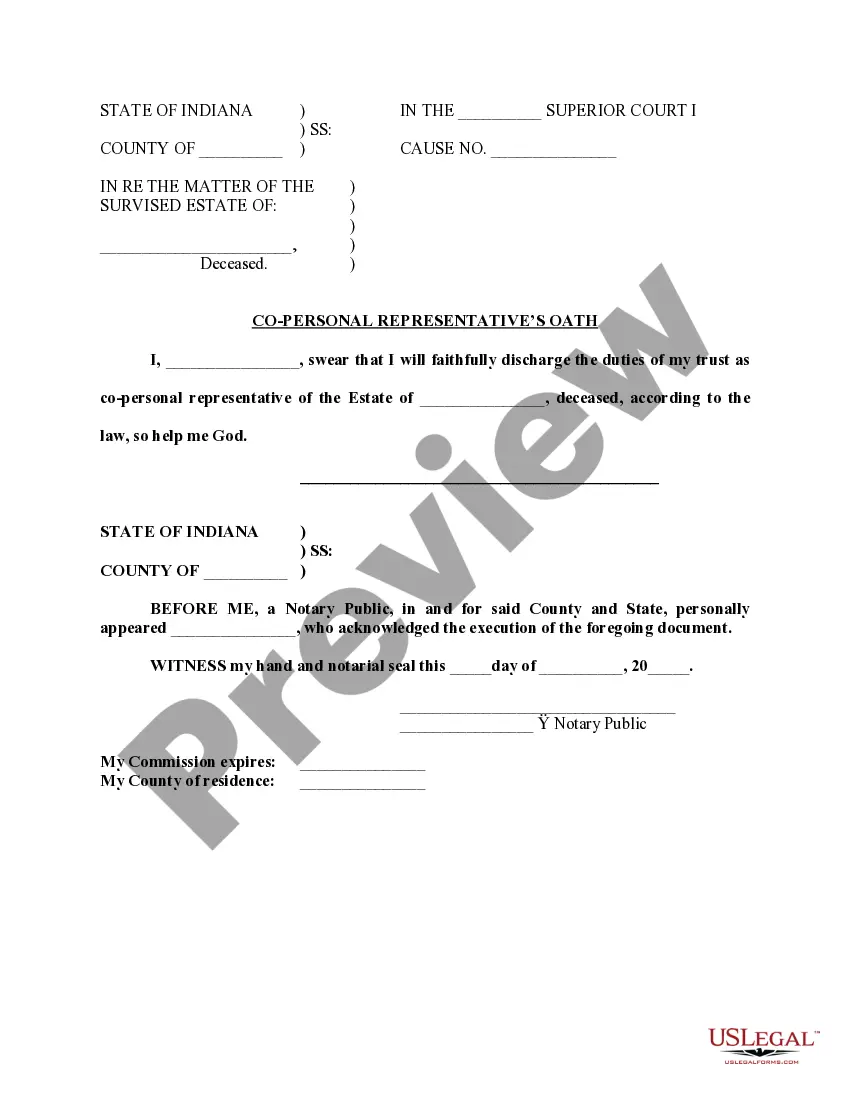

South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate

Description

How to fill out Indiana Instruction To Co-Personal Representatives Of Supervised Estate?

We consistently aim to minimize or avert legal harm when addressing intricate legal or financial concerns.

To achieve this, we opt for legal consultancy services that, as a general rule, can be quite costly.

However, not all legal dilemmas are equally intricate. Many can be managed by ourselves.

