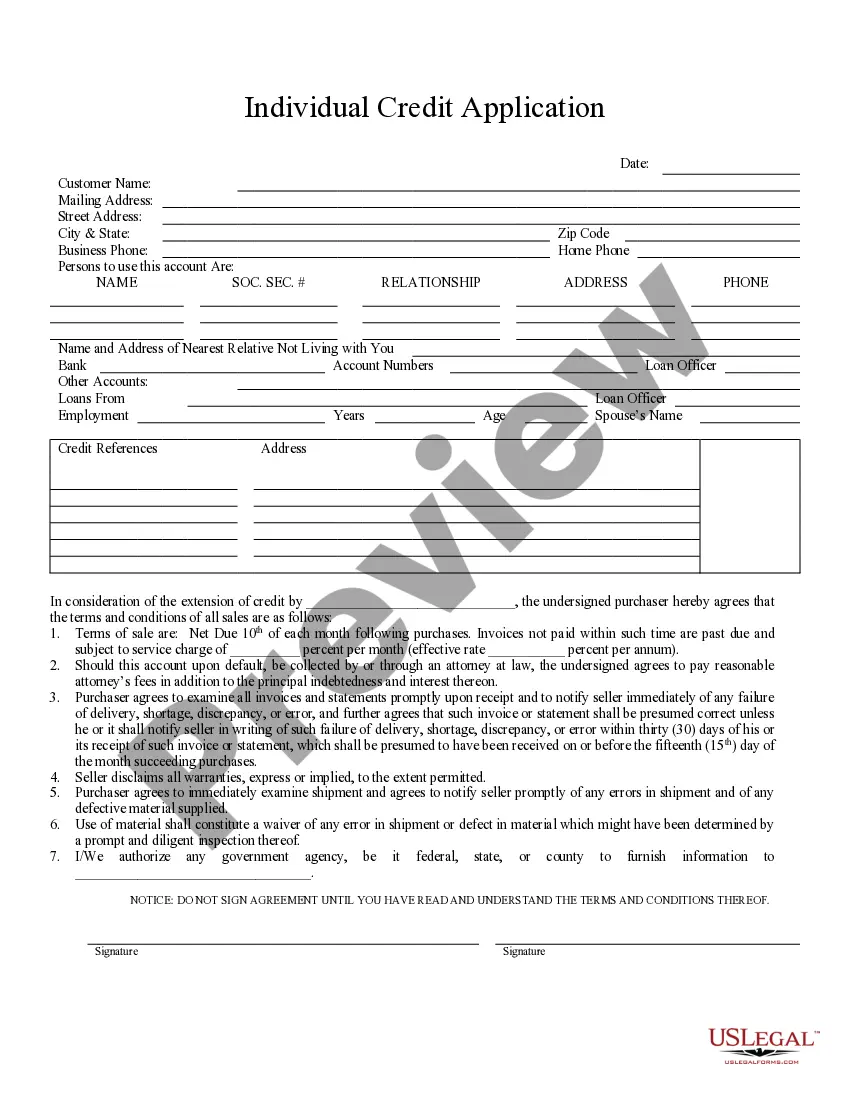

This is a credit application for obtaining credit from an individual. Upon ordering, you may download the form in Word or Rich Text formats.

Fort Wayne Indiana Individual Credit Application is a comprehensive form used by individuals residing in Fort Wayne, Indiana, who are applying for credit. This form is widely utilized by local financial institutions, banks, credit unions, and loan providers in order to evaluate an individual's creditworthiness and determine their eligibility for various credit products. The Fort Wayne Indiana Individual Credit Application is specifically tailored to suit the needs and legal requirements of the state of Indiana. It consists of several sections and requests detailed personal and financial information necessary for assessing an applicant's creditworthiness. Some key sections of the Fort Wayne Indiana Individual Credit Application include: 1. Personal Information: This section requires the applicant to provide their full name, current address, social security number, contact details, and other identifying information. It helps the lender to verify the applicant's identity and maintain accurate records. 2. Employment and Income Details: In this section, the applicant is required to provide details of their current and previous employment. This includes information such as the employer's name, address, occupation, job title, and duration of employment. Additionally, applicants need to disclose their monthly income and any other sources of income. 3. Financial Information: This section focuses on the applicant's overall financial picture. It may include details like monthly expenses, existing debts, assets such as real estate or vehicles, savings, and investments. This information assists lenders in assessing the applicant's ability to repay the credit obligations. 4. Credit References: The Fort Wayne Indiana Individual Credit Application typically asks for credit references, usually requiring the names and contact information of individuals who can attest to the applicant's creditworthiness or financial responsibility. Fort Wayne Indiana Individual Credit Application typically applies to various types of credit, including but not limited to: 1. Personal Loans: Applicants seeking a loan for personal purposes, such as debt consolidation, home improvement, or unexpected expenses, can complete this credit application. 2. Auto Loans: This type of credit application is used when applying for financing for purchasing a vehicle, either new or used. 3. Credit Cards: Individuals interested in obtaining a credit card can use this application to apply for a revolving line of credit offered by financial institutions. 4. Mortgage Loans: A Fort Wayne Indiana Individual Credit Application may also be needed when applying for a home mortgage or refinancing an existing mortgage. It is important to note that each lender may have their own version or format of the Fort Wayne Indiana Individual Credit Application. However, the key purpose remains the same — to evaluate an individual's creditworthiness and determine their eligibility for credit.