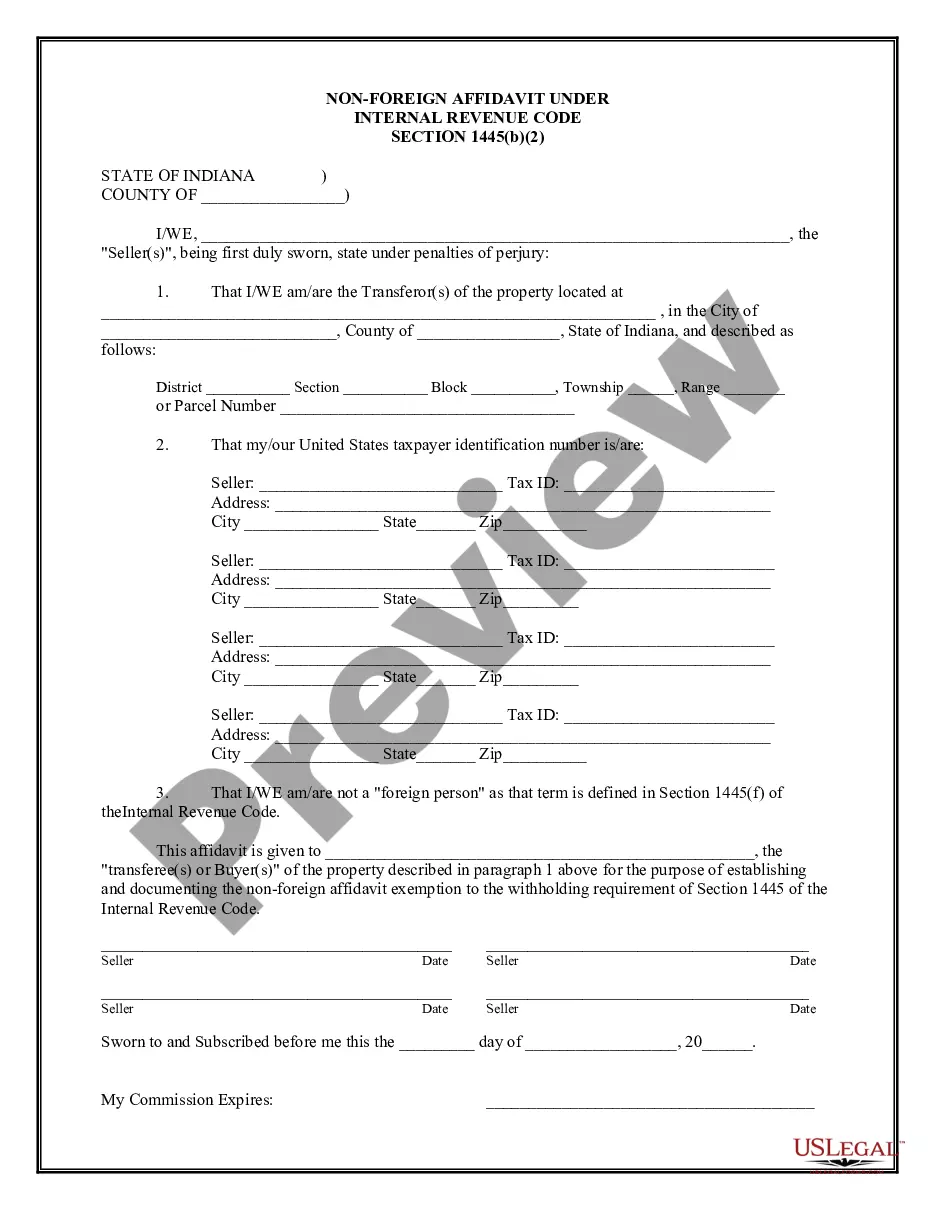

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Indianapolis Indiana Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Indiana Non-Foreign Affidavit Under IRC 1445?

We consistently aim to reduce or evade legal liabilities when navigating intricate legal or financial matters.

To achieve this, we enroll in legal services that are generally quite costly.

However, not all legal challenges are of equal complexity.

Most can be managed independently.

Take advantage of US Legal Forms whenever you need to locate and download the Indianapolis Indiana Non-Foreign Affidavit Under IRC 1445 or any other document swiftly and securely.

- US Legal Forms is an online compilation of current DIY legal templates encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our repository empowers you to handle your affairs autonomously without the necessity of consulting legal professionals.

- We offer access to legal document templates that aren’t universally accessible.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an individual General Partner of the Company, by a responsible officer of a corporate General Partner of the Company (or of the Company, if the Company is a corporation), or by the trustee, executor, or equivalent fiduciary of

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated