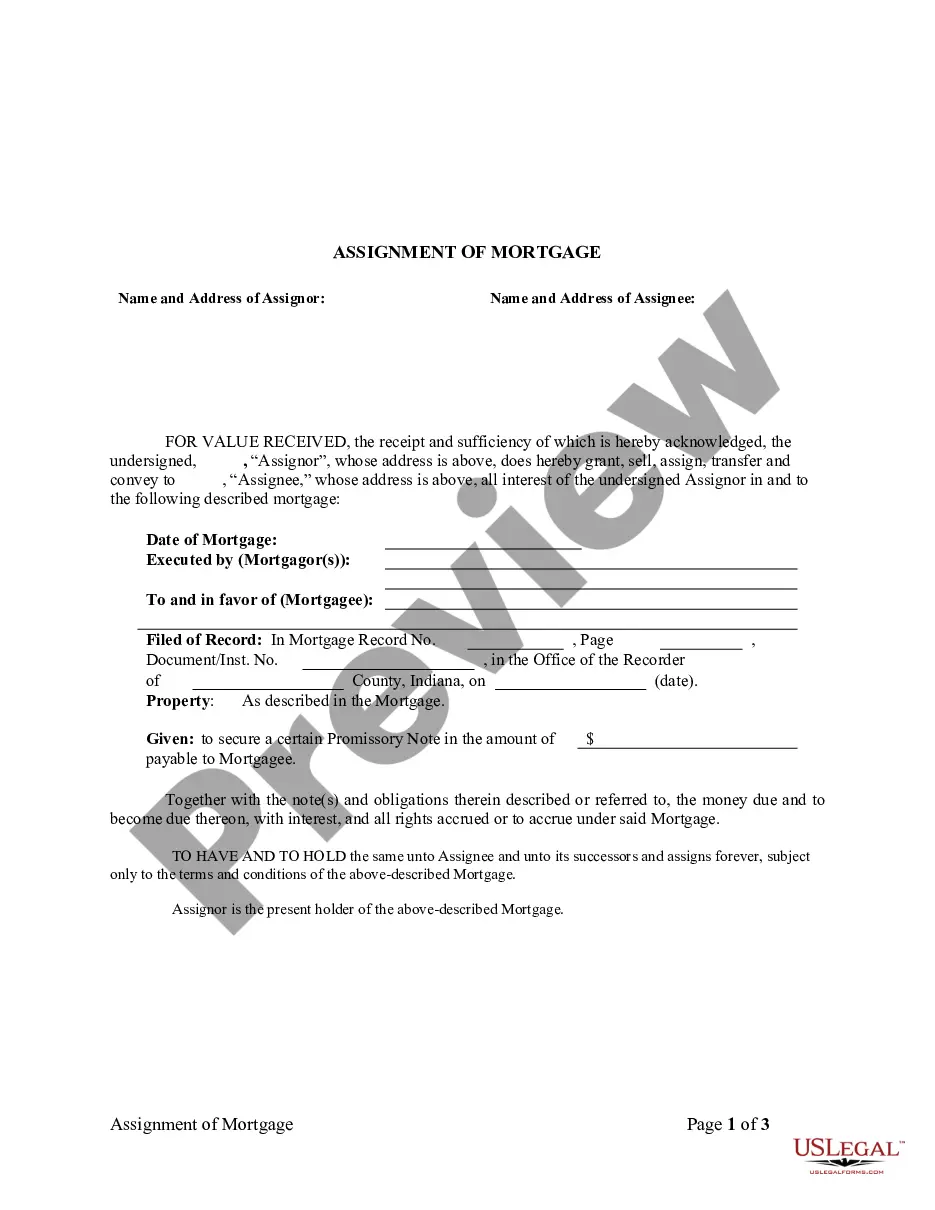

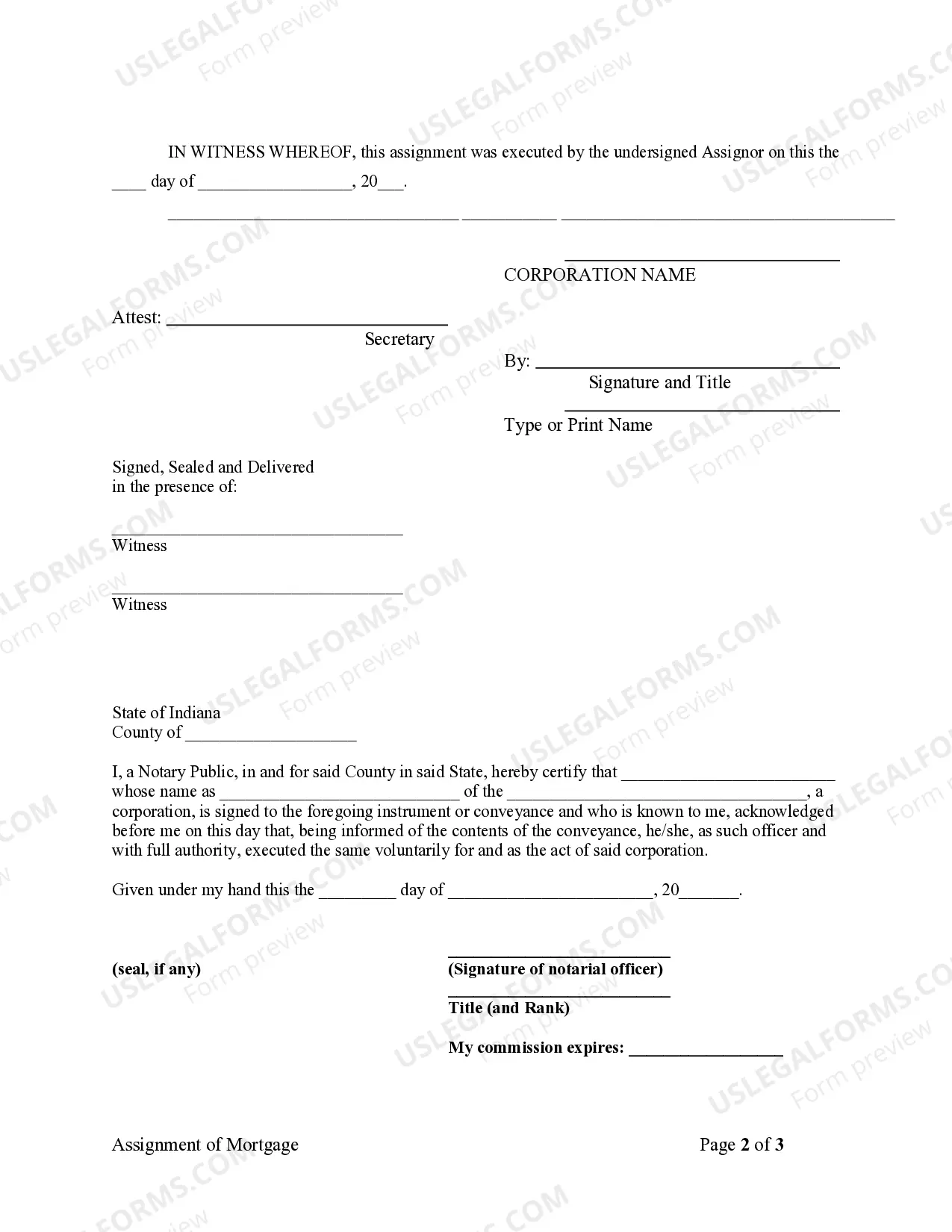

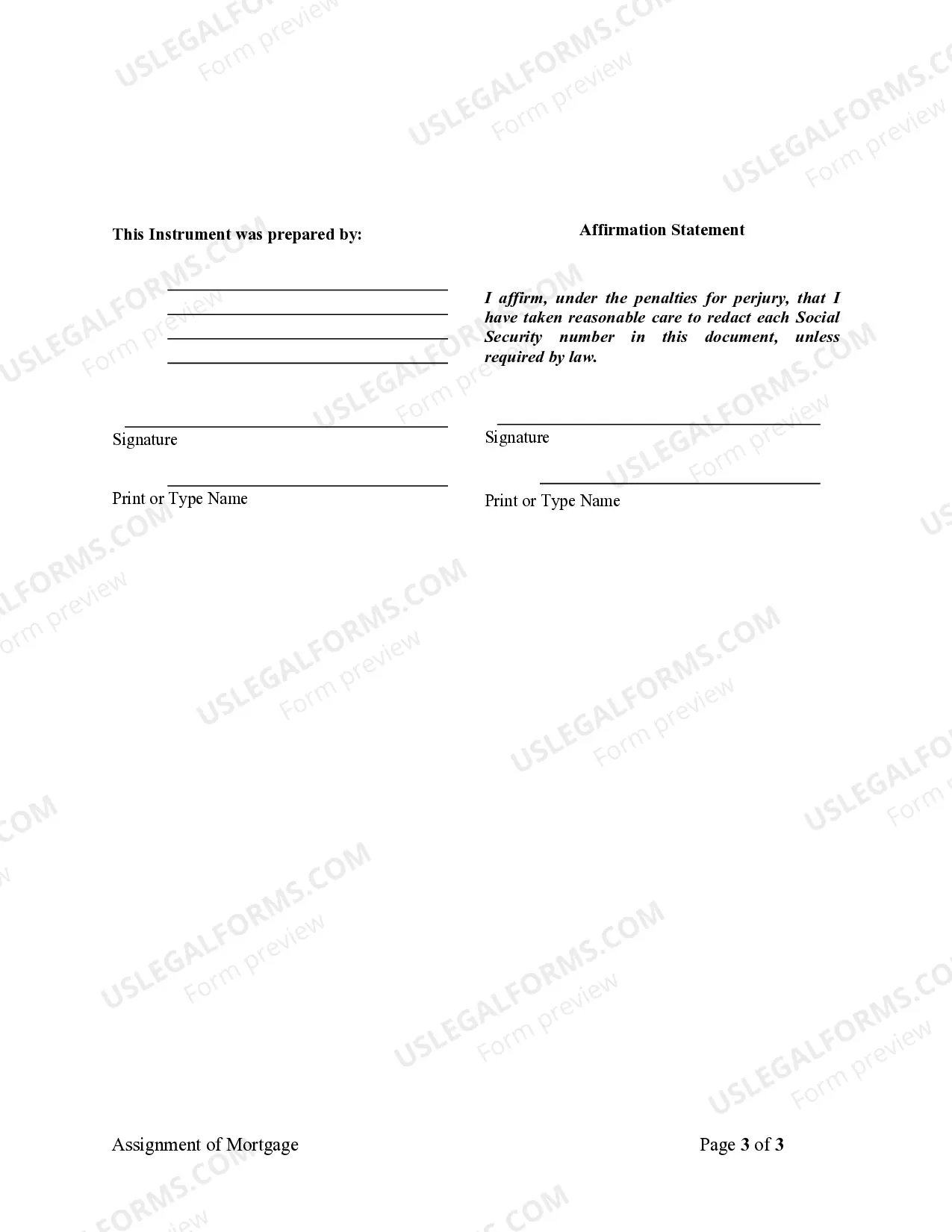

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

South Bend Indiana Assignment of Mortgage by Corporate Mortgage Holder: Detailed Description and Types In South Bend, Indiana, the Assignment of Mortgage by Corporate Mortgage Holder is an important legal document that transfers the rights and obligations of a mortgage from one corporate mortgage holder to another. This process allows the new mortgage holder to assume the rights to the property and any outstanding debt associated with it. The Assignment of Mortgage ensures a smooth transition of ownership and protects the interests of all parties involved. Keywords: South Bend Indiana, Assignment of Mortgage, Corporate Mortgage Holder, transfer of rights, outstanding debt, property ownership, legal document, mortgage process, smooth transition, parties involved. Types of South Bend Indiana Assignment of Mortgage by Corporate Mortgage Holder: 1. Voluntary Assignment: This type of Assignment of Mortgage occurs when the current mortgage holder voluntarily transfers the mortgage to another corporate entity. It typically happens when the mortgage holder wishes to sell or transfer their interest in the property to a new party or when they decide to merge or dissolve their current corporate structure. 2. Involuntary Assignment: In some cases, the Assignment of Mortgage may happen involuntarily, usually due to a foreclosure process or other legal actions. Here, the mortgage holder may default on the mortgage, leading the lender to enforce their rights and transfer the mortgage to another corporate entity for foreclosure proceedings. 