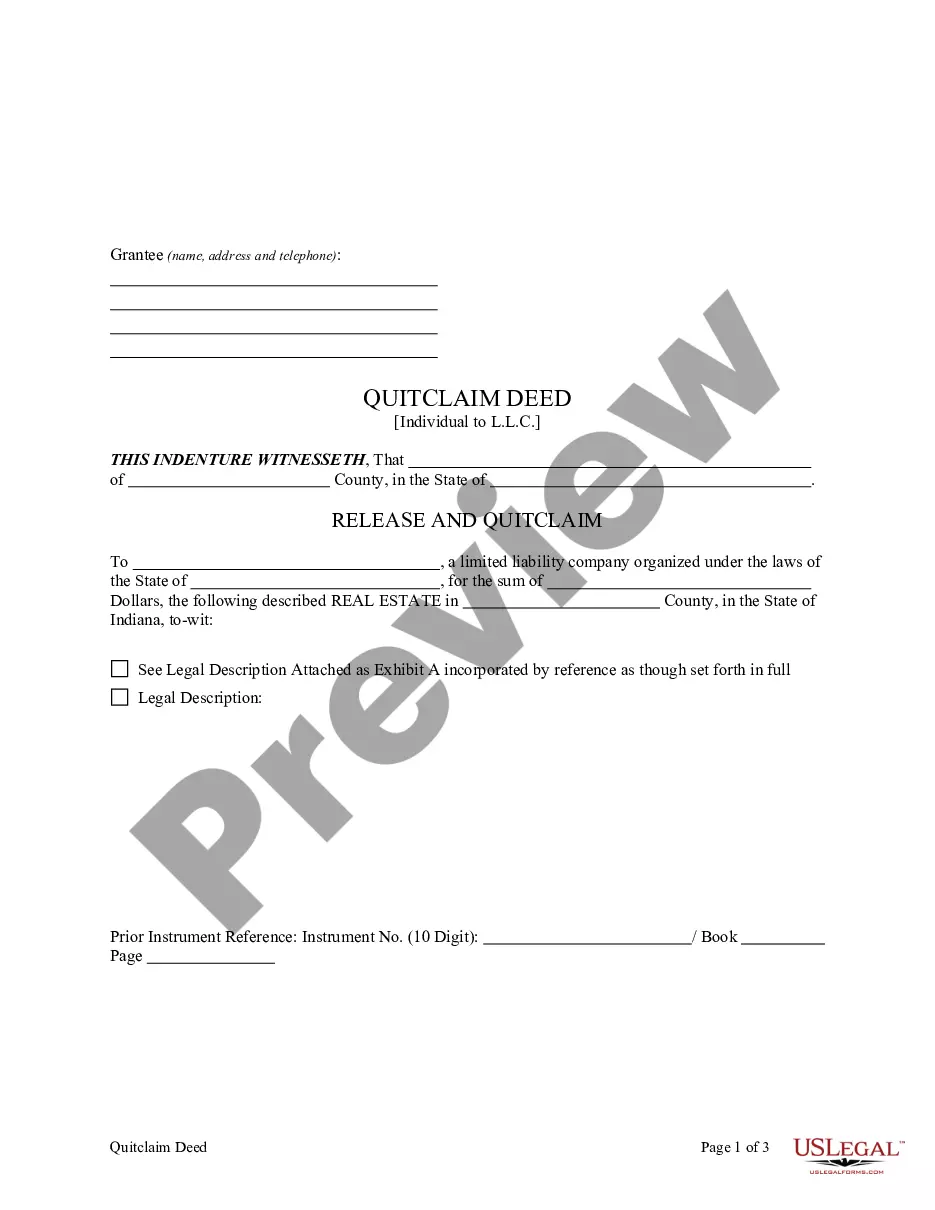

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Carmel Indiana Quitclaim Deed from Individual to LLC

Description

How to fill out Indiana Quitclaim Deed From Individual To LLC?

Locating validated templates pertinent to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and professional purposes as well as various real-world scenarios.

All the papers are systematically classified by area of application and jurisdictional territories, making it effortless and quick to find the Carmel Indiana Quitclaim Deed from Individual to LLC.

Utilize your credit card information or your PayPal account to complete the payment for the subscription.

- Confirm the Preview mode and document description.

- Ensure you’ve selected the correct one that satisfies your needs and fully aligns with your regional jurisdiction criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your requirements, proceed to the next step.

- Finalize the acquisition of the document.

