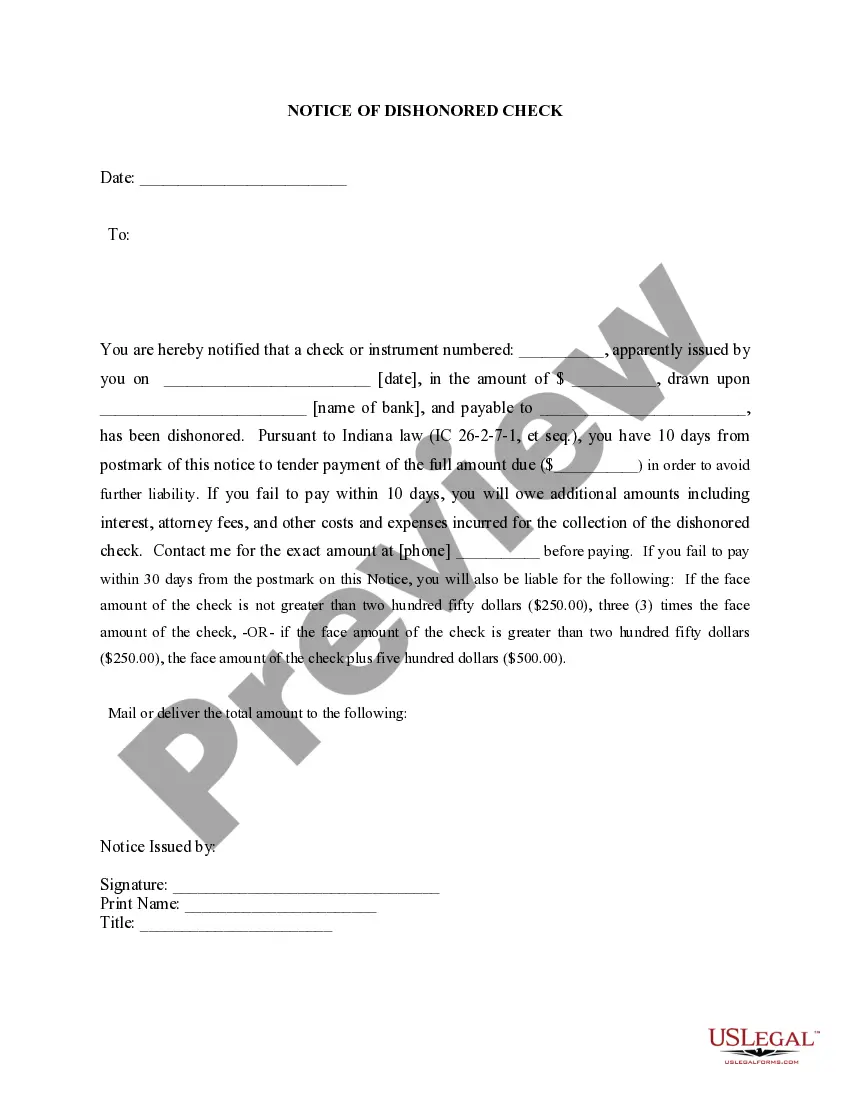

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Evansville Indiana Notice of Dishonored Check — Civil A bad check or bounced check can create financial challenges and legal issues for both the issuer and recipient. In Evansville, Indiana, the law includes provisions to protect individuals and businesses from such occurrences. If you find yourself dealing with a bad check in Evansville, it is important to understand what an Evansville Indiana Notice of Dishonored Check — Civil is and how it can help you seek fair resolution. A bad check refers to a check that cannot be processed by a bank due to insufficient funds in the account or if the issuing account has been closed. This can lead to financial hardships for the recipient who may have counted on the funds for various purposes like paying bills or covering expenses. To protect recipients, the Evansville Indiana Notice of Dishonored Check — Civil provides a legal framework for addressing such issues. When a recipient receives a bad check, they have the right to pursue legal action against the issuer by filing an Evansville Indiana Notice of Dishonored Check — Civil. This notice serves as a formal document to inform the issuer of the dishonored check and provides an opportunity to resolve the matter before further legal actions are initiated. By filing an Evansville Indiana Notice of Dishonored Check — Civil, recipients can demand reimbursement for the amount of the bounced check, any related bank fees, and potentially even additional damages as allowed by law. It is an essential legal recourse to recover funds that are rightfully owed. Different types of bad checks that may result in filing an Evansville Indiana Notice of Dishonored Check — Civil include: 1. Insufficient Funds Check: This occurs when the issuer's account does not have enough funds to cover the amount written on the check. 2. Closed Account Check: If the issuer closes their account before the recipient deposits the check, the check will bounce as the account no longer exists. 3. Post-Dated Check: When the issuer writes a future date on the check, but the recipient deposits it before that date, it can result in a bounced check. Once the Evansville Indiana Notice of Dishonored Check — Civil is filed, the issuer will receive a notice demanding payment for the bounced check. If the issuer fails to respond or make appropriate arrangements, legal action may proceed, potentially resulting in court proceedings and further financial consequences for the issuer. It is important to note that in Evansville, Indiana, intentionally issuing a bad check is considered a criminal offense. Recipients may choose to pursue the criminal route by contacting the local authorities and filing a criminal complaint. However, the Evansville Indiana Notice of Dishonored Check — Civil primarily focuses on civil remedies and monetary compensation for the recipient. In summary, if you discover that you have received a bad check in Evansville, Indiana, filing an Evansville Indiana Notice of Dishonored Check — Civil is a crucial step towards seeking fair resolution and recovering the funds owed to you. By understanding the different types of bad checks and the available legal recourse, you can