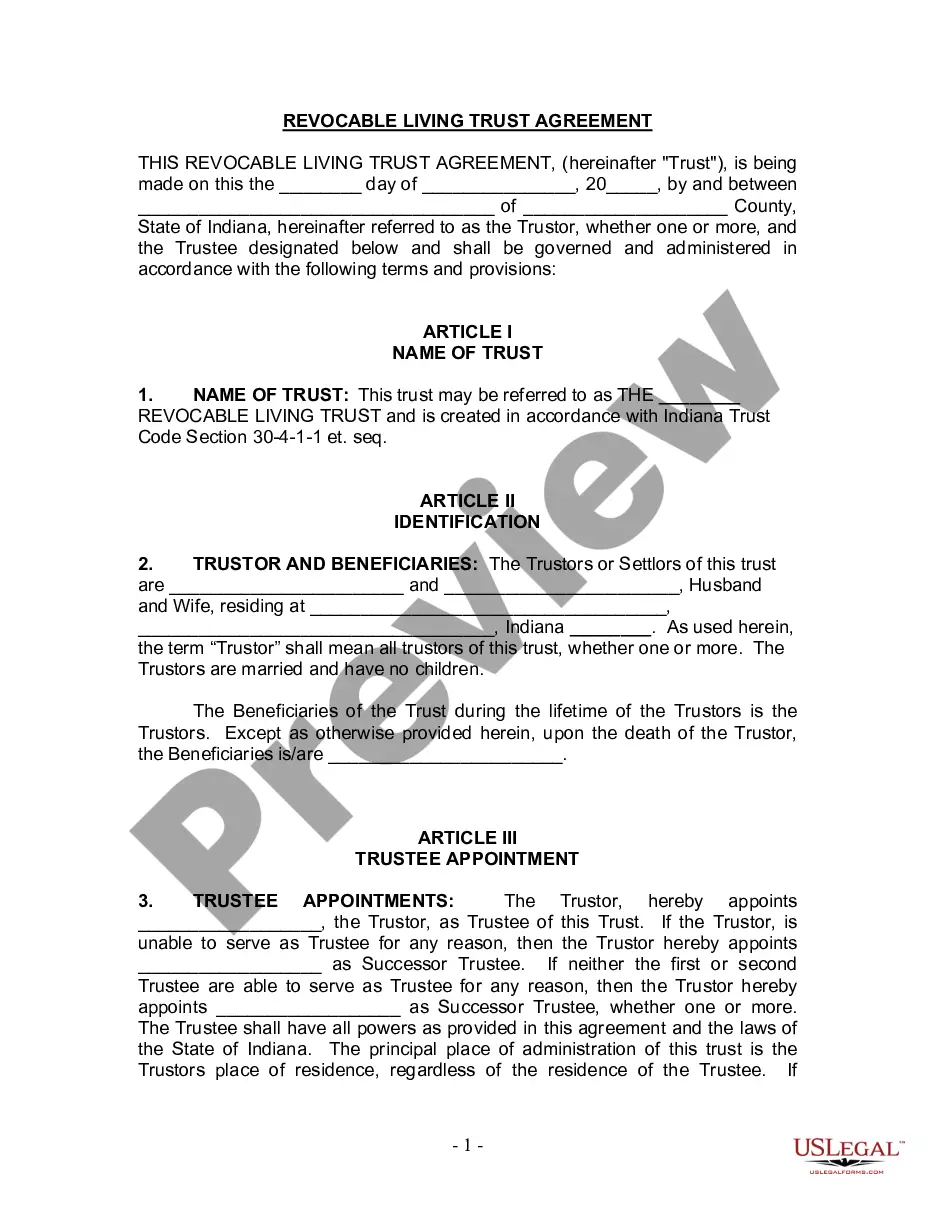

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Evansville Indiana Living Trust for Husband and Wife with No Children: A Comprehensive Guide If you and your spouse reside in Evansville, Indiana, and do not have any children, a Living Trust can provide you with a secure and efficient way to manage your assets during your lifetime and ensure a smooth transfer of your property upon your passing. By utilizing a Living Trust specifically designed for couples without children, you can establish control over your assets, minimize probate costs, and create a tailored plan for the distribution of your estate. In this detailed description, we will cover the key aspects, benefits, and potential variations of an Evansville Indiana Living Trust for Husband and Wife with No Children. 1. Understanding the Evansville Indiana Living Trust: An Evansville Indiana Living Trust for Husband and Wife with No Children is a legally binding document that allows married couples without children to transfer their assets into a trust. The trust then holds these assets for the couple's benefit during their lifetimes and specifies how these assets should be distributed after their passing. This trust serves as an effective alternative to solely relying on a will when it comes to handling your estate. 2. Benefits of Establishing a Living Trust: — Avoidance of Probate: One of the primary advantages of a living trust is the ability to bypass the probate process, which can be costly, time-consuming, and public. By placing assets within the trust, they are no longer considered part of the probate estate and can be distributed according to the terms of the trust, providing privacy and potentially reducing expenses. — Asset Management: A living trust allows you to maintain control over your assets while designating a successor trustee (such as a trusted family member or professional) to manage the trust in the event of your incapacitation or passing. — Flexibility and Customization: With a living trust, you can outline specific instructions for the distribution of your assets, ensuring that your wishes are met. This flexibility allows you to consider various scenarios, such as providing for charitable donations, naming beneficiaries other than immediate family members, or creating special provisions for pets. 3. Types of Evansville Indiana Living Trusts for Husband and Wife with No Children: There can be several variations of living trusts tailored to the unique circumstances and goals of each couple. Here are a few common types: — Revocable Living Trust: As the most common type of living trust, the revocable living trust provides flexibility, allowing you to make changes to the trust, including modifications, additions, or asset removals, during your lifetime. — Irrevocable Living Trust: In contrast to the revocable trust, an irrevocable living trust generally cannot be altered or revoked after its creation. This type of trust can offer additional estate tax benefits and creditor protection. — Joint Living Trust: A joint living trust is established by a husband and wife together and holds their assets jointly. This type of trust allows for seamless asset management and distribution upon the passing of either spouse. — Testamentary Trust: While not technically a living trust, a testamentary trust is created through provisions within a will. It becomes effective after the passing of the second spouse and allows for more specific instructions and asset distribution. Conclusion: Establishing an Evansville Indiana Living Trust for Husband and Wife with No Children offers numerous benefits for couples seeking greater control over their estate planning. Whether you opt for a revocable, irrevocable, joint, or testamentary trust, consulting with an experienced estate planning attorney in Evansville can help ensure that your trust aligns with your unique needs and goals. By setting up a living trust, you can protect your assets, simplify the transfer of your