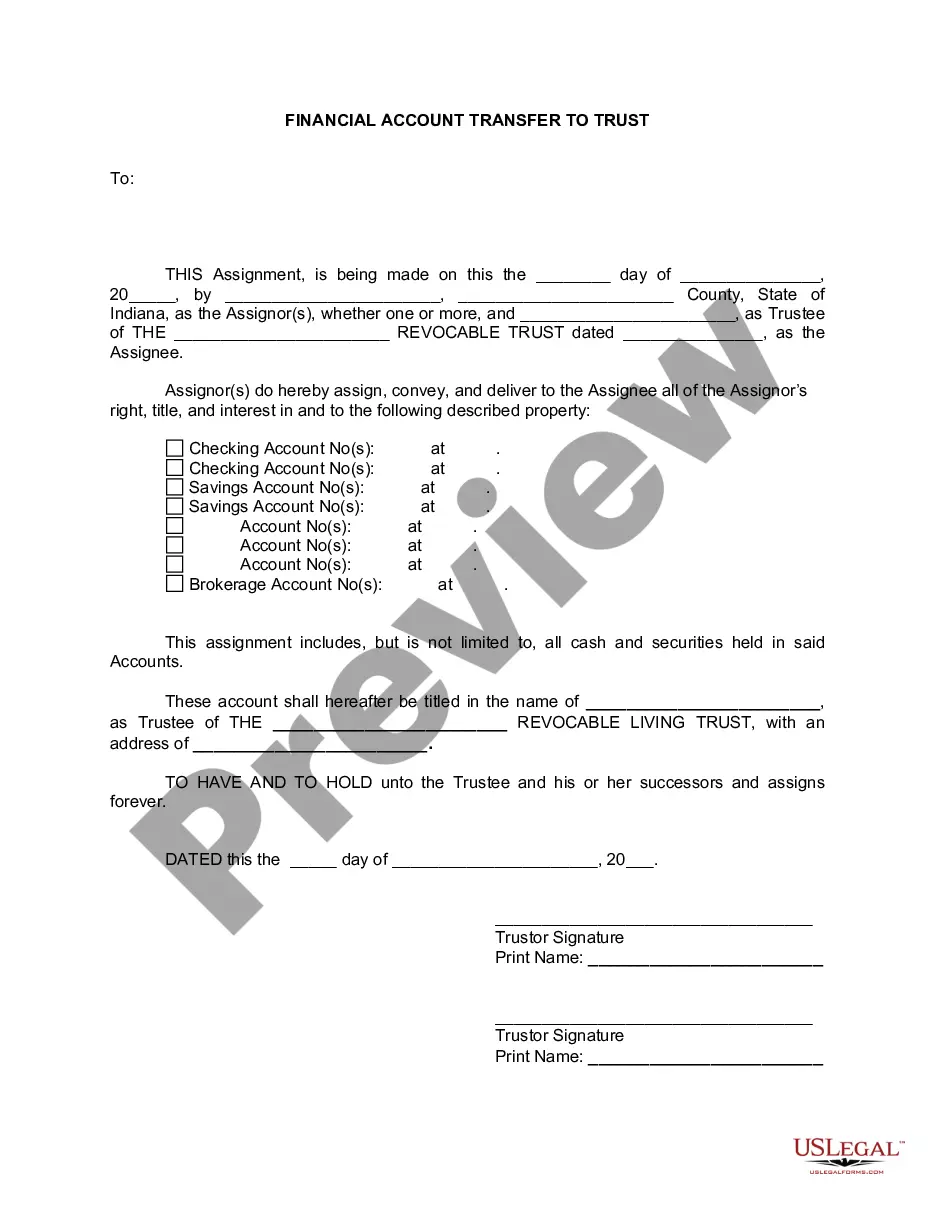

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Fort Wayne Indiana Financial Account Transfer to Living Trust: A Comprehensive Guide Overview: Fort Wayne, Indiana offers residents the opportunity to secure their financial future through the creation of living trusts. One crucial aspect of establishing a living trust is effectively transferring financial accounts to the trust. This process involves legally shifting ownership and control of various financial accounts to a trust entity, governed by the terms and conditions set forth in the trust agreement. Fort Wayne residents can choose from several types of financial account transfers to living trusts based on their specific needs and circumstances. Types of Fort Wayne Indiana Financial Account Transfer to Living Trust: 1. Bank Account Transfer: Transferring bank accounts to a living trust allows seamless management and control of funds. Fort Wayne residents can transfer checking, savings, money market, or certificate of deposit (CD) accounts owned by individuals into the trust. Proper documentation, such as revising account registrations, will link the trust to the financial institution, enabling easy access and administration. 2. Investment Account Transfer: Investment accounts, such as brokerage accounts, can be transferred directly to a living trust. By doing so, Fort Wayne residents can maintain a comprehensive view of their investment portfolio, ensuring efficient management and potential tax benefits. This type of transfer requires coordination with the financial institution and updating account registrations to reflect the trust ownership. 3. Retirement Account Transfer: Fort Wayne residents planning for retirement can protect their assets by transferring retirement accounts, such as 401(k)s, IRAs, or pension plans, into a living trust. This transfer allows for more control over the distribution of retirement funds and may offer potential tax advantages. However, it is crucial to consult with financial advisors and tax professionals to ensure compliance with complex regulations governing retirement account transfers. 4. Real Estate Property Transfer: In addition to financial accounts, Fort Wayne residents can transfer real estate properties into their living trust. This type of transfer allows for centralized management and seamless distribution of properties within the trust. By transferring properties like homes, rental units, or vacant land to the trust, owners can avoid probate, streamline succession planning, and minimize potential tax consequences. 5. Business Ownership Transfer: For individuals who own businesses or shares in a company, transferring these assets to a living trust can provide peace of mind and a clear succession plan. Fort Wayne residents looking to protect their business interests and ensure the continuity of operations can utilize a trust for seamless ownership transition without disruptive probate procedures. 6. Specialty Asset Transfer: Fort Wayne residents with unique assets like valuable collections, intellectual property rights, or mineral rights can consider transferring these specialty assets to a living trust. This approach ensures that such assets are included in the overall estate plan and can be efficiently managed and distributed according to the trust's provisions. Conclusion: The Fort Wayne Indiana Financial Account Transfer to Living Trust encompasses a range of options, allowing residents to customize their estate planning strategies. Whether it involves bank accounts, investment portfolios, retirement savings, real estate properties, business ownership, or specialty assets, creating a living trust in Fort Wayne offers individuals the peace of mind and control they desire. Consulting with legal, financial, and tax professionals is highly recommended navigating the transfer process correctly