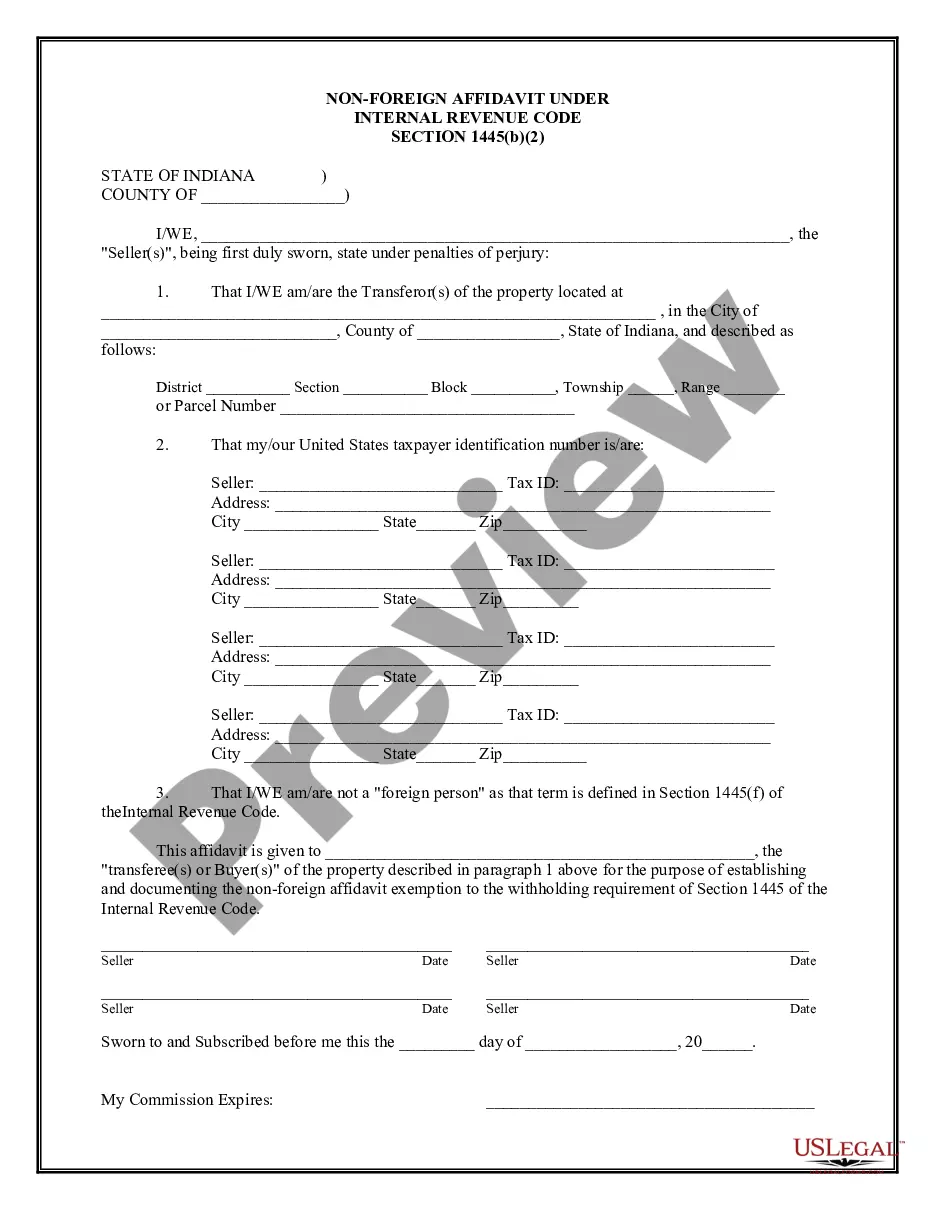

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Carmel Indiana Non-Foreign Affidavit Under IRC 1445 is a legal document required for real estate transactions involving foreign sellers or parties. This affidavit ensures compliance with the Internal Revenue Code (IRC) Section 1445, which imposes withholding tax obligations on the buyer or transferee of US real property interests. A Non-Foreign Affidavit is necessary for the seller (foreign individual/entity) to confirm their non-foreign status to the buyer/transferee, who is responsible for withholding a portion of the purchase price and remitting it to the Internal Revenue Service (IRS) as a form of tax payment. This affidavit is crucial for both parties involved in the transaction as failure to comply with IRC 1445 may result in penalties or legal consequences. There can be different types of Carmel Indiana Non-Foreign Affidavits Under IRC 1445, depending on the specific requirements of the transaction or the unique circumstances of the seller. Some of these variations may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when a foreign individual is selling their US real property interests and needs to provide a written confirmation of their non-foreign status. 2. Entity Non-Foreign Affidavit: In cases where a foreign entity (such as a corporation, partnership, or trust) holds the US real property interests, this type of affidavit is utilized to establish the non-foreign status of the entity. 3. Exemption Certificate: The Carmel Indiana Non-Foreign Affidavit Under IRC 1445 may also include an exemption certificate if the seller qualifies for an exemption from withholding taxes based on certain conditions prescribed by law. In this case, the affidavit will contain detailed information justifying the exemption. It is essential to consult with a knowledgeable attorney or tax professional when dealing with Carmel Indiana Non-Foreign Affidavits Under IRC 1445 to ensure compliance with the relevant regulations and to accurately complete the necessary paperwork.The Carmel Indiana Non-Foreign Affidavit Under IRC 1445 is a legal document required for real estate transactions involving foreign sellers or parties. This affidavit ensures compliance with the Internal Revenue Code (IRC) Section 1445, which imposes withholding tax obligations on the buyer or transferee of US real property interests. A Non-Foreign Affidavit is necessary for the seller (foreign individual/entity) to confirm their non-foreign status to the buyer/transferee, who is responsible for withholding a portion of the purchase price and remitting it to the Internal Revenue Service (IRS) as a form of tax payment. This affidavit is crucial for both parties involved in the transaction as failure to comply with IRC 1445 may result in penalties or legal consequences. There can be different types of Carmel Indiana Non-Foreign Affidavits Under IRC 1445, depending on the specific requirements of the transaction or the unique circumstances of the seller. Some of these variations may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when a foreign individual is selling their US real property interests and needs to provide a written confirmation of their non-foreign status. 2. Entity Non-Foreign Affidavit: In cases where a foreign entity (such as a corporation, partnership, or trust) holds the US real property interests, this type of affidavit is utilized to establish the non-foreign status of the entity. 3. Exemption Certificate: The Carmel Indiana Non-Foreign Affidavit Under IRC 1445 may also include an exemption certificate if the seller qualifies for an exemption from withholding taxes based on certain conditions prescribed by law. In this case, the affidavit will contain detailed information justifying the exemption. It is essential to consult with a knowledgeable attorney or tax professional when dealing with Carmel Indiana Non-Foreign Affidavits Under IRC 1445 to ensure compliance with the relevant regulations and to accurately complete the necessary paperwork.