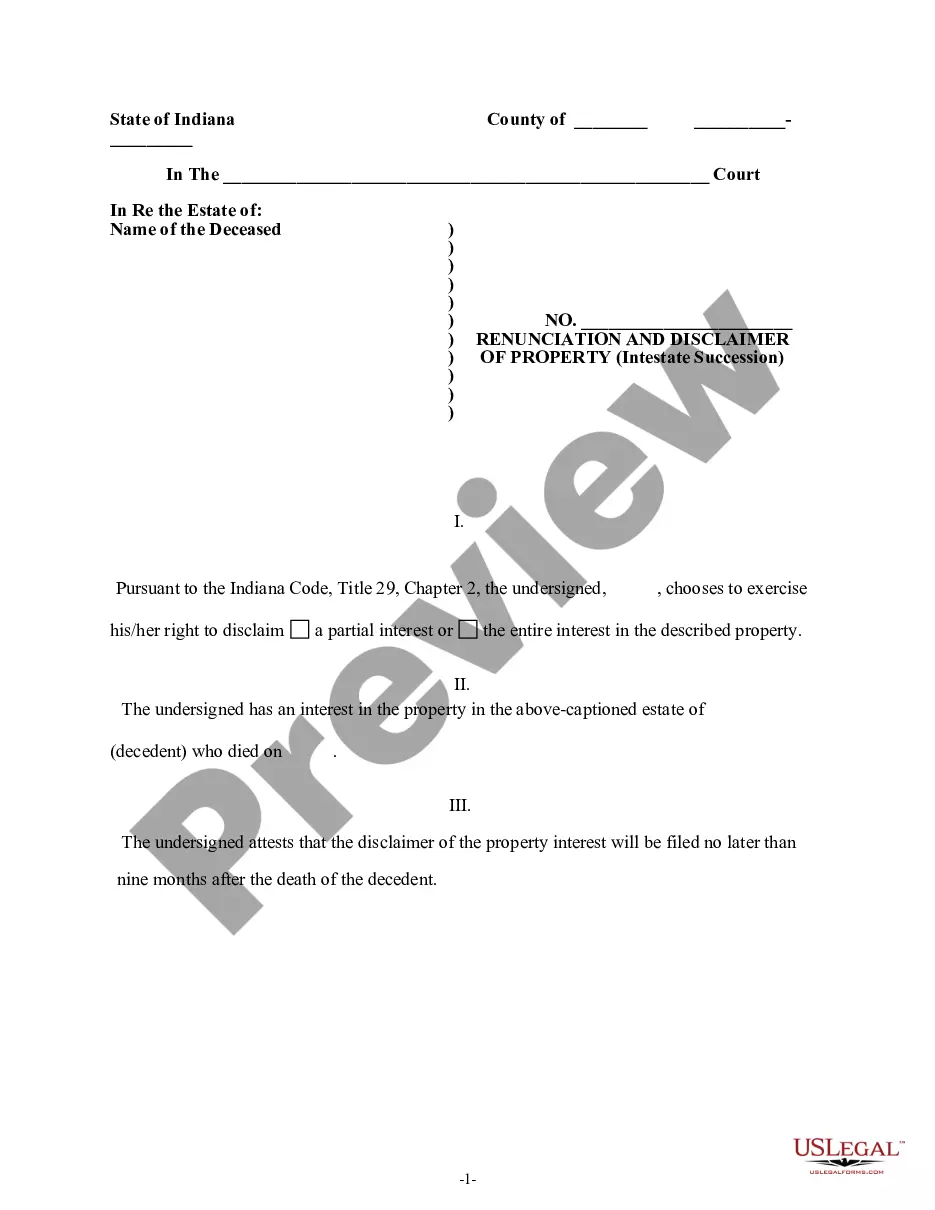

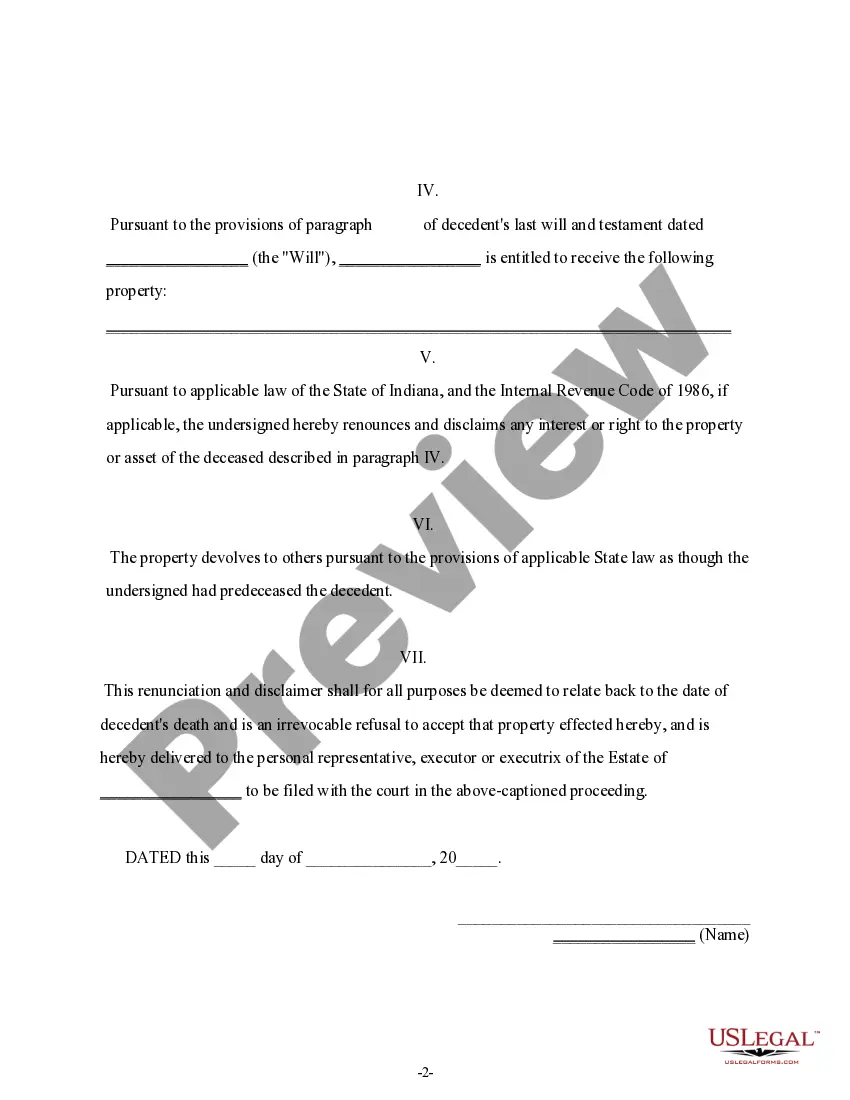

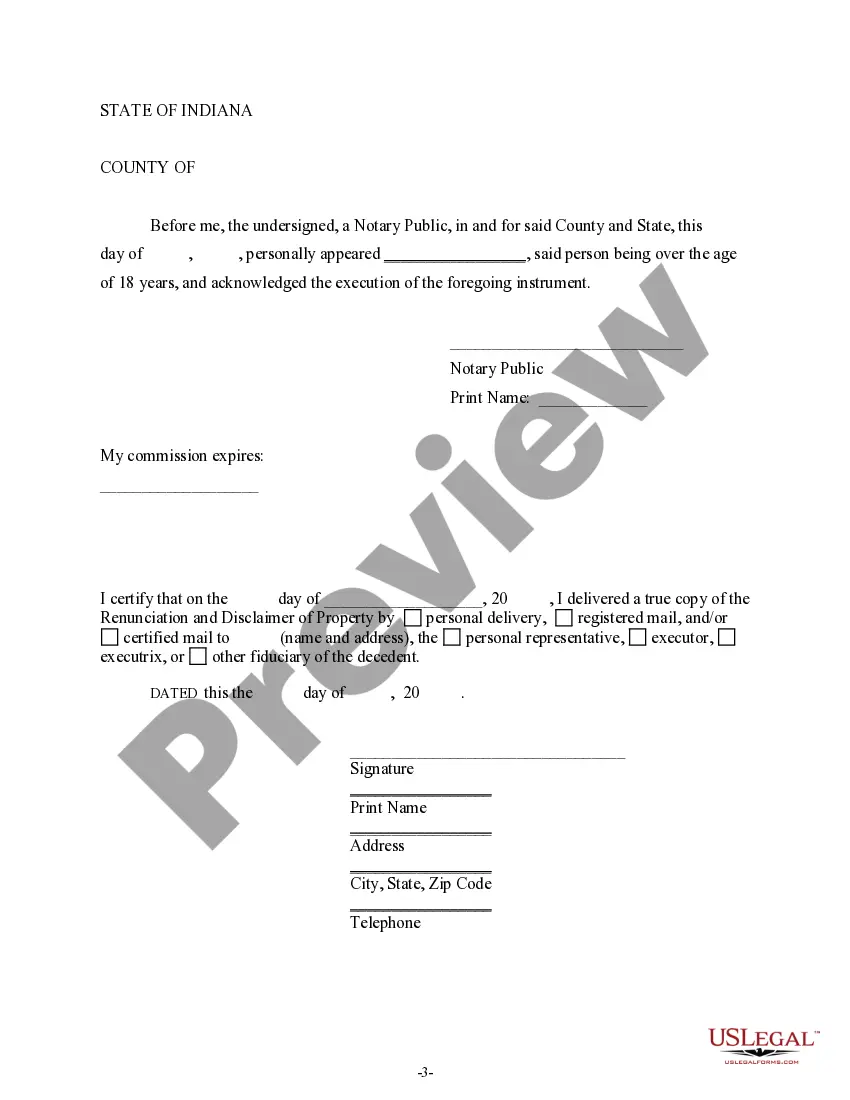

This form is a Renunciation and Disclaimer of Property acquired by intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property. However, according to the Indiana Code, Title 29, Chapter 2, the beneficiary wishes to disclaim a portion of, or the entire interest in the property. The beneficiary attests that the disclaimer will be filed no later than nine months after the death of the decedent. The form also contains an acknowledgment and a certificate to verify delivery.

Carmel Indiana Renunciation and Disclaimer of Property received by Intestate Succession: When a person passes away without a valid will or estate plan in place, their assets are distributed according to the laws of intestate succession. However, in some cases, a beneficiary may choose to renounce or disclaim their entitlement to the property they would otherwise receive. In Carmel, Indiana, there are specific rules and processes for renunciation and disclaimer of property regarding intestate succession. Carmel Indiana Renunciation of Property: A renunciation of property refers to the act of voluntarily giving up one's right to inherit or receive property as per intestate succession. In Carmel, Indiana, an individual who wishes to renounce their entitlement must adhere to certain