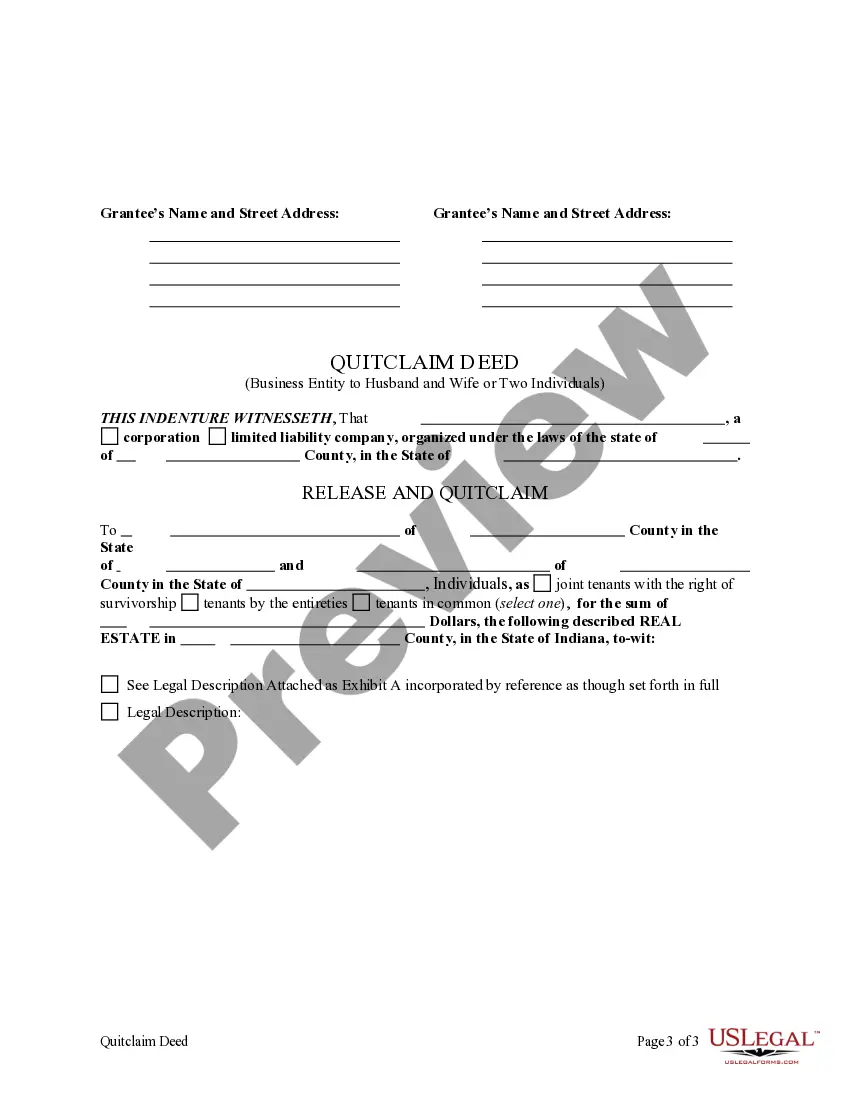

This form is a Quitclaim Deed where the Grantor is a business entity such as a corporation or limited liability company, acting through an attorney, and the Grantees are two individuals or husband and wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

