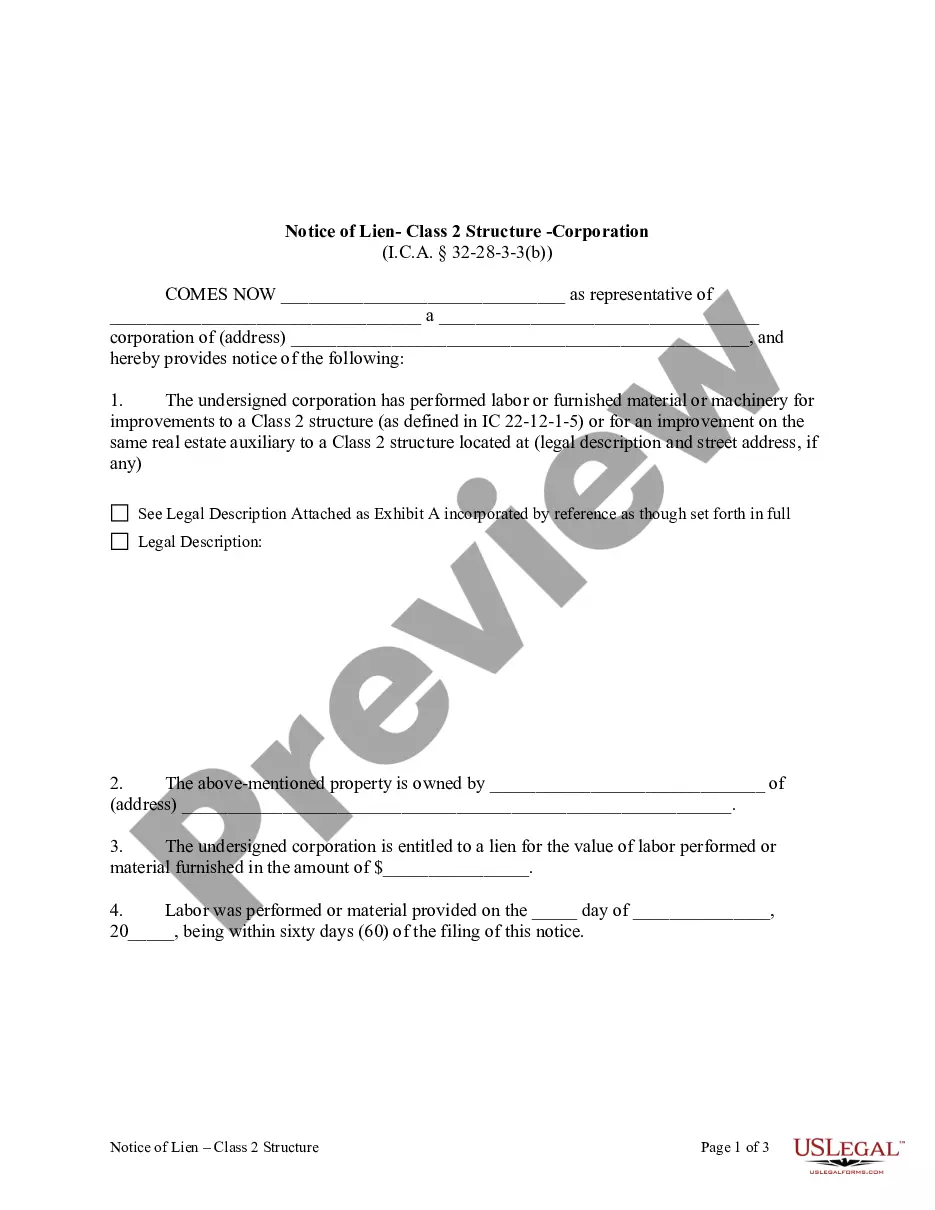

This form is used to officially record a lien for labor or materials supplied towards a class 2 structure as defined by (IC 22-12-1-5). It must be filed in duplicate in the recorder's office within ninety (60) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note this form is used for Class 2 structures.

