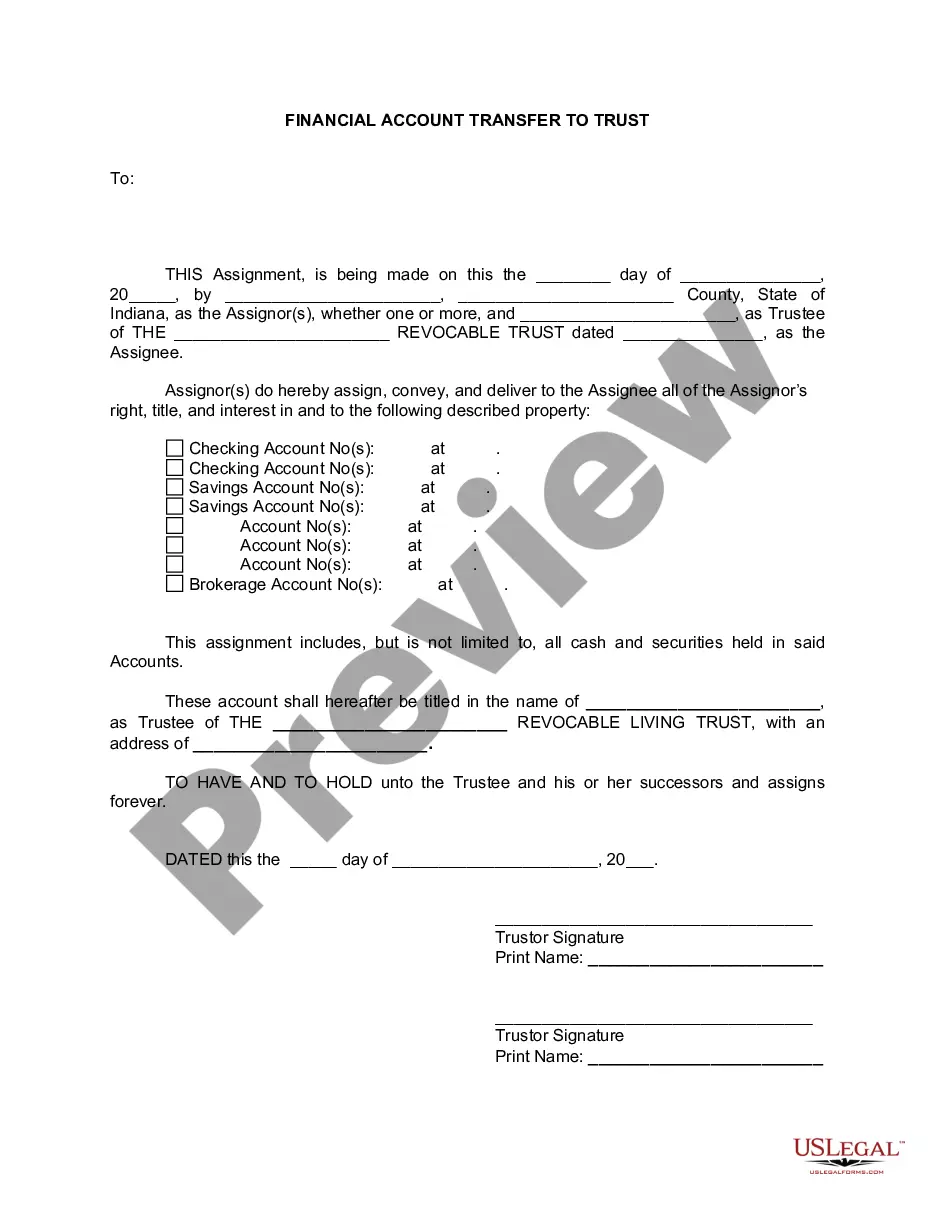

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

South Bend Indiana Financial Account Transfer to Living Trust: When it comes to estate planning and ensuring the smooth transfer of assets, South Bend, Indiana residents often consider setting up a Living Trust. One important aspect of this process is the transfer of financial accounts to the trust, which allows for easier management and distribution of these assets. A Financial Account Transfer to Living Trust in South Bend, Indiana involves transferring ownership of various financial accounts, such as bank accounts, investment accounts, retirement accounts, and other assets, from an individual's name to the name of their established Living Trust. Through this process, the individual, also known as the granter or trust or, ensures that these financial accounts are held and managed by the trust, with clear instructions on who should benefit from them now and in the future. It allows for seamless administration of assets and streamlines the distribution process upon the granter's passing, avoiding the need for probate court involvement. Different types of South Bend Indiana Financial Account Transfer to Living Trust include: 1. Bank Account Transfer to Living Trust: This involves transferring ownership of various banking and deposit accounts, such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), to the Living Trust. 2. Investment Account Transfer to Living Trust: This type of transfer includes moving ownership of investment accounts, such as brokerage accounts, stocks, bonds, mutual funds, and exchange-traded funds (ETFs), into the Living Trust. 3. Retirement Account Transfer to Living Trust: Individuals with retirement accounts, including IRAs (Individual Retirement Accounts) and 401(k)s, may choose to transfer these accounts to their Living Trust, allowing for more control and efficient distribution of these assets. 4. Real Estate Property Transfer to Living Trust: While not directly a financial account transfer, it's worth mentioning that individuals can also transfer ownership of real estate properties, such as homes, rental properties, or vacant land, to their Living Trust. This ensures that the trust manages and distributes these properties according to the granter's wishes. In summary, a South Bend Indiana Financial Account Transfer to Living Trust involves moving various financial accounts to an established Living Trust, including bank accounts, investment accounts, retirement accounts, and potentially real estate properties. By undergoing this transfer process, individuals can ensure efficient management and distribution of their assets while avoiding probate