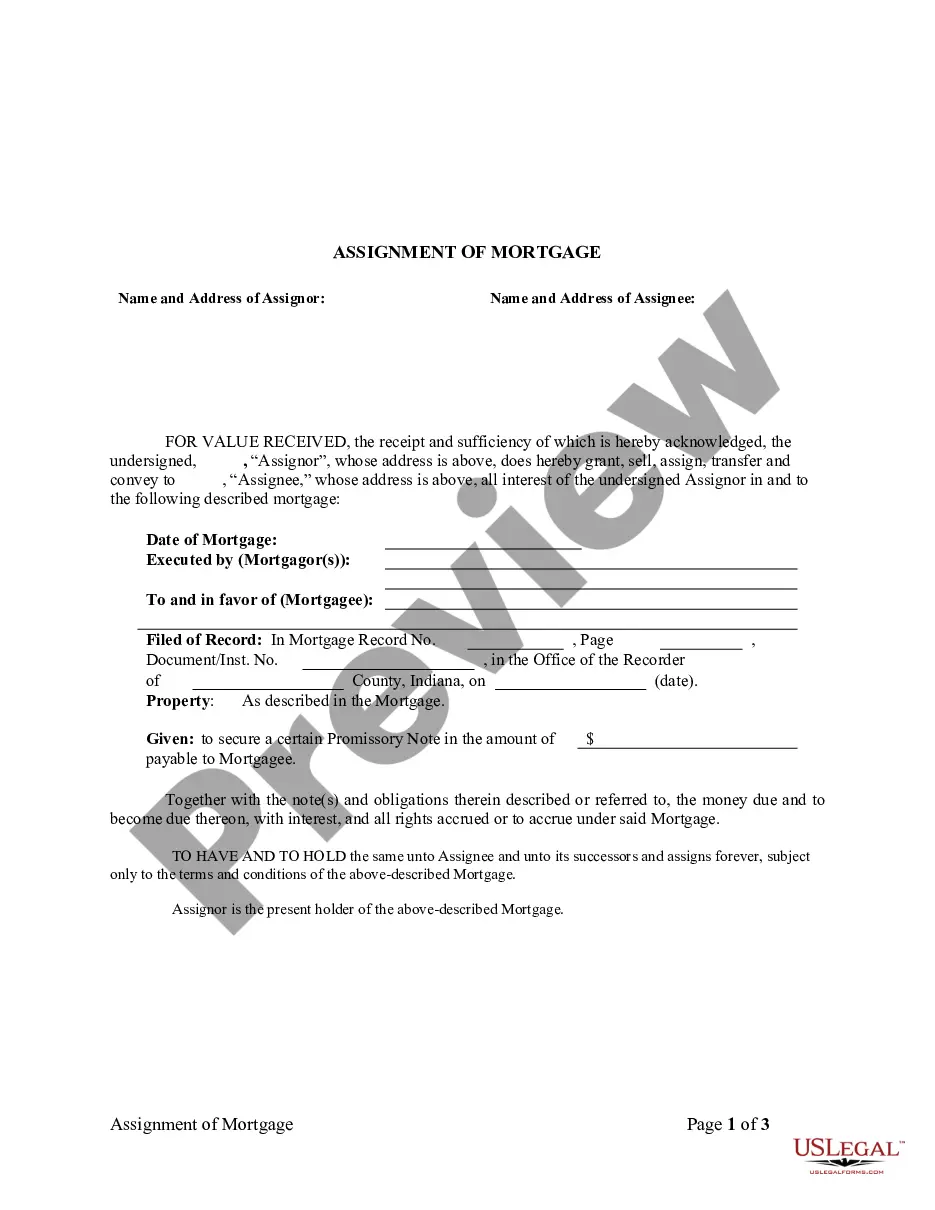

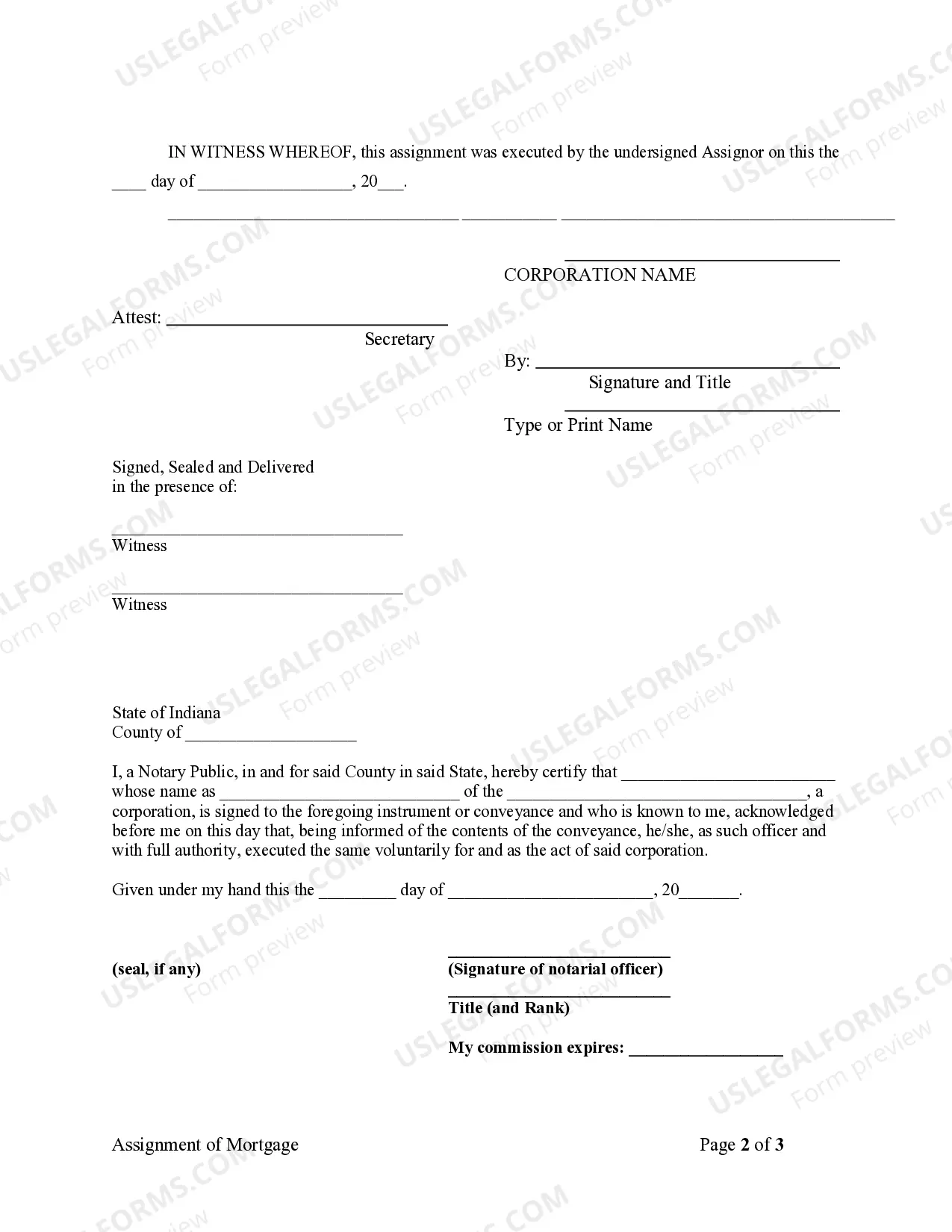

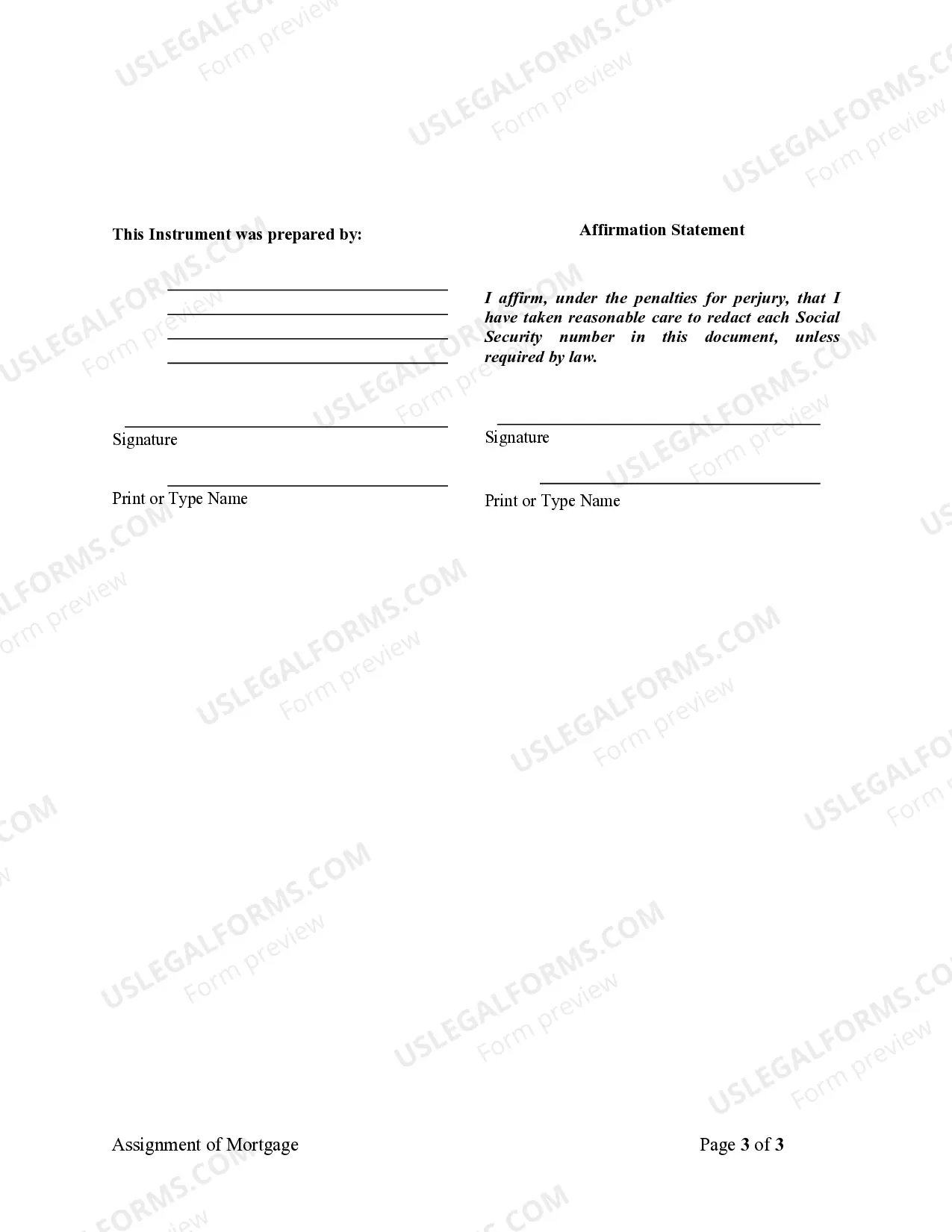

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Indianapolis Indiana Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Indiana Assignment Of Mortgage By Corporate Mortgage Holder?

Finding validated templates pertinent to your local statutes can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All documents are appropriately categorized by field of application and jurisdictional regions, making the search for the Indianapolis Indiana Assignment of Mortgage by Corporate Mortgage Holder as quick and simple as ABC.

Maintaining organized paperwork that adheres to legal standards is of utmost importance. Take advantage of the US Legal Forms library to have crucial document templates readily available for any requirements!

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that satisfies your needs and complies with your local jurisdiction regulations.

- Look for an alternative template, if necessary.

- If you spot any discrepancy, utilize the Search tab above to find the correct one.

- Once you find a suitable document, advance to the next step.

Form popularity

FAQ

Businesses mortgage commercial properties such as offices or retail spaces to conduct business. But can a company take out a mortgage on a residential property like a house? The simple answer is yes, as long as you use the property for commercial purposes.

Technically speaking, there's no limit on the number of mortgages you can have. However, in the real world of real estate investing, financing multiple properties can be much more of a challenge. In 2009, Fannie Mae increased its maximum conventional financed property limit from four to ten.

