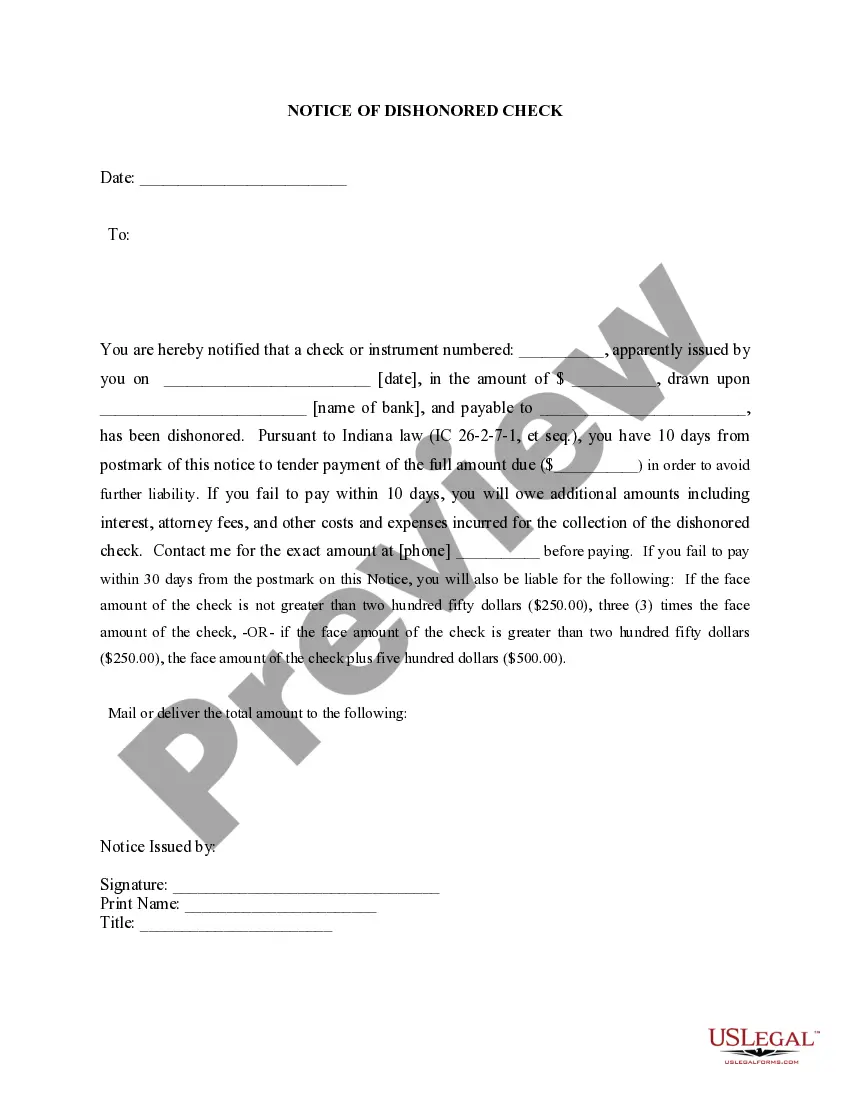

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding South Bend Indiana Notice of Dishonored Check — Civil Proceedings Introduction: In South Bend, Indiana, when a check is returned unpaid or "bounced," legal actions may be taken by the payee or holder of the check. This notice of dishonored check initiates the civil proceedings against the individual who issued the bad check. This article dives into the details of South Bend's notice of dishonored check, including its purpose, key components, and relevant keywords. I. What is a Notice of Dishonored Check — Civil? A South Bend Indiana Notice of Dishonored Check — Civil is a legal document designed to inform the person who issued a bad check about the consequences they may face. It serves as a formal notice of the dishonored check and the initiation of civil proceedings. The notice aims to prompt the check issuer to rectify the situation by paying the owed amount and any additional costs. II. Key Components of a South Bend Indiana Notice of Dishonored Check — Civil: 1. Identification of Parties: The notice should contain the names and addresses of both the payee (recipient of the bad check) and the issuer (person who issued the bad check). 2. Relevant Dates: Include the date the check was issued, the date it was presented for payment, the date it was dishonored, and the date of the notice itself. 3. Description of Bad Check: Provide detailed information about the check, including its amount, check number, and the name of the bank on which it was drawn. 4. Request for Payment: Clearly state the amount owed, including any fees or penalties that may have been incurred due to the dishonored check. 5. Legal Consequences: Inform the check issuer of the possible legal consequences they may face if they fail to resolve the matter, such as litigation, fines, or imprisonment. III. Different Types of South Bend Indiana Notice of Dishonored Check — Civil: 1. Initial Notice: This is the first notice sent to the debtor, making them aware of the dishonored check and requesting payment within a specific period. 2. Final Notice: If the initial notice does not yield any response or payment, a final notice is typically sent, emphasizing the urgency of resolving the matter to avoid further legal actions. 3. Legal Action Notice: If the debtor does not respond to the final notice, a legal action notice may be sent, warning the check issuer of potential legal ramifications. Conclusion: Understanding the South Bend Indiana Notice of Dishonored Check — Civil process is crucial for individuals dealing with bounced checks as payees or holders. This detailed description has highlighted the key components of the notice and mentioned different types that may be encountered during the civil proceedings. By utilizing relevant keywords like bad check and bounced check, anyone in South Bend can better comprehend and navigate the