and providing for their loved ones in the future.South Bend Indiana Financial Account Transfer to Living Trust: When it comes to estate planning and ensuring the smooth transfer of assets, South Bend, Indiana residents often consider setting up a Living Trust. One important aspect of this process is the transfer of financial accounts to the trust, which allows for easier management and distribution of these assets. A Financial Account Transfer to Living Trust in South Bend, Indiana involves transferring ownership of various financial accounts, such as bank accounts, investment accounts, retirement accounts, and other assets, from an individual's name to the name of their established Living Trust. Through this process, the individual, also known as the granter or trust or, ensures that these financial accounts are held and managed by the trust, with clear instructions on who should benefit from them now and in the future. It allows for seamless administration of assets and streamlines the distribution process upon the granter's passing, avoiding the need for probate court involvement. Different types of South Bend Indiana Financial Account Transfer to Living Trust include: 1. Bank Account Transfer to Living Trust: This involves transferring ownership of various banking and deposit accounts, such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), to the Living Trust. 2. Investment Account Transfer to Living Trust: This type of transfer includes moving ownership of investment accounts, such as brokerage accounts, stocks, bonds, mutual funds, and exchange-traded funds (ETFs), into the Living Trust. 3. Retirement Account Transfer to Living Trust: Individuals with retirement accounts, including IRAs (Individual Retirement Accounts) and 401(k)s, may choose to transfer these accounts to their Living Trust, allowing for more control and efficient distribution of these assets. 4. Real Estate Property Transfer to Living Trust: While not directly a financial account transfer, it's worth mentioning that individuals can also transfer ownership of real estate properties, such as homes, rental properties, or vacant land, to their Living Trust. This ensures that the trust manages and distributes these properties according to the granter's wishes. In summary, a South Bend Indiana Financial Account Transfer to Living Trust involves moving various financial accounts to an established Living Trust, including bank accounts, investment accounts, retirement accounts, and potentially real estate properties. By undergoing this transfer process, individuals can ensure efficient management and distribution of their assets while avoiding probate and providing for their loved ones in the future.