This is a Dissolution Package to Dissolve a Corporation in the State of Indiana. This package contains all forms necessary in the dissolution of the corporation including, step by step instructions, forms and other information.

South Bend Indiana Dissolution Package to Dissolve Corporation

Description

How to fill out Indiana Dissolution Package To Dissolve Corporation?

If you are looking for a suitable form, it’s hard to find a more efficient platform than the US Legal Forms website – one of the largest collections online.

With this collection, you can locate a vast array of form samples for business and personal needs by categories and states, or key terms.

Utilizing our top-notch search function, finding the latest South Bend Indiana Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Confirm your selection. Click the Buy now button. After that, select your desired pricing plan and enter your information to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process. Obtain the form. Choose the format and save it onto your device. Modify as needed. Fill in, alter, print, and sign the downloaded South Bend Indiana Dissolution Package to Dissolve Corporation.

- Furthermore, the accuracy of each document is verified by a team of experienced lawyers who routinely review the templates on our platform and revise them in line with the most current state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the South Bend Indiana Dissolution Package to Dissolve Corporation is to Log In to your account and click on the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have selected the form you need. Review its details and use the Preview feature (if available) to examine its content.

- If it doesn’t satisfy your criteria, use the Search field at the top of the page to find the correct file.

Form popularity

FAQ

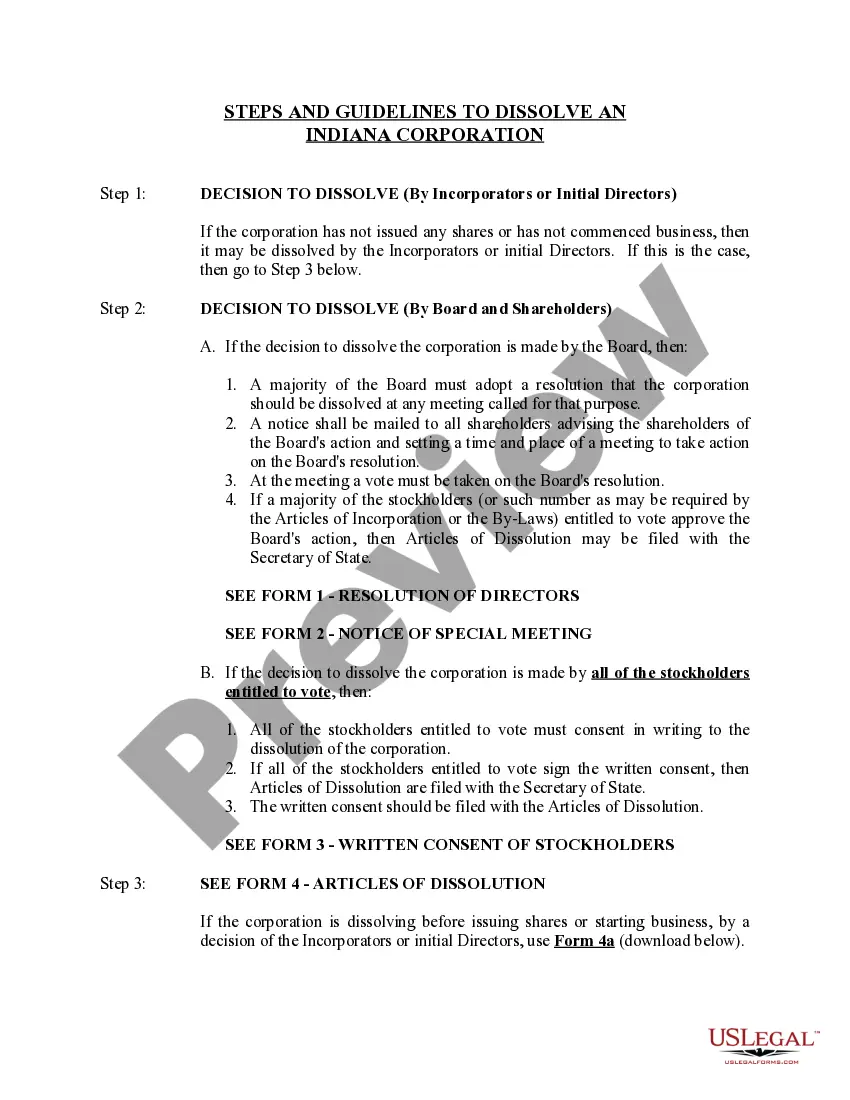

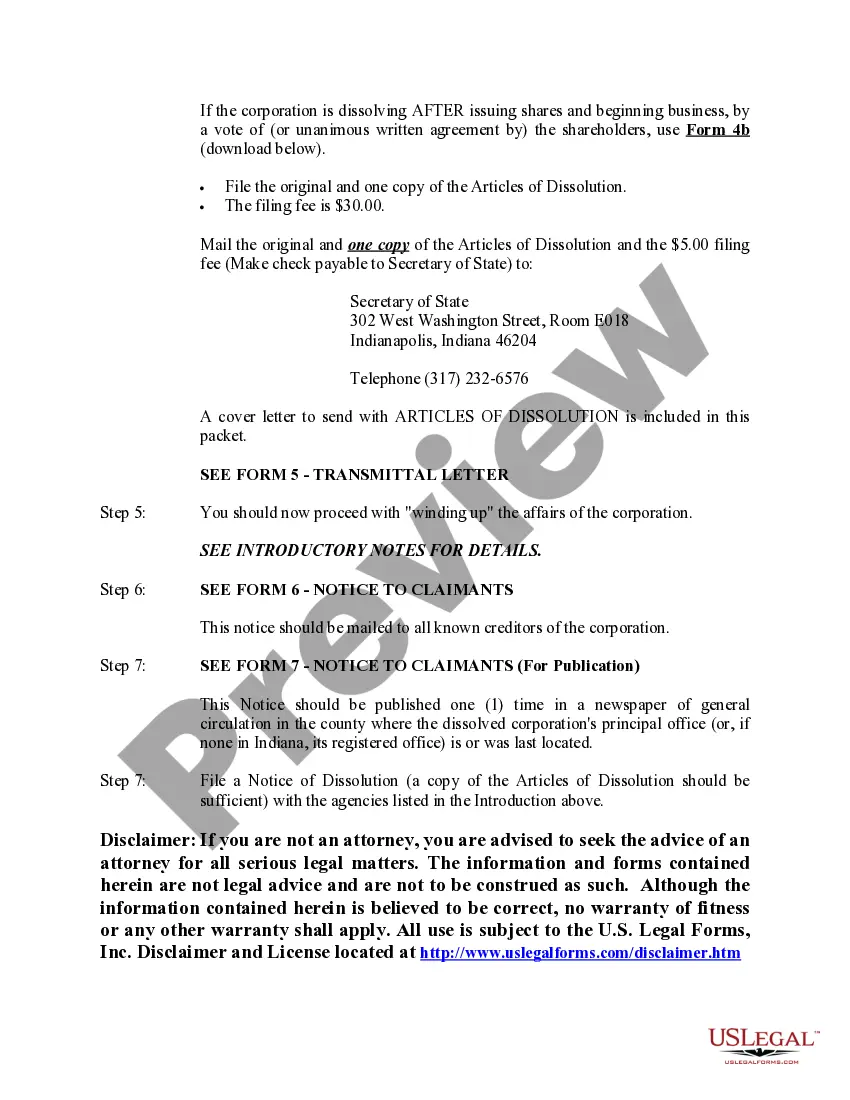

To dissolve an Indiana corporation, you should first ensure that all business debts are settled. Next, file the necessary forms with the Indiana Secretary of State, which includes the Articles of Dissolution. Additionally, consider using the South Bend Indiana Dissolution Package to Dissolve Corporation for a streamlined process. This package simplifies the paperwork and ensures you meet all legal requirements efficiently.

To file articles of dissolution in Indiana, you must complete the necessary forms and submit them to the Secretary of State. This process includes providing essential information about your corporation and meeting specific requirements. The South Bend Indiana Dissolution Package to Dissolve Corporation provides a streamlined approach, ensuring you can file correctly and efficiently without unnecessary complications.

No, liquidation and dissolution do not share the same legal meaning. Dissolution refers to ending a corporation's legal existence, while liquidation is the process of selling assets to satisfy debts. Understanding this distinction is crucial, and the South Bend Indiana Dissolution Package to Dissolve Corporation helps clarify the steps needed to navigate both processes effectively.