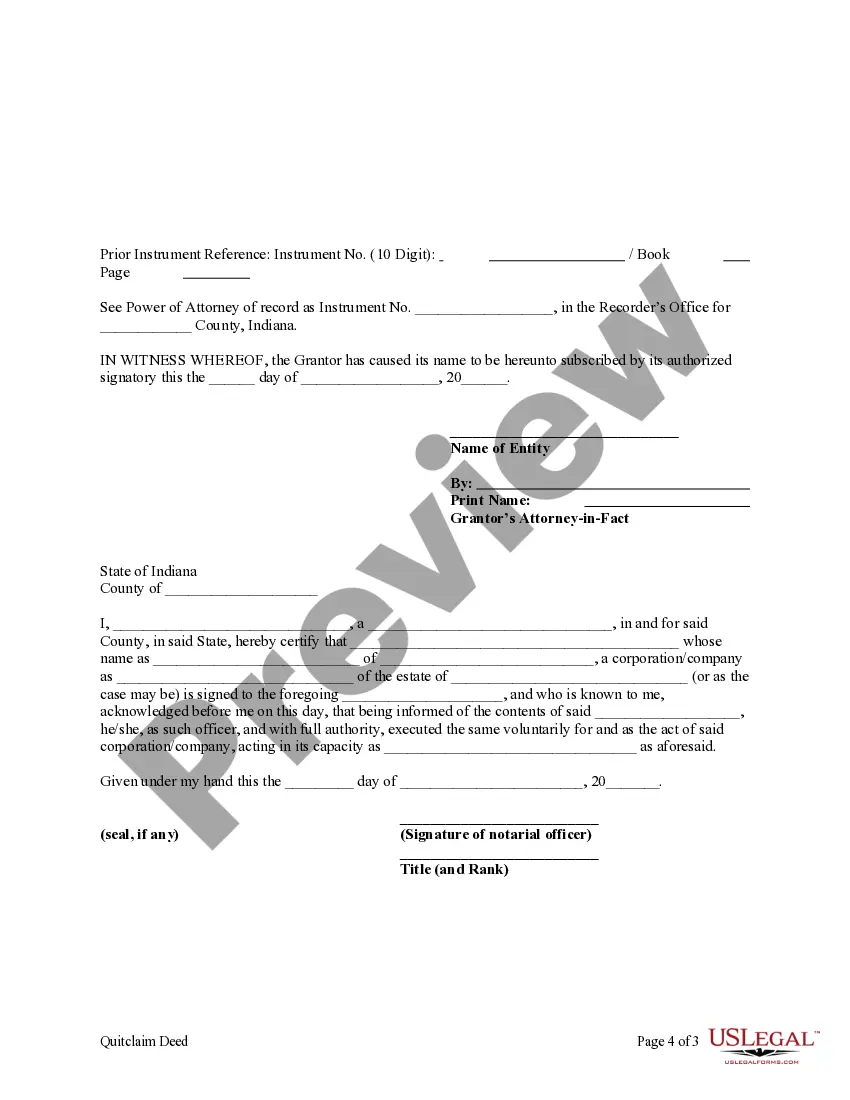

A South Bend Indiana Quitclaim Deed from a Business Entity, through an attorney-in-fact, to Two Individuals or a Husband and Wife refers to a legal document that transfers ownership of a property or real estate from a business entity to two individuals or a married couple. This type of deed is commonly used when a business entity, such as a corporation or partnership, wants to transfer property ownership to individuals or a married couple without any warranty or guarantee of title. There are various types of South Bend Indiana Quitclaim Deeds from Business Entities, through attorney-in-fact, to Two Individuals or a Husband and Wife. Some common ones include: 1. General Quitclaim Deed: This type of deed is the most straightforward and transfers ownership of the property without any warranties or guarantees. It essentially states that the business entity is transferring its interest in the property to the two individuals or the married couple, but it does not make any promises regarding the title. 2. Special Quitclaim Deed: This deed includes specific conditions or limitations imposed by the business entity when transferring the property. For example, the deed may mention any existing liens, encumbrances, or restrictions on the property, making the individuals or the married couple aware of these limitations before accepting the transfer. 3. Corporation to Individuals Quitclaim Deed: This specific type of quitclaim deed is used when a corporation wants to convey property ownership to two individuals or a married couple. It ensures that the transfer is legally recognized and documented. 4. Partnership to Individuals Quitclaim Deed: This type of quitclaim deed is utilized when a partnership wants to transfer ownership of a property to two individuals or a married couple. It allows the partnership to release its interest in the property and transfer it to the individuals or couple involved. 5. Limited Liability Company (LLC) to Individuals Quitclaim Deed: In the case of an LLC, this type of quitclaim deed ensures a proper transfer of property ownership from the business entity to two individuals or a married couple. It legally documents the release of the LLC's interest in the property. In South Bend Indiana, it is crucial to seek legal advice from an attorney experienced in real estate transactions to ensure the quitclaim deed adheres to all local laws and is properly executed. The attorney-in-fact acts as the representative of the business entity, authorized to sign and execute the quitclaim deed on behalf of the entity, transferring the property to the two individuals or the married couple. By using a quitclaim deed, the business entity does not provide a warranty against any potential defects or problems with the title, making it essential for the individuals or the couple to conduct a thorough title search or obtain title insurance before accepting the property transfer.A South Bend Indiana Quitclaim Deed from a Business Entity, through an attorney-in-fact, to Two Individuals or a Husband and Wife refers to a legal document that transfers ownership of a property or real estate from a business entity to two individuals or a married couple. This type of deed is commonly used when a business entity, such as a corporation or partnership, wants to transfer property ownership to individuals or a married couple without any warranty or guarantee of title. There are various types of South Bend Indiana Quitclaim Deeds from Business Entities, through attorney-in-fact, to Two Individuals or a Husband and Wife. Some common ones include: 1. General Quitclaim Deed: This type of deed is the most straightforward and transfers ownership of the property without any warranties or guarantees. It essentially states that the business entity is transferring its interest in the property to the two individuals or the married couple, but it does not make any promises regarding the title. 2. Special Quitclaim Deed: This deed includes specific conditions or limitations imposed by the business entity when transferring the property. For example, the deed may mention any existing liens, encumbrances, or restrictions on the property, making the individuals or the married couple aware of these limitations before accepting the transfer. 3. Corporation to Individuals Quitclaim Deed: This specific type of quitclaim deed is used when a corporation wants to convey property ownership to two individuals or a married couple. It ensures that the transfer is legally recognized and documented. 4. Partnership to Individuals Quitclaim Deed: This type of quitclaim deed is utilized when a partnership wants to transfer ownership of a property to two individuals or a married couple. It allows the partnership to release its interest in the property and transfer it to the individuals or couple involved. 5. Limited Liability Company (LLC) to Individuals Quitclaim Deed: In the case of an LLC, this type of quitclaim deed ensures a proper transfer of property ownership from the business entity to two individuals or a married couple. It legally documents the release of the LLC's interest in the property. In South Bend Indiana, it is crucial to seek legal advice from an attorney experienced in real estate transactions to ensure the quitclaim deed adheres to all local laws and is properly executed. The attorney-in-fact acts as the representative of the business entity, authorized to sign and execute the quitclaim deed on behalf of the entity, transferring the property to the two individuals or the married couple. By using a quitclaim deed, the business entity does not provide a warranty against any potential defects or problems with the title, making it essential for the individuals or the couple to conduct a thorough title search or obtain title insurance before accepting the property transfer.