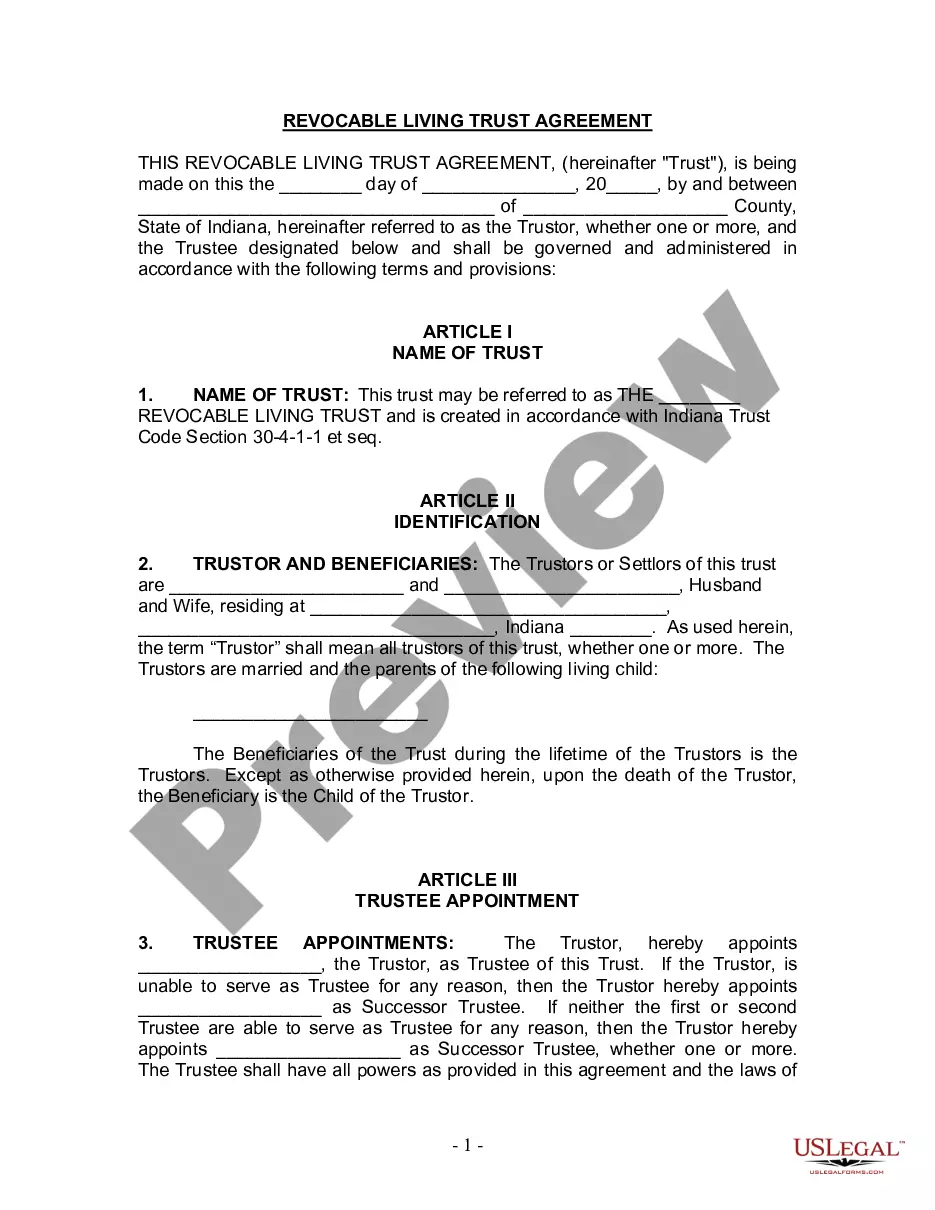

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Carmel Indiana Living Trust for Husband and Wife with One Child is a legal document that allows a couple to protect and manage their assets during their lifetime and control their distribution after their death. It provides a comprehensive plan for the couple's financial affairs and offers various benefits including probate avoidance, tax minimization, and asset protection. Let's dive into some key details. 1. Formation of a Living Trust: A living trust is created by drafting and executing a trust agreement, where the couple acts as the granters and trustees. They name themselves as beneficiaries during their lifetime and appoint a successor trustee to manage the trust upon their incapacity or death. 2. Asset Protection: A living trust helps safeguard the couple's assets by keeping them out of probate. When assets go through probate, they become part of public record and can be subject to claims and lengthy court processes. By transferring assets into the trust, they remain private and protected from potential creditors or lawsuits, ensuring their efficient and confidential distribution to the named beneficiaries. 3. Estate Tax Planning: Carmel Indiana Living Trust for Husband and Wife with One Child may incorporate specific estate tax planning provisions to minimize potential tax liabilities. Utilizing certain strategies such as credit shelter trusts or bypass trusts, the couple can maximize the use of their federal and state estate tax exemptions, reducing the tax burden on their estate and potentially benefiting the surviving spouse and child. 4. Distribution and Management of Assets: The living trust allows the couple to dictate how their assets will be distributed after their passing. They can outline provisions for their child's care, education, and inheritance. The trust can hold assets until the child reaches a certain age, preventing them from receiving a large sum of money at an early age. Additionally, the trust can provide for the surviving spouse's financial well-being while ensuring the child's future needs are adequately met. 5. Testamentary Trusts: Within the realm of Carmel Indiana Living Trusts for Husband and Wife with One Child, there may be variations such as testamentary trusts. These trusts are created in a will to come into effect upon the death of the second spouse. Testamentary trusts offer flexibility in distributing assets and can provide for specific needs of the surviving spouse and child, such as education expenses or medical care. In summary, Carmel Indiana Living Trust for Husband and Wife with One Child offers a comprehensive estate planning solution. It allows couples to protect and manage their assets, minimize taxes, avoid probate, and ensure the smooth transfer of assets to their child and surviving spouse. Consulting with an experienced estate planning attorney can help couples tailor the living