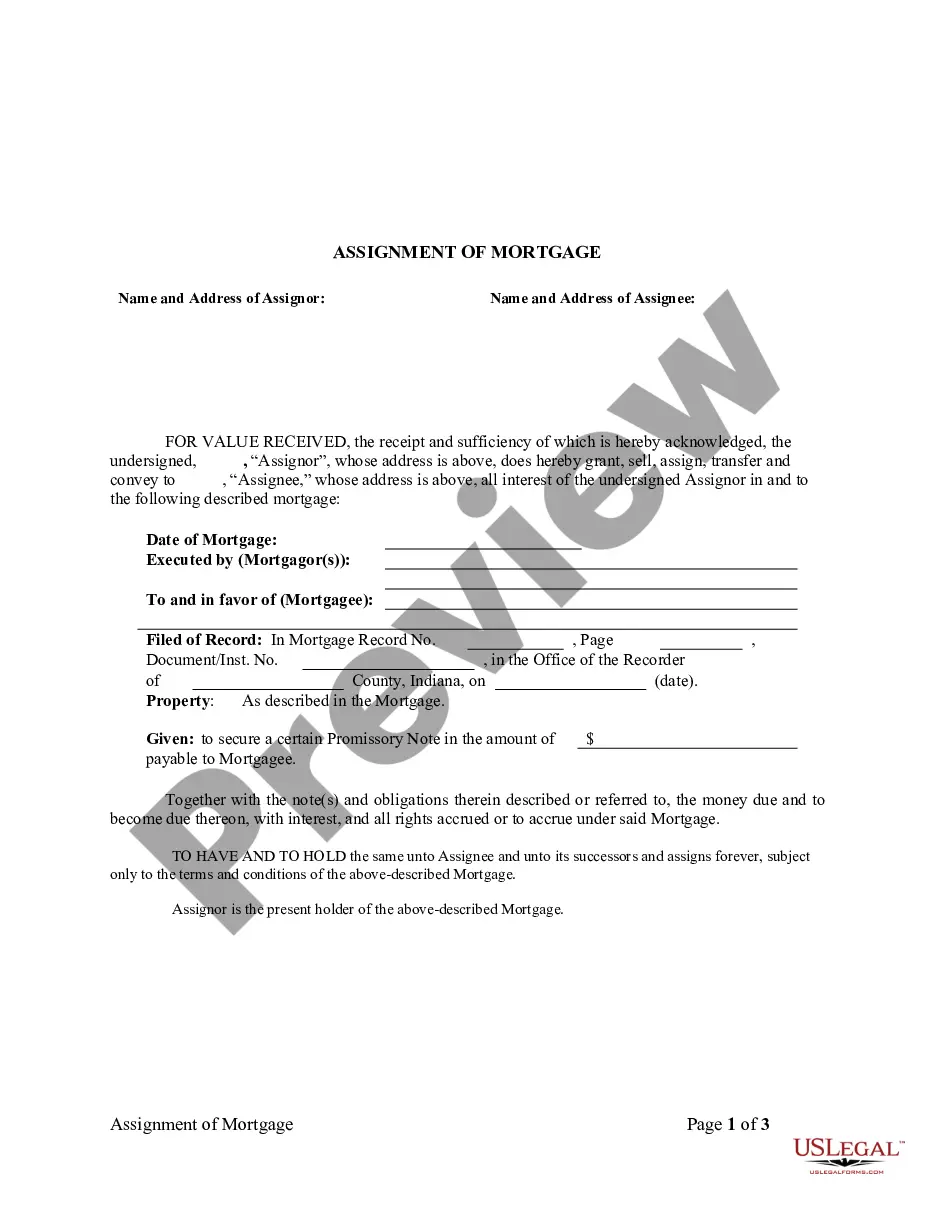

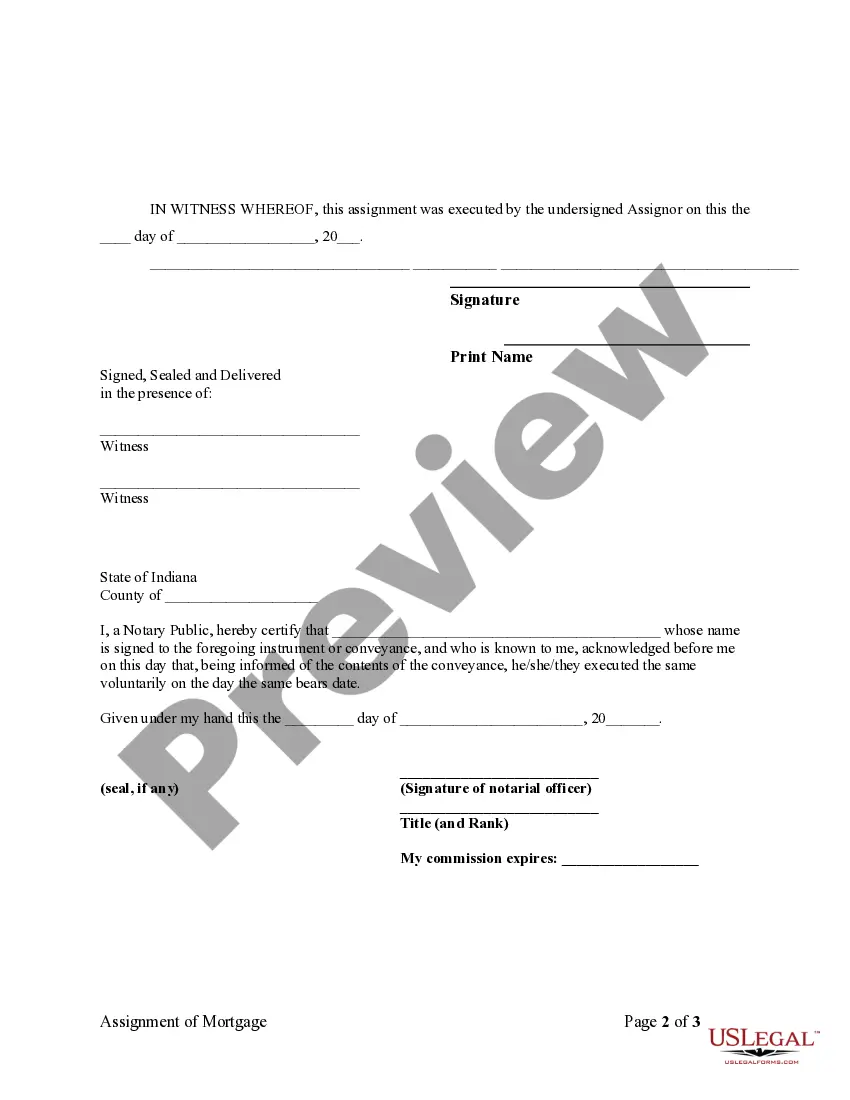

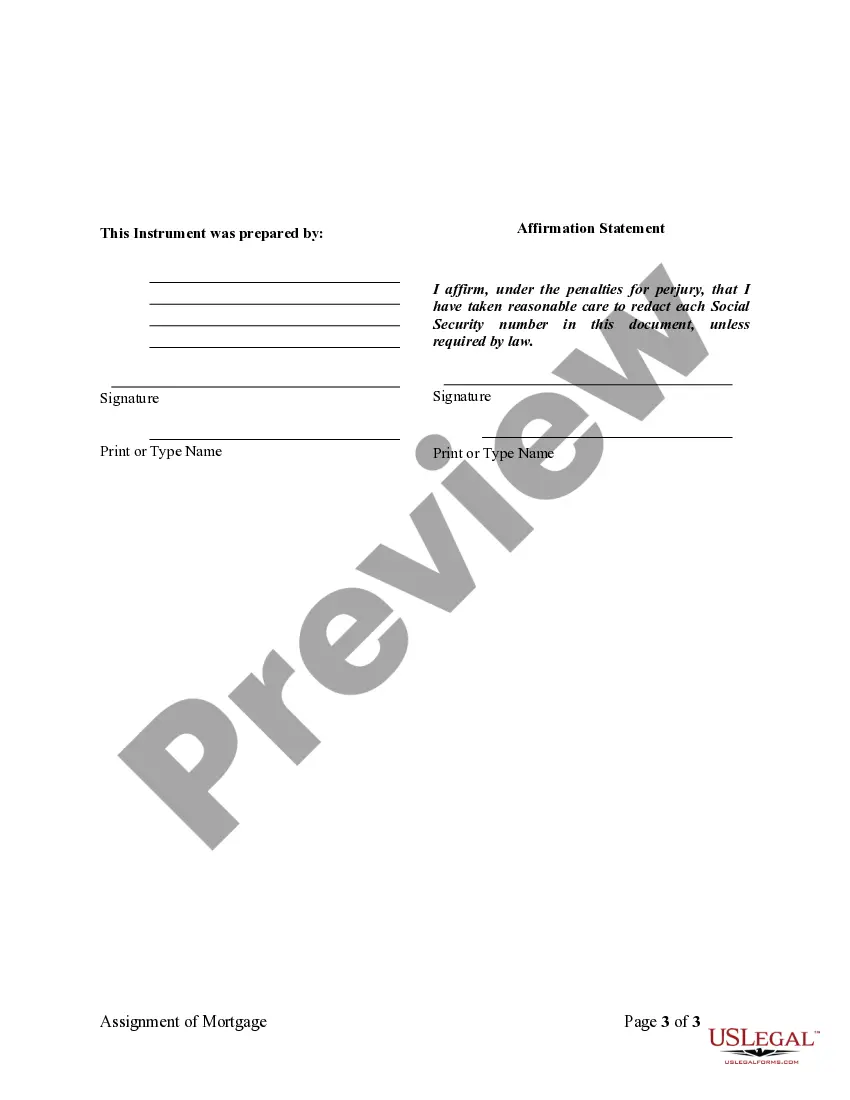

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

South Bend Indiana Assignment of Mortgage by Individual Mortgage Holder is a legal process in which a mortgage loan is transferred from one individual mortgage holder to another. This assignment allows the new mortgage holder to assume all rights and responsibilities associated with the mortgage, including the right to collect payments and enforce the terms of the loan. This is a common practice in real estate transactions and can occur for various reasons, such as the sale of the property or the transfer of the mortgage to another individual. There are different types of South Bend Indiana Assignment of Mortgage by Individual Mortgage Holder, each serving a specific purpose. Some key types include: 1. Voluntary Assignment: This type of assignment occurs when the current mortgage holder willingly transfers the mortgage to another individual. It may happen due to personal reasons, financial considerations, or a desire to transfer the loan to a more favorable interest rate. 2. Involuntary Assignment: In some cases, a mortgage may be involuntarily assigned to another individual mortgage holder. This can happen as a result of a court order, foreclosure proceedings, or bankruptcy proceedings where the mortgage is reassigned to a new party. 3. Partial Assignment: A partial assignment involves transferring only a portion of the mortgage rights to another individual. This could occur when the original mortgage borrower refinances their loan and assigns the new loan to multiple mortgage holders. 