Start Deed of Trust StateMortgage allowedDeed of trust allowedIndianaYIowaYKansasYKentuckyYY47 more rows

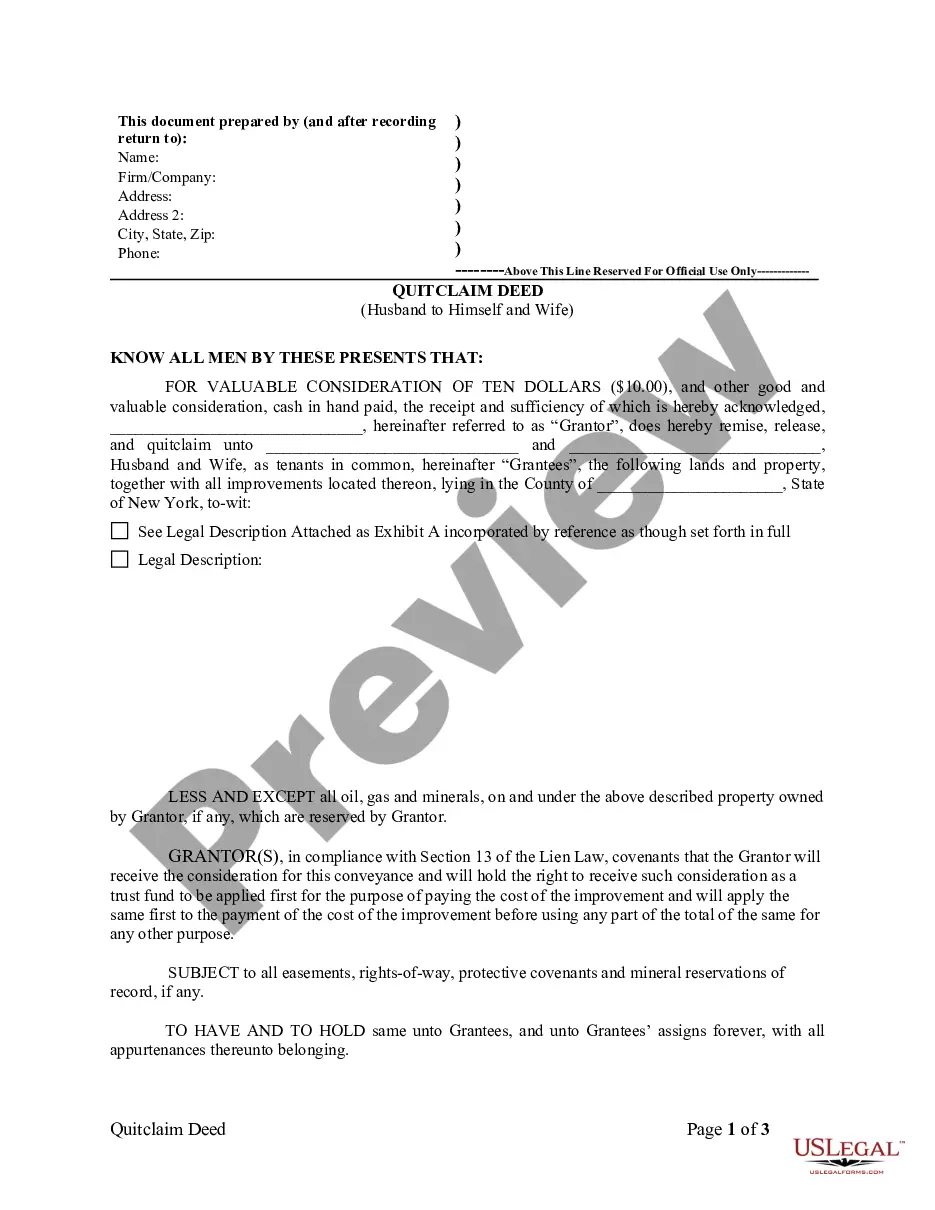

A deed of trust, also called a trust deed, is a legal agreement made at a property's closing. It is a type of secured real estate transaction used in some states in place of a mortgage. The individual purchasing a property and a lender make this agreement, which states that the property buyer will repay a loan.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Both are dictated by state laws. In some states, only a mortgage is legal. In others, lenders can only use a deed of trust. A few states (like Alabama and Michigan) allow both. If your state allows both types of contracts, it's up to your lender to choose which type you receive.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

Difficulty Getting A Mortgage Banks know that LLC members and shareholders can't become personally liable for the LLC or corporation's debts. In this case, many lenders will only extend a mortgage loan to a small LLC or corporation if the business owner volunteers their own personal assets to back the debt.