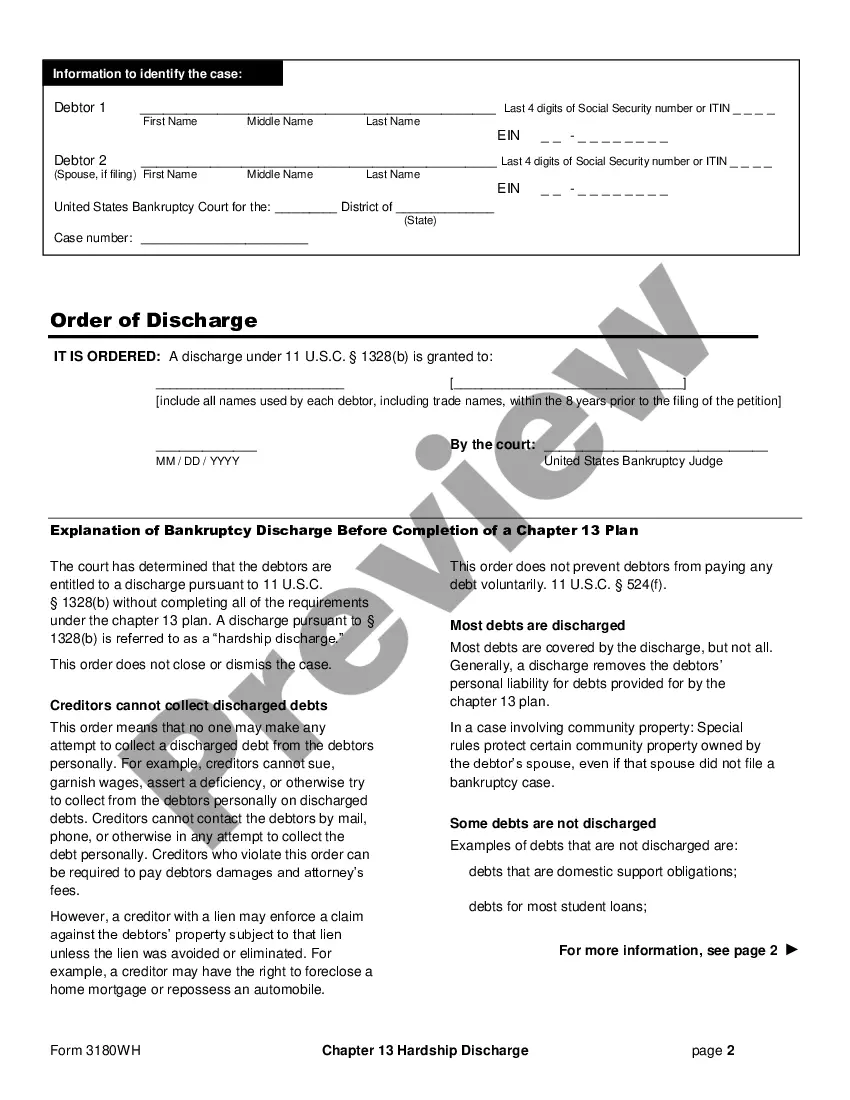

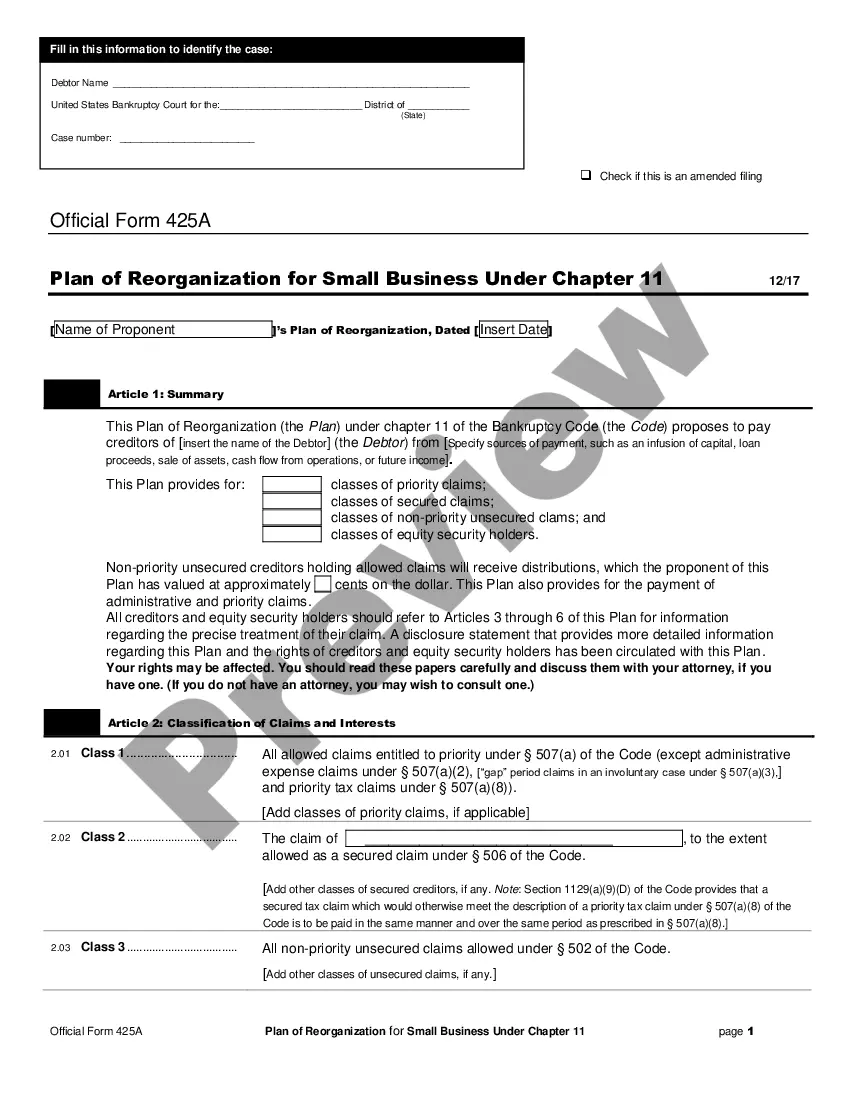

This is a Chapter 13 Plan. It outlines how the Debtor intends to pay back portions of his/her debt and must be sent to all named Creditors.