estate, and establish a solid plan for the future.Evansville Indiana Living Trust for Husband and Wife with No Children: A Comprehensive Guide If you and your spouse reside in Evansville, Indiana, and do not have any children, a Living Trust can provide you with a secure and efficient way to manage your assets during your lifetime and ensure a smooth transfer of your property upon your passing. By utilizing a Living Trust specifically designed for couples without children, you can establish control over your assets, minimize probate costs, and create a tailored plan for the distribution of your estate. In this detailed description, we will cover the key aspects, benefits, and potential variations of an Evansville Indiana Living Trust for Husband and Wife with No Children. 1. Understanding the Evansville Indiana Living Trust: An Evansville Indiana Living Trust for Husband and Wife with No Children is a legally binding document that allows married couples without children to transfer their assets into a trust. The trust then holds these assets for the couple's benefit during their lifetimes and specifies how these assets should be distributed after their passing. This trust serves as an effective alternative to solely relying on a will when it comes to handling your estate. 2. Benefits of Establishing a Living Trust: — Avoidance of Probate: One of the primary advantages of a living trust is the ability to bypass the probate process, which can be costly, time-consuming, and public. By placing assets within the trust, they are no longer considered part of the probate estate and can be distributed according to the terms of the trust, providing privacy and potentially reducing expenses. — Asset Management: A living trust allows you to maintain control over your assets while designating a successor trustee (such as a trusted family member or professional) to manage the trust in the event of your incapacitation or passing. — Flexibility and Customization: With a living trust, you can outline specific instructions for the distribution of your assets, ensuring that your wishes are met. This flexibility allows you to consider various scenarios, such as providing for charitable donations, naming beneficiaries other than immediate family members, or creating special provisions for pets. 3. Types of Evansville Indiana Living Trusts for Husband and Wife with No Children: There can be several variations of living trusts tailored to the unique circumstances and goals of each couple. Here are a few common types: — Revocable Living Trust: As the most common type of living trust, the revocable living trust provides flexibility, allowing you to make changes to the trust, including modifications, additions, or asset removals, during your lifetime. — Irrevocable Living Trust: In contrast to the revocable trust, an irrevocable living trust generally cannot be altered or revoked after its creation. This type of trust can offer additional estate tax benefits and creditor protection. — Joint Living Trust: A joint living trust is established by a husband and wife together and holds their assets jointly. This type of trust allows for seamless asset management and distribution upon the passing of either spouse. — Testamentary Trust: While not technically a living trust, a testamentary trust is created through provisions within a will. It becomes effective after the passing of the second spouse and allows for more specific instructions and asset distribution. Conclusion: Establishing an Evansville Indiana Living Trust for Husband and Wife with No Children offers numerous benefits for couples seeking greater control over their estate planning. Whether you opt for a revocable, irrevocable, joint, or testamentary trust, consulting with an experienced estate planning attorney in Evansville can help ensure that your trust aligns with your unique needs and goals. By setting up a living trust, you can protect your assets, simplify the transfer of your estate, and establish a solid plan for the future.