Form popularity

FAQ

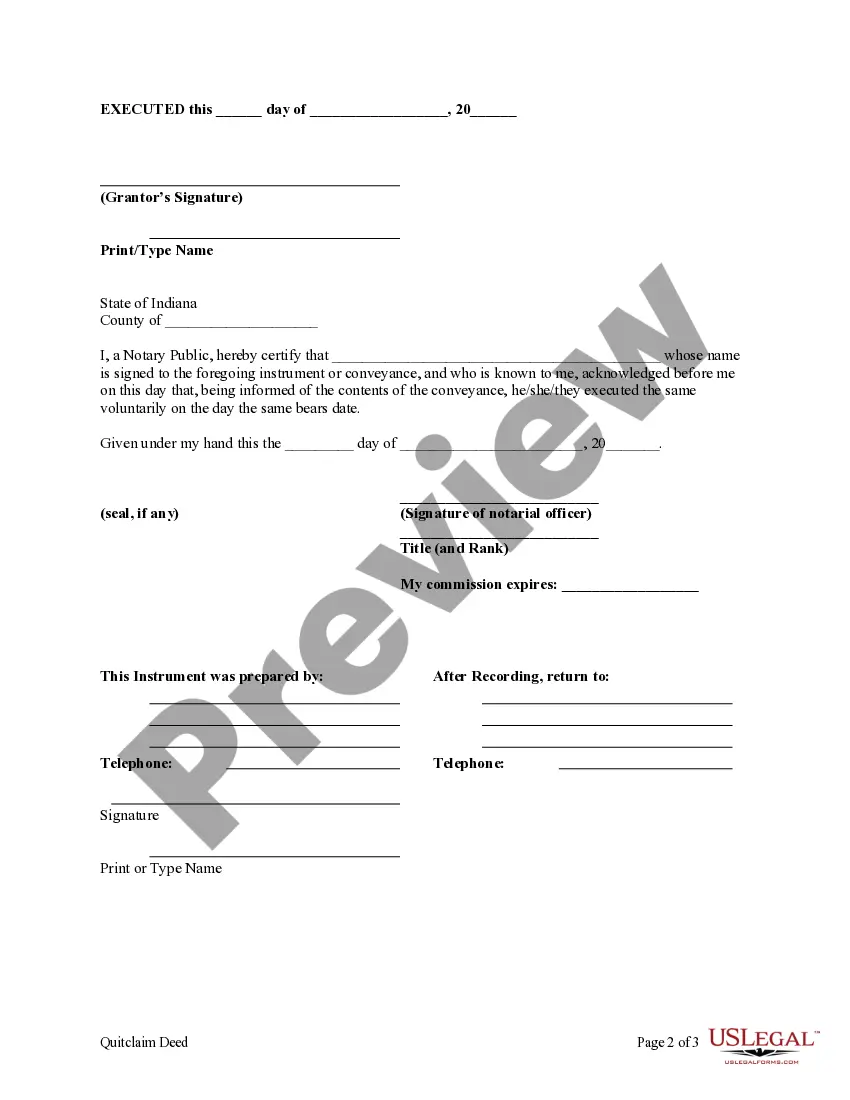

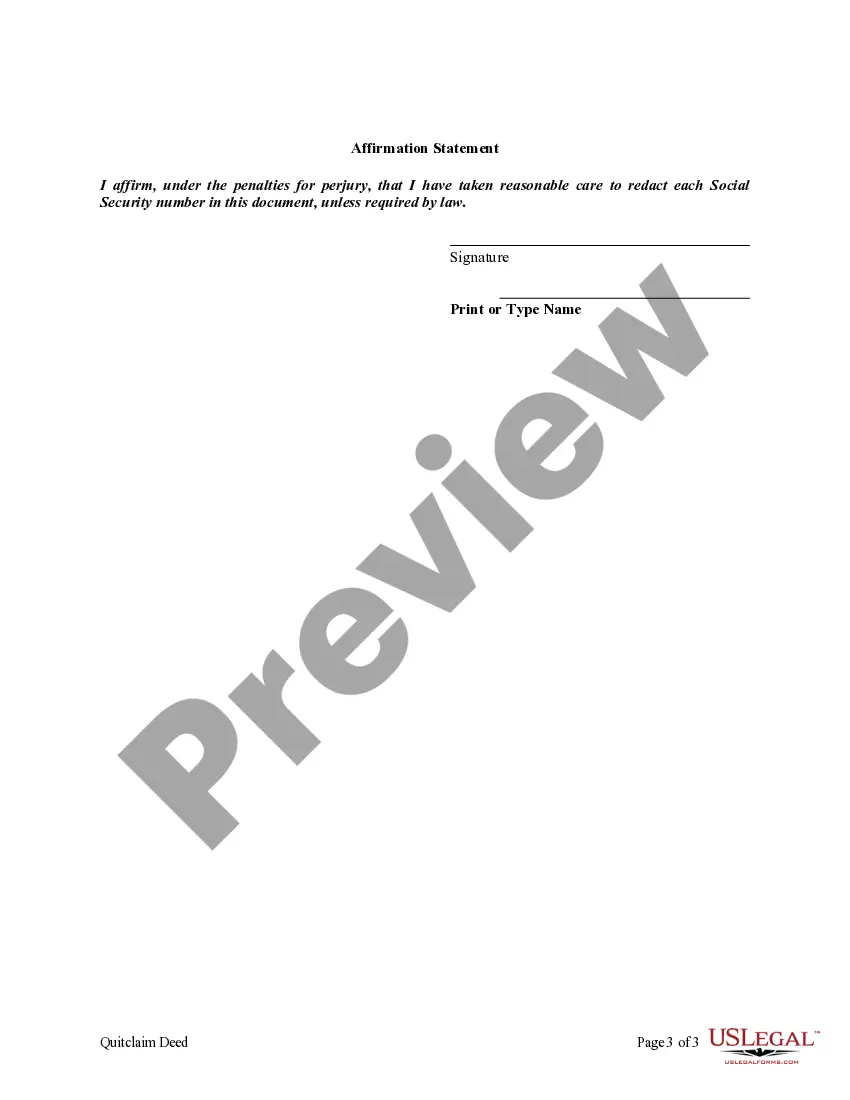

To properly fill out a quit claim deed in Indiana, start by selecting the correct form for a Carmel Indiana Quitclaim Deed from Individual to LLC. You need to enter the names of both the person transferring the property and the LLC receiving it, along with a detailed description of the property. Complete your form with signatures and notarization, and submit it to the county recorder to finalize the transfer.

Filling out a quit claim deed form in Indiana involves several steps. First, ensure you have the appropriate Carmel Indiana Quitclaim Deed from Individual to LLC template. Include the grantor and grantee names, along with a legal description of the property. Don't forget to sign the document and have it notarized, before filing it with the county recorder's office for it to take effect.

To fill out a quitclaim deed, start by obtaining the correct form for a Carmel Indiana Quitclaim Deed from Individual to LLC. Clearly include the names of the granter and grantee, along with the property description. Sign the document in front of a notary public, and check your local requirements for any additional steps. After completion, file the deed with your county recorder's office to make it official.

Yes, you can quit claim your property to your LLC using a Carmel Indiana Quitclaim Deed from Individual to LLC. This transaction allows you to transfer ownership while potentially benefiting from liability protection and tax advantages. However, it's wise to review the implications of such a transfer with a legal or financial expert to ensure it aligns with your long-term goals. Platforms like uslegalforms can help streamline the process by offering templates and guidance tailored for Indiana.

In Indiana, anyone can prepare a quit claim deed, but working with a professional is advisable for clarity and legality. Typically, attorneys, real estate agents, or title companies can assist in drafting a Carmel Indiana Quitclaim Deed from Individual to LLC. Their expertise ensures that the document meets state requirements and reduces the chances of errors. It's always beneficial to consult with a knowledgeable individual to navigate the process effectively.

While a Carmel Indiana Quitclaim Deed from Individual to LLC offers a straightforward property transfer method, it has its drawbacks. This type of deed does not provide warranties about the property's title, meaning you might inherit hidden liens or claims. Additionally, if the grantor holds any undisclosed debts, creditors may come after the property. Thus, it’s essential to conduct thorough research and consider options before proceeding.

People often put their property in an LLC for liability protection and potential tax benefits. By transferring ownership to an LLC, they can separate their personal assets from business risks, which offers peace of mind. If you are considering a Carmel Indiana Quitclaim Deed from Individual to LLC, it might be a smart move for safeguarding your investment.

A deed for an LLC should be signed by a member or authorized representative of the LLC. This ensures that the transfer is legally binding and that the ownership change is properly documented. It is important to follow the correct procedures when executing a Carmel Indiana Quitclaim Deed from Individual to LLC to protect all parties involved.

To transfer your property to an LLC in Indiana, you will need to create a quitclaim deed that documents the transfer of ownership. After signing and notarizing the deed, you must file it with the county recorder's office to make the transfer official. For assistance, consider using uslegalforms to ensure your Carmel Indiana Quitclaim Deed from Individual to LLC is done correctly.

One disadvantage of putting a property in an LLC is the potential for increased paperwork and ongoing fees. LLCs often require additional reporting and compliance, which can be burdensome for some property owners. However, the benefits, such as liability protection from personal assets, may outweigh these drawbacks when considering a Carmel Indiana Quitclaim Deed from Individual to LLC.