There are three main types of corporate dissolution: voluntary dissolution, involuntary dissolution, and administrative dissolution. Voluntary dissolution occurs when owners choose to close the business, often through the South Bend Indiana Dissolution Package to Dissolve Corporation. Involuntary dissolution can happen due to legal action or failure to comply with regulations, while administrative dissolution may occur if the state revokes the corporation's charter.

To dissolve a corporation in Indiana, you must first obtain approval from the corporation's board and shareholders. Next, you should file the Articles of Dissolution with the Indiana Secretary of State. Employing the South Bend Indiana Dissolution Package to Dissolve Corporation can streamline this process by providing you with step-by-step guidance and the relevant forms required for dissolution.

To write a notice of Dissolution, you need to include specific information about your corporation, such as its name, the reason for dissolution, and the effective date. It’s important to draft this document clearly and ensure it meets Indiana’s legal requirements. Utilizing the South Bend Indiana Dissolution Package to Dissolve Corporation simplifies this task and ensures you have the necessary resources to finalize your notice accurately.

When you dissolve a corporation, its debts do not simply vanish. Instead, the corporation must settle its obligations before the dissolution process is complete. If the debts remain unpaid, creditors may still seek payment from the corporation’s assets. Using the South Bend Indiana Dissolution Package to Dissolve Corporation can help you navigate this process efficiently.

You can notify the IRS of your corporation's dissolution by submitting your last tax return, identifying it as the final return. Make sure to include any schedules or documents required by your particular tax situation. Moreover, canceling your business’s Employer Identification Number will further clarify your status to the IRS. The South Bend Indiana Dissolution Package to Dissolve Corporation provides you with the necessary tools for effective communication with the IRS.

To dissolve a corporation in Indiana, begin by filing the Articles of Dissolution with the Indiana Secretary of State. Ensure that you settle all debts and obligations, including taxes. After filing the articles, notify your creditors and distribute any remaining assets. A South Bend Indiana Dissolution Package to Dissolve Corporation can guide you through these legal steps efficiently.

The first step to terminate a corporation is to hold a formal meeting with your board of directors to approve the dissolution. Once the board agrees, you should proceed to file the required dissolution documents with your state's Secretary of State. It’s beneficial to utilize the South Bend Indiana Dissolution Package to Dissolve Corporation for completeness and compliance.