This is a Dissolution Package to Dissolve a Corporation in the State of Indiana. This package contains all forms necessary in the dissolution of the corporation including, step by step instructions, forms and other information.

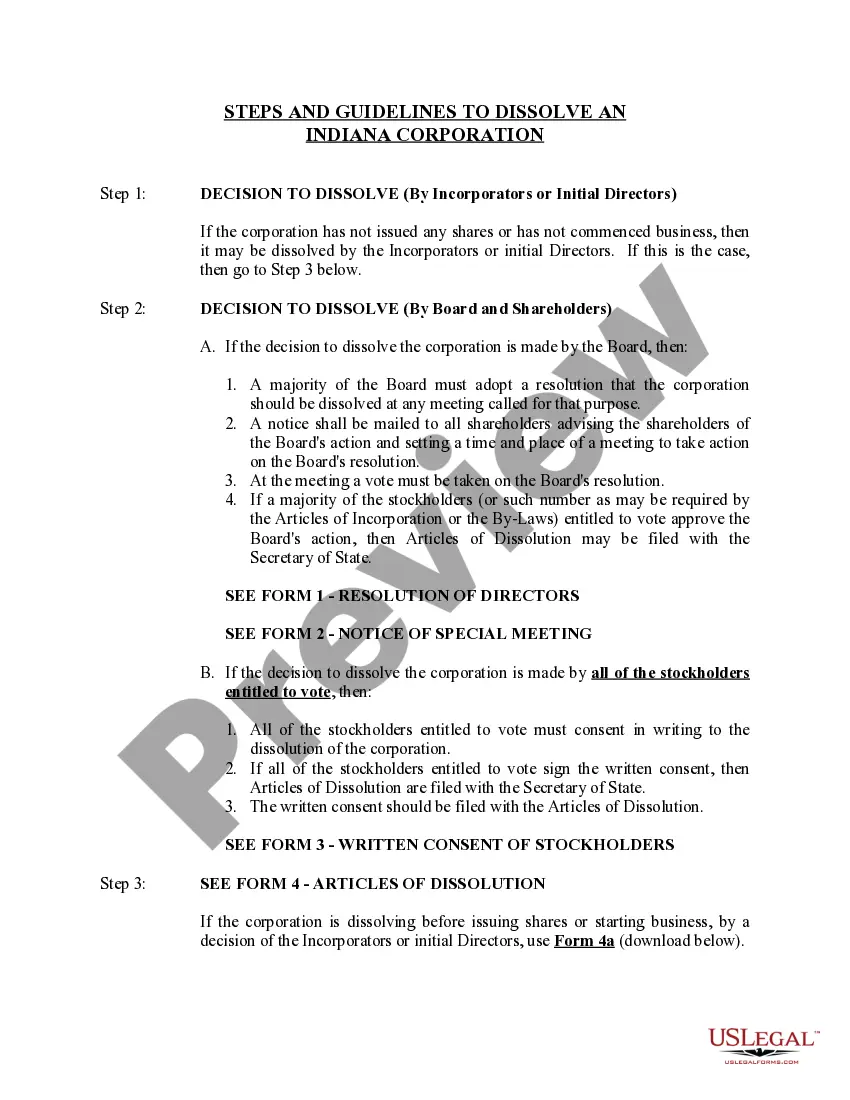

The Fort Wayne Indiana Dissolution Package offers a comprehensive solution for individuals or businesses seeking to dissolve their corporation in the city of Fort Wayne, Indiana. This package provides all the necessary documentation and guidance to ensure a smooth and legally compliant dissolution process. The Dissolution Package includes a detailed step-by-step guide on the dissolution procedure, allowing business owners to easily navigate through the complex legal requirements. It clarifies the necessary forms to be completed, the sequencing of task completion, and the deadlines to be met during the dissolution process. Moreover, the package provides a compilation of relevant forms required for dissolving a corporation in Fort Wayne, Indiana. These forms typically include the Articles of Dissolution, which officially terminates the corporation's existence, as well as additional documents such as the Certificate of Dissolution and the Final Tax Return. The Dissolution Package also includes guidelines on other important aspects to consider during the process, such as the distribution of remaining assets, settlement of liabilities, and the proper filing of tax returns. It ensures that individuals or businesses follow their obligations and avoid any potential legal or financial issues associated with an incomplete or improper dissolution. Additionally, there might be different types of Fort Wayne Indiana Dissolution Packages available based on specific circumstances. Examples include: 1. Standard Dissolution Package: This package is suitable for corporations that have fulfilled their obligations, have a clear financial record, and do not have any pending legal disputes. 2. Dissolution Package with Tax Considerations: Designed for corporations that need to address tax-related matters during the dissolution process, such as filing the Final Tax Return and resolving any outstanding tax issues. 3. Dissolution Package for Corporations with Pending Litigation: This package caters to corporations that are currently involved in legal disputes, ensuring that all legal requirements are met while resolving ongoing litigation matters. In summary, the Fort Wayne Indiana Dissolution Package provides a comprehensive solution to dissolve a corporation in Fort Wayne, Indiana. It offers a detailed guide, necessary forms, and additional considerations to facilitate a smooth and legally compliant dissolution process. Whether it's a standard dissolution, dissolution with tax considerations, or dissolution with pending litigation, these packages ensure all relevant requirements are addressed.

The Fort Wayne Indiana Dissolution Package offers a comprehensive solution for individuals or businesses seeking to dissolve their corporation in the city of Fort Wayne, Indiana. This package provides all the necessary documentation and guidance to ensure a smooth and legally compliant dissolution process. The Dissolution Package includes a detailed step-by-step guide on the dissolution procedure, allowing business owners to easily navigate through the complex legal requirements. It clarifies the necessary forms to be completed, the sequencing of task completion, and the deadlines to be met during the dissolution process. Moreover, the package provides a compilation of relevant forms required for dissolving a corporation in Fort Wayne, Indiana. These forms typically include the Articles of Dissolution, which officially terminates the corporation's existence, as well as additional documents such as the Certificate of Dissolution and the Final Tax Return. The Dissolution Package also includes guidelines on other important aspects to consider during the process, such as the distribution of remaining assets, settlement of liabilities, and the proper filing of tax returns. It ensures that individuals or businesses follow their obligations and avoid any potential legal or financial issues associated with an incomplete or improper dissolution. Additionally, there might be different types of Fort Wayne Indiana Dissolution Packages available based on specific circumstances. Examples include: 1. Standard Dissolution Package: This package is suitable for corporations that have fulfilled their obligations, have a clear financial record, and do not have any pending legal disputes. 2. Dissolution Package with Tax Considerations: Designed for corporations that need to address tax-related matters during the dissolution process, such as filing the Final Tax Return and resolving any outstanding tax issues. 3. Dissolution Package for Corporations with Pending Litigation: This package caters to corporations that are currently involved in legal disputes, ensuring that all legal requirements are met while resolving ongoing litigation matters. In summary, the Fort Wayne Indiana Dissolution Package provides a comprehensive solution to dissolve a corporation in Fort Wayne, Indiana. It offers a detailed guide, necessary forms, and additional considerations to facilitate a smooth and legally compliant dissolution process. Whether it's a standard dissolution, dissolution with tax considerations, or dissolution with pending litigation, these packages ensure all relevant requirements are addressed.