The Indianapolis Indiana Co-Personal Representative's Oath is a legal declaration taken by individuals who are appointed as co-personal representatives in the administration of an estate in Indianapolis, Indiana. A co-personal representative, also known as an executor or administrator, is responsible for managing the assets and affairs of a deceased person's estate. The oath serves as a formal commitment by the co-personal representative to faithfully and diligently carry out their duties according to the laws and regulations of Indianapolis and the state of Indiana. It is taken before a probate court or a qualified official designated to oversee the administration of estates. The exact wording of the oath may vary, but it generally includes key elements such as a solemn promise to fulfill the responsibilities of a co-personal representative with integrity, honesty, and loyalty. The co-personal representative pledges to act in the best interests of the estate and its beneficiaries, and to administer the estate according to the wishes of the deceased as expressed in their will, or in the absence of a will, in accordance with state laws. In addition to the general oath, there may be specific variations depending on the type of co-personal representative. For example, if the appointment is for a co-executor, who is designated alongside one or more individuals to administer the estate, the oath may include additional language acknowledging the joint responsibilities and collaboration required. Similarly, if the co-personal representative is appointed as a co-administrator, who typically serves when the deceased did not leave a will, the oath may contain provisions specific to administering an intestate estate. Overall, the Indianapolis Indiana Co-Personal Representative's Oath is a formal commitment that underscores the co-personal representative's legal obligations and establishes their responsibilities, ensuring the proper administration of the estate for the benefit of the deceased's beneficiaries and in compliance with applicable laws and regulations.

