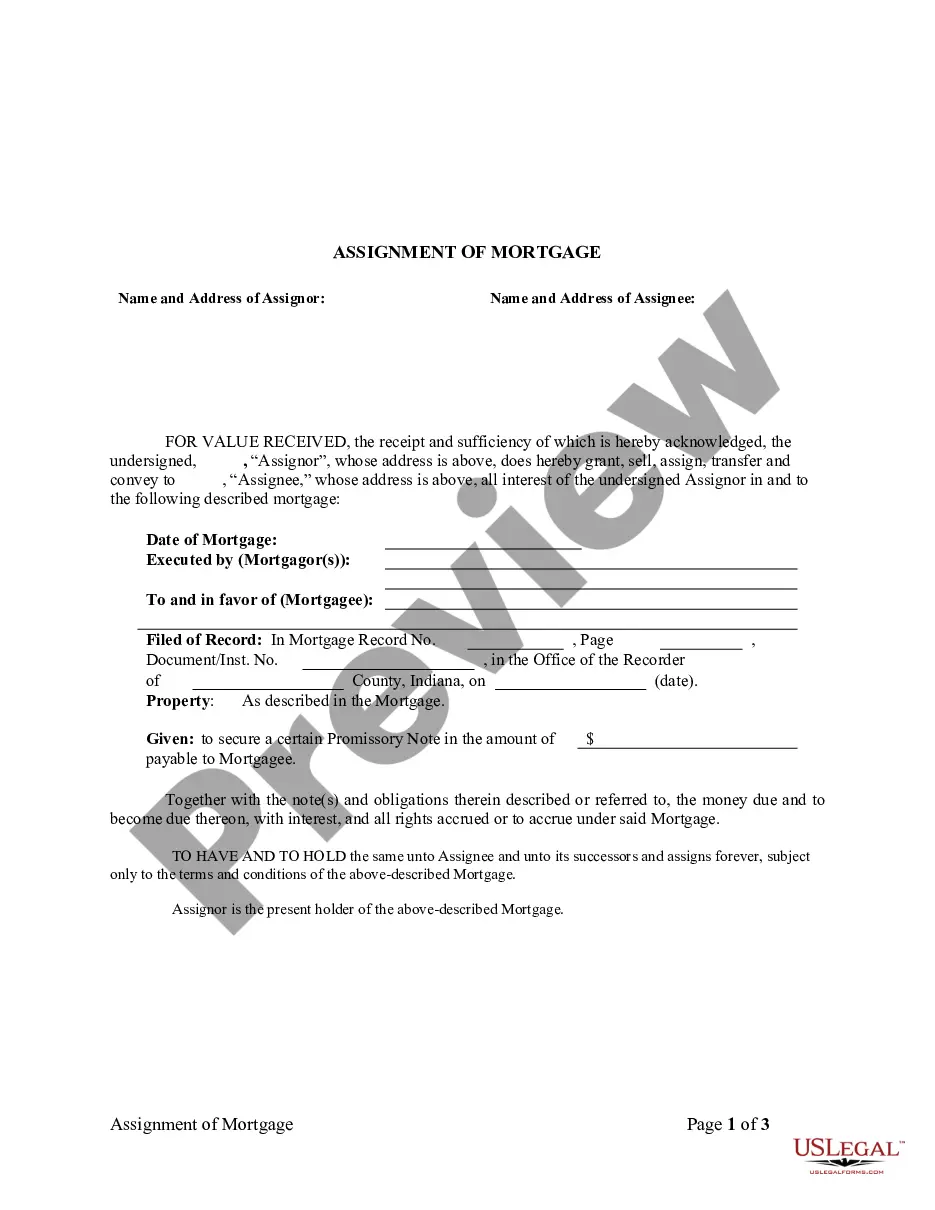

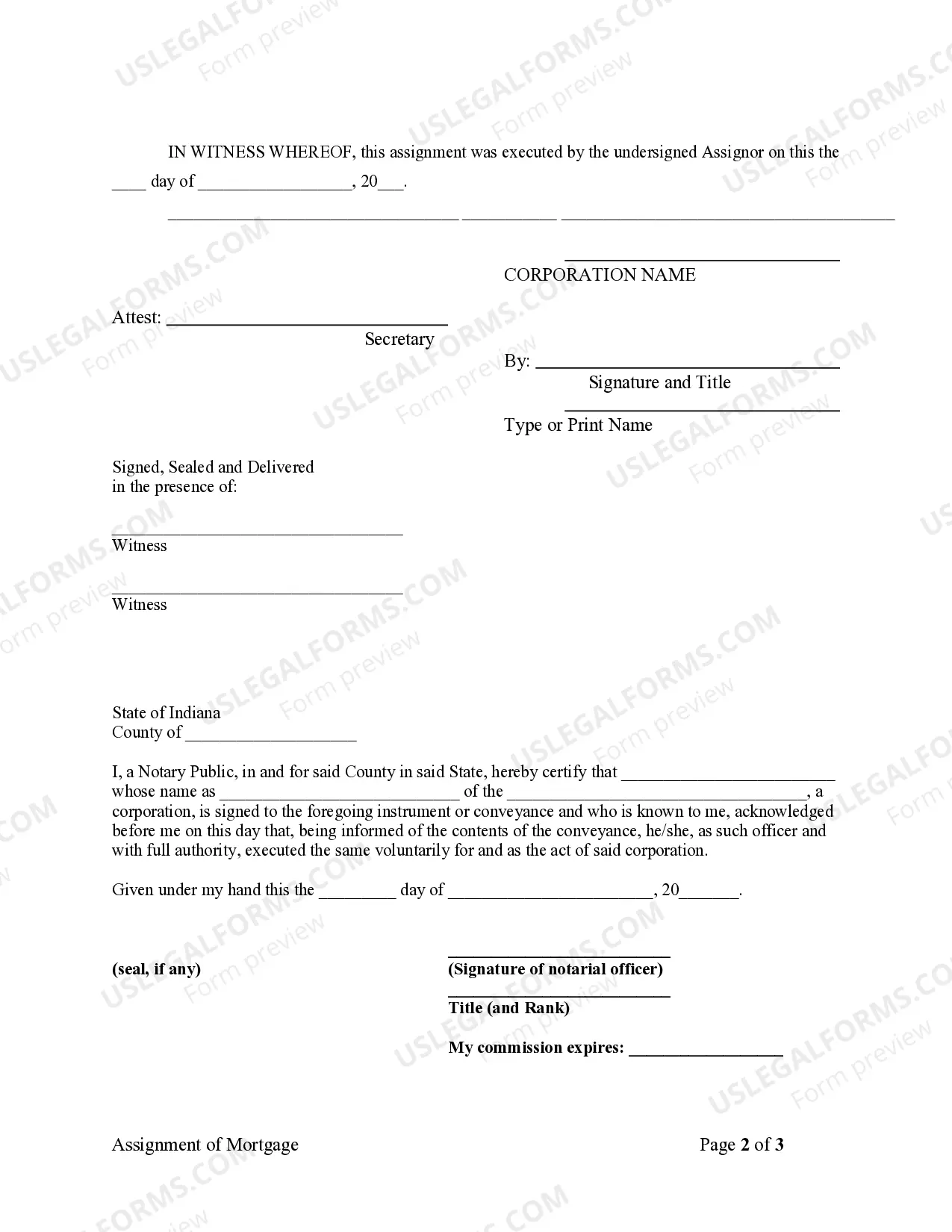

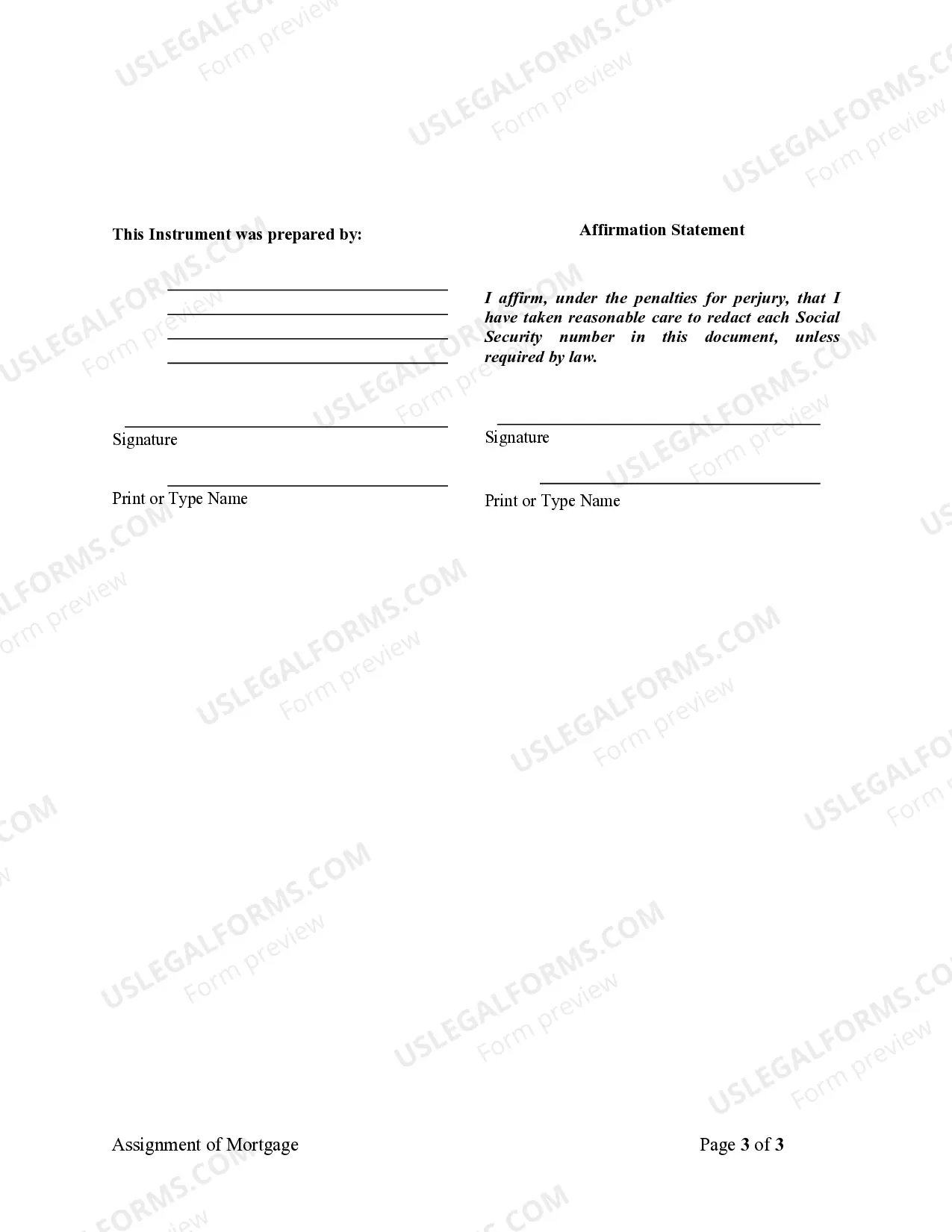

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Carmel Indiana Assignment of Mortgage by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage from one party to another. In this case, the mortgage is assigned by a corporate mortgage holder in Carmel, Indiana. This assignment typically occurs when a mortgage lender sells or transfers their interest in a loan to another entity, such as a bank or mortgage company. The Carmel Indiana Assignment of Mortgage is an important document that outlines the terms and conditions of the transfer, including the new mortgage holder's rights and responsibilities. This document ensures that the new mortgage holder has legal ownership of the loan and can enforce