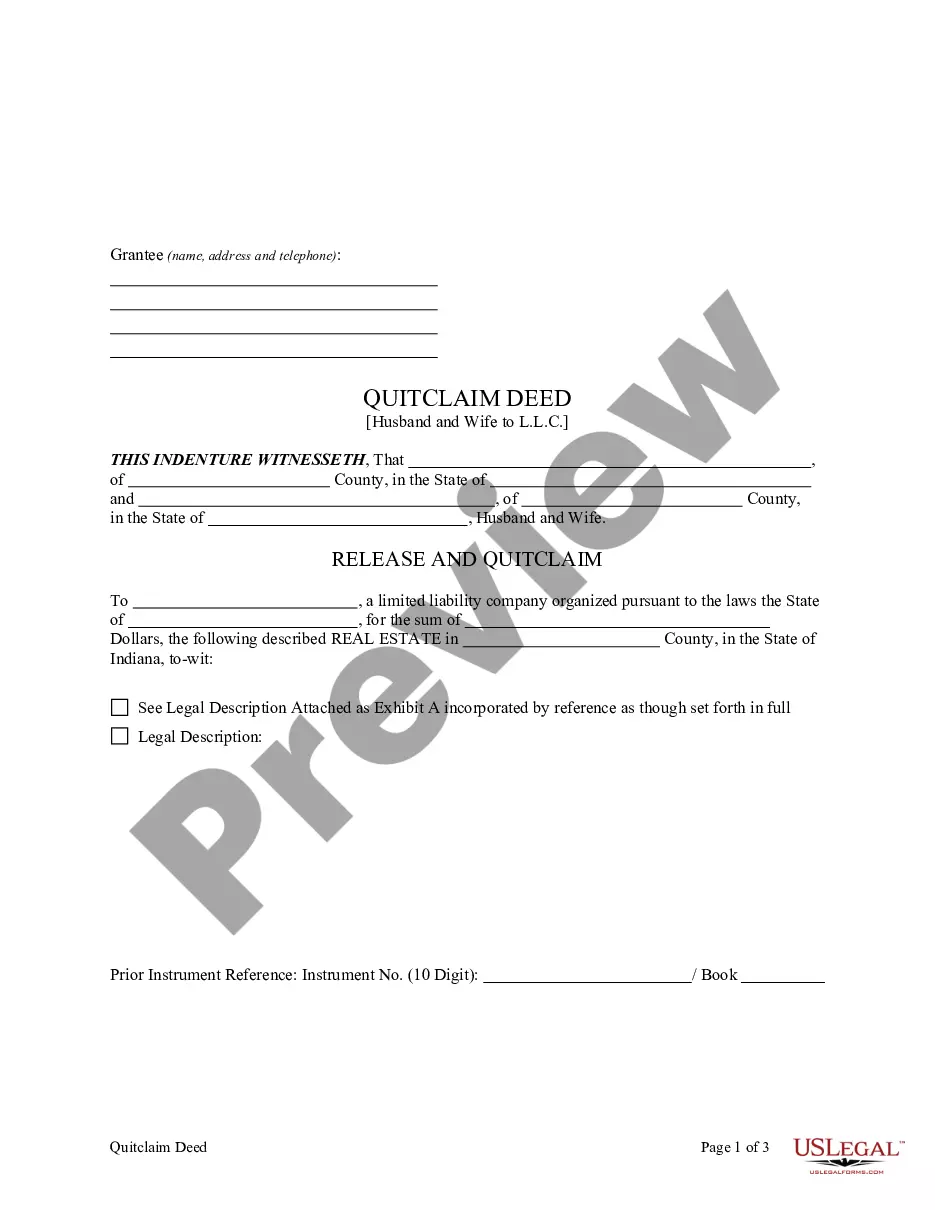

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Carmel Indiana Quitclaim Deed from Husband and Wife to LLC: A Comprehensive Guide A Carmel Indiana Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a Limited Liability Company (LLC) in Carmel, Indiana. This type of deed is commonly utilized when spouses want to transfer their property interests into an entity they jointly own or when they want to protect their personal assets by placing the property under the LLC's ownership. It is important to understand the various types of Carmel Indiana Quitclaim Deed from Husband and Wife to LLC to make informed decisions regarding property ownership and asset protection options. 1. Standard Carmel Indiana Quitclaim Deed from Husband and Wife to LLC: This is the most basic form of quitclaim deed and involves the transfer of ownership of the property from a husband and wife to an LLC. It provides a simple and straightforward method of transferring property interests, ensuring that the LLC becomes the legal owner of the property. 2. Carmel Indiana Quitclaim Deed with Retained Interest: In this type of quitclaim deed, the husband and wife transfer the property to the LLC while retaining certain rights, such as the right to live in the property or receive rental income from it, for a specified period. Retaining an interest can be useful if the couple wants to maintain some control over the property while also enjoying the benefits of placing it under the LLC's ownership. 3. Carmel Indiana Quitclaim Deed with Joint Tenancy: This form of quitclaim deed allows the husband and wife to transfer their property interests into an LLC while maintaining joint ownership with rights of survivorship. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's ownership share. This type of deed is commonly used for estate planning purposes, ensuring that the property seamlessly transfers to the LLC and avoiding probate. 4. Carmel Indiana Quitclaim Deed with Tenancy in Common: In this type of quitclaim deed, the husband and wife transfer their property interests to the LLC while becoming tenants in common with other owners, which can include entities or individuals. Each owner holds a distinct ownership percentage, which can be useful for partners who want to maintain separate ownership interests within the LLC. This type of arrangement is commonly used in business partnerships or investment scenarios. It is crucial to consult with a qualified attorney or real estate professional to understand the intricacies of each type of Carmel Indiana Quitclaim Deed from Husband and Wife to LLC. They can provide guidance on the most suitable option based on individual circumstances and legal requirements. Taking the time to fully grasp the distinct features of each type of deed will aid in making informed decisions and ensuring a smooth transfer of property ownership while