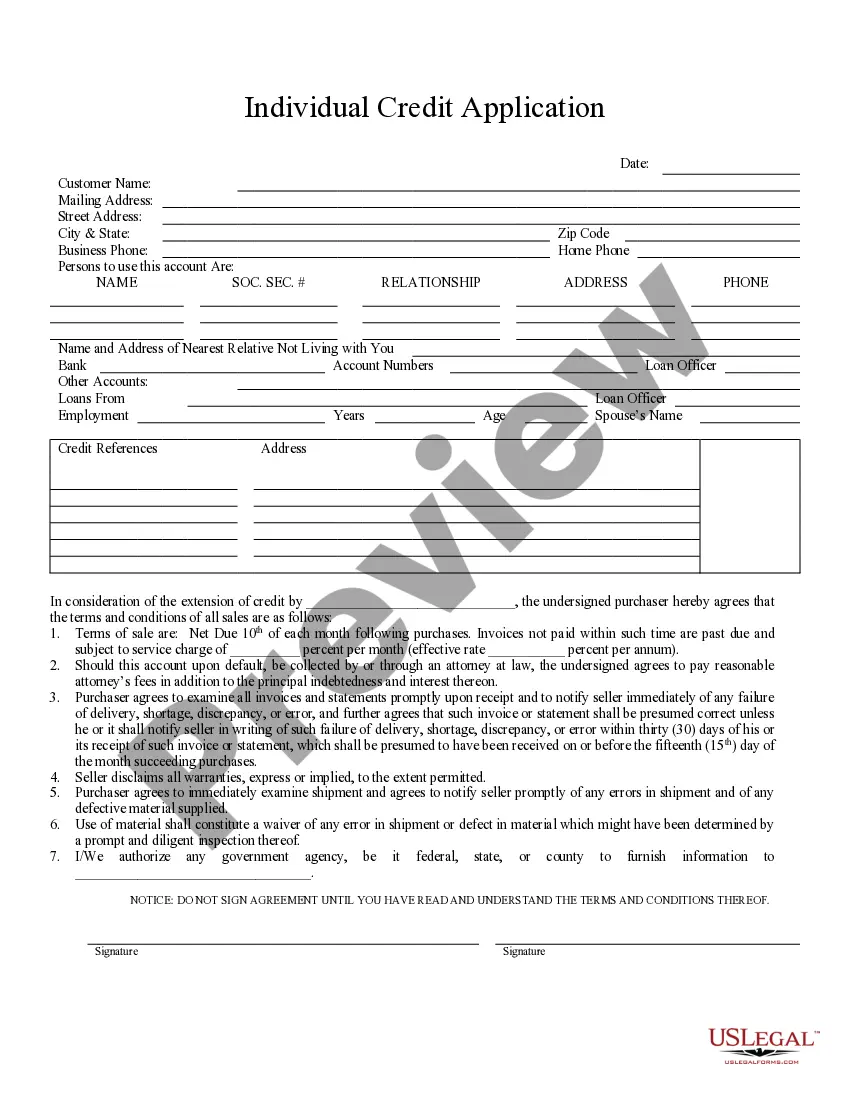

This is a credit application for obtaining credit from an individual. Upon ordering, you may download the form in Word or Rich Text formats.

The Indianapolis Indiana Individual Credit Application is a formal document utilized by individuals residing in Indianapolis, Indiana, for the purpose of applying for credit. This application is designed to gather essential personal and financial information from individuals seeking credit, enabling lenders to assess their creditworthiness and make informed decisions. The application typically requires applicants to provide basic identification details such as full name, address, date of birth, Social Security number, and contact information. Financial information, including employment details (such as employer name, job title, and length of employment), income details (such as salary, bonuses, and other sources of income), and monthly expenses (such as rent or mortgage payments, utility bills, and other regular expenses), are also necessary for assessing the applicant's financial stability. In addition to the personal and financial information, the Indianapolis Indiana Individual Credit Application may include sections for applicants to disclose their existing credit obligations, such as outstanding loans, credit card balances, and any other forms of debt. This assists lenders in evaluating the individual's ability to manage and repay their obligations. The application may also request information regarding the purpose of the credit being sought, such as a car loan, mortgage, or credit card, as well as the desired loan amount or credit limit. This information helps lenders determine the appropriateness of the requested credit based on the applicant's financial profile. It is important to note that there may be variation in the types of Indianapolis Indiana Individual Credit Applications, depending on the specific lender or financial institution offering the application. These variations may include specific requirements or additional sections tailored to different types of credit, such as auto loans, personal loans, or credit cards. By providing a comprehensive understanding of an individual's financial situation and credit history, the Indianapolis Indiana Individual Credit Application allows lenders to assess creditworthiness accurately and make informed decisions regarding the approval and terms of credit offered to individuals in Indianapolis, Indiana.The Indianapolis Indiana Individual Credit Application is a formal document utilized by individuals residing in Indianapolis, Indiana, for the purpose of applying for credit. This application is designed to gather essential personal and financial information from individuals seeking credit, enabling lenders to assess their creditworthiness and make informed decisions. The application typically requires applicants to provide basic identification details such as full name, address, date of birth, Social Security number, and contact information. Financial information, including employment details (such as employer name, job title, and length of employment), income details (such as salary, bonuses, and other sources of income), and monthly expenses (such as rent or mortgage payments, utility bills, and other regular expenses), are also necessary for assessing the applicant's financial stability. In addition to the personal and financial information, the Indianapolis Indiana Individual Credit Application may include sections for applicants to disclose their existing credit obligations, such as outstanding loans, credit card balances, and any other forms of debt. This assists lenders in evaluating the individual's ability to manage and repay their obligations. The application may also request information regarding the purpose of the credit being sought, such as a car loan, mortgage, or credit card, as well as the desired loan amount or credit limit. This information helps lenders determine the appropriateness of the requested credit based on the applicant's financial profile. It is important to note that there may be variation in the types of Indianapolis Indiana Individual Credit Applications, depending on the specific lender or financial institution offering the application. These variations may include specific requirements or additional sections tailored to different types of credit, such as auto loans, personal loans, or credit cards. By providing a comprehensive understanding of an individual's financial situation and credit history, the Indianapolis Indiana Individual Credit Application allows lenders to assess creditworthiness accurately and make informed decisions regarding the approval and terms of credit offered to individuals in Indianapolis, Indiana.