3. Partial Assignment: A Partial Assignment of Mortgage occurs when only a portion of the mortgage debt is transferred to another corporate entity. This type of assignment can happen when the mortgage holder wants to divide the mortgage into separate parts, each with its own terms and conditions. It allows them to assign specific portions of the mortgage to different corporate mortgage holders, giving them flexibility in managing their investments. 4. Collateral Assignment: A Collateral Assignment of Mortgage involves using the property as collateral to secure a debt or loan. Here, the corporate mortgage holder assigns their interest in the mortgage to another entity as collateral until the debt is repaid. If the borrower defaults on the loan, the collateral assignment may grant the new entity the right to foreclose on and sell the property to recover the outstanding debt. 5. Assignment of Mortgage with Assumption: This type of assignment occurs when the current mortgage holder transfers both the mortgage and the liability for the debt to a new corporate mortgage holder. The new mortgage holder assumes all rights, obligations, and responsibilities associated with the property, including the original terms and conditions of the mortgage. This type of assignment enables the original mortgage holder to fully transfer their interests to another party while releasing themselves from any further liability. In conclusion, the South Bend Indiana Assignment of Mortgage by Corporate Mortgage Holder is a critical legal process that allows the transfer of mortgage rights and obligations between corporate entities. Understanding the various types of assignments, such as voluntary, involuntary, partial, collateral, and with assumption, helps ensure a smooth transition of property ownership and debt management. It is essential for all parties involved to consult with legal professionals experienced in