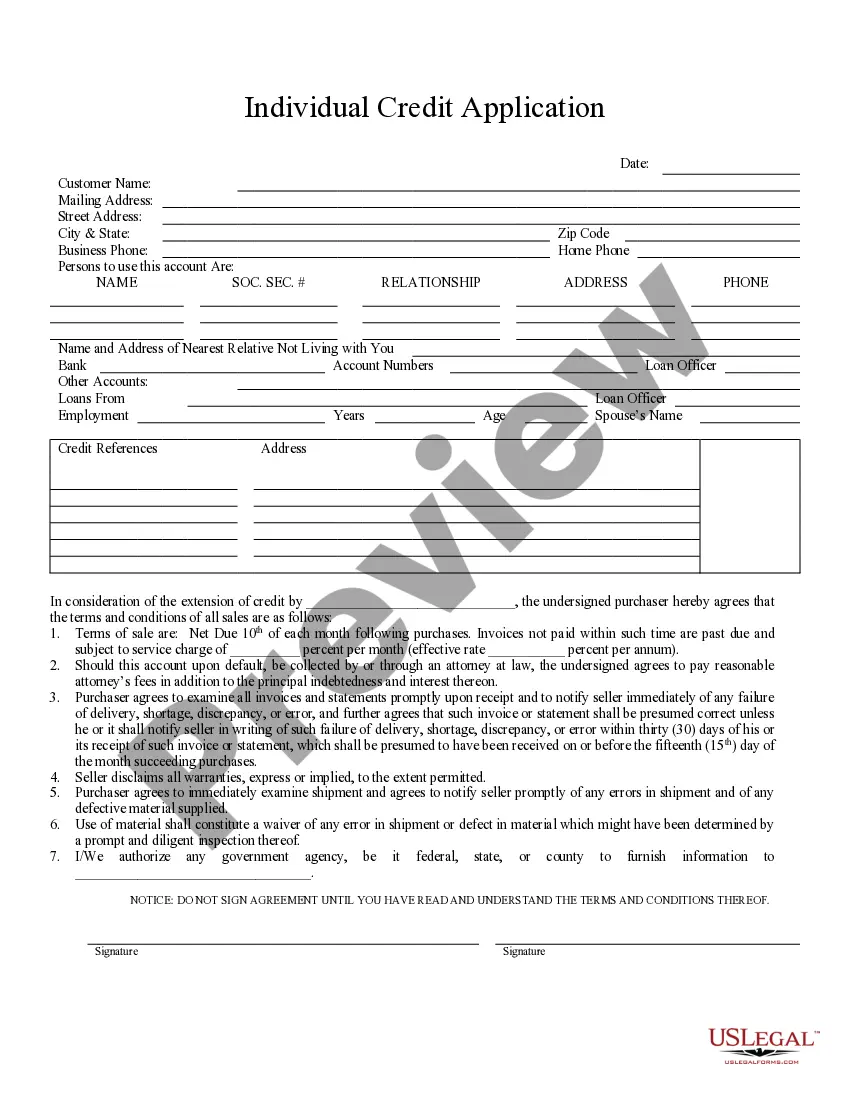

This is a credit application for obtaining credit from an individual. Upon ordering, you may download the form in Word or Rich Text formats.

South Bend Indiana Individual Credit Application is a comprehensive form that individuals residing in South Bend, Indiana, need to complete when applying for credit. This application serves as a crucial document for lenders or financial institutions to assess an individual's creditworthiness and determine whether they qualify for various credit products or services. Keywords: South Bend Indiana, individual credit application, creditworthiness, lenders, financial institutions, credit products, credit services. There might not be different types of South Bend Indiana Individual Credit Applications per se, but variations can exist based on the specific credit products or services being applied for. Some examples could include: 1. South Bend Indiana Mortgage Credit Application: This type of credit application is designed specifically for individuals who intend to apply for a mortgage loan in South Bend, Indiana. It typically requires detailed information regarding the applicant's financial status, employment history, income sources, and other relevant factors that affect mortgage eligibility. 2. South Bend Indiana Auto Loan Credit Application: Individuals seeking an auto loan in South Bend, Indiana, would need to complete this type of credit application. It would ask for information such as the applicant's employment details, income, credit history, and the vehicle details for which the loan is being sought. 3. South Bend Indiana Student Loan Credit Application: Students residing in South Bend, Indiana, who wish to finance their education through loans need to submit this credit application. It usually requires information about the applicant's educational background, financial status, and details about the program they intend to pursue. 4. South Bend Indiana Personal Line of Credit Application: Individuals interested in obtaining a personal line of credit in South Bend, Indiana, can complete this specific credit application. It typically includes information about the applicant's income, expenses, credit history, and the purpose for which the line of credit will be utilized. These are just a few examples of credit application variations that may exist in South Bend, Indiana, depending on the type of credit being sought. It is important to note that each application may have specific requirements and criteria depending on the lending institution. Therefore, individuals are advised to carefully read and complete the relevant credit application, following the instructions provided by the lender.South Bend Indiana Individual Credit Application is a comprehensive form that individuals residing in South Bend, Indiana, need to complete when applying for credit. This application serves as a crucial document for lenders or financial institutions to assess an individual's creditworthiness and determine whether they qualify for various credit products or services. Keywords: South Bend Indiana, individual credit application, creditworthiness, lenders, financial institutions, credit products, credit services. There might not be different types of South Bend Indiana Individual Credit Applications per se, but variations can exist based on the specific credit products or services being applied for. Some examples could include: 1. South Bend Indiana Mortgage Credit Application: This type of credit application is designed specifically for individuals who intend to apply for a mortgage loan in South Bend, Indiana. It typically requires detailed information regarding the applicant's financial status, employment history, income sources, and other relevant factors that affect mortgage eligibility. 2. South Bend Indiana Auto Loan Credit Application: Individuals seeking an auto loan in South Bend, Indiana, would need to complete this type of credit application. It would ask for information such as the applicant's employment details, income, credit history, and the vehicle details for which the loan is being sought. 3. South Bend Indiana Student Loan Credit Application: Students residing in South Bend, Indiana, who wish to finance their education through loans need to submit this credit application. It usually requires information about the applicant's educational background, financial status, and details about the program they intend to pursue. 4. South Bend Indiana Personal Line of Credit Application: Individuals interested in obtaining a personal line of credit in South Bend, Indiana, can complete this specific credit application. It typically includes information about the applicant's income, expenses, credit history, and the purpose for which the line of credit will be utilized. These are just a few examples of credit application variations that may exist in South Bend, Indiana, depending on the type of credit being sought. It is important to note that each application may have specific requirements and criteria depending on the lending institution. Therefore, individuals are advised to carefully read and complete the relevant credit application, following the instructions provided by the lender.