trust to their unique circumstances and goals.A Carmel Indiana Living Trust for Husband and Wife with One Child is a legal document that allows a couple to protect and manage their assets during their lifetime and control their distribution after their death. It provides a comprehensive plan for the couple's financial affairs and offers various benefits including probate avoidance, tax minimization, and asset protection. Let's dive into some key details. 1. Formation of a Living Trust: A living trust is created by drafting and executing a trust agreement, where the couple acts as the granters and trustees. They name themselves as beneficiaries during their lifetime and appoint a successor trustee to manage the trust upon their incapacity or death. 2. Asset Protection: A living trust helps safeguard the couple's assets by keeping them out of probate. When assets go through probate, they become part of public record and can be subject to claims and lengthy court processes. By transferring assets into the trust, they remain private and protected from potential creditors or lawsuits, ensuring their efficient and confidential distribution to the named beneficiaries. 3. Estate Tax Planning: Carmel Indiana Living Trust for Husband and Wife with One Child may incorporate specific estate tax planning provisions to minimize potential tax liabilities. Utilizing certain strategies such as credit shelter trusts or bypass trusts, the couple can maximize the use of their federal and state estate tax exemptions, reducing the tax burden on their estate and potentially benefiting the surviving spouse and child. 4. Distribution and Management of Assets: The living trust allows the couple to dictate how their assets will be distributed after their passing. They can outline provisions for their child's care, education, and inheritance. The trust can hold assets until the child reaches a certain age, preventing them from receiving a large sum of money at an early age. Additionally, the trust can provide for the surviving spouse's financial well-being while ensuring the child's future needs are adequately met. 5. Testamentary Trusts: Within the realm of Carmel Indiana Living Trusts for Husband and Wife with One Child, there may be variations such as testamentary trusts. These trusts are created in a will to come into effect upon the death of the second spouse. Testamentary trusts offer flexibility in distributing assets and can provide for specific needs of the surviving spouse and child, such as education expenses or medical care. In summary, Carmel Indiana Living Trust for Husband and Wife with One Child offers a comprehensive estate planning solution. It allows couples to protect and manage their assets, minimize taxes, avoid probate, and ensure the smooth transfer of assets to their child and surviving spouse. Consulting with an experienced estate planning attorney can help couples tailor the living trust to their unique circumstances and goals.