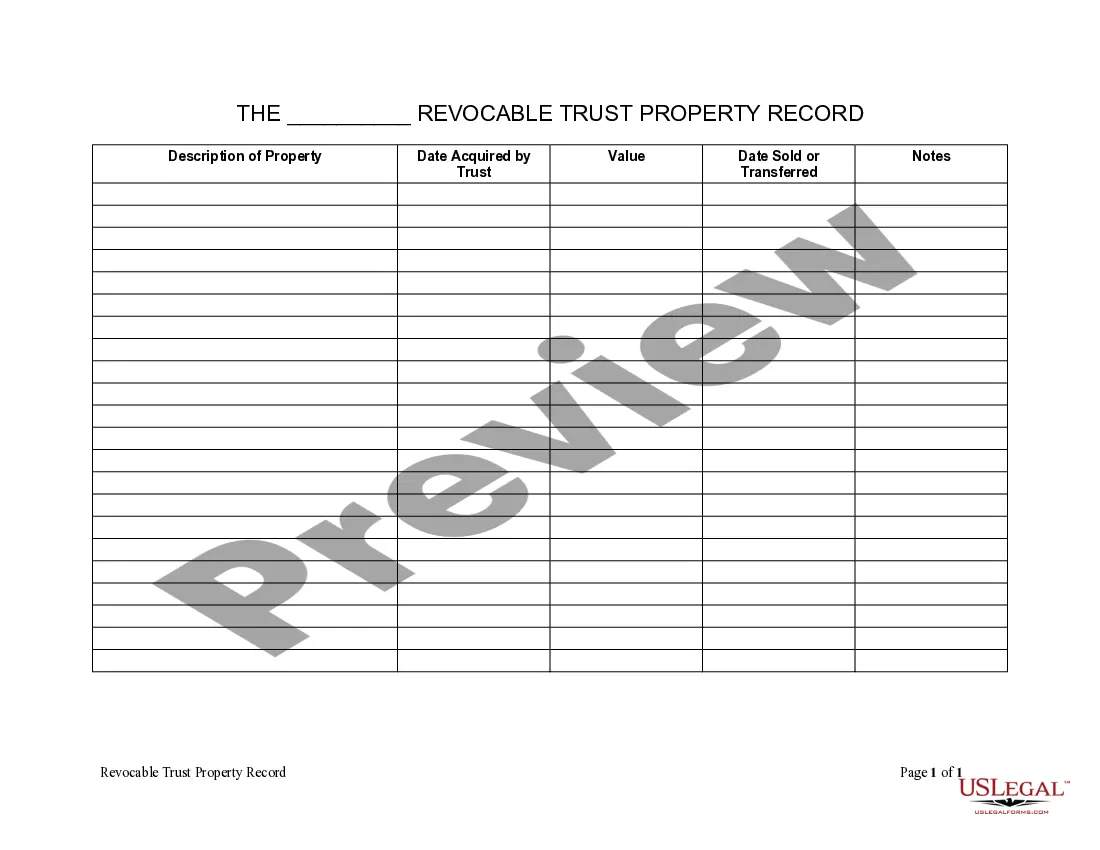

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Carmel, Indiana Living Trust Property Record is a comprehensive and vital document that outlines detailed information about properties owned by individuals or entities through a living trust in the city of Carmel, Indiana. This record is crucial for tracking and maintaining accurate records of real estate assets held in a living trust, ensuring transparency, and promoting efficient estate planning. The Carmel, Indiana Living Trust Property Record includes various essential details related to the properties, such as the property's address, legal description, current owner's name, and trustee information. It also includes relevant financial information like the assessed value, property taxes, and any liens or encumbrances associated with the property. Having a Living Trust Property Record is especially beneficial for individuals or entities using living trusts to hold real estate assets in Carmel, Indiana. A living trust offers a legal mechanism to manage and distribute assets during the granter's lifetime and after their passing, bypassing the often complex probate process. By maintaining an accurate property record within a trust, individuals can eliminate the need for property to go through probate, saving time and money for their beneficiaries. Different types of Carmel, Indiana Living Trust Property Records may include residential properties, commercial properties, industrial properties, and vacant land. Each type of property record may have distinct features depending on the nature of the property held within the living trust. Residential Property Record: This record specifically pertains to properties used for residential purposes, such as single-family homes, townhouses, condominiums, or multi-unit residential buildings, owned through a living trust in Carmel, Indiana. Commercial Property Record: This type of record focuses on properties intended for commercial use, including office buildings, retail spaces, warehouses, or other commercial establishments held within a living trust in Carmel, Indiana. Industrial Property Record: This record encompasses properties designated for industrial purposes, such as manufacturing facilities, warehouses, distribution centers, or industrial complexes, all owned by a living trust in Carmel, Indiana. Vacant Land Property Record: This record pertains to undeveloped or unimproved land held within a living trust in Carmel, Indiana. It includes information related to the location, legal description, and potential permitted uses of the vacant land. In conclusion, a Carmel, Indiana Living Trust Property Record serves as a comprehensive documentation of real estate assets held within a living trust, ensuring transparency, efficiency, and effective estate planning. With various types of property records available, individuals or entities can maintain accurate and up-to-date information about the properties they hold within their living trusts, promoting smooth asset management and distribution processes.