Indianapolis Indiana Co-Personal Representative's Oath

Description

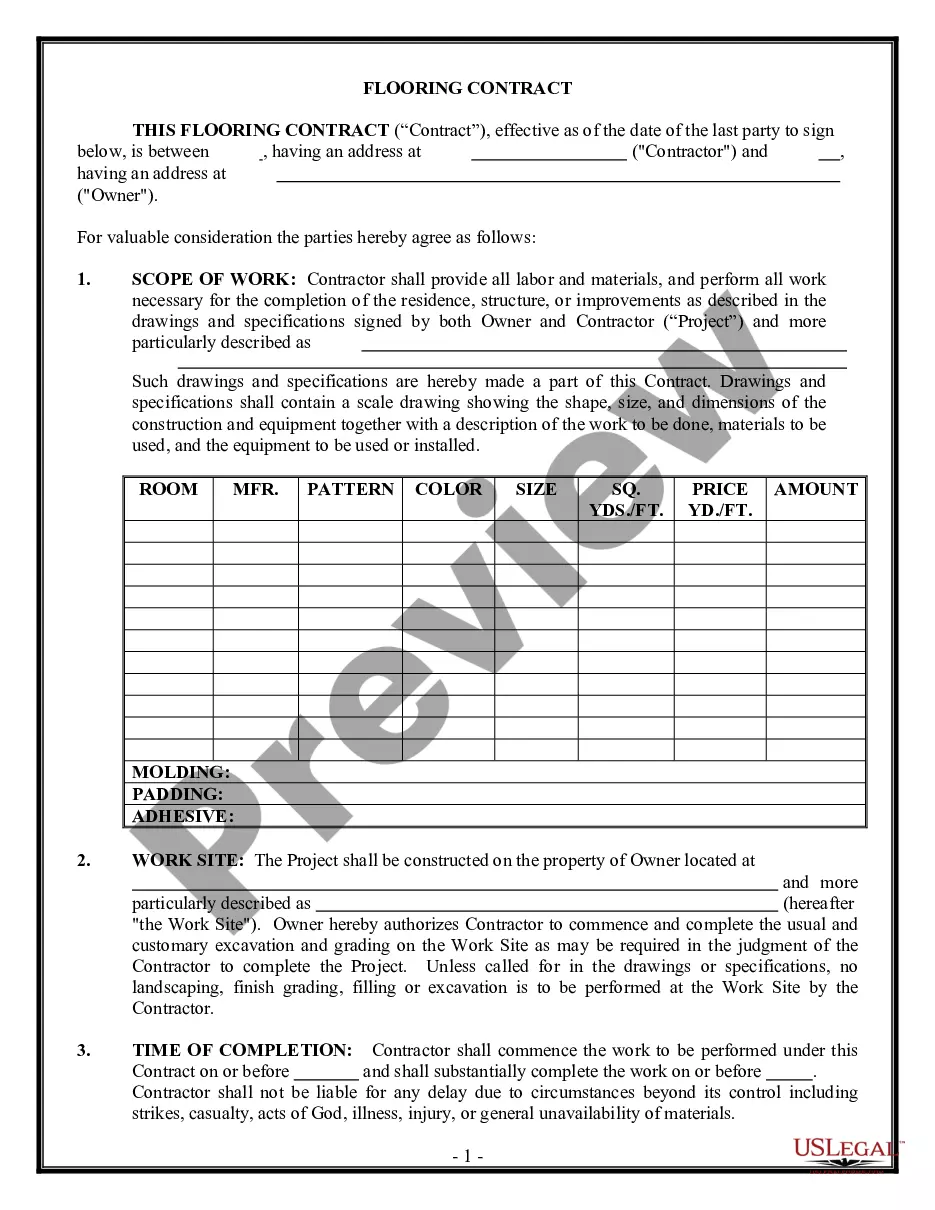

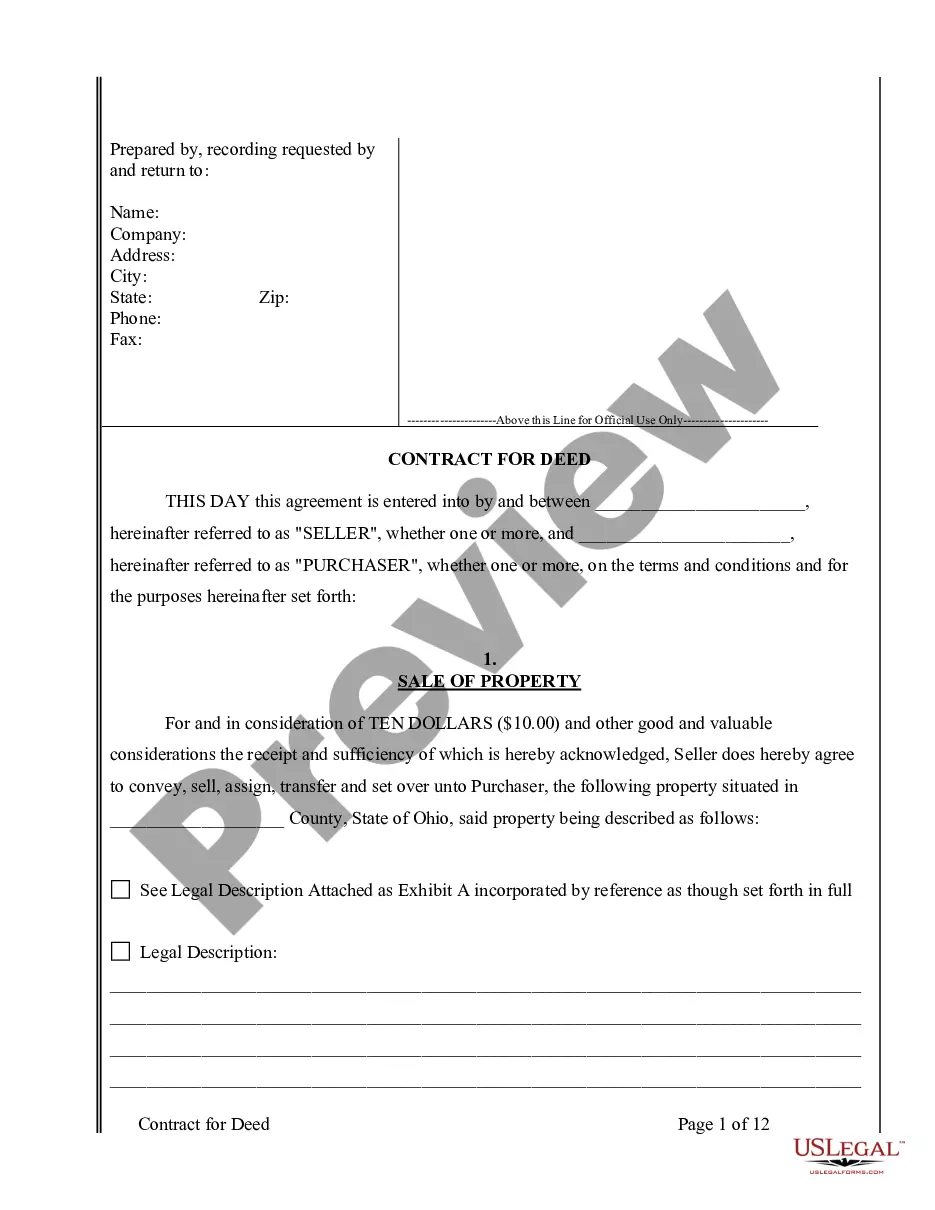

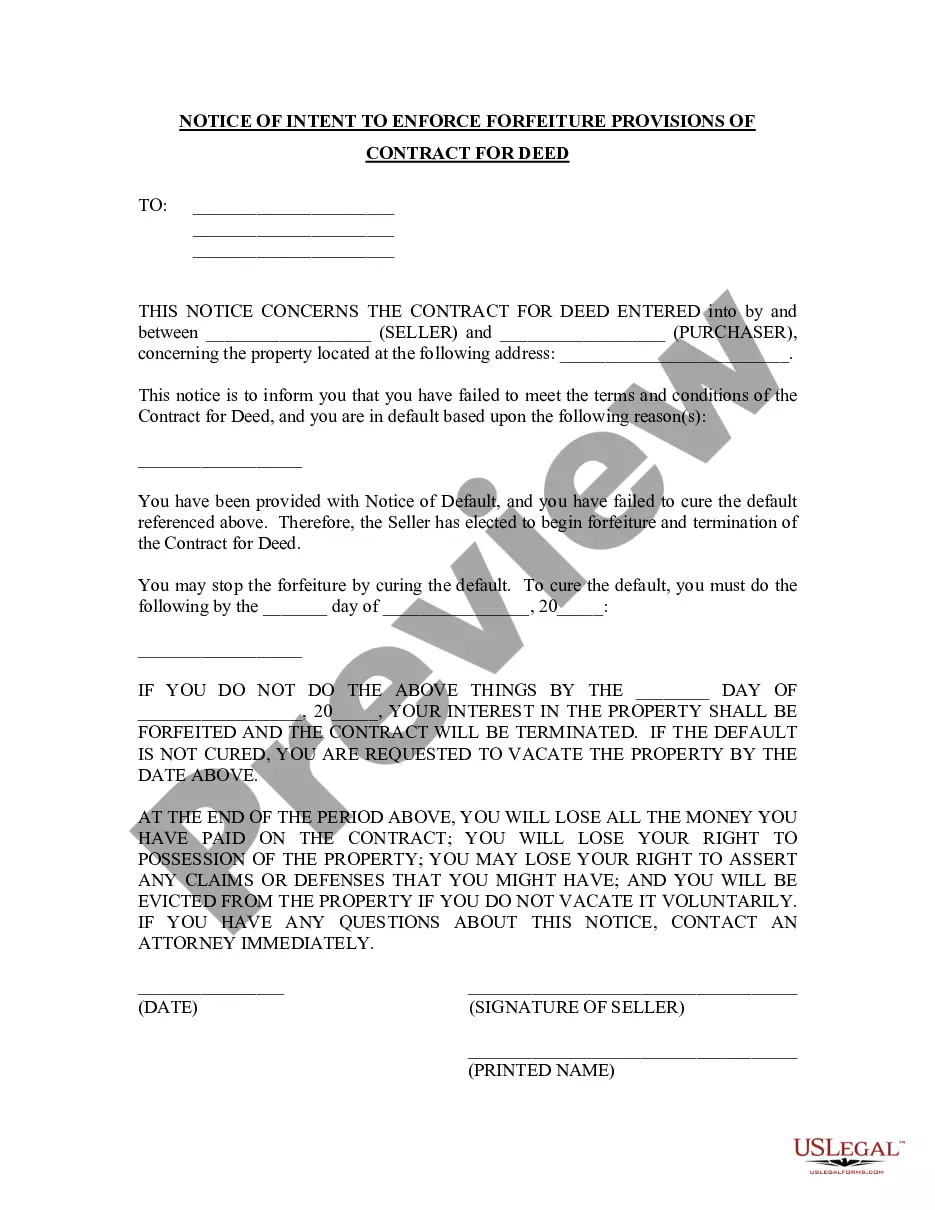

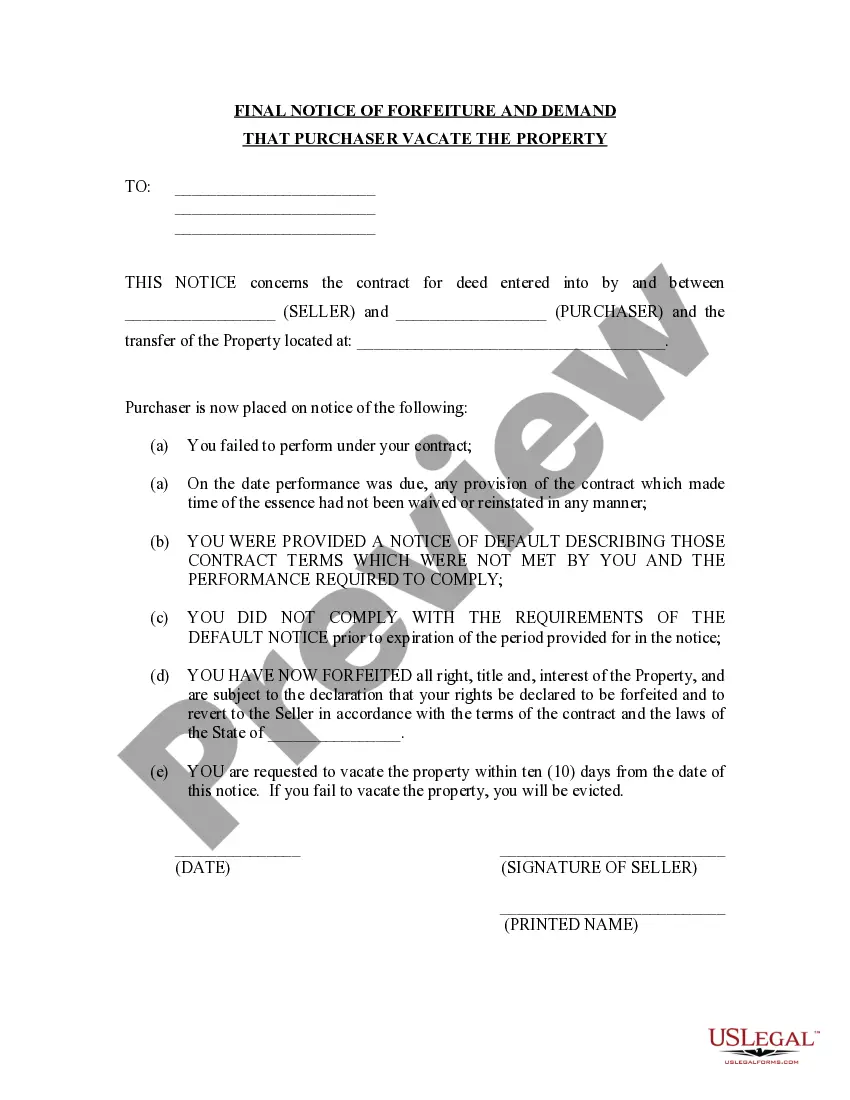

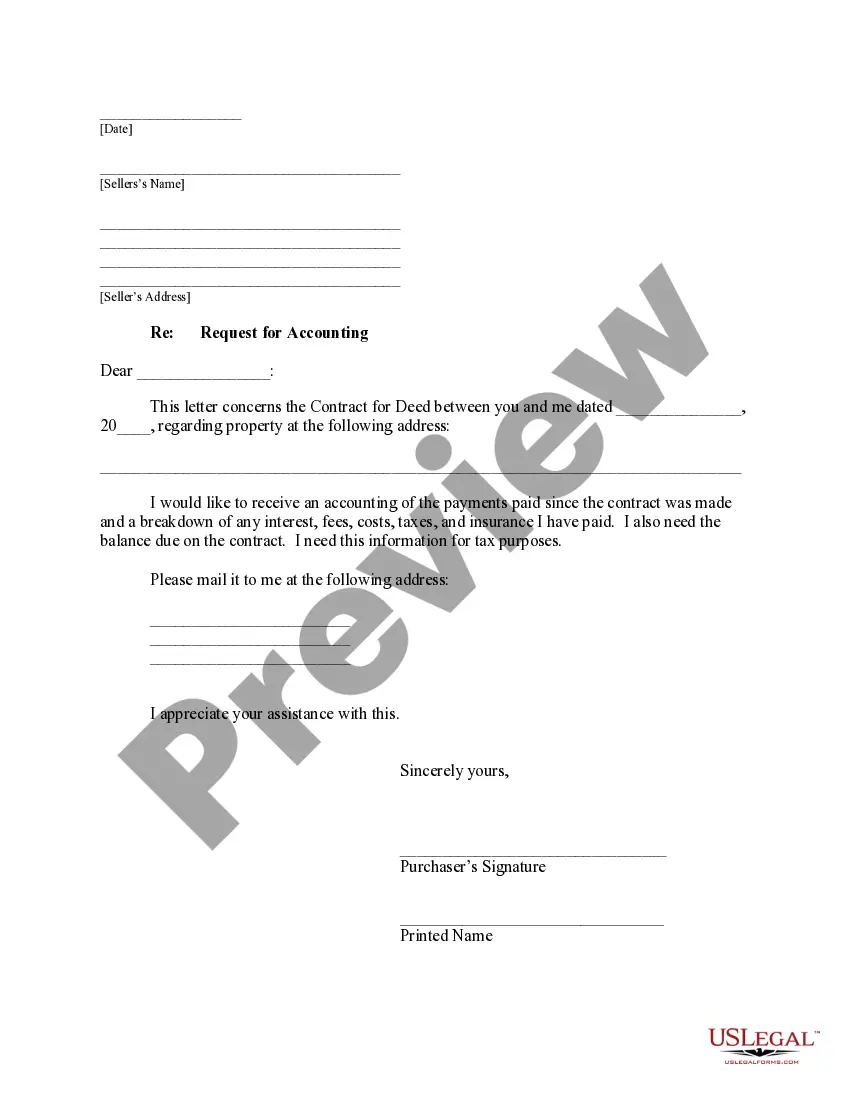

How to fill out Indianapolis Indiana Co-Personal Representative's Oath?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It is an online archive of over 85,000 legal forms for both personal and business purposes and various real-world situations.

All the files are appropriately sorted by usage area and jurisdiction, making the search for the Indianapolis Indiana Co-Personal Representative’s Oath as quick and simple as possible.

Maintaining documents organized and in compliance with legal standards is significantly important. Take advantage of the US Legal Forms library to consistently have crucial document templates for any needs right at your fingertips!

