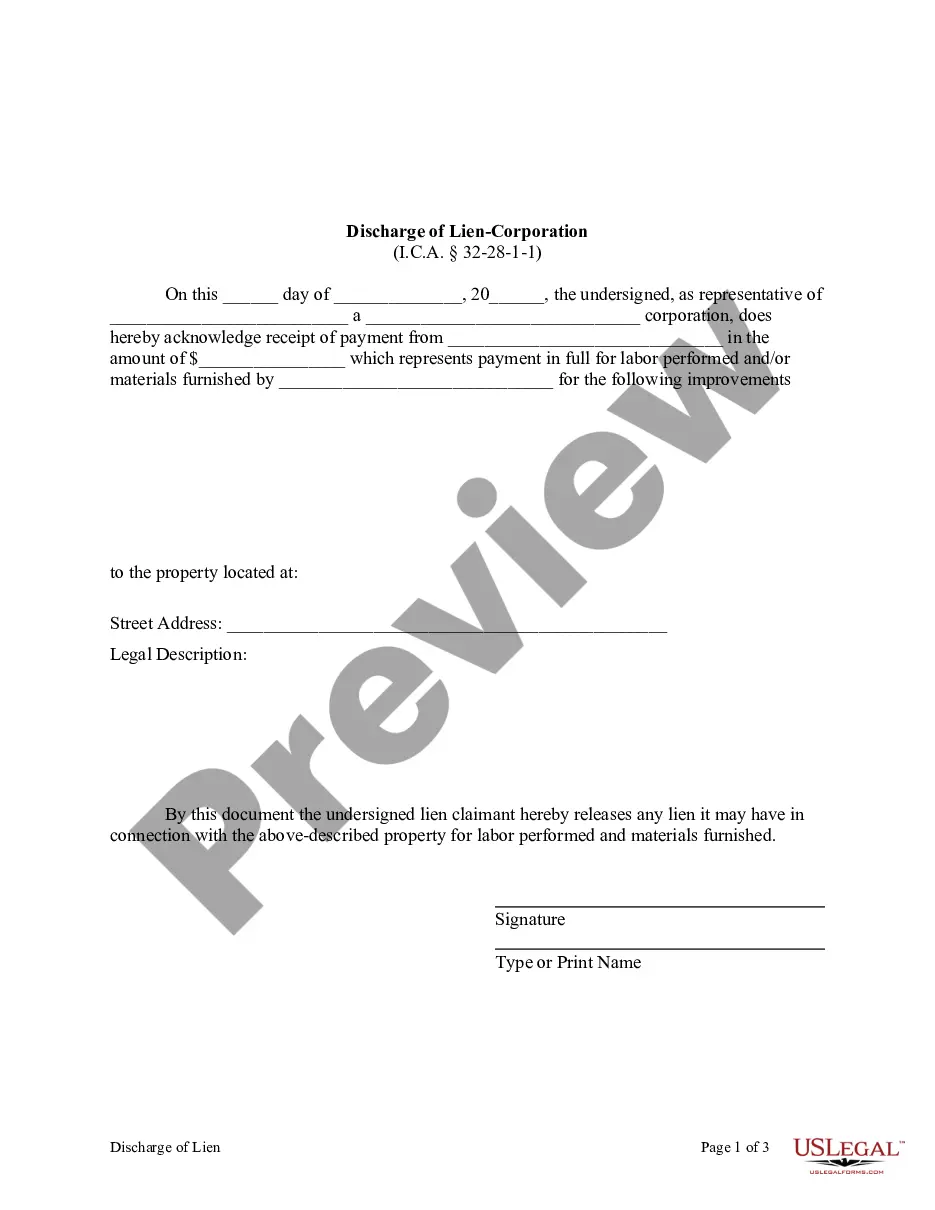

Although Indiana statutes do not have a specific provision for the discharging of liens via payment of the claim, this form can be used by a corporate or LLC lien holder to provide a property owner or other party with a release upon payment in full of the amount owed.

