Title: Simplifying the South Bend Indiana Petition to Waive Filing of Inheritance Tax Return Introduction: The South Bend Indiana Petition to Waive Filing of Inheritance Tax Return is an important legal process that allows eligible individuals to request an exemption from filing an inheritance tax return. This article aims to provide an overview of this petition, its purpose, requirements, and any different types that may exist. 1. Understanding the South Bend Indiana Petition to Waive Filing of Inheritance Tax Return: The South Bend Indiana Petition to Waive Filing of Inheritance Tax Return is a formal request made by eligible individuals to seek relief from the mandatory filing of an inheritance tax return. This petition acknowledges certain circumstances under which the estate's executor or personal representative may be exempted from submitting the usual tax documentation. 2. Eligibility Criteria: a. Immediate Family Petition: This type of waiver petition applies to the immediate family members of the deceased, such as spouses, children, stepchildren, and parents. It is designed to alleviate the burden of inheritance tax reporting for those who have close ties to the estate. b. Low-Value Estate Petition: If the value of the deceased's estate falls below a certain threshold, individuals may qualify for this type of petition. The exact threshold may vary based on current state laws and guidelines. 3. Process and Requirements: a. Completing the Petition: Individuals seeking to waive the filing of an inheritance tax return to South Bend Indiana must file a formal petition with the relevant probate court. The document should include specific details about the nature of the exemption sought, relationship to the deceased, and supporting evidence to justify the request. b. Supporting Documents: Along with the petition, applicants may be required to provide additional documentation such as death certificates, proof of relationship, and financial statements to substantiate the eligibility criteria. c. Legal Assistance: While not mandatory, individuals may choose to seek professional legal counsel to understand the process thoroughly and ensure accurate completion of the petition and accompanying documents. 4. Review and Decision: Upon submission, the court will review the petition, evaluate the provided evidence, and make a decision based on the eligibility criteria and state laws. It is essential to allow sufficient time for the court to review the petition thoroughly and consider any necessary hearings or additional clarifications. Conclusion: The South Bend Indiana Petition to Waive Filing of Inheritance Tax Return serves as a valuable mechanism for simplifying the tax reporting process for eligible individuals, such as immediate family members and those with low-value estates. By understanding the petition's purpose, requirements, and possible variations, individuals can navigate this legal process with more confidence, potentially saving time, effort, and resources associated with filing inheritance tax returns.

South Bend Indiana Petition to Waive Filing of Inheritance Tax Return

Description

How to fill out South Bend Indiana Petition To Waive Filing Of Inheritance Tax Return?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone with no law education to draft this sort of paperwork from scratch, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the South Bend Indiana Petition to Waive Filing of Inheritance Tax Return or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the South Bend Indiana Petition to Waive Filing of Inheritance Tax Return quickly using our reliable platform. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the South Bend Indiana Petition to Waive Filing of Inheritance Tax Return:

- Ensure the form you have chosen is specific to your location since the rules of one state or area do not work for another state or area.

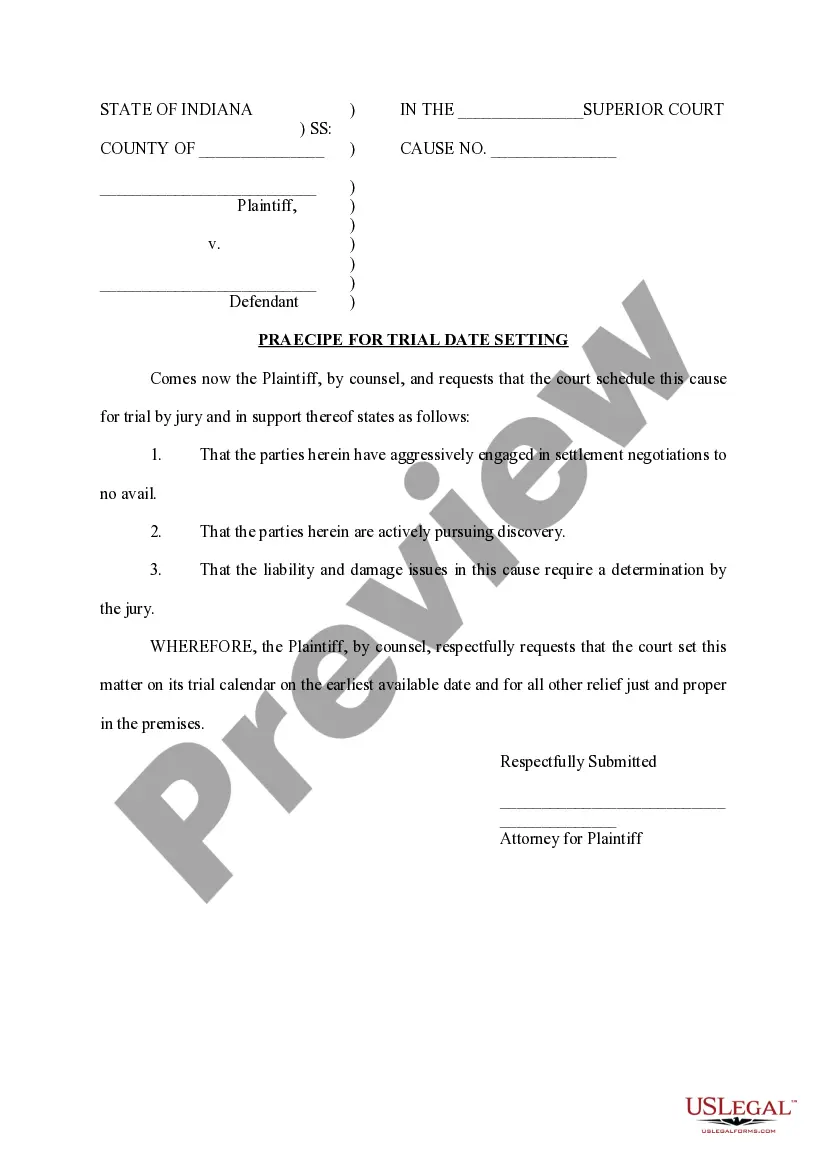

- Preview the document and read a quick outline (if available) of cases the paper can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Choose the payment method and proceed to download the South Bend Indiana Petition to Waive Filing of Inheritance Tax Return once the payment is through.

You’re good to go! Now you can go ahead and print out the document or fill it out online. Should you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.