legal implications of dishonored checks.Title: Understanding South Bend Indiana Notice of Dishonored Check — Civil Proceedings Introduction: In South Bend, Indiana, when a check is returned unpaid or "bounced," legal actions may be taken by the payee or holder of the check. This notice of dishonored check initiates the civil proceedings against the individual who issued the bad check. This article dives into the details of South Bend's notice of dishonored check, including its purpose, key components, and relevant keywords. I. What is a Notice of Dishonored Check — Civil? A South Bend Indiana Notice of Dishonored Check — Civil is a legal document designed to inform the person who issued a bad check about the consequences they may face. It serves as a formal notice of the dishonored check and the initiation of civil proceedings. The notice aims to prompt the check issuer to rectify the situation by paying the owed amount and any additional costs. II. Key Components of a South Bend Indiana Notice of Dishonored Check — Civil: 1. Identification of Parties: The notice should contain the names and addresses of both the payee (recipient of the bad check) and the issuer (person who issued the bad check). 2. Relevant Dates: Include the date the check was issued, the date it was presented for payment, the date it was dishonored, and the date of the notice itself. 3. Description of Bad Check: Provide detailed information about the check, including its amount, check number, and the name of the bank on which it was drawn. 4. Request for Payment: Clearly state the amount owed, including any fees or penalties that may have been incurred due to the dishonored check. 5. Legal Consequences: Inform the check issuer of the possible legal consequences they may face if they fail to resolve the matter, such as litigation, fines, or imprisonment. III. Different Types of South Bend Indiana Notice of Dishonored Check — Civil: 1. Initial Notice: This is the first notice sent to the debtor, making them aware of the dishonored check and requesting payment within a specific period. 2. Final Notice: If the initial notice does not yield any response or payment, a final notice is typically sent, emphasizing the urgency of resolving the matter to avoid further legal actions. 3. Legal Action Notice: If the debtor does not respond to the final notice, a legal action notice may be sent, warning the check issuer of potential legal ramifications. Conclusion: Understanding the South Bend Indiana Notice of Dishonored Check — Civil process is crucial for individuals dealing with bounced checks as payees or holders. This detailed description has highlighted the key components of the notice and mentioned different types that may be encountered during the civil proceedings. By utilizing relevant keywords like bad check and bounced check, anyone in South Bend can better comprehend and navigate the legal implications of dishonored checks.