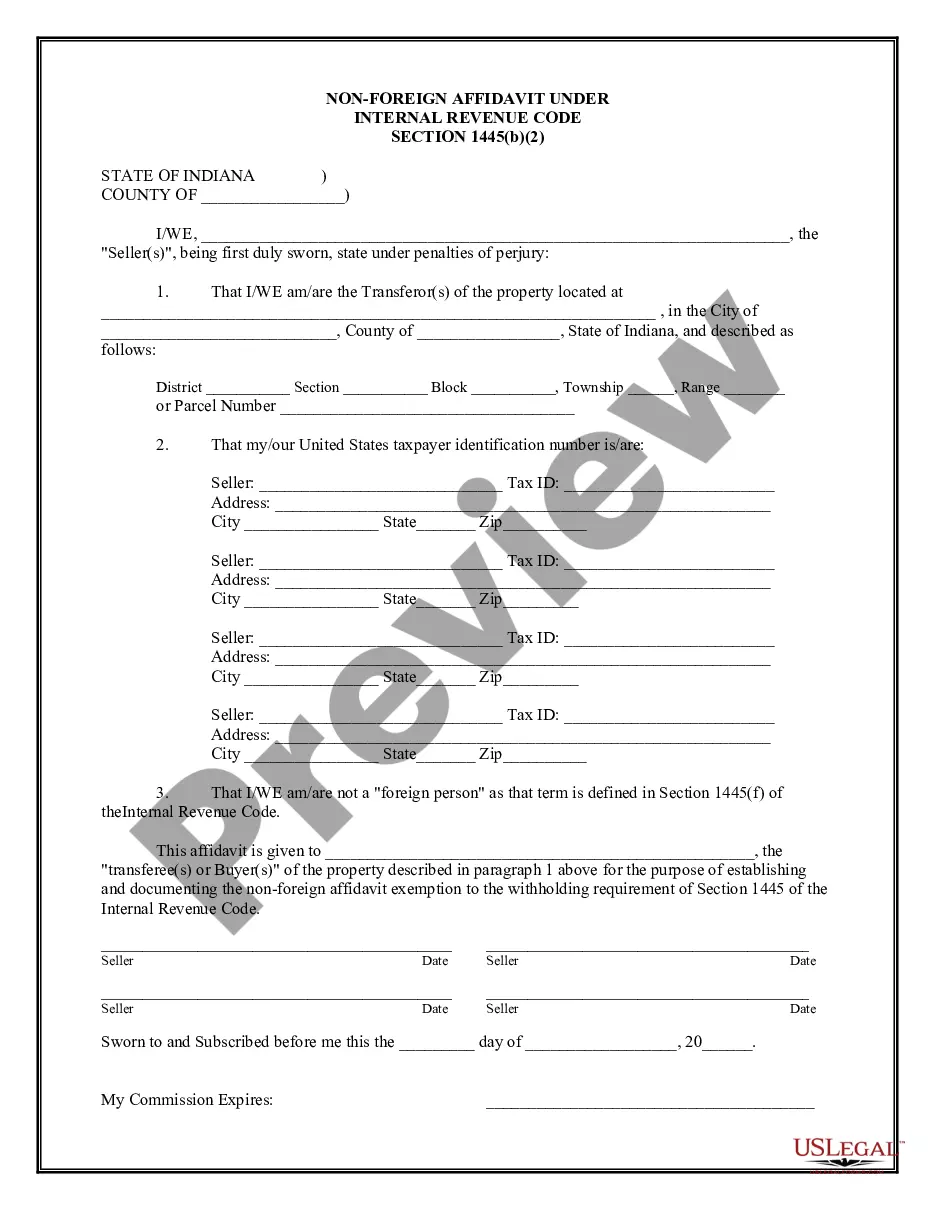

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Fort Wayne Indiana Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: Fort Wayne, Indiana, a bustling city located in Allen County, is home to a diverse population comprising both U.S. residents and non-U.S. residents. In certain real estate transactions, particularly those involving non-U.S. persons, the Internal Revenue Code (IRC) Section 1445 mandates the filing of a Non-Foreign Affidavit. This affidavit serves as an important legal document to ensure compliance with U.S. tax laws and obligations related to the disposition of a U.S. real property interest. Understanding the Purpose: The Non-Foreign Affidavit under IRC 1445 is a form that a buyer or transferee must submit to the Internal Revenue Service (IRS) and the withholding agent (typically the closing agent) when purchasing or acquiring a U.S. real property interest from a non-U.S. person. This affidavit helps determine if any withholding tax obligations exist from the sale. Types of Fort Wayne Indiana Non-Foreign Affidavit under IRC 1445: 1. Fort Wayne Indiana Non-Foreign Certification: This type of affidavit is typically used when the seller or transferor of the U.S. real property interest is a non-U.S. person. The affidavit serves as proof that the seller is not considered a foreign person for tax withholding purposes. 2. Fort Wayne Indiana Non-Foreign Certification — Individual Seller: This particular affidavit variant is applicable when the seller or transferor of the U.S. real property interest is an individual non-U.S. person. It requires to be detailed personal information, including name, address, taxpayer identification number, and a statement certifying their non-foreign status. 3. Fort Wayne Indiana Non-Foreign Certification — Entity Seller: In case the seller or transferor of the U.S. real property interest is a non-U.S. entity, this affidavit must be used. It includes details such as the name and legal structure of the entity, taxpayer identification number, and a statement confirming its non-foreign status. Procedure and Filing Requirements: To correctly complete the Fort Wayne Indiana Non-Foreign Affidavit under IRC 1445, the buyer or transferee must provide accurate information regarding the transaction, the parties involved, and the property details. The affidavit should be signed under penalty of perjury, affirming the accuracy of the provided information. The completed affidavit must be submitted to the IRS and the withholding agent (closing agent) before the closing of the real estate transaction. The withholding agent may require additional documentation, such as copies of passports or taxpayer identification documents, for verification purposes. Conclusion: Complying with the Non-Foreign Affidavit under IRC 1445 is vital for both U.S. buyers and non-U.S. sellers involved in real estate transactions. Failure to adhere to the tax withholding requirements outlined by the IRS in relation to non-U.S. persons can result in penalties and legal consequences. It is advisable to seek guidance from a qualified attorney or tax professional to ensure accurate completion and timely filing of the Fort Wayne Indiana Non-Foreign Affidavit under IRC 1445, facilitating a smooth