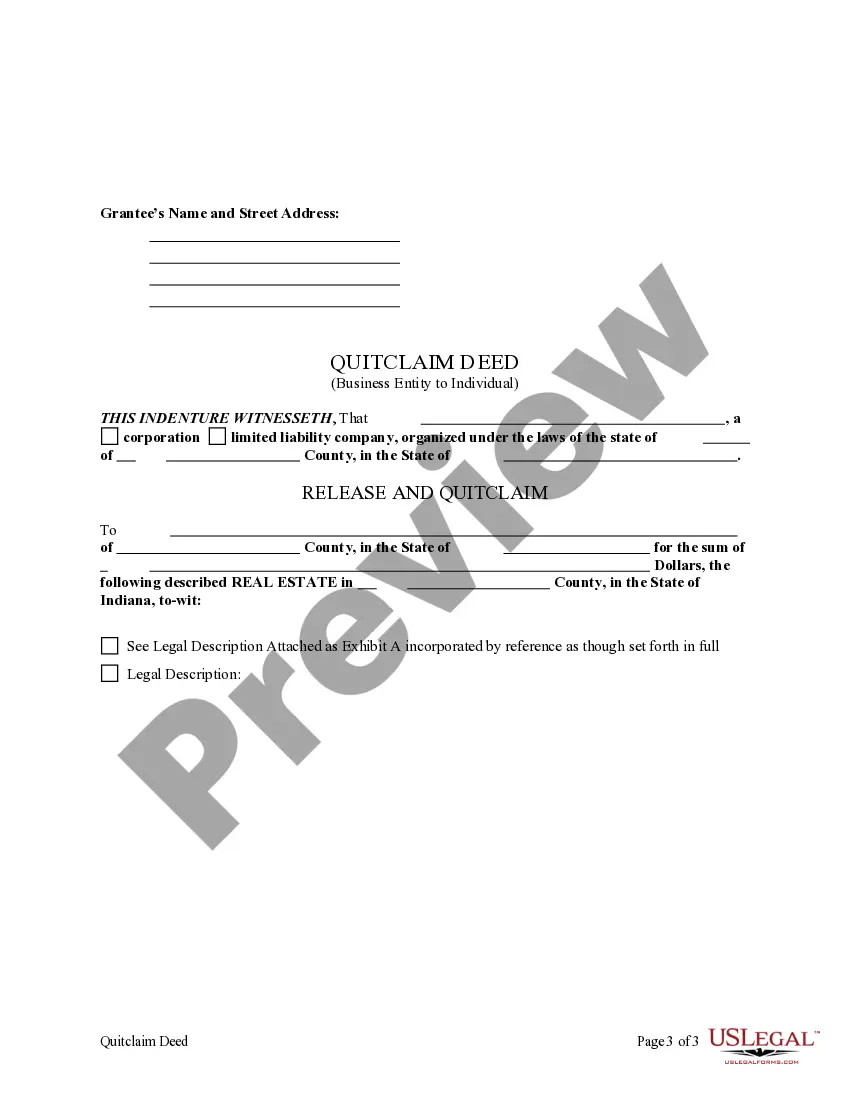

This form is a Quitclaim Deed where the Grantor is a business entity such as a corporation or limited liability company and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Indianapolis Indiana Quitclaim Deed - Business Entity Grantor by Attorney-in-Fact to Individual Grantee

Description

How to fill out Indiana Quitclaim Deed - Business Entity Grantor By Attorney-in-Fact To Individual Grantee?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and business requirements as well as various real-life situations.

All the files are correctly organized by type of use and jurisdictional areas, making the search for the Indianapolis Indiana Quitclaim Deed - Business Entity Grantor by Attorney-in-Fact to Individual Grantee as quick and straightforward as ABC.

Maintaining paperwork organized and compliant with legal obligations is of utmost importance. Take advantage of the US Legal Forms library to always have essential document templates for any requirements right at your fingertips!

- For those already familiar with our service and who have utilized it previously, acquiring the Indianapolis Indiana Quitclaim Deed - Business Entity Grantor by Attorney-in-Fact to Individual Grantee requires just a few clicks.

- All you must do is Log In to your account, select the document, and click Download to save it on your device.

- The process will involve just a couple of extra steps to complete for new users.

- Follow the guidelines below to start with the largest online form collection.

