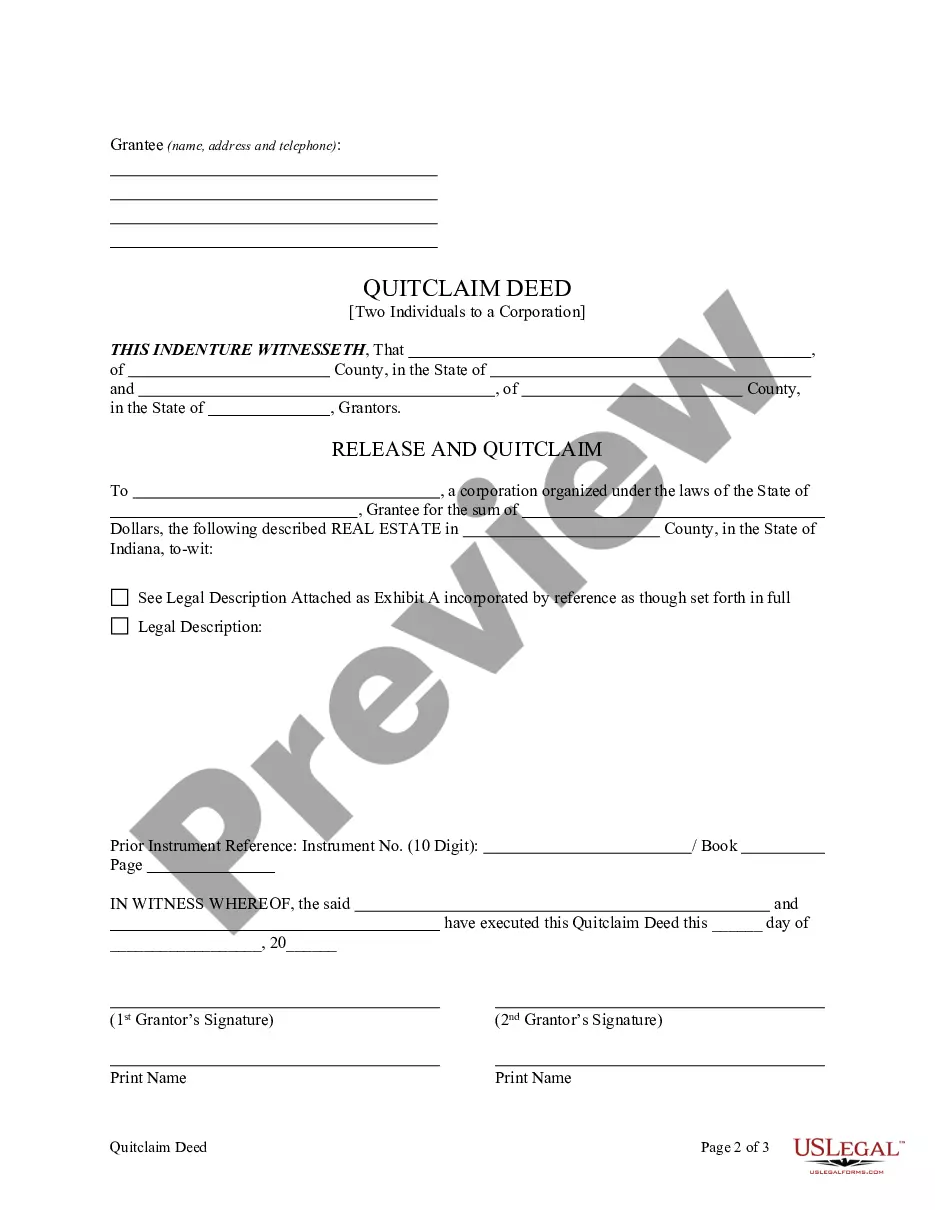

This form is a Quitclaim Deed where the grantors are two unmarried individuals and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

A South Bend Indiana Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers the ownership rights of a real estate property from two individuals to a corporation through the use of a quitclaim deed. This type of deed is commonly used when individuals want to transfer their interests in a property to a corporation they own or are associated with. The Quitclaim Deed effectively states that the individuals, known as granters, are conveying their rights, titles, and interests in the property to the corporation, known as the grantee, without any warranties or guarantees. This means that the granters do not guarantee that they have clear ownership or guarantee against any encumbrances on the property. This type of property transfer can be done for several reasons, including facilitating the transfer of property ownership within a corporation, asset protection, or tax planning purposes. It provides a simple and straightforward way to transfer property without the need to research, establish, or warrant clear title. In South Bend, Indiana, there are different types of Quitclaim Deed by Two Individuals to Corporation that may be named based on specific circumstances or purposes. For example: 1. General South Bend Indiana Quitclaim Deed by Two Individuals to Corporation: This type of deed is used when the two individuals are transferring their interests in a property to a corporation for general business purposes, without any specific conditions or restrictions. 2. South Bend Indiana Quitclaim Deed by Two Individuals to Corporation with Asset Protection: If the individuals intend to protect their personal assets by transferring a property to a corporation, this type of deed might be used. The transfer is done with the aim of shielding personal assets from potential liabilities. 3. South Bend Indiana Quitclaim Deed by Two Individuals to Corporation for Tax Purposes: In certain cases, individuals may choose to transfer a property to a corporation to take advantage of specific tax benefits. This type of deed might be used when the transfer is primarily motivated by tax planning. It is important to consult with a qualified attorney or legal professional to ensure that the specific requirements and provisions of the South Bend Indiana Quitclaim Deed by Two Individuals to Corporation are accurately met. This will help protect the interests of all parties involved and ensure a legal and valid transfer of property ownership.A South Bend Indiana Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers the ownership rights of a real estate property from two individuals to a corporation through the use of a quitclaim deed. This type of deed is commonly used when individuals want to transfer their interests in a property to a corporation they own or are associated with. The Quitclaim Deed effectively states that the individuals, known as granters, are conveying their rights, titles, and interests in the property to the corporation, known as the grantee, without any warranties or guarantees. This means that the granters do not guarantee that they have clear ownership or guarantee against any encumbrances on the property. This type of property transfer can be done for several reasons, including facilitating the transfer of property ownership within a corporation, asset protection, or tax planning purposes. It provides a simple and straightforward way to transfer property without the need to research, establish, or warrant clear title. In South Bend, Indiana, there are different types of Quitclaim Deed by Two Individuals to Corporation that may be named based on specific circumstances or purposes. For example: 1. General South Bend Indiana Quitclaim Deed by Two Individuals to Corporation: This type of deed is used when the two individuals are transferring their interests in a property to a corporation for general business purposes, without any specific conditions or restrictions. 2. South Bend Indiana Quitclaim Deed by Two Individuals to Corporation with Asset Protection: If the individuals intend to protect their personal assets by transferring a property to a corporation, this type of deed might be used. The transfer is done with the aim of shielding personal assets from potential liabilities. 3. South Bend Indiana Quitclaim Deed by Two Individuals to Corporation for Tax Purposes: In certain cases, individuals may choose to transfer a property to a corporation to take advantage of specific tax benefits. This type of deed might be used when the transfer is primarily motivated by tax planning. It is important to consult with a qualified attorney or legal professional to ensure that the specific requirements and provisions of the South Bend Indiana Quitclaim Deed by Two Individuals to Corporation are accurately met. This will help protect the interests of all parties involved and ensure a legal and valid transfer of property ownership.