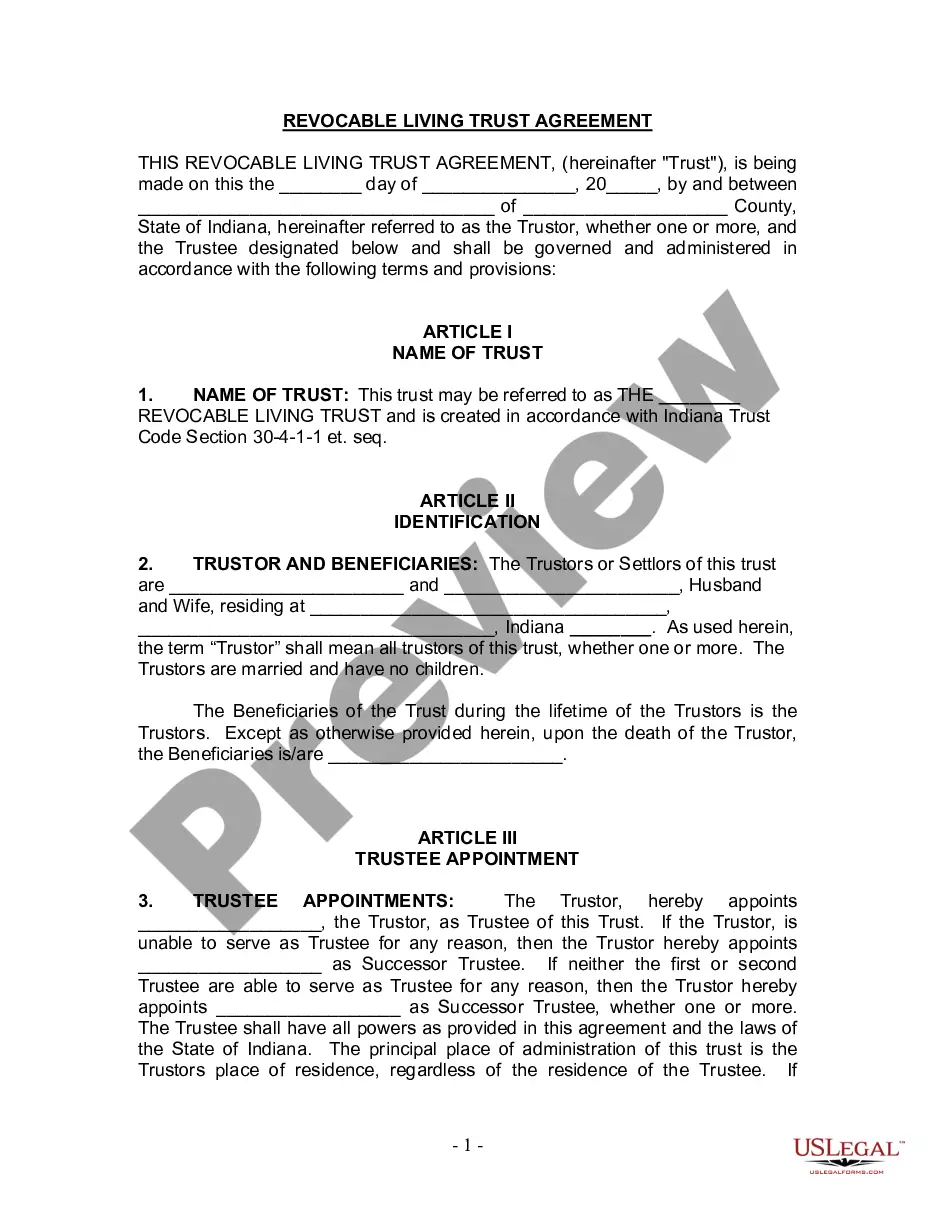

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A South Bend Indiana Living Trust for Husband and Wife with No Children is a legal document that allows a married couple without children to establish a trust to protect and manage their assets during their lifetime and after their passing. This type of living trust provides numerous benefits such as avoiding probate, ensuring privacy, and allowing greater control over the distribution of assets. It also helps to minimize estate taxes and legal fees. One of the main advantages of a living trust is the ability to avoid probate, which can be a lengthy and costly legal process. By placing assets into a trust, they are no longer considered part of an individual's estate, and therefore not subject to probate. This allows assets to be transferred to beneficiaries in a more efficient and timely manner. Another benefit is privacy. Unlike a will, which becomes a public record upon probate, a living trust remains confidential. This means that the distribution of assets, as well as the identity of beneficiaries and the value of the estate, can remain private. A South Bend Indiana Living Trust for Husband and Wife with No Children provides the couple with complete control over their assets. They can dictate how and when beneficiaries will receive their inheritance, ensuring that assets are managed and distributed according to their wishes. This level of control is particularly important for couples without children, as they may have specific charitable or personal intentions for their wealth. There are various types of South Bend Indiana Living Trusts for Husband and Wife with No Children: 1. Revocable Living Trust: This type of trust can be modified, amended, or even revoked entirely by the granters (the husband and wife) during their lifetime. It offers flexibility and allows the couple to retain full control over their assets. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once established. It offers more asset protection and tax benefits but limits the couple's ability to make changes in the future. 3. A/B Trust: Also known as a "credit shelter trust," this type of trust is designed to maximize estate tax exemptions for both spouses. Upon the death of the first spouse, assets are divided into two separate trusts (A and B). The surviving spouse can benefit from the income generated by both trusts while preserving the estate tax benefits. In conclusion, a South Bend Indiana Living Trust for Husband and Wife with No Children is a powerful tool that allows a couple to protect and manage their assets during their lifetime and effectively distribute them upon their passing. It provides benefits such as avoiding probate, ensuring privacy, and granting control over asset distribution. There are different types of trusts available, including revocable, irrevocable, and A/B trusts, each tailored