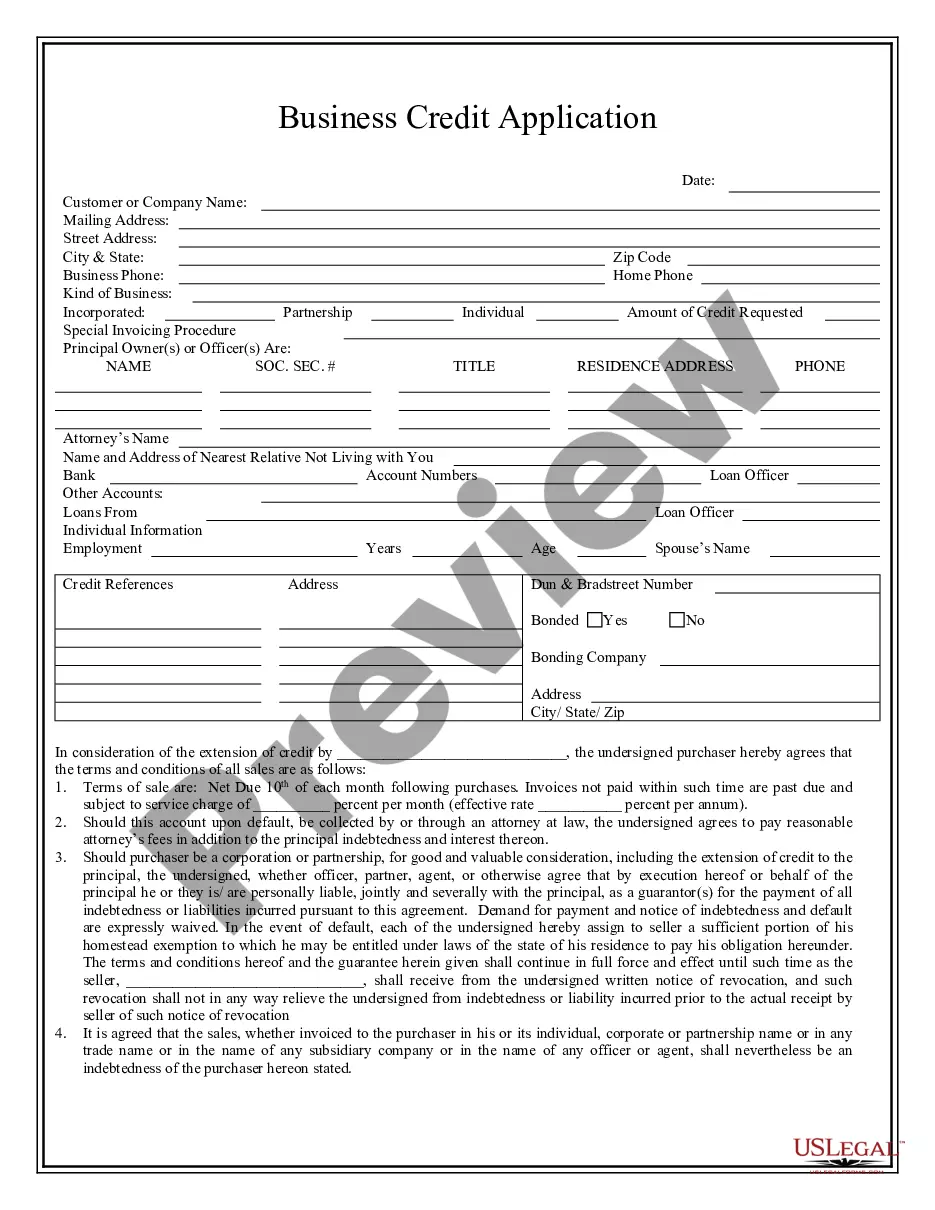

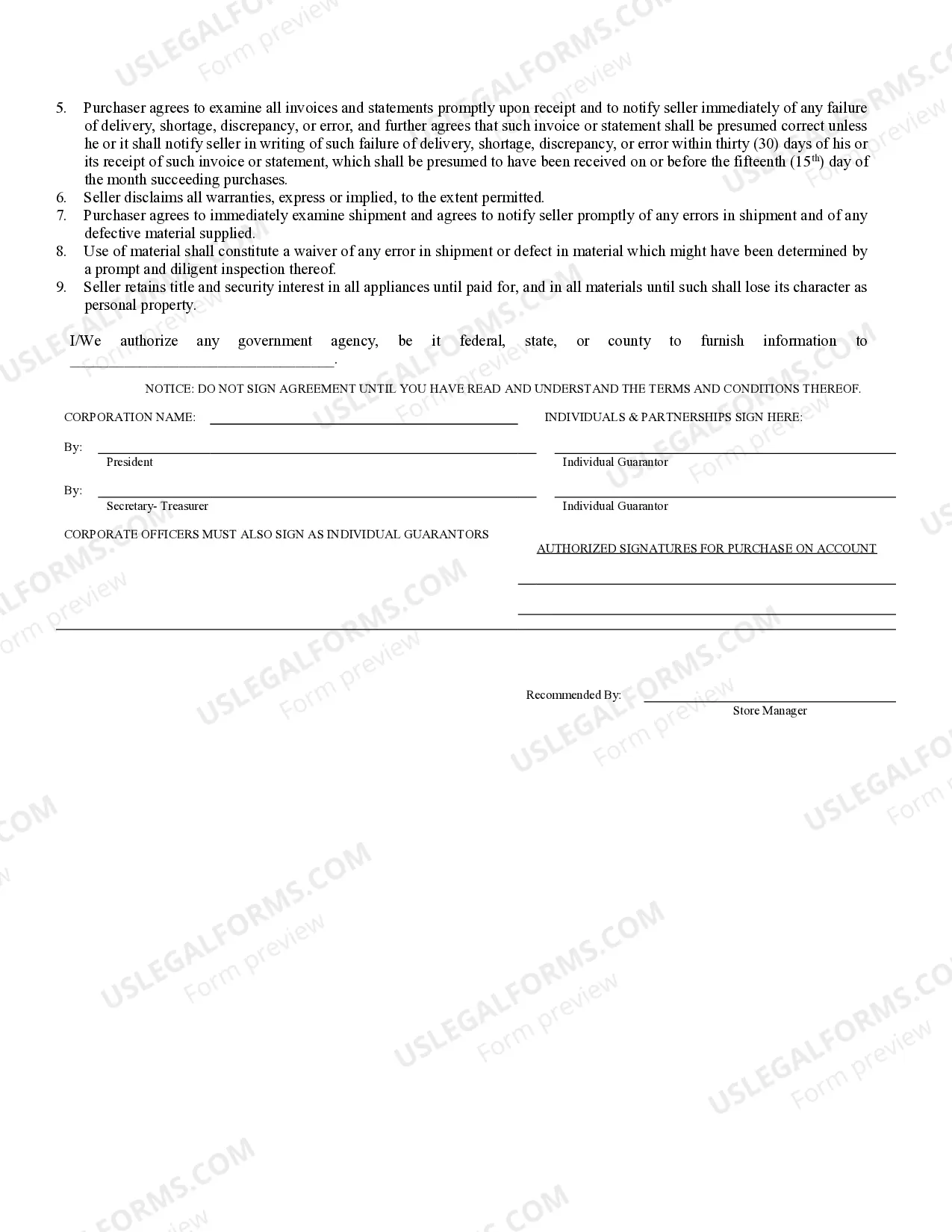

This is a credit application for obtaining credit at a business. Upon ordering, you may download the form in Word or Rich Text formats.

Carmel Indiana Business Credit Application is a comprehensive and straightforward document that businesses in Carmel, Indiana used to apply for credit. It allows businesses to request credit from various financial institutions, lenders, or vendors, enabling them to acquire essential resources to grow and sustain their operations. The Carmel Indiana Business Credit Application typically consists of several sections, each gathering vital information about the business and its financial standing. The application collects the business's legal name, contact information, tax identification number, and years in operations. It may also request details about the business structure and ownership, including the names of key officers or partners. Additionally, the application requires a thorough financial assessment, typically involving the submission of balance sheets, profit and loss statements, cash flow projections, and other financial documents. These documents help lenders evaluate the business's creditworthiness and make informed decisions regarding loan amounts and interest rates. The Carmel Indiana Business Credit Application aims to provide a comprehensive overview of the business's financial health and its ability to handle credit responsibly. It gives lenders an insight into the business's industry, target market, and growth potential. This information allows financial institutions to assess the level of risk associated with extending credit to the business. There are different types of business credit applications available in Carmel, Indiana, depending on specific financing needs. These may include: 1. Small Business Loan Application: Specifically designed for small businesses seeking funding for expansion, purchasing equipment, or meeting working capital needs. 2. Business Line of Credit Application: Primarily used to establish a revolving credit account that enables the business to withdraw funds as needed. 3. Commercial Mortgage Application: Intended for businesses looking to secure financing for real estate purchases or property development. 4. Business Credit Card Application: Tailored for businesses requiring a dedicated credit card to streamline expenses and manage cash flow. 5. Trade Credit Application: For businesses seeking credit terms with suppliers and vendors, allowing them to obtain goods or services and pay at a later date. The Carmel Indiana Business Credit Application plays a crucial role in the financial success of businesses in the region. By providing a thorough evaluation of a business's creditworthiness, it enables