legal requirements. This renunciation can occur when a beneficiary does not wish to receive their share of the estate due to various reasons, such as wanting to minimize tax liabilities or financial obligations. To renounce property received by intestate succession in Carmel, Indiana, the beneficiary must file a written renunciation within a specific timeframe, usually within a certain number of months from the date of the decedent's death. The renunciation should detail the beneficiary's name, relationship to the deceased, and clear intent to renounce their right to the property. It is crucial to ensure that the renunciation is properly witnessed and notarized to maintain its legal validity. Carmel Indiana Disclaimer of Property received by Intestate Succession: Similar to renunciation, a disclaimer of property allows a beneficiary to refuse their entitlement to property received by intestate succession. However, there are some distinctions between the two processes. While a renunciation is a proactive decision to give up the right to inherit, a disclaimer occurs when a beneficiary must reject their share of the estate due to specific circumstances or legal obligations. Carmel, Indiana recognizes disclaimers of property as a way to avoid certain tax consequences or to transfer inherited assets to another beneficiary. To make a valid disclaimer, the beneficiary must provide a written and properly executed disclaimer document, affirmatively stating their intent to refuse the property within a specific timeframe. Like renunciation, it is crucial to ensure that the disclaimer is correctly witnessed and notarized to maintain its legal effectiveness. Different types of Carmel Indiana Renunciation and Disclaimer of Property: In Carmel, Indiana, the types of renunciations and disclaimers of property received by intestate succession generally fall under two categories: partial and full renunciations or disclaimers. 1. Partial Renunciation or Disclaimer: This type involves renouncing or disclaiming only a portion of the property a beneficiary is entitled to receive. It may occur when the beneficiary does not wish to accept specific assets or wants to redistribute a part of their share to other heirs or beneficiaries. 2. Full Renunciation or Disclaimer: This type involves a complete renunciation or disclaimer of all the property a beneficiary would inherit through intestate succession. It means the beneficiary chooses to waive their rights entirely and forego any claim to the estate. By understanding the concept of Carmel Indiana Renunciation and Disclaimer of Property received by Intestate Succession, individuals can make informed decisions regarding their inheritance and ensure compliance with the specific legal requirements in Carmel, Indiana.