navigate this challenging situation with confidence.Evansville Indiana Notice of Dishonored Check — Civil A bad check or bounced check can create financial challenges and legal issues for both the issuer and recipient. In Evansville, Indiana, the law includes provisions to protect individuals and businesses from such occurrences. If you find yourself dealing with a bad check in Evansville, it is important to understand what an Evansville Indiana Notice of Dishonored Check — Civil is and how it can help you seek fair resolution. A bad check refers to a check that cannot be processed by a bank due to insufficient funds in the account or if the issuing account has been closed. This can lead to financial hardships for the recipient who may have counted on the funds for various purposes like paying bills or covering expenses. To protect recipients, the Evansville Indiana Notice of Dishonored Check — Civil provides a legal framework for addressing such issues. When a recipient receives a bad check, they have the right to pursue legal action against the issuer by filing an Evansville Indiana Notice of Dishonored Check — Civil. This notice serves as a formal document to inform the issuer of the dishonored check and provides an opportunity to resolve the matter before further legal actions are initiated. By filing an Evansville Indiana Notice of Dishonored Check — Civil, recipients can demand reimbursement for the amount of the bounced check, any related bank fees, and potentially even additional damages as allowed by law. It is an essential legal recourse to recover funds that are rightfully owed. Different types of bad checks that may result in filing an Evansville Indiana Notice of Dishonored Check — Civil include: 1. Insufficient Funds Check: This occurs when the issuer's account does not have enough funds to cover the amount written on the check. 2. Closed Account Check: If the issuer closes their account before the recipient deposits the check, the check will bounce as the account no longer exists. 3. Post-Dated Check: When the issuer writes a future date on the check, but the recipient deposits it before that date, it can result in a bounced check. Once the Evansville Indiana Notice of Dishonored Check — Civil is filed, the issuer will receive a notice demanding payment for the bounced check. If the issuer fails to respond or make appropriate arrangements, legal action may proceed, potentially resulting in court proceedings and further financial consequences for the issuer. It is important to note that in Evansville, Indiana, intentionally issuing a bad check is considered a criminal offense. Recipients may choose to pursue the criminal route by contacting the local authorities and filing a criminal complaint. However, the Evansville Indiana Notice of Dishonored Check — Civil primarily focuses on civil remedies and monetary compensation for the recipient. In summary, if you discover that you have received a bad check in Evansville, Indiana, filing an Evansville Indiana Notice of Dishonored Check — Civil is a crucial step towards seeking fair resolution and recovering the funds owed to you. By understanding the different types of bad checks and the available legal recourse, you can navigate this challenging situation with confidence.