return with the appropriate tax authorities. This petition aims to alleviate the administrative burden associated with the inheritance tax process for qualifying individuals. 2. Process of Filing a Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: a. Determine eligibility: Before filing a petition, it is important to verify if you meet the eligibility criteria set by the state of Indiana. b. Gather required documents: Prepare all necessary documentation, such as the death certificate, the will, relevant financial records, and any other supporting documents. c. Complete the petition form: Obtain the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return form, available either online or from the Indiana Department of Revenue. d. Submit the petition: File the completed petition with the appropriate tax authorities within the designated time frame. e. Await a decision: The tax authorities will review the petition and communicate their decision regarding the waiver request. 3. Eligibility Criteria for Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: To qualify for the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return, specific eligibility conditions must be met. These criteria may include but are not limited to: — Relationship to the deceased: Typically limited to certain family members or beneficiaries. — Value threshold: The total value of the assets inherited. — Statutory requirements: Meeting all required legal obligations. 4. Different Types of Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: a. General Petition: This is the standard petition filed by eligible individuals seeking an exemption from filing an inheritance tax return based on the established criteria. b. Conditional Petition: In certain exceptional cases where specific conditions are met, a conditional petition may be filed, allowing the waiver request to be considered differently by the tax authorities. c. Amended Petition: If new information or circumstances arise after the submission of the initial petition, individuals may need to file an amended petition to reflect these changes or updates in their waiver request. Conclusion: The Carmel Indiana Petition to Waive Filing of Inheritance Tax Return offers eligible individuals a process to request an exemption from filing an inheritance tax return to Carmel, Indiana. Understanding the purpose, eligibility criteria, and potential variations of this petition is crucial for those who wish to navigate the inheritance tax process efficiently and effectively. Always consult with legal and tax professionals for personalized information and guidance tailored to your specific situation.

Carmel Indiana Petition to Waive Filing of Inheritance Tax Return

State:

Indiana

City:

Carmel

Control #:

IN-043LCRS

Format:

Word;

Rich Text

Instant download

Public form

Description

An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated obligations.

Title: Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: A Comprehensive Guide Introduction: In Carmel, Indiana, individuals seeking exemption from filing an inheritance tax return have the option to petition for a waiver. This article provides an in-depth overview of the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return, explaining its purpose, process, eligibility criteria, and potential variations. 1. What is the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return? The Carmel Indiana Petition to Waive Filing of Inheritance Tax Return is a legal document that allows eligible beneficiaries or heirs to request an exemption from filing an inheritance tax return with the appropriate tax authorities. This petition aims to alleviate the administrative burden associated with the inheritance tax process for qualifying individuals. 2. Process of Filing a Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: a. Determine eligibility: Before filing a petition, it is important to verify if you meet the eligibility criteria set by the state of Indiana. b. Gather required documents: Prepare all necessary documentation, such as the death certificate, the will, relevant financial records, and any other supporting documents. c. Complete the petition form: Obtain the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return form, available either online or from the Indiana Department of Revenue. d. Submit the petition: File the completed petition with the appropriate tax authorities within the designated time frame. e. Await a decision: The tax authorities will review the petition and communicate their decision regarding the waiver request. 3. Eligibility Criteria for Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: To qualify for the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return, specific eligibility conditions must be met. These criteria may include but are not limited to: — Relationship to the deceased: Typically limited to certain family members or beneficiaries. — Value threshold: The total value of the assets inherited. — Statutory requirements: Meeting all required legal obligations. 4. Different Types of Carmel Indiana Petition to Waive Filing of Inheritance Tax Return: a. General Petition: This is the standard petition filed by eligible individuals seeking an exemption from filing an inheritance tax return based on the established criteria. b. Conditional Petition: In certain exceptional cases where specific conditions are met, a conditional petition may be filed, allowing the waiver request to be considered differently by the tax authorities. c. Amended Petition: If new information or circumstances arise after the submission of the initial petition, individuals may need to file an amended petition to reflect these changes or updates in their waiver request. Conclusion: The Carmel Indiana Petition to Waive Filing of Inheritance Tax Return offers eligible individuals a process to request an exemption from filing an inheritance tax return to Carmel, Indiana. Understanding the purpose, eligibility criteria, and potential variations of this petition is crucial for those who wish to navigate the inheritance tax process efficiently and effectively. Always consult with legal and tax professionals for personalized information and guidance tailored to your specific situation.

How to fill out Carmel Indiana Petition To Waive Filing Of Inheritance Tax Return?

If you’ve already used our service before, log in to your account and save the Carmel Indiana Petition to Waive Filing of Inheritance Tax Return on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Carmel Indiana Petition to Waive Filing of Inheritance Tax Return. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!