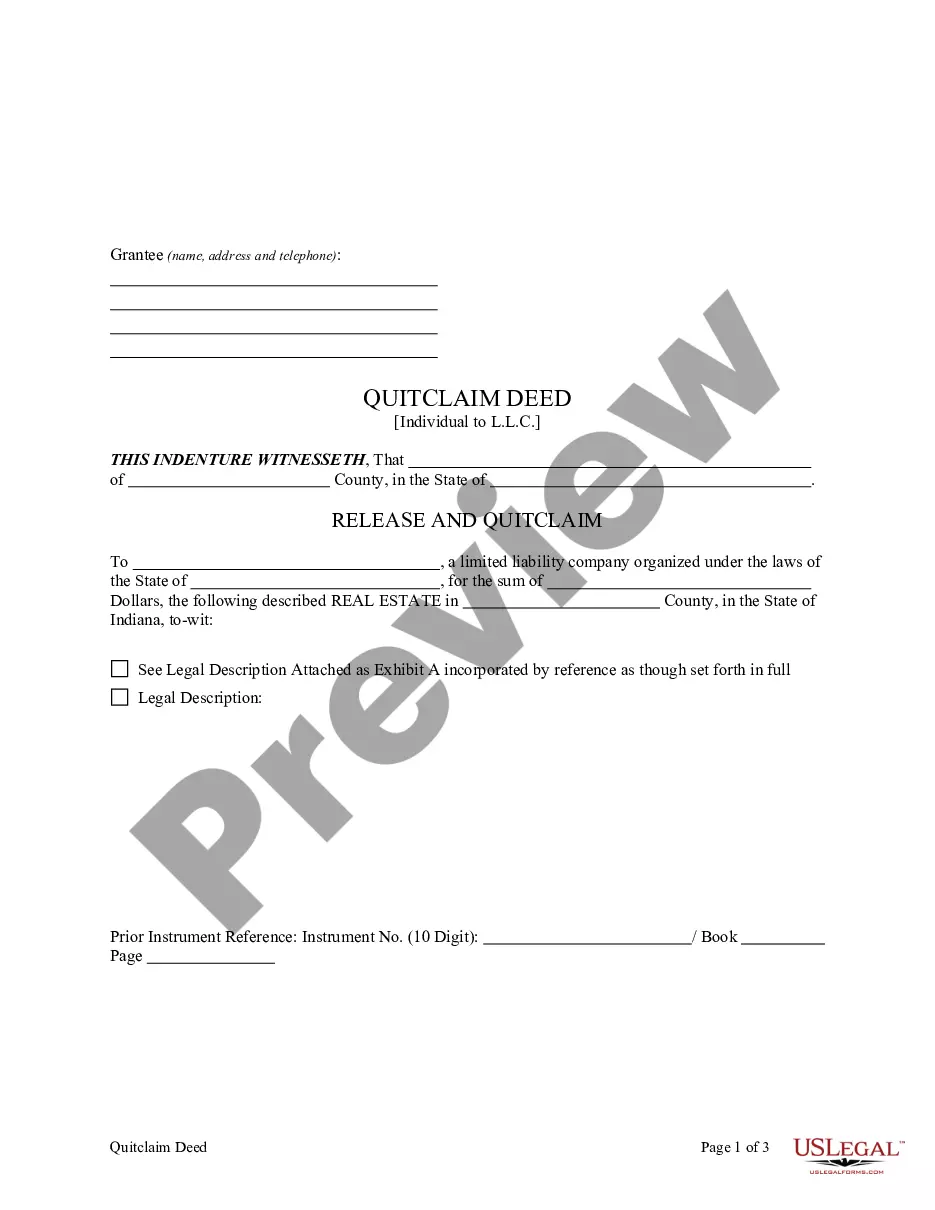

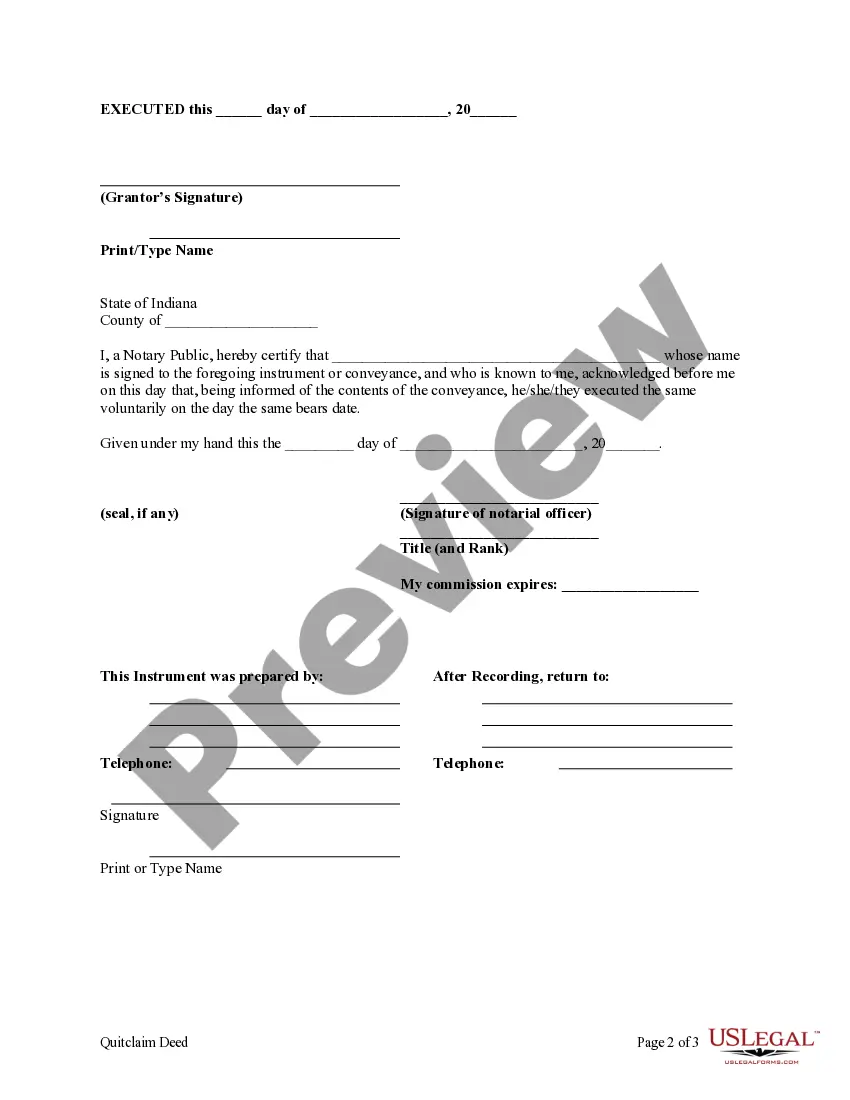

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

A Quitclaim Deed from an Individual to LLC in Indianapolis, Indiana is a legal document that transfers ownership of a property from an individual to a limited liability company (LLC). This type of deed is often used when an individual wants to transfer their personal property to their newly formed LLC, or when an individual wishes to contribute their property to an existing LLC. The Quitclaim Deed is a legally binding document that conveys the individual's interest in the property to the LLC. It is important to note that a Quitclaim Deed does not provide any guarantees or warranties about the property's title, but rather transfers whatever interest the individual has in the property, if any. The LLC will assume ownership and responsibilities related to the property upon the completion of the deed transfer. There are different types of Quitclaim Deeds from Individuals to LCS that may be used in Indianapolis, Indiana. These include: 1. Standard Quitclaim Deed: This is the most common form of quitclaim deed used in property transfers. It transfers the individual's interest in the property directly to the LLC. 2. Joint Tenancy Quitclaim Deed: This type of quitclaim deed is used when the property is co-owned by multiple individuals, and one of the co-owners wishes to transfer their interest to the LLC. The deed specifies the percentage of ownership being transferred. 3. Tenants in Common Quitclaim Deed: Similar to the joint tenancy quitclaim deed, this type of deed is used when property is co-owned by individuals who hold separate and distinct shares. An individual may transfer their share to the LLC through this deed. 4. Life Estate Quitclaim Deed: This quitclaim deed is used when an individual owns a life estate in a property, which allows them to reside on or use the property until their death. The life estate holder can transfer their interest to the LLC, allowing the LLC to assume ownership upon their passing. These are just a few examples of the types of Indianapolis Indiana Quitclaim Deeds from Individuals to LCS that exist. It is important to consult with a qualified attorney or real estate professional to ensure the correct type of quitclaim deed is used, as well as to understand the legal