businesses to access the necessary funding to fuel growth, meet operational demands, and seize new opportunities.Carmel Indiana Business Credit Application is a comprehensive and straightforward document that businesses in Carmel, Indiana used to apply for credit. It allows businesses to request credit from various financial institutions, lenders, or vendors, enabling them to acquire essential resources to grow and sustain their operations. The Carmel Indiana Business Credit Application typically consists of several sections, each gathering vital information about the business and its financial standing. The application collects the business's legal name, contact information, tax identification number, and years in operations. It may also request details about the business structure and ownership, including the names of key officers or partners. Additionally, the application requires a thorough financial assessment, typically involving the submission of balance sheets, profit and loss statements, cash flow projections, and other financial documents. These documents help lenders evaluate the business's creditworthiness and make informed decisions regarding loan amounts and interest rates. The Carmel Indiana Business Credit Application aims to provide a comprehensive overview of the business's financial health and its ability to handle credit responsibly. It gives lenders an insight into the business's industry, target market, and growth potential. This information allows financial institutions to assess the level of risk associated with extending credit to the business. There are different types of business credit applications available in Carmel, Indiana, depending on specific financing needs. These may include: 1. Small Business Loan Application: Specifically designed for small businesses seeking funding for expansion, purchasing equipment, or meeting working capital needs. 2. Business Line of Credit Application: Primarily used to establish a revolving credit account that enables the business to withdraw funds as needed. 3. Commercial Mortgage Application: Intended for businesses looking to secure financing for real estate purchases or property development. 4. Business Credit Card Application: Tailored for businesses requiring a dedicated credit card to streamline expenses and manage cash flow. 5. Trade Credit Application: For businesses seeking credit terms with suppliers and vendors, allowing them to obtain goods or services and pay at a later date. The Carmel Indiana Business Credit Application plays a crucial role in the financial success of businesses in the region. By providing a thorough evaluation of a business's creditworthiness, it enables businesses to access the necessary funding to fuel growth, meet operational demands, and seize new opportunities.