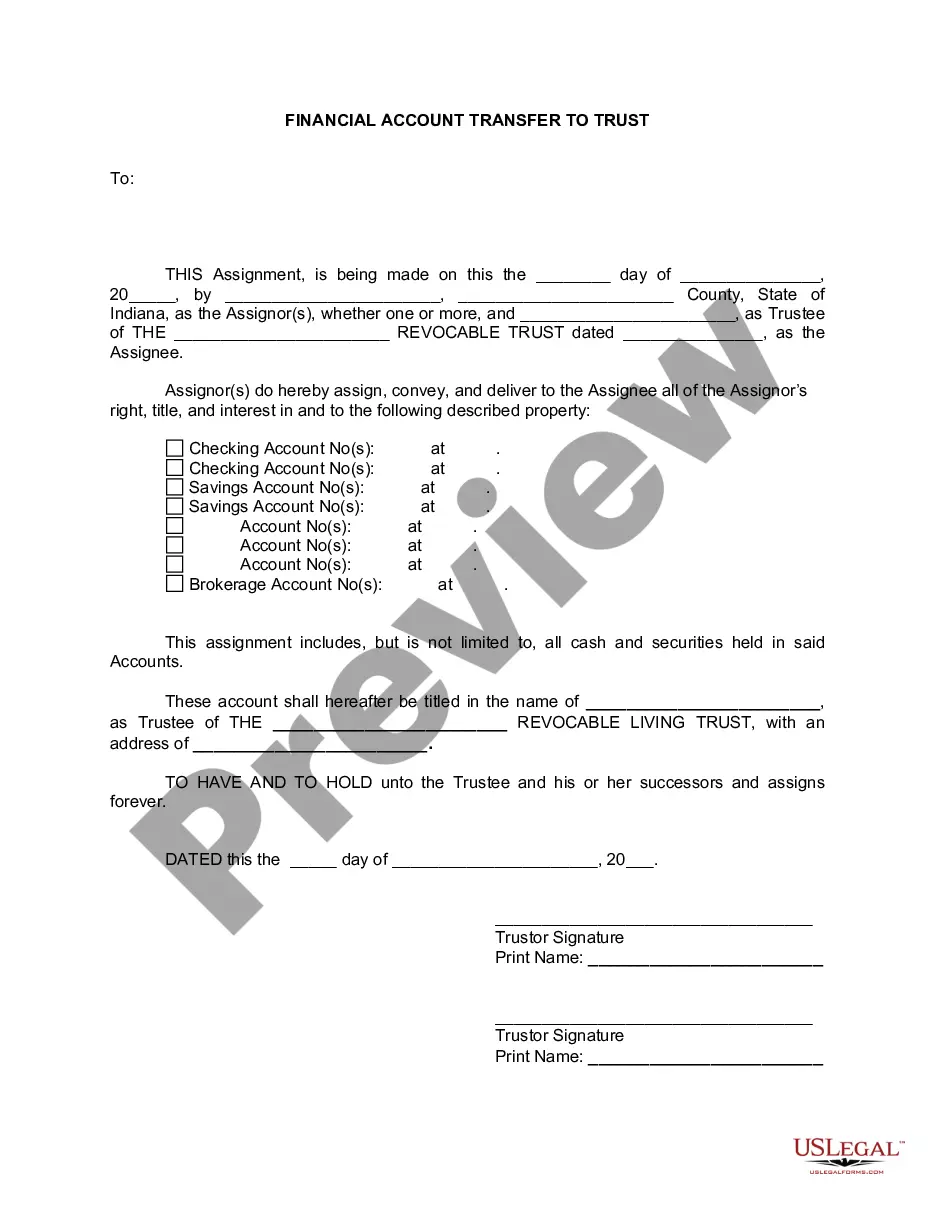

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Indianapolis Indiana Financial Account Transfer to Living Trust is a legal process that allows individuals to transfer their financial accounts to a living trust in Indianapolis, Indiana. This type of transfer ensures that the funds, assets, and investments held in the financial accounts are governed by the terms and conditions outlined in the individual's living trust. A living trust is a legal document that specifies the distribution of a person's assets during their lifetime and upon their death. By transferring financial accounts to a living trust, individuals can ensure a seamless transition of their wealth and avoid probate, a legal process that validates a person's will and distributes their estate. There are different types of Indianapolis Indiana Financial Account Transfer to Living Trust, including the following: 1. Checking and savings accounts: By transferring these accounts to a living trust, individuals retain control over their funds during their lifetime, and upon their death, the trust beneficiaries receive immediate access to the assets. 2. Investment accounts: Transferring investment accounts to a living trust allows individuals to maintain control over their investments and make changes as needed. Additionally, this type of transfer ensures that investment assets are distributed according to the trust's terms, reducing the potential for disputes or delays. 3. Retirement accounts: While it is generally not recommended to transfer retirement accounts like IRAs or 401(k)s directly to a living trust, individuals can name the trust as the beneficiary of these accounts. This approach allows for the seamless distribution and control of retirement assets while maximizing tax advantages. 4. Brokerage accounts: Similar to investment accounts, transferring brokerage accounts to a living trust streamlines the distribution process upon the account owner's death while allowing for continued management and control during their lifetime. The process of transferring financial accounts to a living trust involves contacting each financial institution and completing the necessary paperwork. This typically includes providing the trust's name, the trustee's information, and the account details. Once the transfer is complete, the financial accounts will be titled in the name of the living trust. Overall, Indianapolis Indiana Financial Account Transfer to Living Trust offers numerous benefits, such as asset protection, privacy, and efficient wealth distribution. It is advisable to consult with an estate planning attorney or financial advisor to ensure that the transfer is done correctly and aligns with individual's