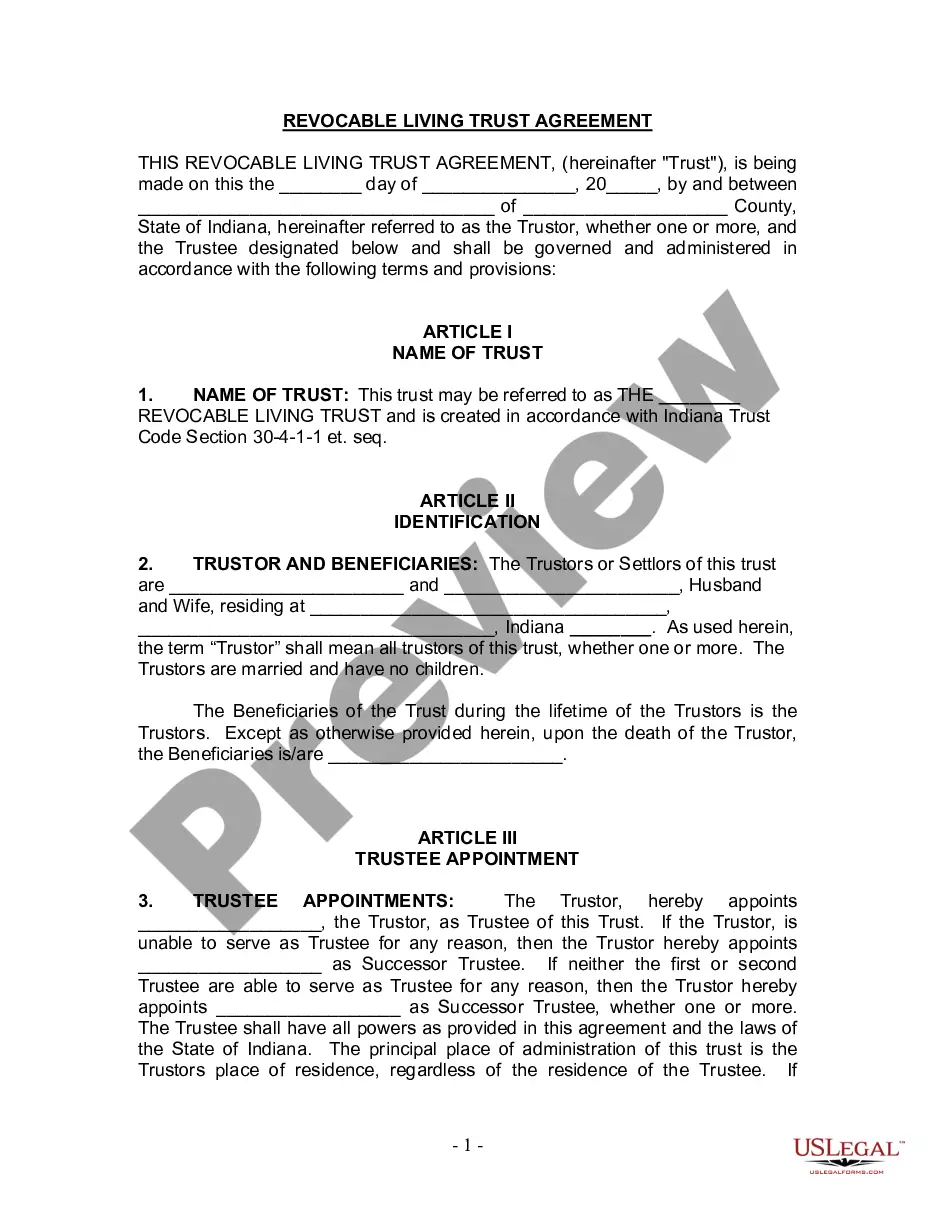

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Carmel Indiana Living Trust for Husband and Wife with No Children is a legal arrangement that allows a married couple to transfer their assets and plan for their future without the need for probate. This type of trust provides various benefits such as privacy, asset protection, and control over the distribution of property after the death of both spouses. One common type of Carmel Indiana Living Trust for Husband and Wife with No Children is the revocable living trust. This trust can be changed or revoked by the creators during their lifetime, providing flexibility and control over their assets. It allows the couple to manage and use their assets as they wish and specifies how these assets will be distributed after their passing. Another type of living trust option available for couples without children is the irrevocable living trust. This trust is more permanent and cannot be altered or revoked without the consent of the beneficiaries. It offers additional asset protection benefits and may be favorable for couples interested in minimizing estate taxes or protecting their assets from potential creditors. Creating a living trust involves transferring the couple's assets, such as real estate, investments, bank accounts, and personal property, into the trust's ownership. The couple serves as the trust's trustees during their lifetime, maintaining control over their assets. They can name successor trustees who will manage the trust and distribute the assets upon their death. One significant advantage of a Carmel Indiana Living Trust for Husband and Wife with No Children is the avoidance of probate. Probate is a legal process that can be time-consuming and costly, potentially delaying asset distribution. By establishing a living trust, the assets held within the trust can bypass probate, allowing for a more efficient transfer of wealth to beneficiaries. Moreover, a living trust maintains privacy as it is not a public record like a will. It provides confidentiality regarding the couple's assets and beneficiaries, keeping personal matters private. In summary, a Carmel Indiana Living Trust for Husband and Wife with No Children is a valuable estate planning tool for couples who wish to maintain control over their assets, avoid probate, and ensure privacy. It offers flexibility, protection, and ease of asset distribution after both spouses have passed away. Whether a revocable or irrevocable trust is chosen, consulting with an experienced estate planning attorney is crucial to tailor the trust to the couple's specific needs and goals. Keywords: Carmel Indiana, living trust, husband, wife, no children, revocable living trust, irrevocable living trust, asset protection, probate, estate planning, privacy, asset distribution, trustees, successor trustees, confidentiality, estate taxes, wealth