Evansville Indiana Notice of Lien — ClasStructureur— - Corporation or LLC is a legal document that indicates a lien placed on a Class 2 structure owned by a Corporation or Limited Liability Company (LLC) in the city of Evansville, Indiana. This notice serves as a public record and is typically filed with the county recorder's office to establish a creditor's claim against the property. When a Corporation or LLC fails to fulfill its financial obligations, such as outstanding debts, taxes, fines, or contractual agreements, a lien may be placed on its Class 2 structure. A Class 2 structure refers to any commercial property owned by a Corporation or LLC, including office buildings, warehouses, retail spaces, factories, or other commercial facilities. The Evansville Indiana Notice of Lien is important as it protects the rights of the creditor and provides notice to other interested parties, such as potential buyers or lenders, about the existence of the lien. This notice helps to ensure that the debt owed by the Corporation or LLC is not overlooked or ignored, and that appropriate actions can be taken to resolve the outstanding obligations. Different types of Evansville Indiana Notice of Lien — ClasStructureur— - Corporation or LLC may include: 1. Tax Lien: This type of lien is imposed by the government when a Corporation or LLC fails to pay its taxes. It can include unpaid federal, state, or local taxes and must be satisfied before the title of the property can be transferred. 2. Contractor's Lien: If a Corporation or LLC fails to pay a contractor or subcontractor for work performed on the Class 2 structure, the contractor may file a lien to claim a portion of the property's value equal to the unpaid amount. This type of lien ensures that construction professionals are paid for their services. 3. Judgment Lien: When a Corporation or LLC loses a lawsuit and is ordered to pay a monetary judgment, a lien may be placed on the Class 2 structure to secure the payment. This lien ensures that the judgment creditor has a legal claim against the property. 4. Mechanics' Lien: If a Corporation or LLC fails to pay suppliers of goods, materials, or equipment used in construction or repair work on the Class 2 structure, those suppliers may file a mechanics' lien. This lien allows them to claim a portion of the property's value equal to the unpaid amount. It's important for businesses operating as Corporations or LCS in Evansville, Indiana to be aware of the Notice of Lien process, especially when dealing with Class 2 structures. By understanding the different types of liens that can be imposed and the potential consequences, businesses can take proactive measures to avoid disputes and protect their property rights.

Evansville Indiana Notice of Lien — ClasStructureur— - Corporation or LLC is a legal document that indicates a lien placed on a Class 2 structure owned by a Corporation or Limited Liability Company (LLC) in the city of Evansville, Indiana. This notice serves as a public record and is typically filed with the county recorder's office to establish a creditor's claim against the property. When a Corporation or LLC fails to fulfill its financial obligations, such as outstanding debts, taxes, fines, or contractual agreements, a lien may be placed on its Class 2 structure. A Class 2 structure refers to any commercial property owned by a Corporation or LLC, including office buildings, warehouses, retail spaces, factories, or other commercial facilities. The Evansville Indiana Notice of Lien is important as it protects the rights of the creditor and provides notice to other interested parties, such as potential buyers or lenders, about the existence of the lien. This notice helps to ensure that the debt owed by the Corporation or LLC is not overlooked or ignored, and that appropriate actions can be taken to resolve the outstanding obligations. Different types of Evansville Indiana Notice of Lien — ClasStructureur— - Corporation or LLC may include: 1. Tax Lien: This type of lien is imposed by the government when a Corporation or LLC fails to pay its taxes. It can include unpaid federal, state, or local taxes and must be satisfied before the title of the property can be transferred. 2. Contractor's Lien: If a Corporation or LLC fails to pay a contractor or subcontractor for work performed on the Class 2 structure, the contractor may file a lien to claim a portion of the property's value equal to the unpaid amount. This type of lien ensures that construction professionals are paid for their services. 3. Judgment Lien: When a Corporation or LLC loses a lawsuit and is ordered to pay a monetary judgment, a lien may be placed on the Class 2 structure to secure the payment. This lien ensures that the judgment creditor has a legal claim against the property. 4. Mechanics' Lien: If a Corporation or LLC fails to pay suppliers of goods, materials, or equipment used in construction or repair work on the Class 2 structure, those suppliers may file a mechanics' lien. This lien allows them to claim a portion of the property's value equal to the unpaid amount. It's important for businesses operating as Corporations or LCS in Evansville, Indiana to be aware of the Notice of Lien process, especially when dealing with Class 2 structures. By understanding the different types of liens that can be imposed and the potential consequences, businesses can take proactive measures to avoid disputes and protect their property rights.