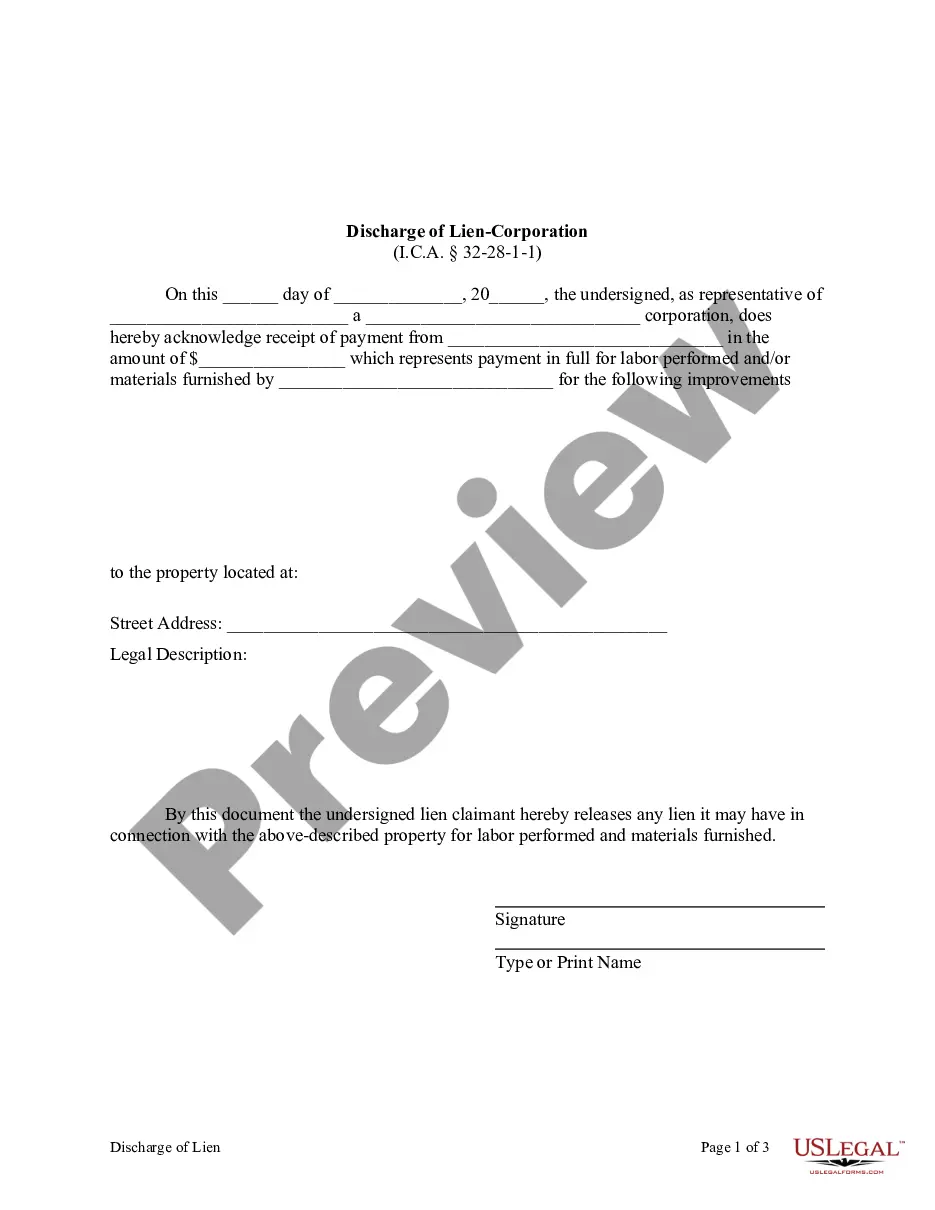

Although Indiana statutes do not have a specific provision for the discharging of liens via payment of the claim, this form can be used by a corporate or LLC lien holder to provide a property owner or other party with a release upon payment in full of the amount owed.

Carmel Indiana Discharge of Lien - Corporation or LLC

Description

How to fill out Indiana Discharge Of Lien - Corporation Or LLC?

