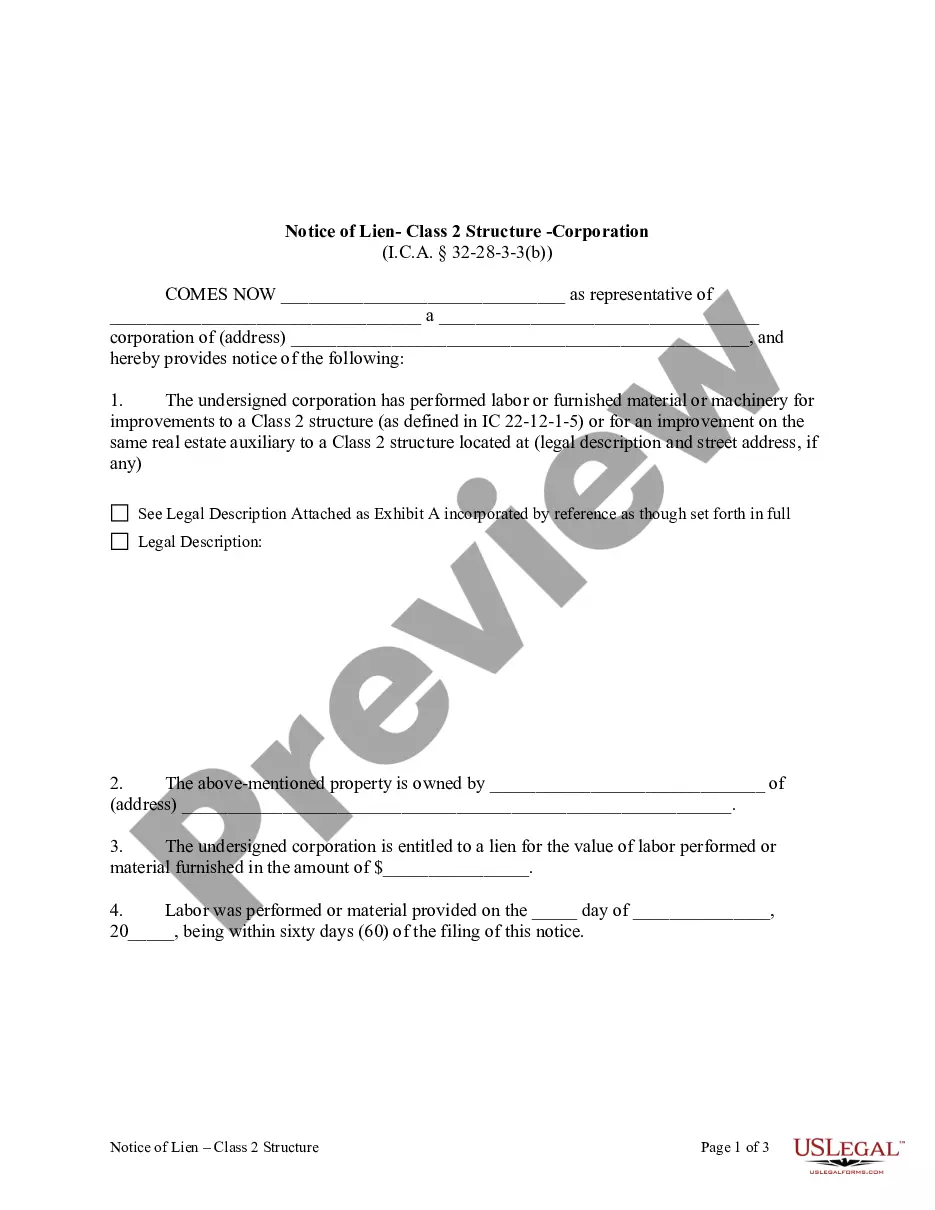

This form is used to officially record a lien for labor or materials supplied towards a class 2 structure as defined by (IC 22-12-1-5). It must be filed in duplicate in the recorder's office within ninety (60) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note this form is used for Class 2 structures.