to suit the unique needs and goals of the couple.A South Bend Indiana Living Trust for Husband and Wife with No Children is a legal document that allows a married couple without children to establish a trust to protect and manage their assets during their lifetime and after their passing. This type of living trust provides numerous benefits such as avoiding probate, ensuring privacy, and allowing greater control over the distribution of assets. It also helps to minimize estate taxes and legal fees. One of the main advantages of a living trust is the ability to avoid probate, which can be a lengthy and costly legal process. By placing assets into a trust, they are no longer considered part of an individual's estate, and therefore not subject to probate. This allows assets to be transferred to beneficiaries in a more efficient and timely manner. Another benefit is privacy. Unlike a will, which becomes a public record upon probate, a living trust remains confidential. This means that the distribution of assets, as well as the identity of beneficiaries and the value of the estate, can remain private. A South Bend Indiana Living Trust for Husband and Wife with No Children provides the couple with complete control over their assets. They can dictate how and when beneficiaries will receive their inheritance, ensuring that assets are managed and distributed according to their wishes. This level of control is particularly important for couples without children, as they may have specific charitable or personal intentions for their wealth. There are various types of South Bend Indiana Living Trusts for Husband and Wife with No Children: 1. Revocable Living Trust: This type of trust can be modified, amended, or even revoked entirely by the granters (the husband and wife) during their lifetime. It offers flexibility and allows the couple to retain full control over their assets. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once established. It offers more asset protection and tax benefits but limits the couple's ability to make changes in the future. 3. A/B Trust: Also known as a "credit shelter trust," this type of trust is designed to maximize estate tax exemptions for both spouses. Upon the death of the first spouse, assets are divided into two separate trusts (A and B). The surviving spouse can benefit from the income generated by both trusts while preserving the estate tax benefits. In conclusion, a South Bend Indiana Living Trust for Husband and Wife with No Children is a powerful tool that allows a couple to protect and manage their assets during their lifetime and effectively distribute them upon their passing. It provides benefits such as avoiding probate, ensuring privacy, and granting control over asset distribution. There are different types of trusts available, including revocable, irrevocable, and A/B trusts, each tailored to suit the unique needs and goals of the couple.