Evansville Indiana Chapter 13 Plan

Description

How to fill out Indiana Chapter 13 Plan?

We consistently aim to minimize or evade legal repercussions when engaging with complex law-related or financial matters.

To achieve this, we enlist legal services that are typically very expensive. However, not every legal issue is equally intricate. Most can be handled by ourselves.

US Legal Forms is an online repository of current DIY legal templates encompassing everything from wills and powers of attorney to incorporation articles and petitions for dissolution. Our library empowers you to manage your affairs independently without requiring an attorney's services.

We provide access to legal form templates that are not always publicly accessible. Our templates are specific to states and regions, which greatly simplifies the search process.

Ensure to verify that the Evansville Indiana Chapter 13 Plan aligns with the laws and regulations applicable to your state and region. Additionally, it is crucial that you examine the form’s description (if one is available), and if you notice any inconsistencies with your original requirements, look for an alternative form. Once you've confirmed that the Evansville Indiana Chapter 13 Plan is suitable for your needs, you can select the subscription option and proceed to payment. Subsequently, you can download the document in any compatible file format. For over 24 years, we’ve supported millions by delivering ready-to-customize and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Utilize US Legal Forms whenever you wish to locate and download the Evansville Indiana Chapter 13 Plan or any other form swiftly and securely.

- All you need to do is Log In to your account and click the Get button adjacent to it.

- Should you misplace the document, you can always retrieve it again in the My documents section.

- The process remains equally straightforward if you are not familiar with the platform!

- You can establish your account in just a few minutes.

Form popularity

FAQ

Your Chapter 13 payment may be high due to various factors, such as your total debt amount and your income level. In the Evansville Indiana Chapter 13 Plan, the court requires you to repay as much as your financial situation allows. If you owe substantial debts or have limited disposable income, your monthly payment will reflect that reality. Working with a professional can help you understand calculations and possibly reduce your costs.

A 100% payment plan under the Evansville Indiana Chapter 13 Plan means you will repay all of your unsecured debts in full over the repayment period, which is usually three to five years. This type of plan is often available if your income is sufficient to cover the full amount of your debts. Meeting this requirement assures creditors receive the total amount owed, fostering trust and stability. Additionally, the plan can help protect your assets during the repayment period.

The average payment plan for an Evansville Indiana Chapter 13 Plan varies widely depending on several factors, including your total debts and income. Generally, monthly payments can range from a few hundred to over a thousand dollars. However, every case is unique, and a legal expert can help you calculate a reasonable plan based on your financial circumstances. Understanding your financial obligations can make the process smoother.

If you find it difficult to afford Chapter 13 payments, you have several options to consider under the Evansville Indiana Chapter 13 Plan. You may be able to modify your plan to accommodate your current financial situation. Alternatively, you can explore hardship provisions that allow temporary payment reductions. Seeking advice from a qualified attorney can provide tailored solutions that suit your needs.

Certain factors can disqualify you from filing for an Evansville Indiana Chapter 13 Plan. If your unsecured debts exceed $394,725 or secured debts exceed $1,184,200, you might be ineligible. Additionally, if you have filed for bankruptcy previously and did not complete the plan, this may affect your eligibility. It's crucial to evaluate your financial situation with a professional to determine your options.

The duration for completing an Evansville Indiana Chapter 13 Plan typically ranges from three to five years. This timeline allows you to repay your debts under a structured repayment plan. However, specific circumstances such as your total debts and monthly income can influence the timeframe. Consulting with a legal expert can help you understand your unique situation better.

Under the Evansville Indiana Chapter 13 Plan, the payment duration typically ranges from three to five years. The specific length depends on your income level and the amount of debt you owe. During this period, you will make regular payments to a court-appointed trustee, who will distribute the funds to your creditors. It's important to have a clear understanding of your repayment plan to manage your finances effectively.

Yes, you can be denied an Evansville Indiana Chapter 13 Plan if you do not meet the eligibility criteria or if you fail to propose a feasible repayment plan. Common reasons for denial include failing to complete the credit counseling requirement or having debts that exceed the legal limits. It’s important to prepare thoroughly and consult an expert to avoid these pitfalls. A knowledgeable resource can help ensure you understand the requirements and submit an effective application.

While it's legal to file for an Evansville Indiana Chapter 13 Plan yourself, it’s generally advisable to seek professional help. Bankruptcy can be complex, and any mistakes in your filing can lead to delays or complications. A professional can guide you through the process and help you prepare a viable repayment plan. Consider using resources like the US Legal Forms platform to get the necessary documents and information.

The average monthly payment under an Evansville Indiana Chapter 13 Plan can vary significantly based on your income, expenses, and total debt. Generally, it ranges from $200 to $1,000 depending on these factors. This payment is made to the bankruptcy trustee, who, in turn, distributes the funds to your creditors. Careful planning will help you determine what you can afford while ensuring compliance with the bankruptcy court’s requirements.