real estate and mortgage laws to ensure compliance and protect their interests effectively.South Bend Indiana Assignment of Mortgage by Corporate Mortgage Holder: Detailed Description and Types In South Bend, Indiana, the Assignment of Mortgage by Corporate Mortgage Holder is an important legal document that transfers the rights and obligations of a mortgage from one corporate mortgage holder to another. This process allows the new mortgage holder to assume the rights to the property and any outstanding debt associated with it. The Assignment of Mortgage ensures a smooth transition of ownership and protects the interests of all parties involved. Keywords: South Bend Indiana, Assignment of Mortgage, Corporate Mortgage Holder, transfer of rights, outstanding debt, property ownership, legal document, mortgage process, smooth transition, parties involved. Types of South Bend Indiana Assignment of Mortgage by Corporate Mortgage Holder: 1. Voluntary Assignment: This type of Assignment of Mortgage occurs when the current mortgage holder voluntarily transfers the mortgage to another corporate entity. It typically happens when the mortgage holder wishes to sell or transfer their interest in the property to a new party or when they decide to merge or dissolve their current corporate structure. 2. Involuntary Assignment: In some cases, the Assignment of Mortgage may happen involuntarily, usually due to a foreclosure process or other legal actions. Here, the mortgage holder may default on the mortgage, leading the lender to enforce their rights and transfer the mortgage to another corporate entity for foreclosure proceedings. 