Regardless of one's social or occupational rank, completing legal forms is a regrettable obligation in the current professional landscape. Frequently, it’s nearly impossible for someone without legal training to draft such documents from scratch, primarily due to the intricate language and legal details they involve.

This is where US Legal Forms comes into play. Our platform offers an extensive collection of over 85,000 ready-to-use state-specific forms that cater to nearly any legal circumstance. US Legal Forms is also an excellent resource for associates or legal advisors who wish to enhance their efficiency by utilizing our DIY forms.

Whether you need the Carmel Indiana Discharge of Lien - Corporation or LLC, or any other document suitable for your state or locality, with US Legal Forms, everything is conveniently accessible. Here’s how you can obtain the Carmel Indiana Discharge of Lien - Corporation or LLC in minutes using our reliable service. If you are already a customer, you can proceed to Log In to your account to retrieve the appropriate form.

You’re all set! You can now either print the document or fill it out online. Should you encounter any issues accessing your purchased forms, you can easily locate them in the My documents section.

No matter what issue you’re addressing, US Legal Forms is here to assist you. Give it a try today and witness the benefits for yourself.

- Verify that the form you selected is suitable for your area, as the regulations of one state or region do not apply to another.

- View the document and read a brief description (if available) of the circumstances for which the form can be utilized.

- If the form you picked does not meet your requirements, you can start again and look for the necessary document.

- Click Buy now and select the subscription plan that works best for you.

- Log in to your account {using your credentials or create a new one from scratch.

- Choose the payment option and proceed to download the Carmel Indiana Discharge of Lien - Corporation or LLC once your payment is confirmed.

Form popularity

FAQ

You can obtain a lien release form from several sources, including the website of your local county recorder's office or legal assistance providers. Additionally, US Legal Forms offers a simple way to access various legal forms, including the Carmel Indiana discharge of lien - corporation or LLC templates you need. Using these platforms ensures you have the correct and up-to-date documents for your specific situation.

To obtain a lien release from a company that is no longer in operation, you typically need to provide documentation proving the original debt was settled. You may also contact the county recorder's office or legal counsel for guidance. They can help you navigate the process of obtaining a Carmel Indiana discharge of lien for your corporation or LLC. If necessary, filing a court petition can also be a pathway to resolving this situation.

To put a lien on an LLC, start by obtaining a copy of the LLC's formation documents and confirming the debt amount. Prepare a lien document that includes all relevant details, such as the names of the creditor and debtor, and the description of the debt obligation. Then, file the lien with the appropriate state agency or county office. Utilizing the US Legal Forms platform can streamline this process for a Carmel Indiana discharge of lien - corporation or LLC, providing you with helpful tools and templates.

While liens can secure your interests, they also come with disadvantages. They may limit the property owner’s ability to sell or refinance their property. Moreover, a lien can create a negative impression of your business, affecting future transactions. Understanding these factors is crucial when considering a Carmel Indiana discharge of lien - corporation or LLC.

Filling out a lien affidavit involves providing key information about the debt and the parties involved. Start by specifying the name of the creditor and the debtor, along with the details of the debt. Next, don't forget to include a description of the property subject to the lien. The US Legal Forms platform can simplify this process by offering templates tailored for Carmel Indiana discharge of lien - corporation or LLC.

To file a lien on a company, you need to gather necessary details, such as the corporation's or LLC's name and address, and the nature of the debt. Then, you can prepare the lien document, ensuring it meets your state's legal requirements. After that, you must submit the document to the appropriate county clerk or recorder's office. Finally, consider using the US Legal Forms platform for easy access to templates and guidance on filing a Carmel Indiana discharge of lien for corporations or LLCs.

