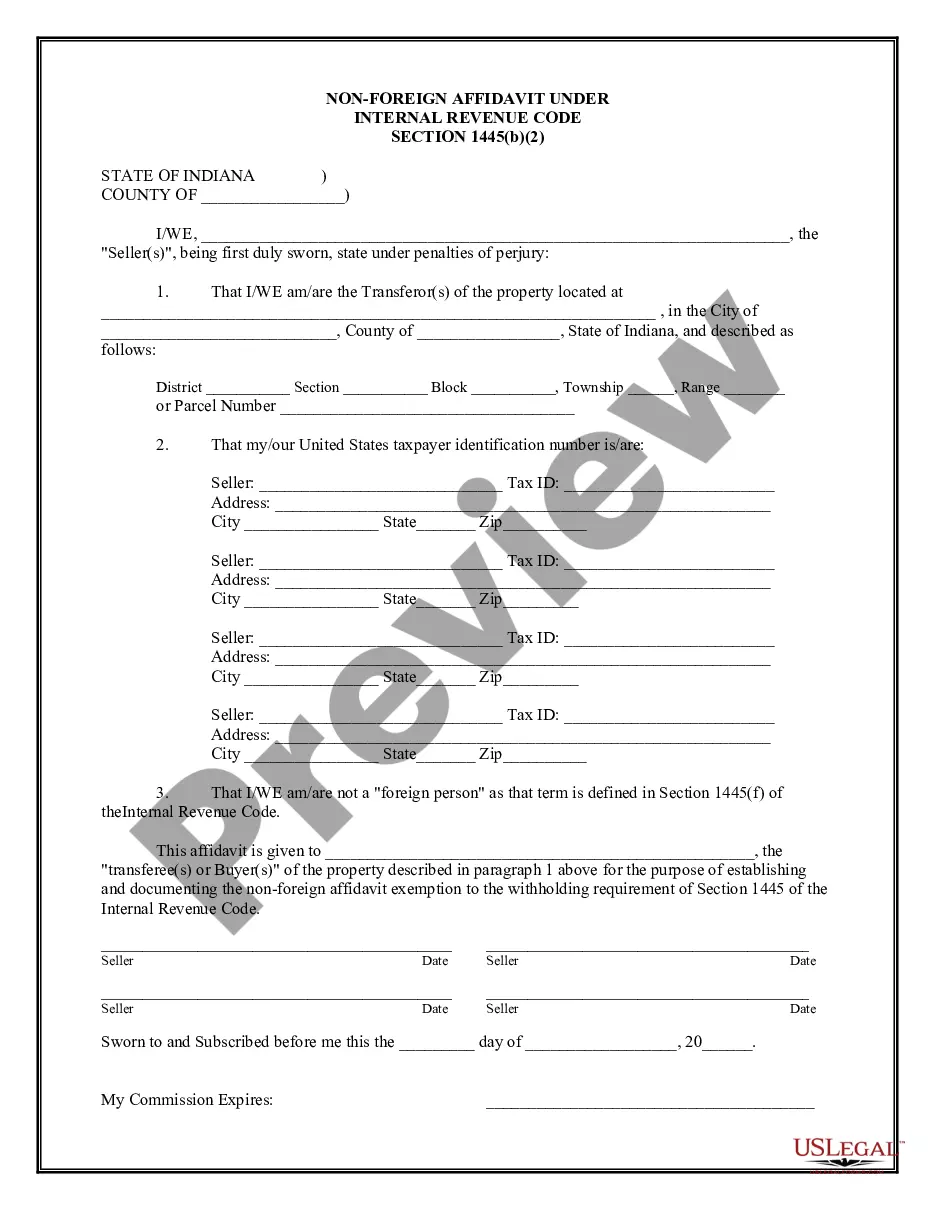

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Evansville Indiana Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Code (IRC) section 1445 for real estate transactions involving non-foreign individuals in Evansville, Indiana. This affidavit serves as a declaration by the seller of real property to confirm their non-foreign status, stating that they are a U.S. citizen, U.S. resident alien, or domestic corporation. When purchasing real estate in Evansville, Indiana, it is crucial for the buyer to ensure compliance with IRS regulations, particularly regarding the withholding of taxes, as per IRC 1445. This section requires the buyer to withhold a specific amount of the sales proceeds when the seller is a foreign individual. However, if the seller is a non-foreign individual, they can request an exemption from this withholding requirement by providing a properly completed Evansville Indiana Non-Foreign Affidavit Under IRC 1445. The affidavit includes essential information about the seller, including their name, address, taxpayer identification number (such as a social security number or employer identification number), and the property details. The completion of this affidavit indicates that the seller is certifying, under penalties of perjury, their non-foreign status. It is essential for all the information provided to be accurate and truthful. Different types of Evansville Indiana Non-Foreign Affidavit Under IRC 1445 may exist based on specific circumstances. For example, there might be separate forms for individual U.S. citizens, U.S. resident aliens, and domestic corporations. Each form would ask for the relevant information related to the respective entity type. To ensure compliance with the IRS regulations and avoid any potential penalties, it is advisable to consult with a qualified attorney or tax professional who can help prepare and review the Evansville Indiana Non-Foreign Affidavit Under IRC 1445 accurately. They can guide the seller through the process, ensuring all necessary details are included and the affidavit complies with the applicable regulations. It is important to note that while this content provides a general overview of Evansville Indiana Non-Foreign Affidavit Under IRC 1445, it does not substitute for professional legal or tax advice. Laws and regulations can change, so it is crucial to consult with a qualified professional to receive up-to-date information and guidance tailored to your specific circumstances.Evansville Indiana Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Code (IRC) section 1445 for real estate transactions involving non-foreign individuals in Evansville, Indiana. This affidavit serves as a declaration by the seller of real property to confirm their non-foreign status, stating that they are a U.S. citizen, U.S. resident alien, or domestic corporation. When purchasing real estate in Evansville, Indiana, it is crucial for the buyer to ensure compliance with IRS regulations, particularly regarding the withholding of taxes, as per IRC 1445. This section requires the buyer to withhold a specific amount of the sales proceeds when the seller is a foreign individual. However, if the seller is a non-foreign individual, they can request an exemption from this withholding requirement by providing a properly completed Evansville Indiana Non-Foreign Affidavit Under IRC 1445. The affidavit includes essential information about the seller, including their name, address, taxpayer identification number (such as a social security number or employer identification number), and the property details. The completion of this affidavit indicates that the seller is certifying, under penalties of perjury, their non-foreign status. It is essential for all the information provided to be accurate and truthful. Different types of Evansville Indiana Non-Foreign Affidavit Under IRC 1445 may exist based on specific circumstances. For example, there might be separate forms for individual U.S. citizens, U.S. resident aliens, and domestic corporations. Each form would ask for the relevant information related to the respective entity type. To ensure compliance with the IRS regulations and avoid any potential penalties, it is advisable to consult with a qualified attorney or tax professional who can help prepare and review the Evansville Indiana Non-Foreign Affidavit Under IRC 1445 accurately. They can guide the seller through the process, ensuring all necessary details are included and the affidavit complies with the applicable regulations. It is important to note that while this content provides a general overview of Evansville Indiana Non-Foreign Affidavit Under IRC 1445, it does not substitute for professional legal or tax advice. Laws and regulations can change, so it is crucial to consult with a qualified professional to receive up-to-date information and guidance tailored to your specific circumstances.