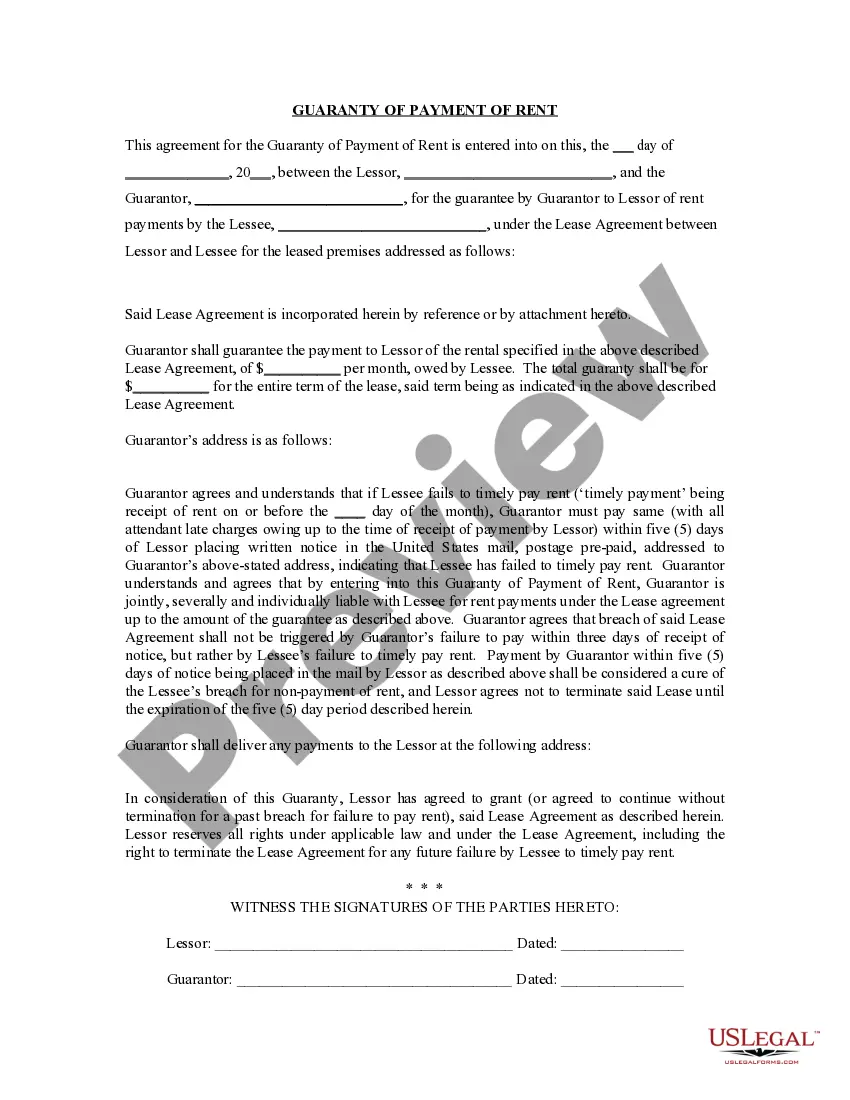

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent is a legally binding agreement between a landlord and a third party, known as the guarantor, which ensures that the rent will be paid in case the tenant defaults on their payment obligations. This agreement provides financial security and reassurance to the landlord, protecting their investment and minimizing the risk of loss due to non-payment of rent. One type of Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent is the corporate guaranty, where a business entity acts as the guarantor. This could be a parent company guaranteeing the rent payment on behalf of its subsidiary or a separate business providing a guarantee for the tenant. The corporate guarantor assumes the responsibility of rent payment if the tenant fails to fulfill their obligation, giving the landlord an additional layer of security. Another type is the personal guaranty, where an individual steps in as the guarantor for the tenant. Typically, this individual has a close relationship with the tenant, such as a family member, friend, or business partner. With a personal guaranty, the guarantor pledges their personal assets and income to cover any rent arrears if the tenant cannot meet their financial obligations. Landlords often require a personal guaranty when dealing with individuals without a strong credit history or unstable income. In Fort Wayne, Indiana, the lease agreement may specifically outline the terms and conditions of the guaranty, including the duration of the guarantee, the maximum amount covered, and any provisions for termination or modification. Landlords may also request financial documentation from potential guarantors to assess their creditworthiness and ability to fulfill their obligations under the agreement. It is important for both landlords and guarantors to fully understand the terms of the Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent before entering into the agreement. Seeking legal advice and reviewing the document thoroughly can help clarify the responsibilities and rights of each party involved. In conclusion, a Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent is a crucial tool for landlords to mitigate the risk of rent default. It provides peace of mind by assuring landlords that they will receive rent even if the tenant fails to pay. Different types of guaranties exist, such as corporate and personal guaranties, with each offering a different level of financial protection. Clarifying the terms of the agreement and seeking legal advice are crucial steps in ensuring a smooth and secure rental experience for all parties involved.Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent is a legally binding agreement between a landlord and a third party, known as the guarantor, which ensures that the rent will be paid in case the tenant defaults on their payment obligations. This agreement provides financial security and reassurance to the landlord, protecting their investment and minimizing the risk of loss due to non-payment of rent. One type of Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent is the corporate guaranty, where a business entity acts as the guarantor. This could be a parent company guaranteeing the rent payment on behalf of its subsidiary or a separate business providing a guarantee for the tenant. The corporate guarantor assumes the responsibility of rent payment if the tenant fails to fulfill their obligation, giving the landlord an additional layer of security. Another type is the personal guaranty, where an individual steps in as the guarantor for the tenant. Typically, this individual has a close relationship with the tenant, such as a family member, friend, or business partner. With a personal guaranty, the guarantor pledges their personal assets and income to cover any rent arrears if the tenant cannot meet their financial obligations. Landlords often require a personal guaranty when dealing with individuals without a strong credit history or unstable income. In Fort Wayne, Indiana, the lease agreement may specifically outline the terms and conditions of the guaranty, including the duration of the guarantee, the maximum amount covered, and any provisions for termination or modification. Landlords may also request financial documentation from potential guarantors to assess their creditworthiness and ability to fulfill their obligations under the agreement. It is important for both landlords and guarantors to fully understand the terms of the Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent before entering into the agreement. Seeking legal advice and reviewing the document thoroughly can help clarify the responsibilities and rights of each party involved. In conclusion, a Fort Wayne Indiana Guaranty or Guarantee of Payment of Rent is a crucial tool for landlords to mitigate the risk of rent default. It provides peace of mind by assuring landlords that they will receive rent even if the tenant fails to pay. Different types of guaranties exist, such as corporate and personal guaranties, with each offering a different level of financial protection. Clarifying the terms of the agreement and seeking legal advice are crucial steps in ensuring a smooth and secure rental experience for all parties involved.