overall estate planning goals and objectives.Indianapolis Indiana Financial Account Transfer to Living Trust is a legal process that allows individuals to transfer their financial accounts to a living trust in Indianapolis, Indiana. This type of transfer ensures that the funds, assets, and investments held in the financial accounts are governed by the terms and conditions outlined in the individual's living trust. A living trust is a legal document that specifies the distribution of a person's assets during their lifetime and upon their death. By transferring financial accounts to a living trust, individuals can ensure a seamless transition of their wealth and avoid probate, a legal process that validates a person's will and distributes their estate. There are different types of Indianapolis Indiana Financial Account Transfer to Living Trust, including the following: 1. Checking and savings accounts: By transferring these accounts to a living trust, individuals retain control over their funds during their lifetime, and upon their death, the trust beneficiaries receive immediate access to the assets. 2. Investment accounts: Transferring investment accounts to a living trust allows individuals to maintain control over their investments and make changes as needed. Additionally, this type of transfer ensures that investment assets are distributed according to the trust's terms, reducing the potential for disputes or delays. 3. Retirement accounts: While it is generally not recommended to transfer retirement accounts like IRAs or 401(k)s directly to a living trust, individuals can name the trust as the beneficiary of these accounts. This approach allows for the seamless distribution and control of retirement assets while maximizing tax advantages. 4. Brokerage accounts: Similar to investment accounts, transferring brokerage accounts to a living trust streamlines the distribution process upon the account owner's death while allowing for continued management and control during their lifetime. The process of transferring financial accounts to a living trust involves contacting each financial institution and completing the necessary paperwork. This typically includes providing the trust's name, the trustee's information, and the account details. Once the transfer is complete, the financial accounts will be titled in the name of the living trust. Overall, Indianapolis Indiana Financial Account Transfer to Living Trust offers numerous benefits, such as asset protection, privacy, and efficient wealth distribution. It is advisable to consult with an estate planning attorney or financial advisor to ensure that the transfer is done correctly and aligns with individual's overall estate planning goals and objectives.