and compliant real estate transaction process.Fort Wayne Indiana Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: Fort Wayne, Indiana, a bustling city located in Allen County, is home to a diverse population comprising both U.S. residents and non-U.S. residents. In certain real estate transactions, particularly those involving non-U.S. persons, the Internal Revenue Code (IRC) Section 1445 mandates the filing of a Non-Foreign Affidavit. This affidavit serves as an important legal document to ensure compliance with U.S. tax laws and obligations related to the disposition of a U.S. real property interest. Understanding the Purpose: The Non-Foreign Affidavit under IRC 1445 is a form that a buyer or transferee must submit to the Internal Revenue Service (IRS) and the withholding agent (typically the closing agent) when purchasing or acquiring a U.S. real property interest from a non-U.S. person. This affidavit helps determine if any withholding tax obligations exist from the sale. Types of Fort Wayne Indiana Non-Foreign Affidavit under IRC 1445: 1. Fort Wayne Indiana Non-Foreign Certification: This type of affidavit is typically used when the seller or transferor of the U.S. real property interest is a non-U.S. person. The affidavit serves as proof that the seller is not considered a foreign person for tax withholding purposes. 2. Fort Wayne Indiana Non-Foreign Certification — Individual Seller: This particular affidavit variant is applicable when the seller or transferor of the U.S. real property interest is an individual non-U.S. person. It requires to be detailed personal information, including name, address, taxpayer identification number, and a statement certifying their non-foreign status. 3. Fort Wayne Indiana Non-Foreign Certification — Entity Seller: In case the seller or transferor of the U.S. real property interest is a non-U.S. entity, this affidavit must be used. It includes details such as the name and legal structure of the entity, taxpayer identification number, and a statement confirming its non-foreign status. Procedure and Filing Requirements: To correctly complete the Fort Wayne Indiana Non-Foreign Affidavit under IRC 1445, the buyer or transferee must provide accurate information regarding the transaction, the parties involved, and the property details. The affidavit should be signed under penalty of perjury, affirming the accuracy of the provided information. The completed affidavit must be submitted to the IRS and the withholding agent (closing agent) before the closing of the real estate transaction. The withholding agent may require additional documentation, such as copies of passports or taxpayer identification documents, for verification purposes. Conclusion: Complying with the Non-Foreign Affidavit under IRC 1445 is vital for both U.S. buyers and non-U.S. sellers involved in real estate transactions. Failure to adhere to the tax withholding requirements outlined by the IRS in relation to non-U.S. persons can result in penalties and legal consequences. It is advisable to seek guidance from a qualified attorney or tax professional to ensure accurate completion and timely filing of the Fort Wayne Indiana Non-Foreign Affidavit under IRC 1445, facilitating a smooth and compliant real estate transaction process.