- Review the Preview mode and form description. Ensure you have chosen the correct one that aligns with your needs and completely matches your local jurisdiction requirements.

Form popularity

FAQ

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

The Indiana quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

The person who owns the property signs the Quitclaim Deed stating who will now have legal title to the property.

Definition of Quitclaim Deed? A deed by which the grantor releases any interest he may have in real property. The deed makes no representation as to ownership or warranty.

No guarantees to the new owner: Unlike a warranty deed, a quitclaim deed does not guarantee that a property is free from title defects such as tax liens or title claims from third parties. For this reason, it is a poor legal instrument to use when selling a piece of property for cash considerations.

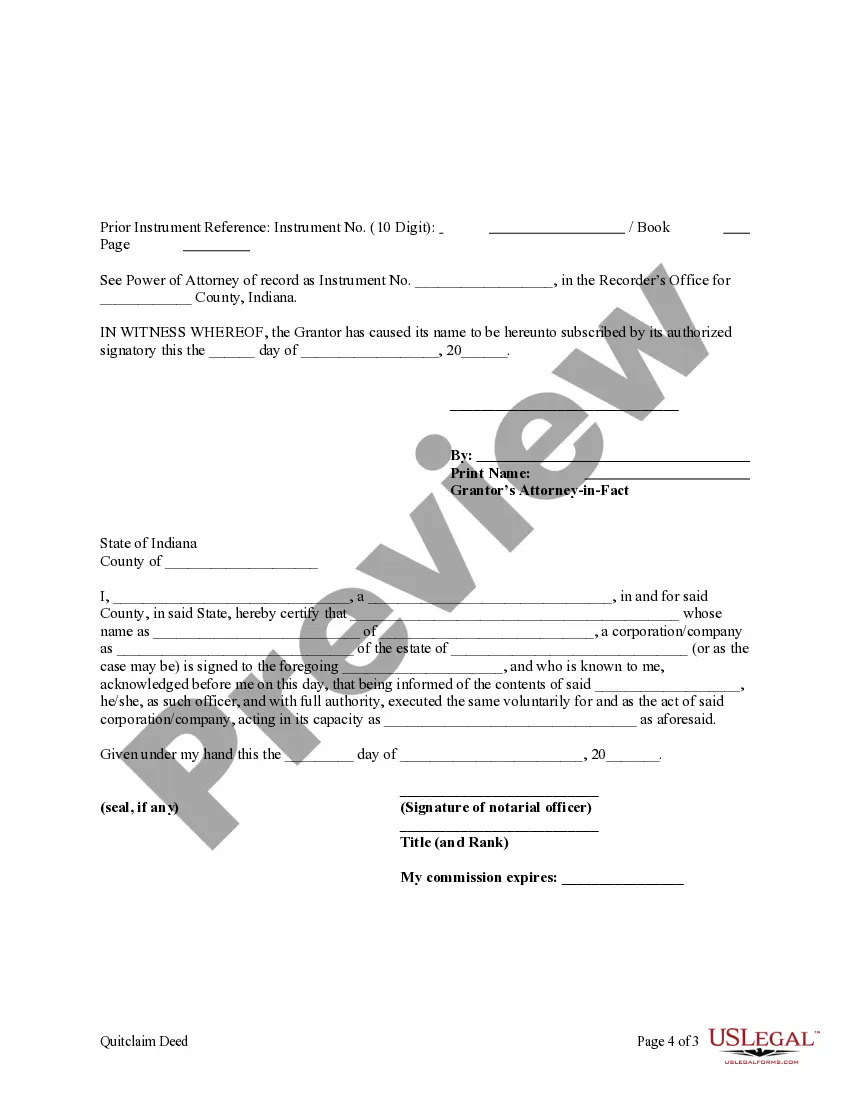

Signing (IC § 32-21-2-3) ? All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county

How to Write & File a Quitclaim Deed in Indiana Step 1: Find your IN quitclaim deed form.Step 2: Gather the information you need.Step 3: Enter the information about the parties.Step 4: Enter the legal description of the property.Step 5: Have the grantor sign the document in the presence of a Notary Public.

In which of the following situations could a quitclaim deed NOT be used? c. The answer is to warrant that a title is valid.

Which of the following is not required for a deed to be valid? Signature of the grantee.