its terms. One type of Carmel Indiana Assignment of Mortgage by Corporate Mortgage Holder is the partial assignment. This occurs when only a portion of the loan is transferred. For example, a corporate mortgage holder may assign a portion of the mortgage to another lender while retaining ownership of the remaining balance. This type of assignment is common when a loan is syndicated or sold to multiple investors. Another type is the complete assignment of mortgage, where the entire loan is transferred to a new corporate mortgage holder. This type of assignment is often seen when a corporate mortgage holder wants to sell off their entire portfolio or transfer the loan to another entity for servicing purposes. Carmel Indiana Assignment of Mortgage by Corporate Mortgage Holder also includes an assignment of all the associated rights and interests in the mortgage. This includes the right to collect payments, foreclose on the property in case of default, and modify the terms of the loan if necessary. It is important to note that this process requires strict adherence to legal requirements and regulations in Carmel, Indiana. Any assignment of mortgage must be properly executed, recorded, and filed with the appropriate authorities to ensure its validity and enforceability. In conclusion, Carmel Indiana Assignment of Mortgage by Corporate Mortgage Holder is a crucial legal process that allows for the transfer of a mortgage from one corporate mortgage holder to another. Whether it is a partial assignment or a complete assignment, this document ensures the new mortgage holder has the legal rights and responsibilities associated with the loan.