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that fits your requirements and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it satisfies your needs, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than $100,000. The affidavit cannot be filed earlier than forty-five (45) days after the date of death and must be signed in front of a notary public.

While the probate process isn't necessary for every estate in Indiana, a sizable portion of them will be forced to go before the court. However, there are certain assets of a decedent that will skip past this process, as they already have heirs or beneficiaries chosen. These include: Life insurance.

As we mentioned above, Indiana only requires probate of estates worth $50,000 or more. Smaller estates do not require administration. The family or personal representative can pay bills and transfer assets using an affidavit or written statement.

Is Probate Required in Indiana? Any estate worth more than $50,000 is subject to probate in Indiana. Estates worth less than $50,000 transfer ownership to heirs through the small estate administration with a written statement proving entitlement to the assets.

Ideally, the decedent named a personal representative in his will; otherwise, the court will appoint one. The personal representative can be a spouse, family member, or professional associate.

In general, expect it to take at least six months up to a year before probate is closed and the assets distributed to the heirs. If there are disputes, claims against the estate or other delays, it could take much longer.

The person in possession of the will at the time of the deceased person's death must present the will to the court before probate can begin. They must present it within a reasonable time, or they may be compelled to do so by the personal representative.

The first family members to inherit your estate are your children and/or grandchildren. If you don't have any children, each parent will receive 25 percent of the estate and any siblings, nieces, or nephews will receive the rest.

For intestate estates that do not qualify as small estates, or need to be administered by the court for other reason, any interested party can petition the court to be appointed the executor--also called the personal representative.

Indiana Restrictions and Guidelines for an Executor In Indiana, your Executor must be eighteen years or older, and of sound mind, meaning that he/she has not been declared incapacitated by a court. Indiana also prohibits naming an Executor who has been convicted of any federal or state felony.