transfer, beneficiaries, estate planning attorney.A Carmel Indiana Living Trust for Husband and Wife with No Children is a legal arrangement that allows a married couple to transfer their assets and plan for their future without the need for probate. This type of trust provides various benefits such as privacy, asset protection, and control over the distribution of property after the death of both spouses. One common type of Carmel Indiana Living Trust for Husband and Wife with No Children is the revocable living trust. This trust can be changed or revoked by the creators during their lifetime, providing flexibility and control over their assets. It allows the couple to manage and use their assets as they wish and specifies how these assets will be distributed after their passing. Another type of living trust option available for couples without children is the irrevocable living trust. This trust is more permanent and cannot be altered or revoked without the consent of the beneficiaries. It offers additional asset protection benefits and may be favorable for couples interested in minimizing estate taxes or protecting their assets from potential creditors. Creating a living trust involves transferring the couple's assets, such as real estate, investments, bank accounts, and personal property, into the trust's ownership. The couple serves as the trust's trustees during their lifetime, maintaining control over their assets. They can name successor trustees who will manage the trust and distribute the assets upon their death. One significant advantage of a Carmel Indiana Living Trust for Husband and Wife with No Children is the avoidance of probate. Probate is a legal process that can be time-consuming and costly, potentially delaying asset distribution. By establishing a living trust, the assets held within the trust can bypass probate, allowing for a more efficient transfer of wealth to beneficiaries. Moreover, a living trust maintains privacy as it is not a public record like a will. It provides confidentiality regarding the couple's assets and beneficiaries, keeping personal matters private. In summary, a Carmel Indiana Living Trust for Husband and Wife with No Children is a valuable estate planning tool for couples who wish to maintain control over their assets, avoid probate, and ensure privacy. It offers flexibility, protection, and ease of asset distribution after both spouses have passed away. Whether a revocable or irrevocable trust is chosen, consulting with an experienced estate planning attorney is crucial to tailor the trust to the couple's specific needs and goals. Keywords: Carmel Indiana, living trust, husband, wife, no children, revocable living trust, irrevocable living trust, asset protection, probate, estate planning, privacy, asset distribution, trustees, successor trustees, confidentiality, estate taxes, wealth transfer, beneficiaries, estate planning attorney.