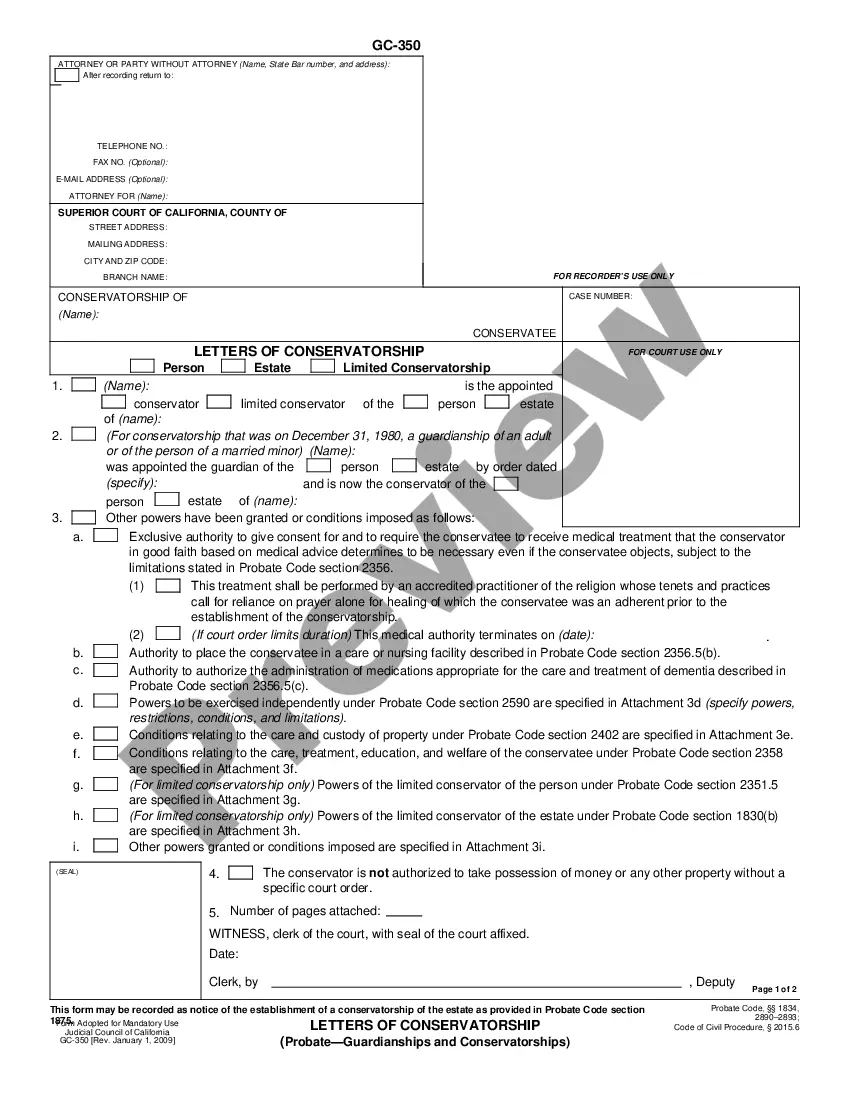

This is a Dissolution Package to Dissolve a Corporation in the State of Indiana. This package contains all forms necessary in the dissolution of the corporation including, step by step instructions, forms and other information.

Carmel Indiana Dissolution Package to Dissolve Corporation

Description

How to fill out Indiana Dissolution Package To Dissolve Corporation?

If you are looking for an authentic form template, it’s exceptionally challenging to select a more suitable platform than the US Legal Forms website – one of the most comprehensive collections online.

Here you can obtain a vast array of form samples for organizational and personal uses categorized by types and states, or keywords.

With the efficient search capability, obtaining the latest Carmel Indiana Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Process the payment. Utilize your credit card or PayPal account to finish the registration process.

Retrieve the template. Select the file format and download it to your device.

- Additionally, the accuracy of each document is verified by a team of qualified attorneys who routinely review the templates on our platform and update them in compliance with the latest state and county laws.

- If you are already acquainted with our service and possess a registered account, all you need to access the Carmel Indiana Dissolution Package to Dissolve Corporation is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have selected the form you need. Examine its description and utilize the Preview option (if available) to inspect its content. If it doesn’t fulfill your requirements, use the Search box at the top of the page to find the suitable document.

- Verify your selection. Click the Buy now button. After that, choose the desired subscription plan and enter information to create an account.

Form popularity

FAQ

Filling out an articles of dissolution form is straightforward when using the Carmel Indiana Dissolution Package to Dissolve Corporation. This package provides step-by-step instructions to guide you through the process. Be prepared to provide your corporation’s details, including its name, address, and reason for dissolution. Carefully review your information before submitting to ensure accuracy.