implications and any potential tax consequences of the property transfer.A Quitclaim Deed from an Individual to LLC in Indianapolis, Indiana is a legal document that transfers ownership of a property from an individual to a limited liability company (LLC). This type of deed is often used when an individual wants to transfer their personal property to their newly formed LLC, or when an individual wishes to contribute their property to an existing LLC. The Quitclaim Deed is a legally binding document that conveys the individual's interest in the property to the LLC. It is important to note that a Quitclaim Deed does not provide any guarantees or warranties about the property's title, but rather transfers whatever interest the individual has in the property, if any. The LLC will assume ownership and responsibilities related to the property upon the completion of the deed transfer. There are different types of Quitclaim Deeds from Individuals to LCS that may be used in Indianapolis, Indiana. These include: 1. Standard Quitclaim Deed: This is the most common form of quitclaim deed used in property transfers. It transfers the individual's interest in the property directly to the LLC. 2. Joint Tenancy Quitclaim Deed: This type of quitclaim deed is used when the property is co-owned by multiple individuals, and one of the co-owners wishes to transfer their interest to the LLC. The deed specifies the percentage of ownership being transferred. 3. Tenants in Common Quitclaim Deed: Similar to the joint tenancy quitclaim deed, this type of deed is used when property is co-owned by individuals who hold separate and distinct shares. An individual may transfer their share to the LLC through this deed. 4. Life Estate Quitclaim Deed: This quitclaim deed is used when an individual owns a life estate in a property, which allows them to reside on or use the property until their death. The life estate holder can transfer their interest to the LLC, allowing the LLC to assume ownership upon their passing. These are just a few examples of the types of Indianapolis Indiana Quitclaim Deeds from Individuals to LCS that exist. It is important to consult with a qualified attorney or real estate professional to ensure the correct type of quitclaim deed is used, as well as to understand the legal implications and any potential tax consequences of the property transfer.