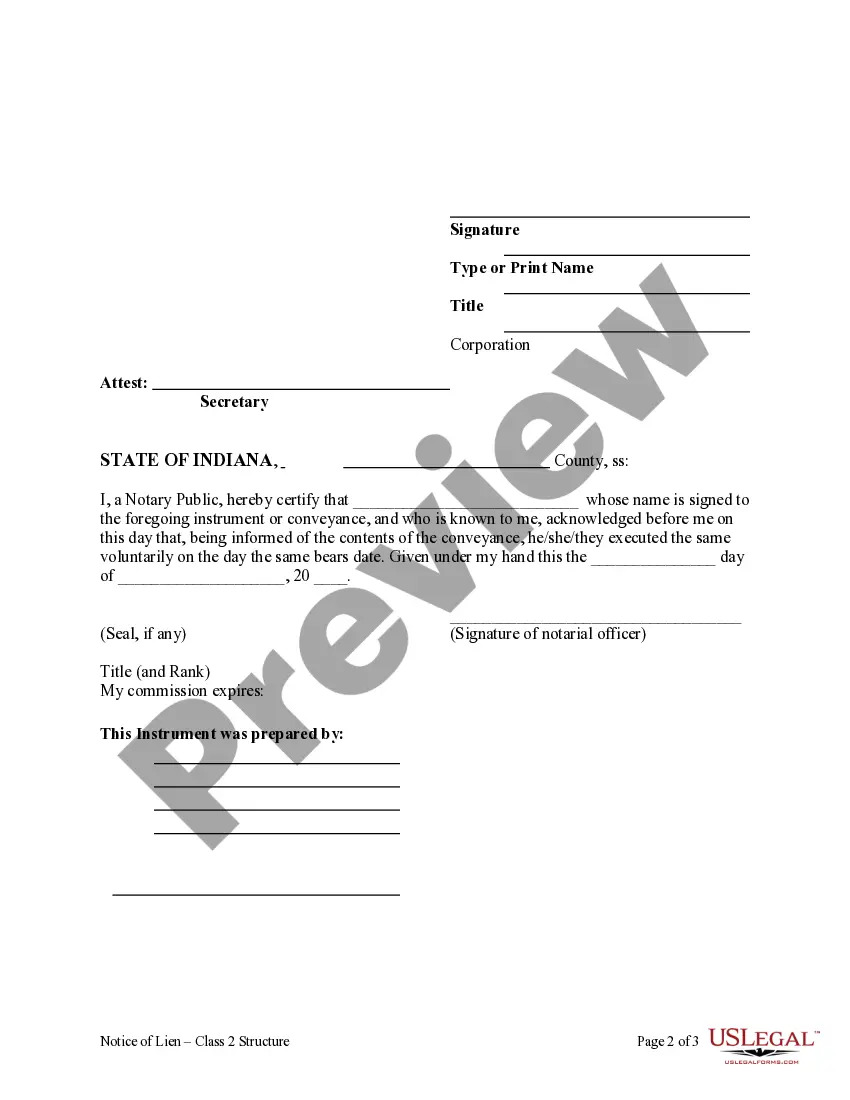

The Indianapolis Indiana Notice of Lien — ClasStructureur— - Corporation or LLC is a legal document issued by the Marion County Clerk's Office in the state of Indiana. It is primarily used to establish a claim against a Class 2 structure owned by a Corporation or Limited Liability Company (LLC) for unpaid taxes or fees. Keywords: Indianapolis Indiana Notice of Lien, Class 2 Structure, Corporation, LLC, Marion County Clerk's Office, state of Indiana, claim, unpaid taxes, fees. This notice serves as a formal notification to the entity that a lien has been placed on their Class 2 structure due to their failure to fulfill their financial obligations to the county. It is a legal mechanism employed by the local government to ensure that the debts owed to the county are eventually paid. The Class 2 structure refers to any property owned by a Corporation or LLC, which includes commercial buildings, factories, warehouses, or other types of non-residential properties. Different types of structures may have specific requirements or regulations associated with them, but the notice of lien serves as a general mechanism for all types of Class 2 structures owned by corporations or LCS. It is important to note that variations or specific types of liens can exist, depending on the nature of the debt or the particular circumstances of the property in question. For example, there could be liens specifically related to unpaid property taxes, unpaid sewer or utility bills, delinquent permit fees, or outstanding fines for violations of local regulations. The notice of lien is recorded with the Marion County Clerk's Office to provide public notice that the corporation or LLC has an outstanding debt. By doing so, any potential buyers or interested parties conducting due diligence will be made aware of the claim and will be able to ascertain the financial status of the property. Upon receiving the notice of lien, the responsible corporation or LLC has a certain period of time to address the outstanding debt and settle with the county. Failure to do so may result in further legal action, including the possibility of foreclosure or the forcible collection of the debt by the government entities. In summary, the Indianapolis Indiana Notice of Lien — ClasStructureur— - Corporation or LLC is a legally binding document issued by the Marion County Clerk's Office, which establishes a claim against a Class 2 structure owned by a corporation or LLC for unpaid taxes, fees, or other debts owed to the county. It serves as a means to protect the county's financial interests and provides public notice to interested parties, ensuring transparency in property transactions.The Indianapolis Indiana Notice of Lien — ClasStructureur— - Corporation or LLC is a legal document issued by the Marion County Clerk's Office in the state of Indiana. It is primarily used to establish a claim against a Class 2 structure owned by a Corporation or Limited Liability Company (LLC) for unpaid taxes or fees. Keywords: Indianapolis Indiana Notice of Lien, Class 2 Structure, Corporation, LLC, Marion County Clerk's Office, state of Indiana, claim, unpaid taxes, fees. This notice serves as a formal notification to the entity that a lien has been placed on their Class 2 structure due to their failure to fulfill their financial obligations to the county. It is a legal mechanism employed by the local government to ensure that the debts owed to the county are eventually paid. The Class 2 structure refers to any property owned by a Corporation or LLC, which includes commercial buildings, factories, warehouses, or other types of non-residential properties. Different types of structures may have specific requirements or regulations associated with them, but the notice of lien serves as a general mechanism for all types of Class 2 structures owned by corporations or LCS. It is important to note that variations or specific types of liens can exist, depending on the nature of the debt or the particular circumstances of the property in question. For example, there could be liens specifically related to unpaid property taxes, unpaid sewer or utility bills, delinquent permit fees, or outstanding fines for violations of local regulations. The notice of lien is recorded with the Marion County Clerk's Office to provide public notice that the corporation or LLC has an outstanding debt. By doing so, any potential buyers or interested parties conducting due diligence will be made aware of the claim and will be able to ascertain the financial status of the property. Upon receiving the notice of lien, the responsible corporation or LLC has a certain period of time to address the outstanding debt and settle with the county. Failure to do so may result in further legal action, including the possibility of foreclosure or the forcible collection of the debt by the government entities. In summary, the Indianapolis Indiana Notice of Lien — ClasStructureur— - Corporation or LLC is a legally binding document issued by the Marion County Clerk's Office, which establishes a claim against a Class 2 structure owned by a corporation or LLC for unpaid taxes, fees, or other debts owed to the county. It serves as a means to protect the county's financial interests and provides public notice to interested parties, ensuring transparency in property transactions.