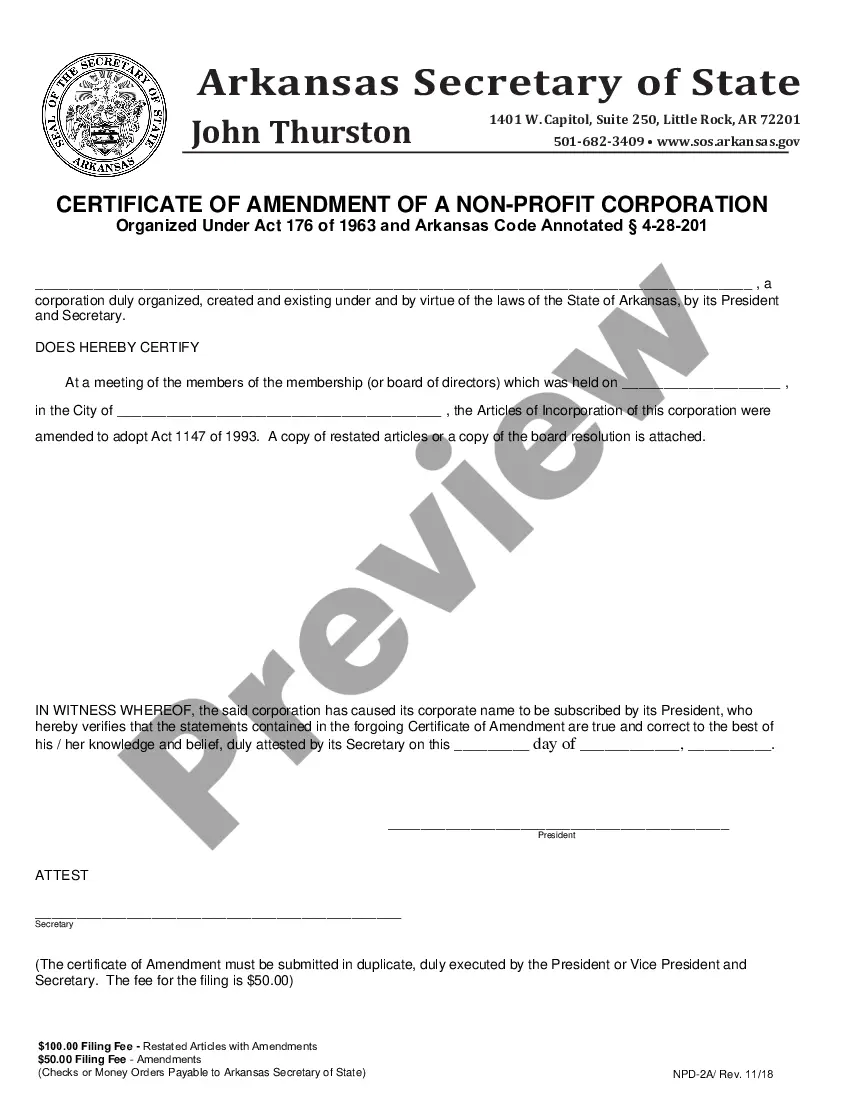

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from within the My documents tab. The procedure is equally straightforward even if you're unacquainted with the platform! You can set up your account in just a few minutes.

- Our repository empowers you to handle your affairs without consulting a lawyer.

- We provide access to legal form templates that aren't always freely accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to quickly and securely find and download the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate or any other form.

Form popularity

FAQ

The appointment of a personal representative in Indiana is a crucial step in the probate process. This individual is designated by the court to oversee the estate's administration according to the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate. The appointment process involves submitting a petition to the court, where eligibility and suitability are assessed. This ensures that the estate is handled properly and in accordance with the law.

In Indiana, a personal representative is the individual appointed to manage and administer a deceased person's estate. This role involves handling the estate's assets, settling debts, and ensuring proper distribution to beneficiaries. Understanding the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate can be vital in navigating this responsibility effectively. By following these instructions, personal representatives can fulfill their duties with clarity and confidence.

A supervised estate in Indiana refers to an estate subject to court supervision throughout the probate process. This means that the court monitors the actions of the personal representative to ensure they properly manage and distribute the estate’s assets. Familiarity with the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate equips you with the necessary framework to navigate these requirements effectively.

In the context of estate management, a beneficiary is not considered a category of personal representative. Beneficiaries receive assets but do not have fiduciary responsibilities like a personal representative or executor. Clarity on such distinctions, as provided by the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate, can significantly aid in effective estate administration.

Yes, in Indiana, bank accounts typically go through probate unless specific arrangements are in place, such as joint ownership or a payable-on-death designation. This process ensures that the funds are distributed according to the decedent's wishes, as outlined in the will. Understanding this aspect can help in the proper administration of estates in accordance with the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate.

A personal representative is a broader term that encompasses anyone managing an estate, while an executor specifically refers to an individual named in a will to oversee the estate. Both roles are vital in administering the estate's affairs, but not all personal representatives are termed executors. The South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate details these distinctions for better understanding.

In South Bend, Indiana, anyone who is at least 18 years old and has the legal capacity can qualify as a personal representative. This includes individuals nominated in a will or appointed by the court. Personal representatives manage the estate's assets and ensure the wishes of the deceased are honored. Understanding the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate can clarify the roles and responsibilities involved.

Certain individuals cannot serve as personal representatives in Indiana, including convicted felons and those who are deemed incapacitated. This restriction helps ensure that the responsibilities of managing an estate are entrusted to trustworthy individuals. Knowing these requirements is vital when selecting a personal representative. For further information, consult the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate for guidance.

A Power of Attorney (POA) grants someone the authority to make decisions on behalf of another individual, often pertaining to financial or medical matters. In contrast, an authorized representative, especially in the context of estates, may assist with specific tasks but does not hold the same broad legal power. Understanding these distinctions can help you choose the right person for each role in your estate planning. For detailed insights, explore the South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate.

Yes, a personal representative can also be a beneficiary of the estate in South Bend Indiana. This situation is common, as it allows for efficient management of the estate’s assets. However, it's important to handle any potential conflicts of interest properly. Consulting South Bend Indiana Instruction to Co-Personal Representatives of Supervised Estate will provide the necessary information to navigate these complexities.