protecting personal assets under the LLC's umbrella.Carmel Indiana Quitclaim Deed from Husband and Wife to LLC: A Comprehensive Guide A Carmel Indiana Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a Limited Liability Company (LLC) in Carmel, Indiana. This type of deed is commonly utilized when spouses want to transfer their property interests into an entity they jointly own or when they want to protect their personal assets by placing the property under the LLC's ownership. It is important to understand the various types of Carmel Indiana Quitclaim Deed from Husband and Wife to LLC to make informed decisions regarding property ownership and asset protection options. 1. Standard Carmel Indiana Quitclaim Deed from Husband and Wife to LLC: This is the most basic form of quitclaim deed and involves the transfer of ownership of the property from a husband and wife to an LLC. It provides a simple and straightforward method of transferring property interests, ensuring that the LLC becomes the legal owner of the property. 2. Carmel Indiana Quitclaim Deed with Retained Interest: In this type of quitclaim deed, the husband and wife transfer the property to the LLC while retaining certain rights, such as the right to live in the property or receive rental income from it, for a specified period. Retaining an interest can be useful if the couple wants to maintain some control over the property while also enjoying the benefits of placing it under the LLC's ownership. 3. Carmel Indiana Quitclaim Deed with Joint Tenancy: This form of quitclaim deed allows the husband and wife to transfer their property interests into an LLC while maintaining joint ownership with rights of survivorship. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's ownership share. This type of deed is commonly used for estate planning purposes, ensuring that the property seamlessly transfers to the LLC and avoiding probate. 4. Carmel Indiana Quitclaim Deed with Tenancy in Common: In this type of quitclaim deed, the husband and wife transfer their property interests to the LLC while becoming tenants in common with other owners, which can include entities or individuals. Each owner holds a distinct ownership percentage, which can be useful for partners who want to maintain separate ownership interests within the LLC. This type of arrangement is commonly used in business partnerships or investment scenarios. It is crucial to consult with a qualified attorney or real estate professional to understand the intricacies of each type of Carmel Indiana Quitclaim Deed from Husband and Wife to LLC. They can provide guidance on the most suitable option based on individual circumstances and legal requirements. Taking the time to fully grasp the distinct features of each type of deed will aid in making informed decisions and ensuring a smooth transfer of property ownership while protecting personal assets under the LLC's umbrella.