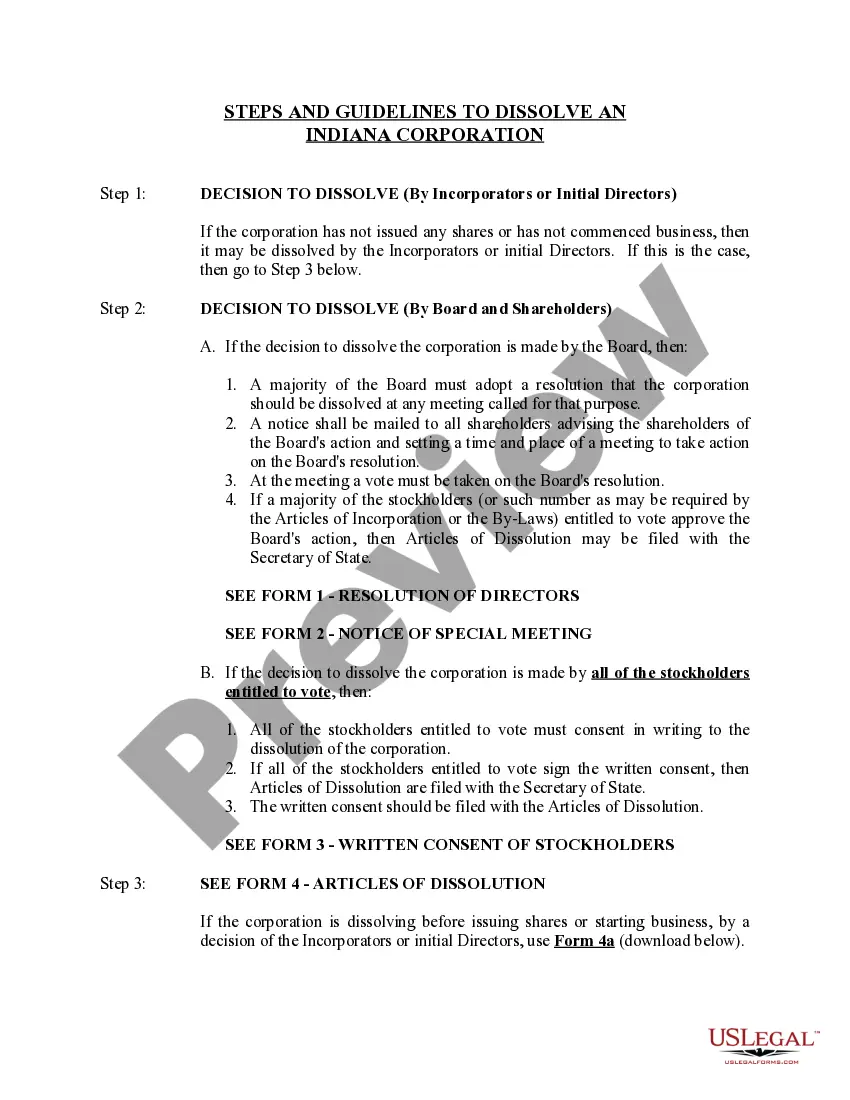

Dissolving a corporation in Indiana involves several key steps, starting with the appropriate forms included in the Carmel Indiana Dissolution Package to Dissolve Corporation. You will need to gather information about your corporation and prepare necessary filings. Then, submit these documents to the Secretary of State. Don't forget to notify your stakeholders and settle any outstanding matters.

To dissolve a corporation in Indiana, begin by obtaining the Carmel Indiana Dissolution Package to Dissolve Corporation. This package includes the necessary forms and guidelines specific to Indiana’s requirements. After completing the required documentation, you will file it with the Secretary of State. Ensure to follow any additional steps such as notifying creditors and settling debts.

When you dissolve a corporation using the Carmel Indiana Dissolution Package to Dissolve Corporation, any outstanding debts do not disappear. The corporation is still responsible for its debts even after dissolution. Creditors may pursue the owners personally if they guaranteed any debts. It is advisable to settle all debts before proceeding with dissolution.

Deciding whether to dissolve your LLC or keep it inactive depends on your future plans. If you do not intend to conduct business, dissolution saves you potential fees and legal obligations. However, if you think you'll resume, keeping it inactive might be beneficial. The Carmel Indiana Dissolution Package to Dissolve Corporation can help you make an informed decision by outlining the steps and implications involved.

To dissolve your LLC in Indiana, start by obtaining the necessary forms from the Indiana Secretary of State's website. Fill out the dissolution form, and make sure to settle any outstanding debts. Submitting the completed form and any required fees will initiate the process. Utilizing the Carmel Indiana Dissolution Package to Dissolve Corporation can streamline this task and ensure compliance.

The dissolution process begins with obtaining board and shareholder approval for dissolution. After that, you need to file dissolution paperwork with your state and notify any creditors. Finally, settle any debts and inform the IRS. Incorporating the Carmel Indiana Dissolution Package to Dissolve Corporation can guide you through these steps efficiently.

The best way to dissolve a company involves a systematic approach: first, obtain approval from your board and shareholders; next, file the required dissolution forms with the state. It is also important to settle any debts and obligations to avoid complications. Utilizing the Carmel Indiana Dissolution Package to Dissolve Corporation can streamline this process and ensure compliance.

While dissolving a corporation does not automatically trigger an audit, it may draw attention from the IRS if there are irregularities in your final tax returns. Maintaining proper documentation throughout the dissolution process is essential to avoid potential issues. Opting for the Carmel Indiana Dissolution Package to Dissolve Corporation can help ensure you follow all necessary steps clearly.

The steps to dissolve a corporation begin with board approval and shareholder consent, followed by filing the Articles of Dissolution with your state. Next, settle any outstanding debts and obligations. Finally, notify the IRS and other tax authorities, which can be easily managed using the Carmel Indiana Dissolution Package to Dissolve Corporation.