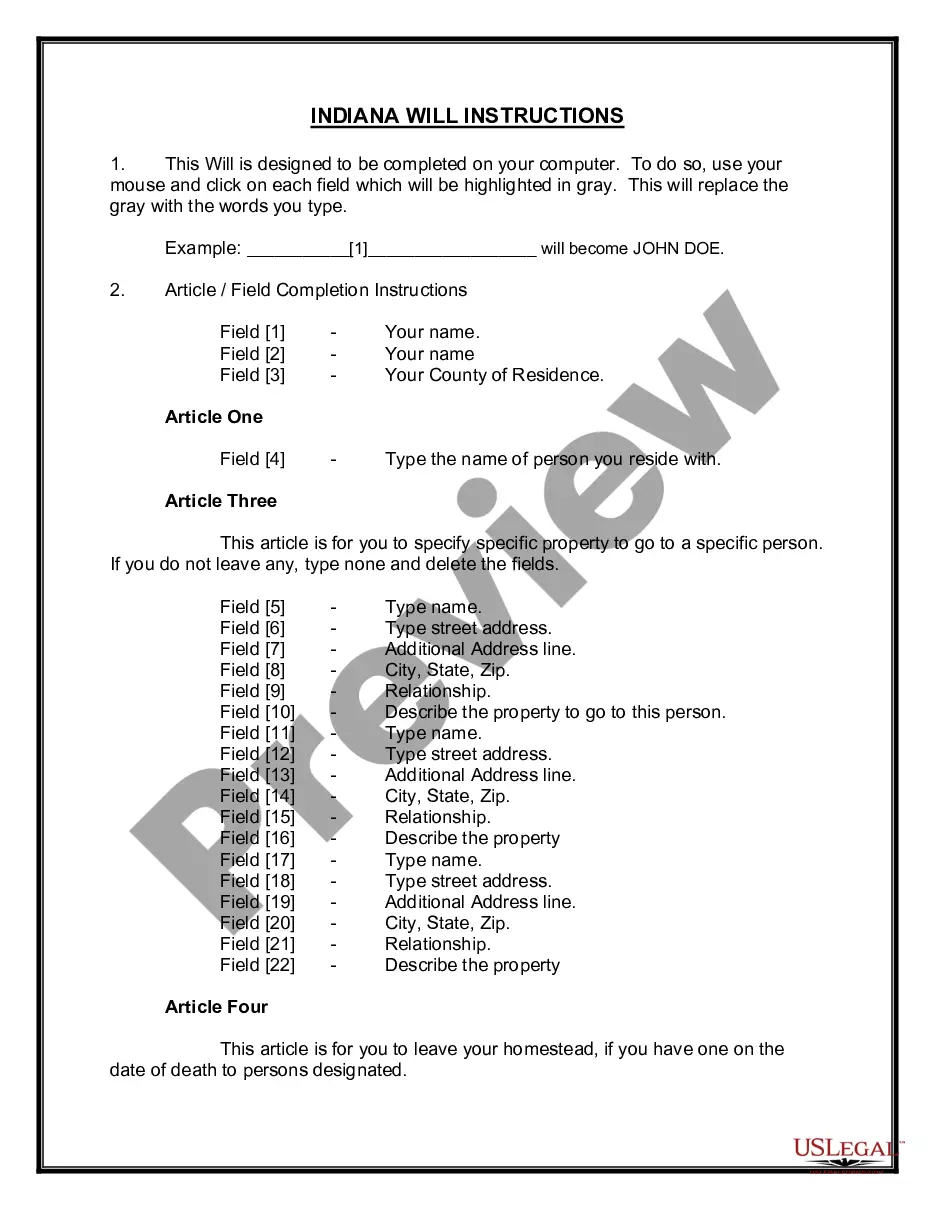

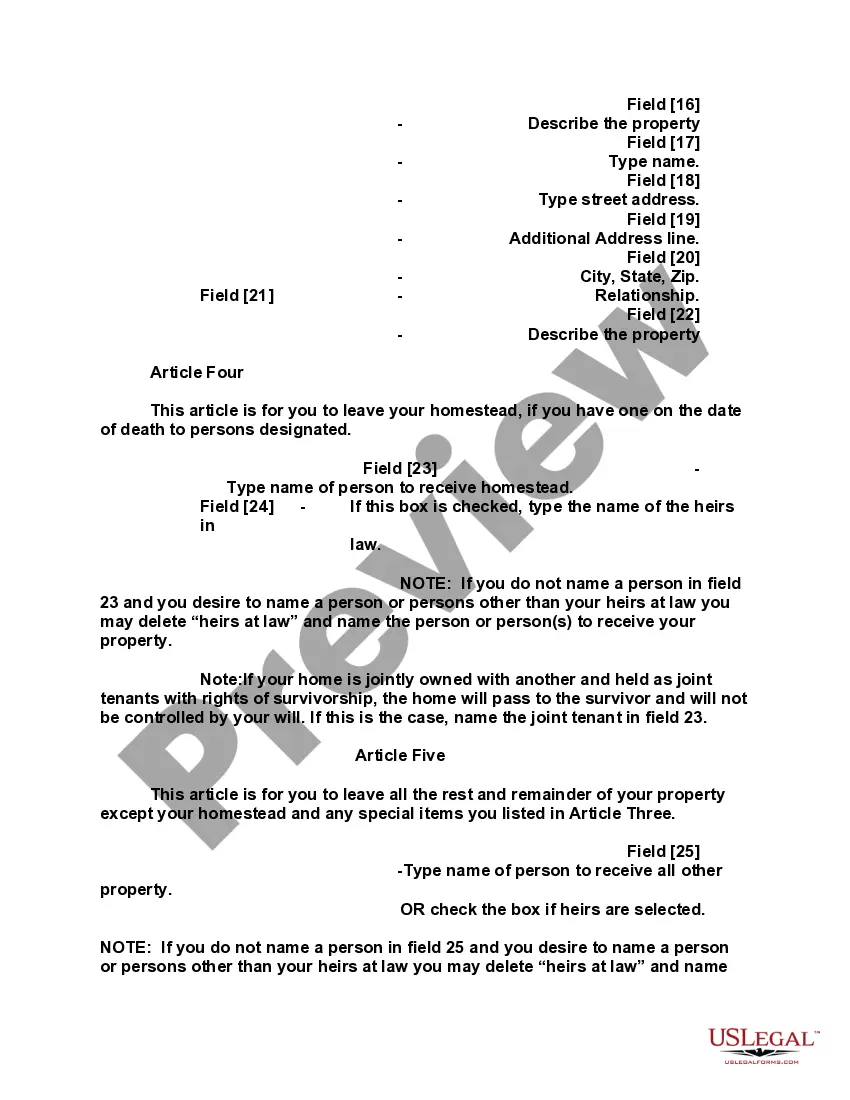

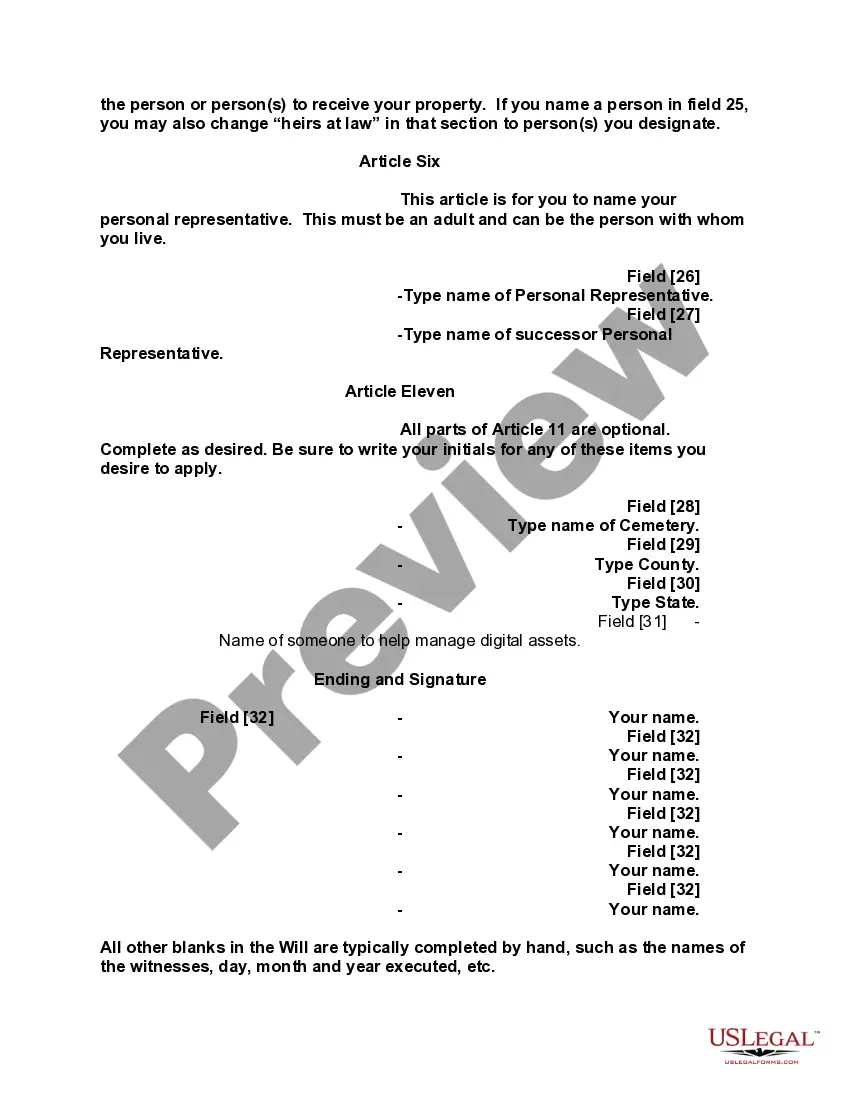

This will package contains two wills for a man and woman living together with no children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other. State specific instructions are also included.

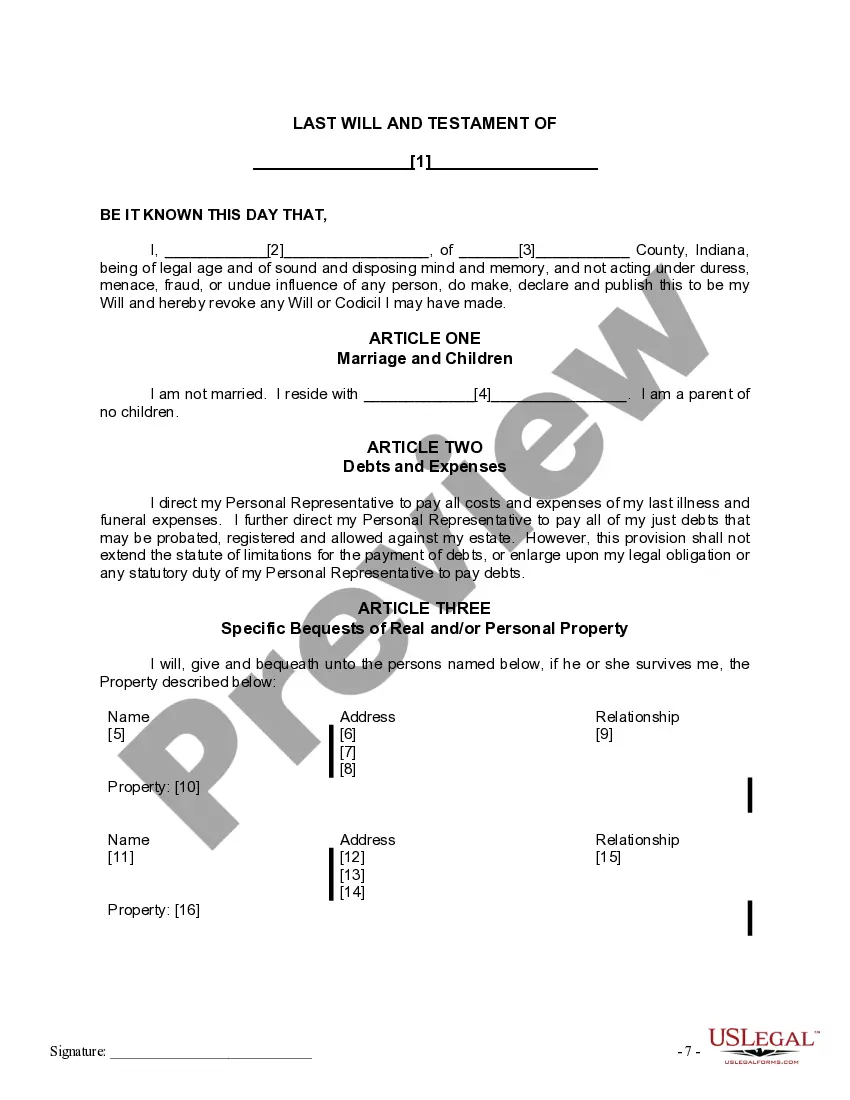

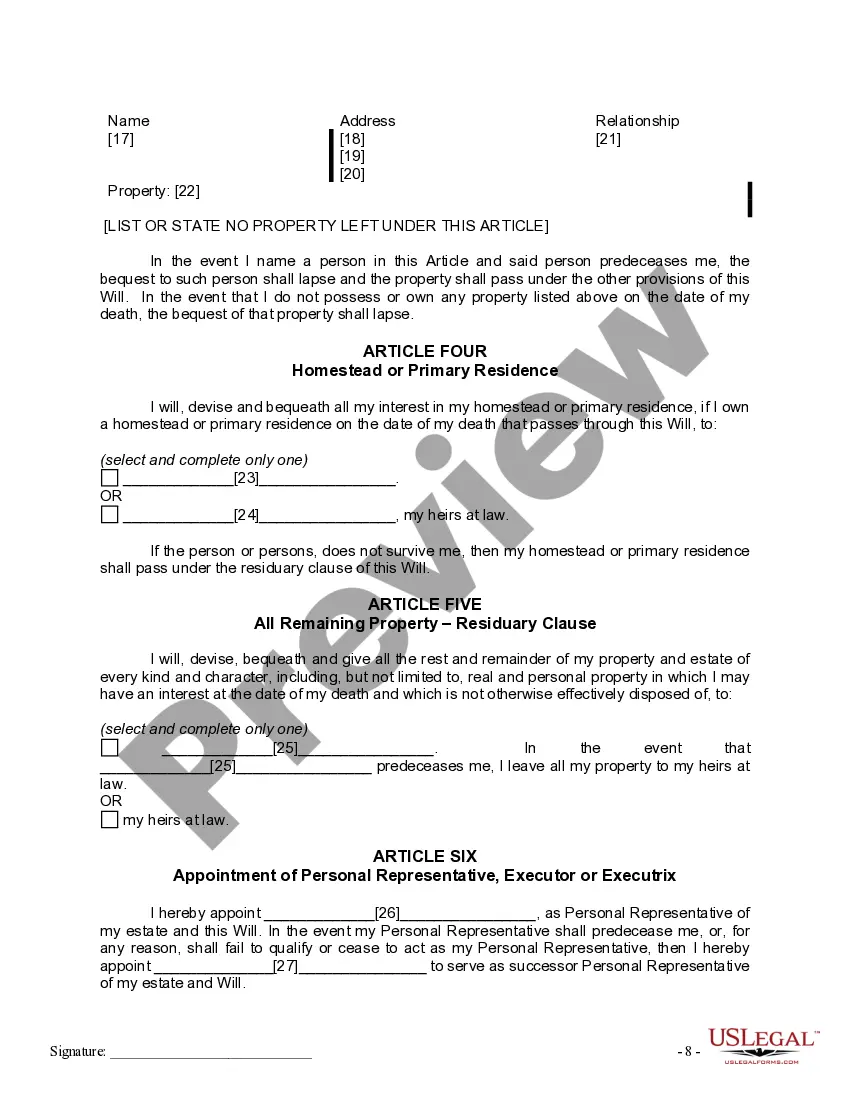

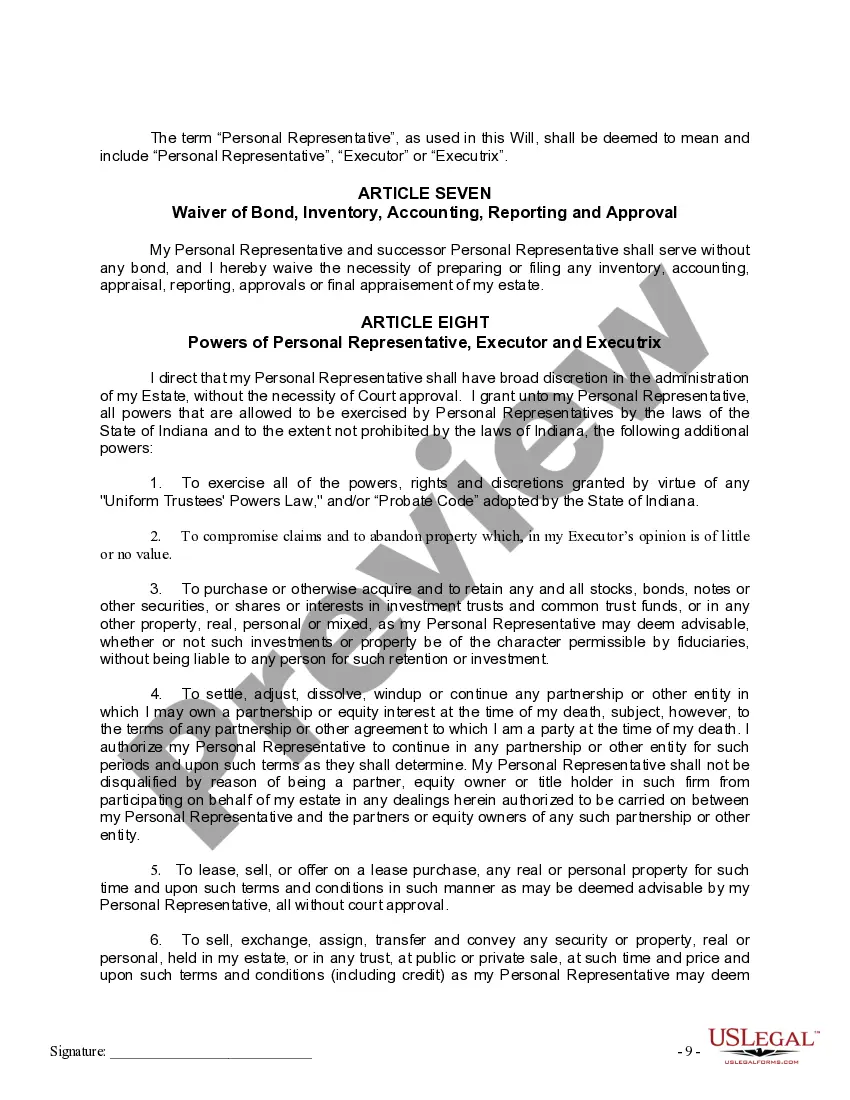

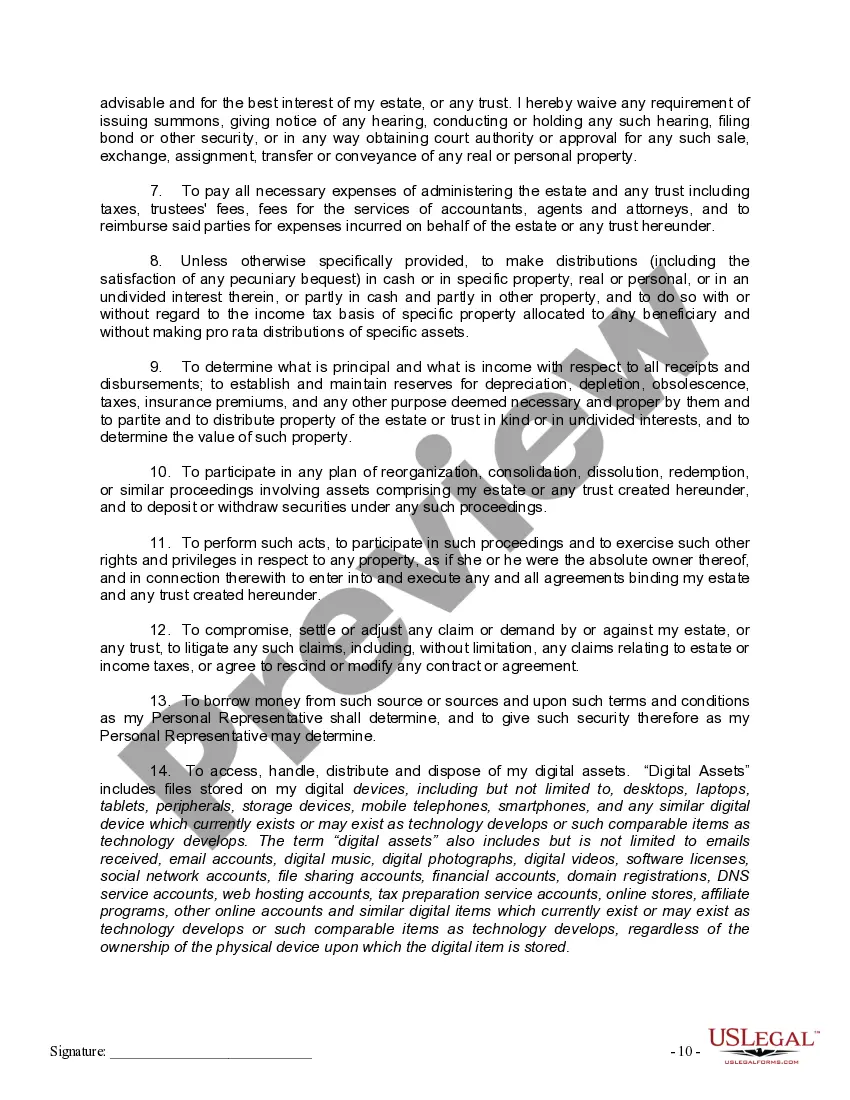

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills. Indianapolis Indiana Mutual Wills containing Last Will and Testaments for Unmarried Persons living together with No Children are legal documents that allow two individuals who are in a committed relationship but are not married to ensure that their assets are distributed according to their wishes upon their death. These wills are specifically designed for unmarried couples who do not have any children. The mutual wills are created by the individuals to establish how they want their assets and properties to be distributed. They outline the beneficiaries of their estate, including any family members or friends they wish to include. They also specify the share of each beneficiary and any specific bequests or gifts they want to make. One important aspect of these mutual wills is that they are reciprocal, meaning that both individuals are making similar provisions in their respective wills. This is done to ensure that both parties have a mutual understanding and agreement on the distribution of their assets. These mutual wills also appoint an executor who will be responsible for carrying out the wishes stated in the wills. The executor may be a trusted friend, family member, or even a professional executor. It is