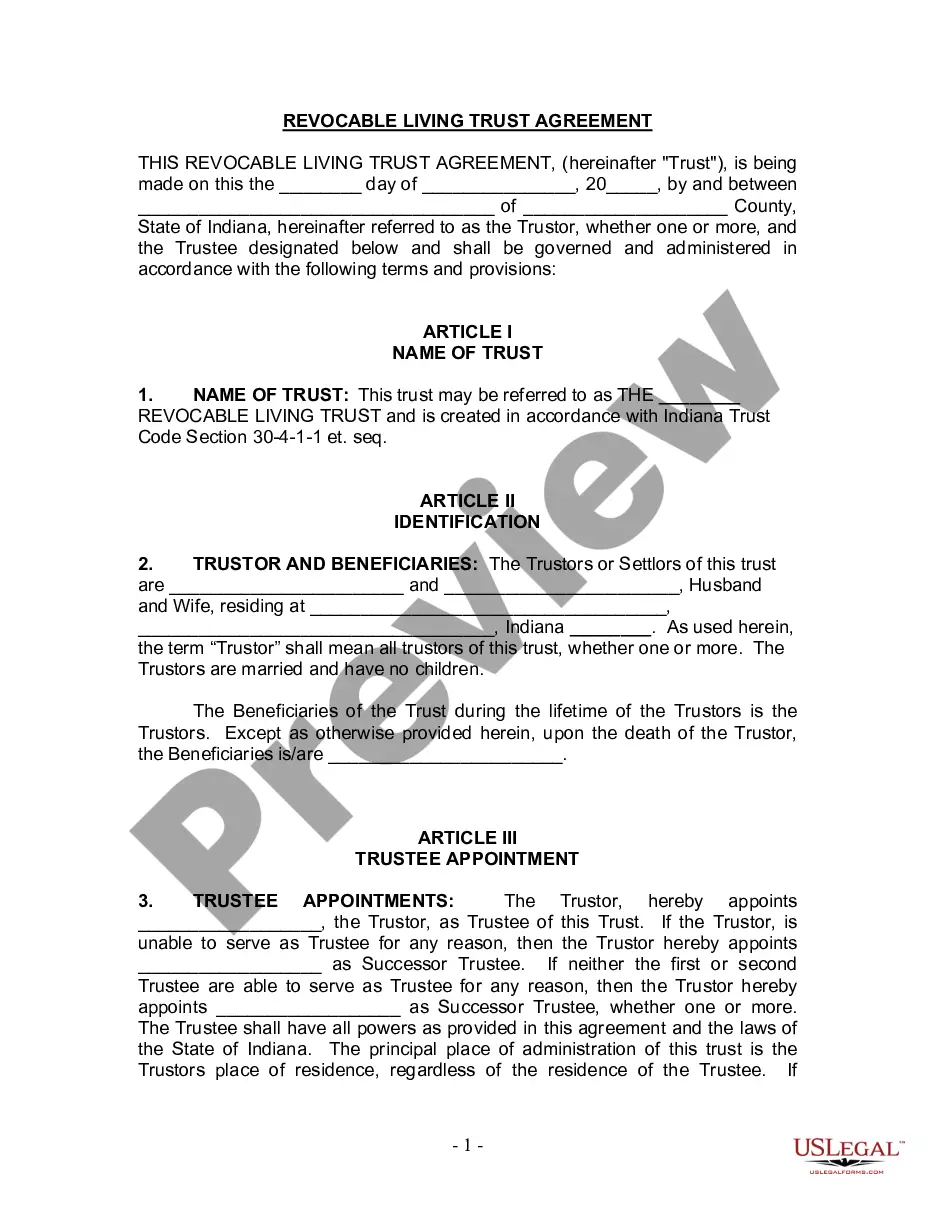

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A living trust for husband and wife with no children is a legal document that allows a couple to manage their assets during their lifetime and plan for the distribution of those assets after their passing. This type of trust is commonly used by couples to ensure that their assets are protected and distributed according to their wishes, without the need for probate. In Indianapolis, Indiana, there are several types of living trusts available for husband and wife with no children. These include: 1. Revocable Living Trust: This is the most common type of living trust, which allows the couple to maintain control over their assets during their lifetime. The trust can be modified or revoked at any time, giving them flexibility in managing their estate. 2. Irrevocable Living Trust: Unlike revocable living trusts, an irrevocable trust cannot be modified or revoked. Once assets are transferred into this trust, they are no longer owned by the couple. However, this type of trust provides tax benefits and protects assets from creditors. 3. Joint Living Trust: A joint living trust is created by a married couple together, allowing them to combine their assets into a single trust. This type of trust is beneficial for couples who have shared assets and want to simplify the management and distribution process. 4. Testamentary Trust: Unlike the aforementioned living trusts, a testamentary trust is established upon the death of the couple. The trust is created through a will and includes specific instructions on how the assets should be handled after both spouses have passed away. Creating an Indianapolis Indiana Living Trust for Husband and Wife with No Children involves several key steps. The couple must first identify their assets, including real estate, bank accounts, investments, and personal belongings. They must then appoint a trustee, who will handle the management and distribution of the assets as outlined in the trust. Additionally, the couple should outline their specific wishes regarding asset division and any specific beneficiaries they wish to designate. Overall, an Indianapolis Indiana Living Trust for Husband and Wife with No Children offers couples a range of benefits, including privacy, avoidance of probate, and the ability to customize asset distribution. However, it is essential to consult with an experienced attorney specializing in estate planning to ensure that all legal requirements are met and the trust accurately reflects the couple's intentions.