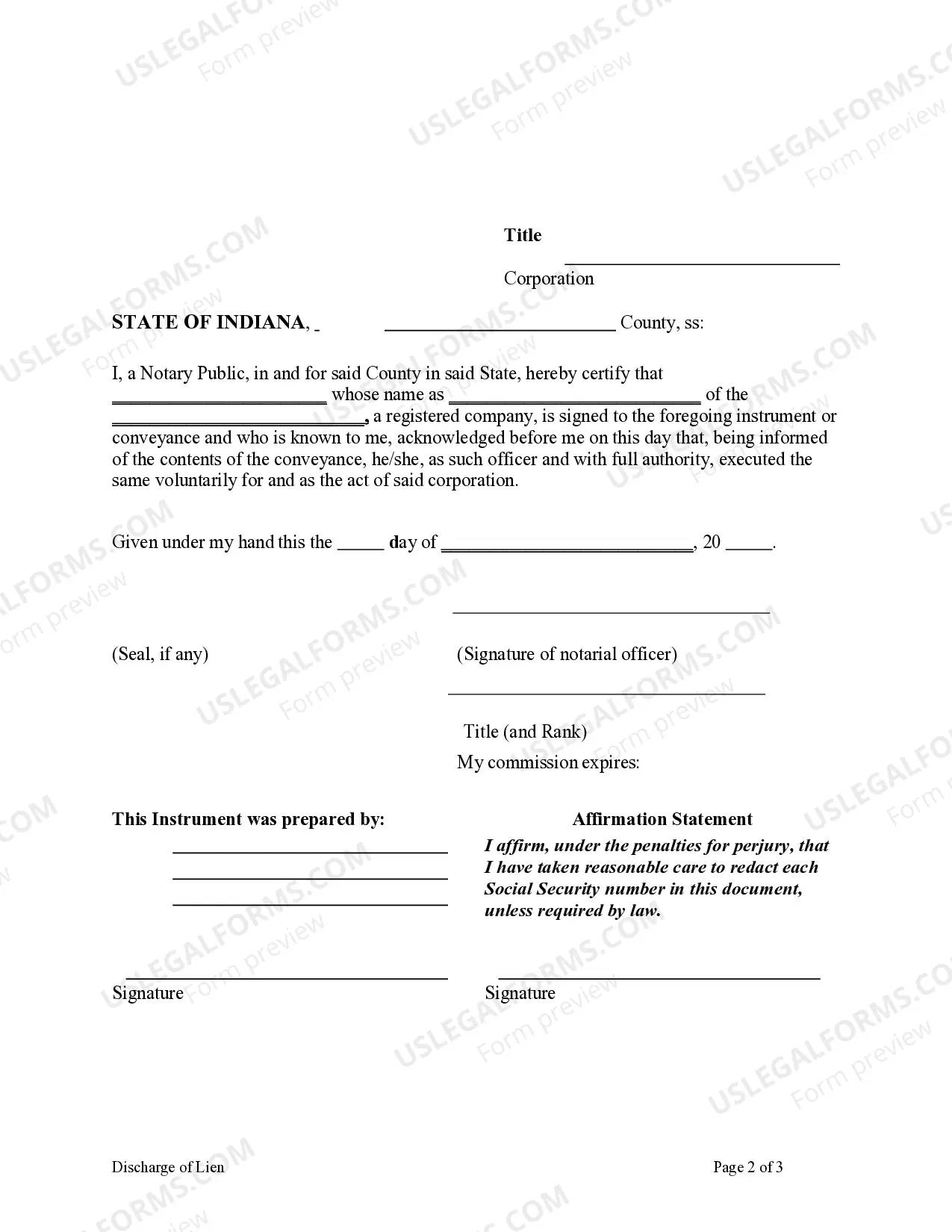

South Bend Indiana Discharge of Lien — Corporation or LLC: In South Bend, Indiana, when it comes to the discharge of lien, both corporations and Limited Liability Companies (LCS) are subject to specific procedures. Discharging a lien is a crucial step for businesses to remove encumbrances on their properties, ensuring clear ownership titles and maintaining financial integrity. Let's dive into the details of the South Bend Indiana Discharge of Lien for Corporations and LCS. 1. Discharging Lien — Corporation: When a corporation owns property in South Bend, Indiana, and a lien has been placed on it due to debts or obligations, the corporation can request a discharge of the lien. This process involves filing the necessary paperwork with the appropriate authorities, such as the South Bend County Recorder's Office or other relevant entities. The paperwork usually includes information about the lien, the property involved, and the corporation's details. By successfully completing the discharge process, the corporation can free the property from any outstanding liens and maintain clear ownership. 2. Discharging Lien — LLC: Similar to corporations, Limited Liability Companies in South Bend, Indiana, can also initiate a discharge of lien for their properties. LCS have the advantage of liability protection, and the process of discharging a lien for an LLC follows a similar pattern as for corporations. Generally, filing the required documents with the South Bend County Recorder's Office or relevant authorities is necessary. These documents typically provide details about the lien, property, and specifics of the LLC. By successfully completing the discharge process, the LLC can remove any existing encumbrances on the property, safeguarding its assets and financial interests. It is essential to understand that the discharge of lien procedures may have slight differences for corporations and LCS, depending on the specific regulations enforced in South Bend, Indiana. Official sources such as the South Bend County government website or legal professionals can provide accurate and up-to-date information regarding the discharge process for each entity type. Remember, the South Bend Indiana Discharge of Lien — Corporation or LLC aims to facilitate the removal of liens for properties owned by businesses operating as corporations or Limited Liability Companies. By following the necessary procedures and providing the required documentation, corporations and LCS can successfully discharge liens, ensuring the integrity of their property ownership and financial stability. Keywords: South Bend Indiana, discharge of lien, corporation, LLC, South Bend County Recorder's Office, property, documents, encumbrances, ownership titles, financial integrity, liability protection, legal