important to choose someone who is willing and capable of handling the responsibilities that come with this role. In Indianapolis, Indiana, there may be different types of mutual wills based on the specific needs of the couple. For example, there could be a basic mutual will that outlines the general distribution of assets without any additional complexities. Alternatively, there may be a mutual will that includes provisions for the division of jointly owned property and assets, as well as any debts or liabilities. Another type of mutual will that may exist is a mutual will with a survivorship clause. This clause states that if one person in the couple passes away, their assets automatically transfer to the surviving partner. This can be a useful provision for couples who want to ensure that their partner is taken care of in the event of their death. To create a mutual will, both individuals must be of sound mind and over the legal age of 18. It is recommended to seek legal advice and assistance to ensure that the mutual wills are legally binding and meet all the necessary requirements under Indianapolis, Indiana law. In summary, Indianapolis Indiana Mutual Wills containing Last Will and Testaments for Unmarried Persons living together with No Children are legally binding documents that allow unmarried couples to specify how they want their assets and properties to be distributed upon their death. These wills are tailored to the specific needs and wishes of the couple, ensuring that their wishes are carried out and their assets are protected.

Indianapolis Indiana Mutual Wills containing Last Will and Testaments for Unmarried Persons living together with No Children are legal documents that allow two individuals who are in a committed relationship but are not married to ensure that their assets are distributed according to their wishes upon their death. These wills are specifically designed for unmarried couples who do not have any children. The mutual wills are created by the individuals to establish how they want their assets and properties to be distributed. They outline the beneficiaries of their estate, including any family members or friends they wish to include. They also specify the share of each beneficiary and any specific bequests or gifts they want to make. One important aspect of these mutual wills is that they are reciprocal, meaning that both individuals are making similar provisions in their respective wills. This is done to ensure that both parties have a mutual understanding and agreement on the distribution of their assets. These mutual wills also appoint an executor who will be responsible for carrying out the wishes stated in the wills. The executor may be a trusted friend, family member, or even a professional executor. It is important to choose someone who is willing and capable of handling the responsibilities that come with this role. In Indianapolis, Indiana, there may be different types of mutual wills based on the specific needs of the couple. For example, there could be a basic mutual will that outlines the general distribution of assets without any additional complexities. Alternatively, there may be a mutual will that includes provisions for the division of jointly owned property and assets, as well as any debts or liabilities. Another type of mutual will that may exist is a mutual will with a survivorship clause. This clause states that if one person in the couple passes away, their assets automatically transfer to the surviving partner. This can be a useful provision for couples who want to ensure that their partner is taken care of in the event of their death. To create a mutual will, both individuals must be of sound mind and over the legal age of 18. It is recommended to seek legal advice and assistance to ensure that the mutual wills are legally binding and meet all the necessary requirements under Indianapolis, Indiana law. In summary, Indianapolis Indiana Mutual Wills containing Last Will and Testaments for Unmarried Persons living together with No Children are legally binding documents that allow unmarried couples to specify how they want their assets and properties to be distributed upon their death. These wills are tailored to the specific needs and wishes of the couple, ensuring that their wishes are carried out and their assets are protected.