4. Full Assignment: A full assignment involves the complete transfer of the mortgage loan to another individual mortgage holder. This typically occurs when the property is sold, and the new buyer assumes the mortgage obligation. When an Assignment of Mortgage by Individual Mortgage Holder takes place in South Bend, Indiana, it is crucial for all parties involved to ensure that the assignment is properly documented and recorded. This ensures that the new mortgage holder has a legal right to enforce the loan terms, collect payments, and protect their interest in the property. Overall, the Assignment of Mortgage by Individual Mortgage Holder is a significant legal process that facilitates the transfer of mortgage rights from one individual to another in South Bend, Indiana. It is important to consult with legal professionals or seek expert advice to navigate this process effectively.South Bend Indiana Assignment of Mortgage by Individual Mortgage Holder is a legal process in which a mortgage loan is transferred from one individual mortgage holder to another. This assignment allows the new mortgage holder to assume all rights and responsibilities associated with the mortgage, including the right to collect payments and enforce the terms of the loan. This is a common practice in real estate transactions and can occur for various reasons, such as the sale of the property or the transfer of the mortgage to another individual. There are different types of South Bend Indiana Assignment of Mortgage by Individual Mortgage Holder, each serving a specific purpose. Some key types include: 1. Voluntary Assignment: This type of assignment occurs when the current mortgage holder willingly transfers the mortgage to another individual. It may happen due to personal reasons, financial considerations, or a desire to transfer the loan to a more favorable interest rate. 2. Involuntary Assignment: In some cases, a mortgage may be involuntarily assigned to another individual mortgage holder. This can happen as a result of a court order, foreclosure proceedings, or bankruptcy proceedings where the mortgage is reassigned to a new party. 3. Partial Assignment: A partial assignment involves transferring only a portion of the mortgage rights to another individual. This could occur when the original mortgage borrower refinances their loan and assigns the new loan to multiple mortgage holders. 4. Full Assignment: A full assignment involves the complete transfer of the mortgage loan to another individual mortgage holder. This typically occurs when the property is sold, and the new buyer assumes the mortgage obligation. When an Assignment of Mortgage by Individual Mortgage Holder takes place in South Bend, Indiana, it is crucial for all parties involved to ensure that the assignment is properly documented and recorded. This ensures that the new mortgage holder has a legal right to enforce the loan terms, collect payments, and protect their interest in the property. Overall, the Assignment of Mortgage by Individual Mortgage Holder is a significant legal process that facilitates the transfer of mortgage rights from one individual to another in South Bend, Indiana. It is important to consult with legal professionals or seek expert advice to navigate this process effectively.