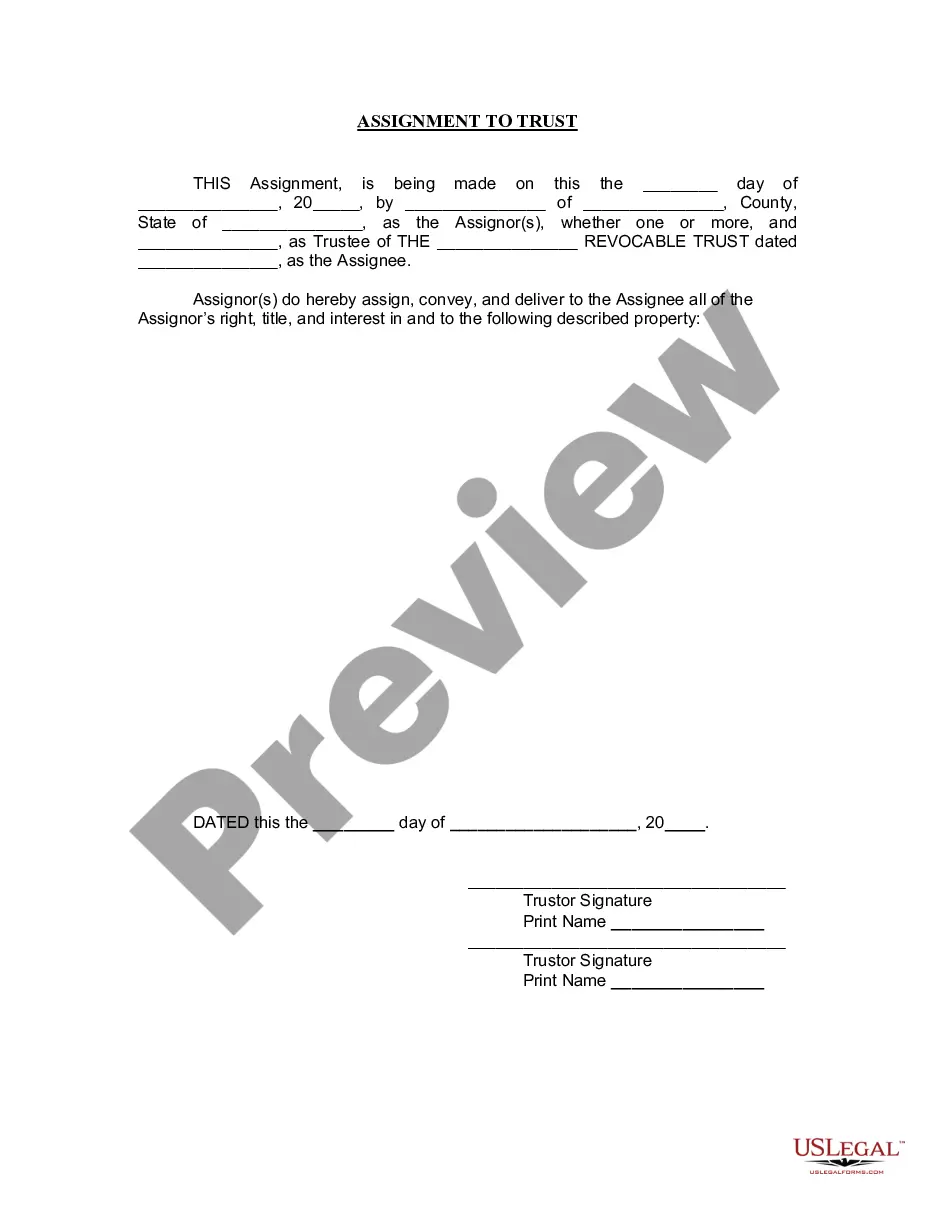

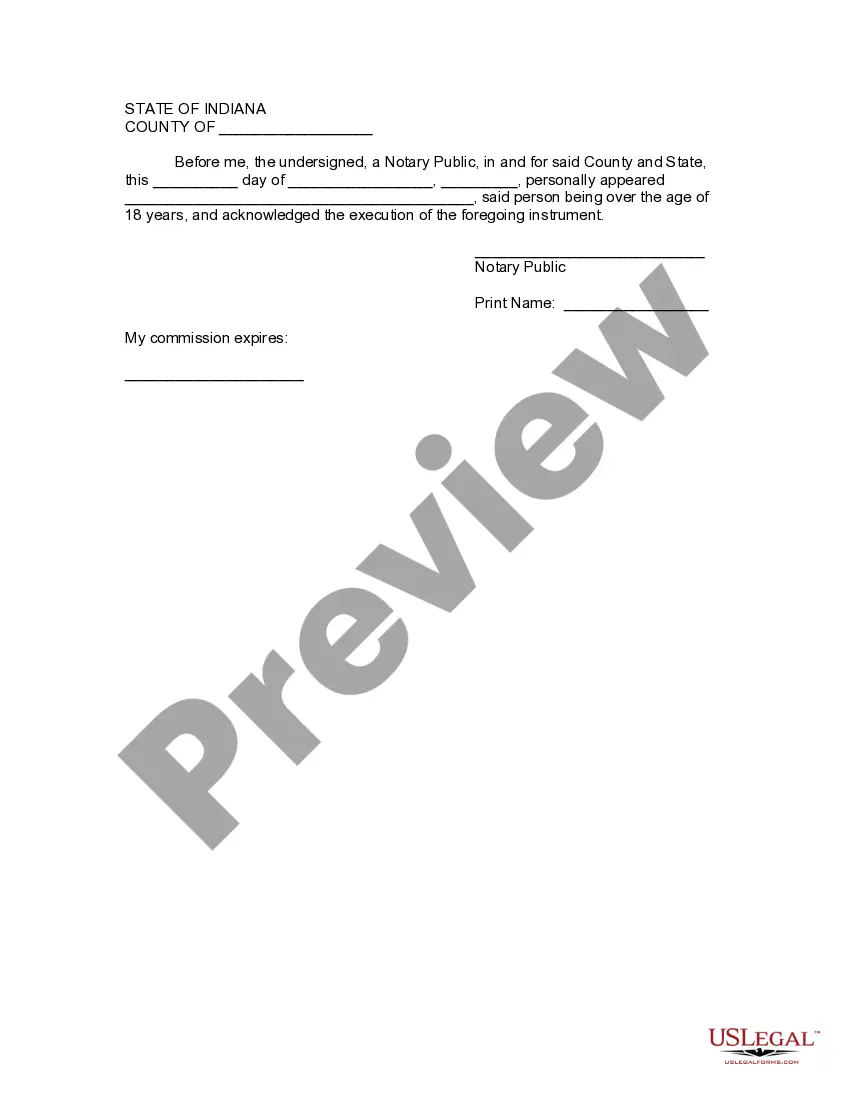

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

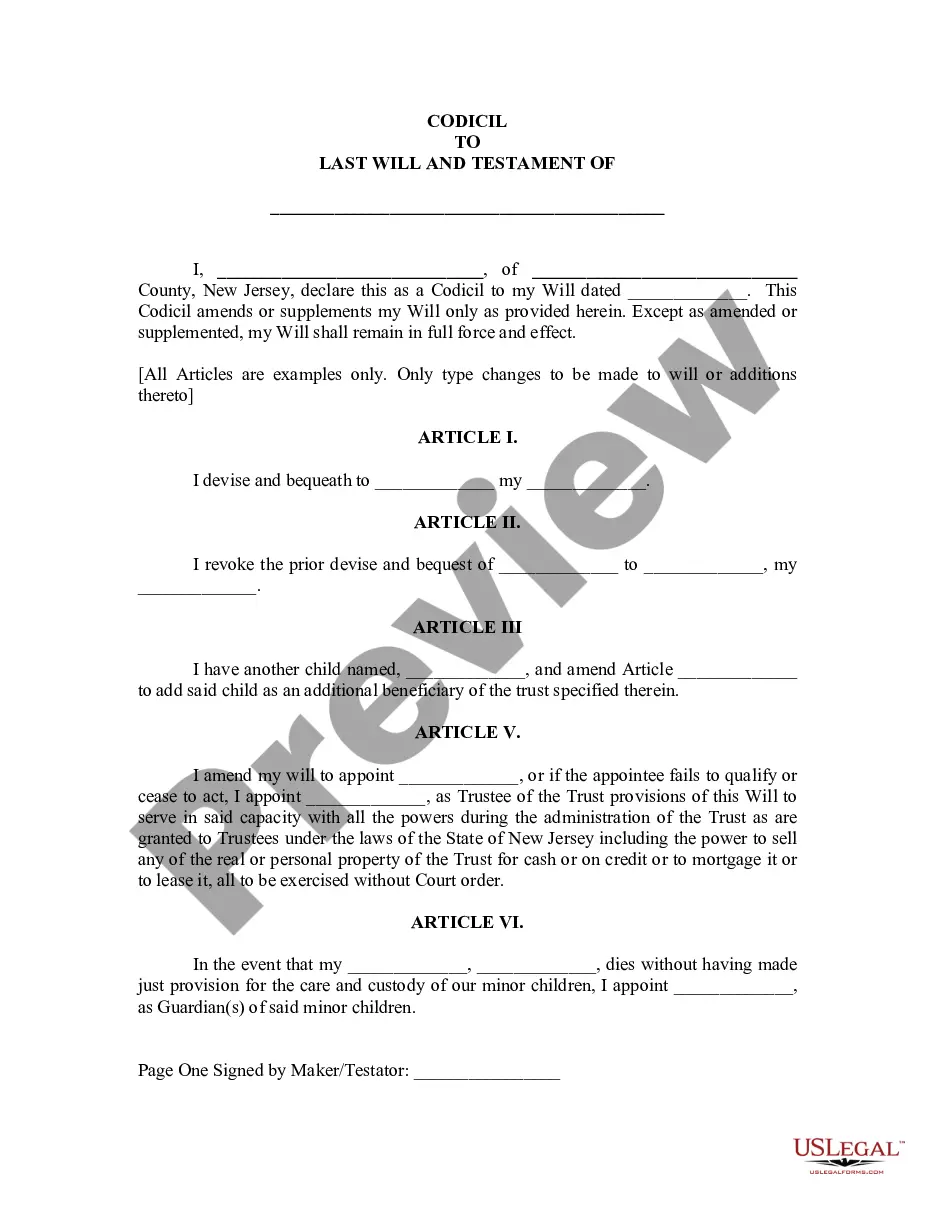

Carmel Indiana Assignment to Living Trust is a legal process that allows individuals to transfer ownership of their assets and properties into a trust, thereby preserving their assets and controlling their distribution even after their demise. This type of trust is often created as part of estate planning and helps individuals ensure the smooth transfer of their assets to their chosen beneficiaries. In Carmel, Indiana, there are two main types of living trusts commonly utilized for assignment purposes: revocable living trusts and irrevocable living trusts. 1. Revocable Living Trust: A revocable living trust is the most common type of trust used in Carmel, Indiana for assignment to living trusts. With a revocable trust, the trust creator (also known as the granter or settler) retains complete control and