professionals.South Bend Indiana Discharge of Lien — Corporation or LLC: In South Bend, Indiana, when it comes to the discharge of lien, both corporations and Limited Liability Companies (LCS) are subject to specific procedures. Discharging a lien is a crucial step for businesses to remove encumbrances on their properties, ensuring clear ownership titles and maintaining financial integrity. Let's dive into the details of the South Bend Indiana Discharge of Lien for Corporations and LCS. 1. Discharging Lien — Corporation: When a corporation owns property in South Bend, Indiana, and a lien has been placed on it due to debts or obligations, the corporation can request a discharge of the lien. This process involves filing the necessary paperwork with the appropriate authorities, such as the South Bend County Recorder's Office or other relevant entities. The paperwork usually includes information about the lien, the property involved, and the corporation's details. By successfully completing the discharge process, the corporation can free the property from any outstanding liens and maintain clear ownership. 2. Discharging Lien — LLC: Similar to corporations, Limited Liability Companies in South Bend, Indiana, can also initiate a discharge of lien for their properties. LCS have the advantage of liability protection, and the process of discharging a lien for an LLC follows a similar pattern as for corporations. Generally, filing the required documents with the South Bend County Recorder's Office or relevant authorities is necessary. These documents typically provide details about the lien, property, and specifics of the LLC. By successfully completing the discharge process, the LLC can remove any existing encumbrances on the property, safeguarding its assets and financial interests. It is essential to understand that the discharge of lien procedures may have slight differences for corporations and LCS, depending on the specific regulations enforced in South Bend, Indiana. Official sources such as the South Bend County government website or legal professionals can provide accurate and up-to-date information regarding the discharge process for each entity type. Remember, the South Bend Indiana Discharge of Lien — Corporation or LLC aims to facilitate the removal of liens for properties owned by businesses operating as corporations or Limited Liability Companies. By following the necessary procedures and providing the required documentation, corporations and LCS can successfully discharge liens, ensuring the integrity of their property ownership and financial stability. Keywords: South Bend Indiana, discharge of lien, corporation, LLC, South Bend County Recorder's Office, property, documents, encumbrances, ownership titles, financial integrity, liability protection, legal professionals.