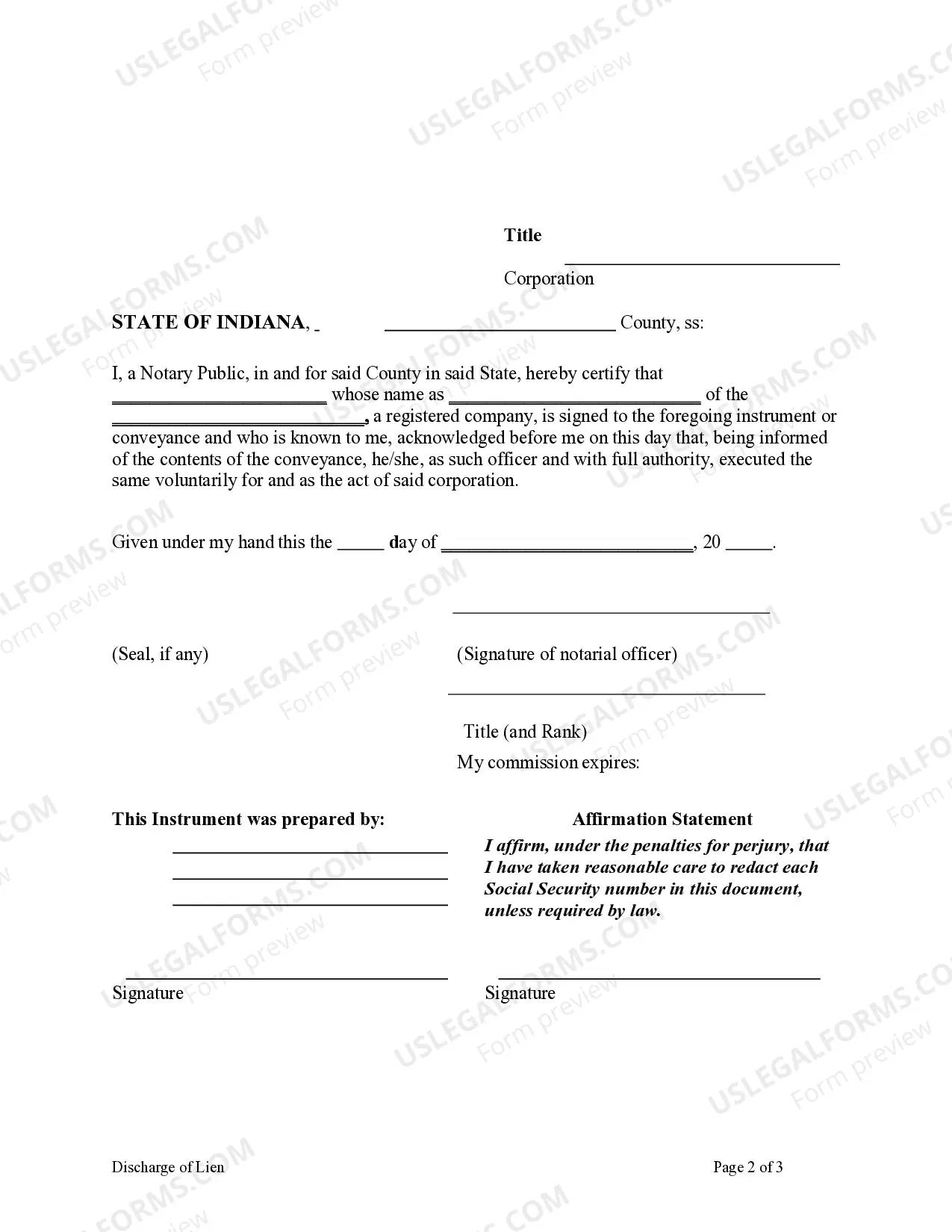

Releasing a lien in Indiana involves preparing and filing a release document with the county recorder where the lien was filed. Follow all procedural guidelines, including paying any associated fees. Utilizing reliable resources like USLegalForms can make the process smoother for your Carmel Indiana Discharge of Lien - Corporation or LLC.

To expedite the release of a lien, gather all necessary documentation and ensure accuracy before submission. Contact the appropriate county office to clarify their specific requirements and consider using services from platforms like USLegalForms for guidance. Acting quickly can significantly enhance your Carmel Indiana Discharge of Lien - Corporation or LLC experience.

Creating a release of lien involves drafting a document that states the lien's discharge. Ensure you include the original lien document's details, along with your signature and the date. Completing this accurately is vital to ensure the validity of the Carmel Indiana Discharge of Lien - Corporation or LLC.

To file a lien against an LLC in Carmel, Indiana, you need to complete a lien statement form outlining the details of your claim. Once you fill out the form, file it with the county recorder's office where the LLC is registered. Properly documenting your claim is essential for an effective Carmel Indiana Discharge of Lien - Corporation or LLC.