3. Partial Assignment: A Partial Assignment of Mortgage occurs when only a portion of the mortgage debt is transferred to another corporate entity. This type of assignment can happen when the mortgage holder wants to divide the mortgage into separate parts, each with its own terms and conditions. It allows them to assign specific portions of the mortgage to different corporate mortgage holders, giving them flexibility in managing their investments. 4. Collateral Assignment: A Collateral Assignment of Mortgage involves using the property as collateral to secure a debt or loan. Here, the corporate mortgage holder assigns their interest in the mortgage to another entity as collateral until the debt is repaid. If the borrower defaults on the loan, the collateral assignment may grant the new entity the right to foreclose on and sell the property to recover the outstanding debt. 5. Assignment of Mortgage with Assumption: This type of assignment occurs when the current mortgage holder transfers both the mortgage and the liability for the debt to a new corporate mortgage holder. The new mortgage holder assumes all rights, obligations, and responsibilities associated with the property, including the original terms and conditions of the mortgage. This type of assignment enables the original mortgage holder to fully transfer their interests to another party while releasing themselves from any further liability. In conclusion, the South Bend Indiana Assignment of Mortgage by Corporate Mortgage Holder is a critical legal process that allows the transfer of mortgage rights and obligations between corporate entities. Understanding the various types of assignments, such as voluntary, involuntary, partial, collateral, and with assumption, helps ensure a smooth transition of property ownership and debt management. It is essential for all parties involved to consult with legal professionals experienced in real estate and mortgage laws to ensure compliance and protect their interests effectively.