and maximize the benefits of a living trust.Fort Wayne Indiana Financial Account Transfer to Living Trust: A Comprehensive Guide Overview: Fort Wayne, Indiana offers residents the opportunity to secure their financial future through the creation of living trusts. One crucial aspect of establishing a living trust is effectively transferring financial accounts to the trust. This process involves legally shifting ownership and control of various financial accounts to a trust entity, governed by the terms and conditions set forth in the trust agreement. Fort Wayne residents can choose from several types of financial account transfers to living trusts based on their specific needs and circumstances. Types of Fort Wayne Indiana Financial Account Transfer to Living Trust: 1. Bank Account Transfer: Transferring bank accounts to a living trust allows seamless management and control of funds. Fort Wayne residents can transfer checking, savings, money market, or certificate of deposit (CD) accounts owned by individuals into the trust. Proper documentation, such as revising account registrations, will link the trust to the financial institution, enabling easy access and administration. 2. Investment Account Transfer: Investment accounts, such as brokerage accounts, can be transferred directly to a living trust. By doing so, Fort Wayne residents can maintain a comprehensive view of their investment portfolio, ensuring efficient management and potential tax benefits. This type of transfer requires coordination with the financial institution and updating account registrations to reflect the trust ownership. 3. Retirement Account Transfer: Fort Wayne residents planning for retirement can protect their assets by transferring retirement accounts, such as 401(k)s, IRAs, or pension plans, into a living trust. This transfer allows for more control over the distribution of retirement funds and may offer potential tax advantages. However, it is crucial to consult with financial advisors and tax professionals to ensure compliance with complex regulations governing retirement account transfers. 4. Real Estate Property Transfer: In addition to financial accounts, Fort Wayne residents can transfer real estate properties into their living trust. This type of transfer allows for centralized management and seamless distribution of properties within the trust. By transferring properties like homes, rental units, or vacant land to the trust, owners can avoid probate, streamline succession planning, and minimize potential tax consequences. 5. Business Ownership Transfer: For individuals who own businesses or shares in a company, transferring these assets to a living trust can provide peace of mind and a clear succession plan. Fort Wayne residents looking to protect their business interests and ensure the continuity of operations can utilize a trust for seamless ownership transition without disruptive probate procedures. 6. Specialty Asset Transfer: Fort Wayne residents with unique assets like valuable collections, intellectual property rights, or mineral rights can consider transferring these specialty assets to a living trust. This approach ensures that such assets are included in the overall estate plan and can be efficiently managed and distributed according to the trust's provisions. Conclusion: The Fort Wayne Indiana Financial Account Transfer to Living Trust encompasses a range of options, allowing residents to customize their estate planning strategies. Whether it involves bank accounts, investment portfolios, retirement savings, real estate properties, business ownership, or specialty assets, creating a living trust in Fort Wayne offers individuals the peace of mind and control they desire. Consulting with legal, financial, and tax professionals is highly recommended navigating the transfer process correctly and maximize the benefits of a living trust.