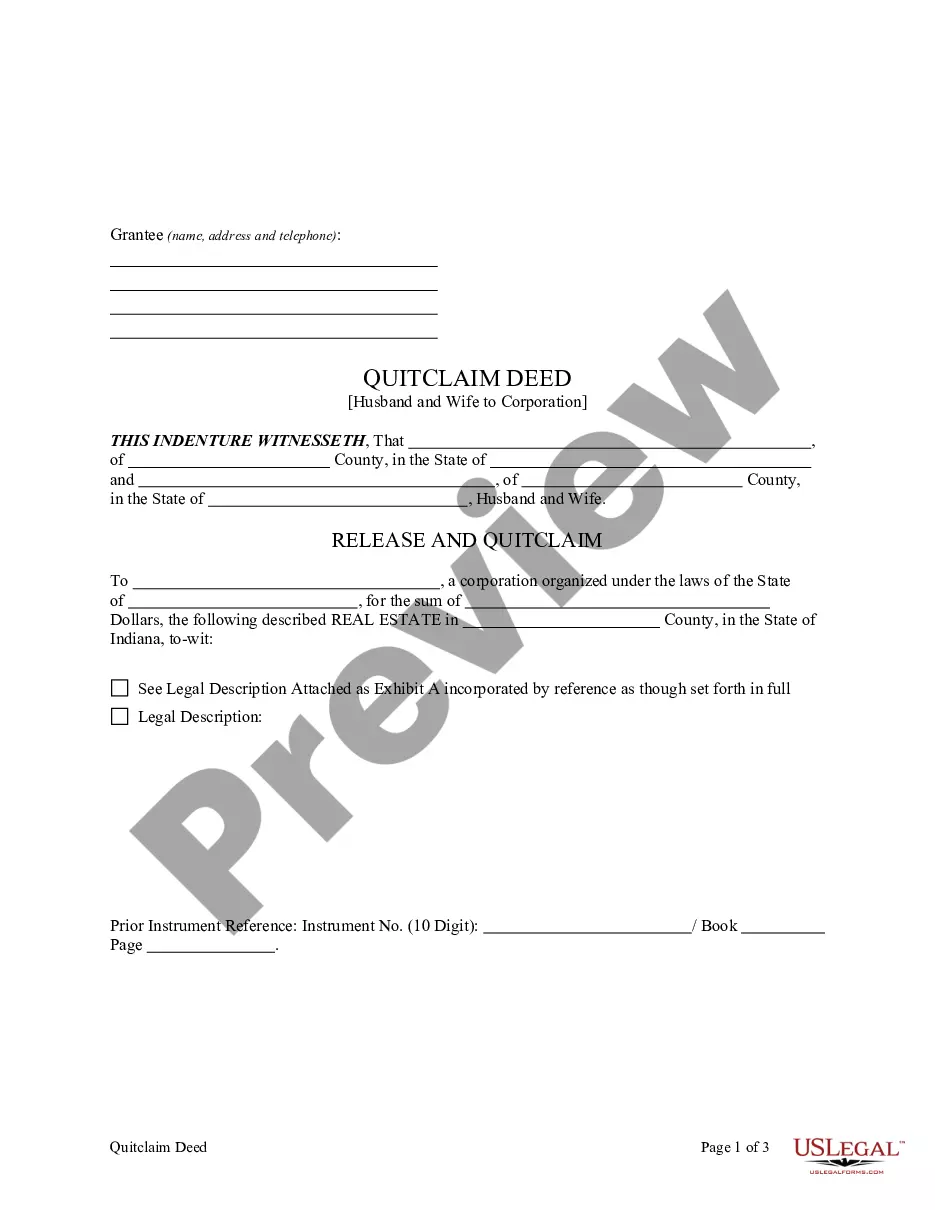

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

An Evansville Indiana Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that transfers the ownership rights of a property from a married couple to a corporation. This deed is commonly used when a couple wishes to transfer their property ownership to a business entity for various reasons, such as liability protection or business structuring. The Evansville Indiana Quitclaim Deed from Husband and Wife to Corporation is executed by both spouses, often accompanied by their respective authorized representatives or attorneys, to ensure a legally binding transfer. It is essential for all parties involved to carefully review and understand the terms and conditions outlined in the deed before signing. The purpose of this transfer is to transform the property from personal ownership to that of a corporation, with specific benefits and implications. By utilizing a quitclaim deed, this transfer is typically done without any warranties or guarantees regarding the property's title. The transfer occurs on an "as-is" basis, with no promises made regarding any potential encumbrances, liens, or defects on the property's title. The Evansville Indiana Quitclaim Deed from Husband and Wife to Corporation serves as a crucial legal instrument in various situations, such as when spouses who jointly own a property wish to protect their personal assets by transferring ownership to a separate entity. Additionally, this deed can also be used for estate planning purposes or to comply with corporate governance regulations. Different variations of the Evansville Indiana Quitclaim Deed from Husband and Wife to Corporation may include: 1. Evansville Indiana Enhanced Life Estate Deed from Husband and Wife to Corporation: This type of deed grants the couple a life estate in the property, allowing them to live there until their death, while simultaneously ensuring that the property's ownership rights are transferred to a designated corporation. 2. Evansville Indiana Joint Tenancy Quitclaim Deed from Husband and Wife to Corporation: In this scenario, the married couple may choose to hold the property as joint tenants with rights of survivorship. Upon either spouse's passing, the surviving spouse automatically inherits the deceased spouse's ownership share. If both spouses pass away, the property ownership is transferred to the designated corporation. 3. Evansville Indiana Warranty Deed from Husband and Wife to Corporation: Unlike a quitclaim deed, this type of deed provides certain warranties and guarantees about the property's title, ensuring a higher level of protection for the corporation receiving the ownership rights. In conclusion, an Evansville Indiana Quitclaim Deed from Husband and Wife to Corporation is a vital legal document used to transfer property ownership from a married couple to a corporation. Understanding the different variations and implications associated with this deed is crucial to ensure a smooth and legally valid transaction. Whether it's for asset protection, estate planning, or corporate structuring, consulting with a qualified attorney is highly recommended navigating the complexities and requirements of such a transfer.