ownership over the assets transferred to the trust during their lifetime. The granter can modify or revoke the trust at any time, making it a flexible option. 2. Irrevocable Living Trust: Irrevocable living trusts in Carmel, Indiana offer advanced estate planning benefits. Once the assets are assigned to this type of trust, the granter relinquishes all control and ownership rights over the assets. As a result, these assets are protected from estate taxes, creditors, and potential lawsuits. The process of assigning assets to a living trust in Carmel, Indiana involves several key steps. First, the granter must create the trust document, either with the assistance of an attorney or using a trust creation software. The trust document outlines the terms, conditions, and beneficiaries of the trust. Next, the granter must transfer the ownership of assets into the trust's name. This may involve re-titling real estate properties, vehicles, financial accounts, and other valuable assets. It is crucial to ensure that all necessary paperwork is completed, such as deed transfers, bank account re-registrations, and beneficiary designations. Once the assets are successfully assigned to the living trust, the granter can enjoy benefits such as avoiding probate, maintaining privacy, minimizing estate taxes, and ensuring a seamless transfer of assets to beneficiaries. Additionally, if the granter becomes incapacitated, the living trust can provide a successor trustee to manage and distribute assets according to their wishes, avoiding the need for a court-appointed conservatorship. Carmel Indiana Assignment to Living Trust offers individuals the peace of mind knowing their assets are protected and will be distributed according to their wishes. It is crucial to consult with a qualified attorney or estate planning professional to understand the specific laws and regulations regarding trust assignments in Carmel, Indiana, and to tailor the trust to one's unique needs and goals.