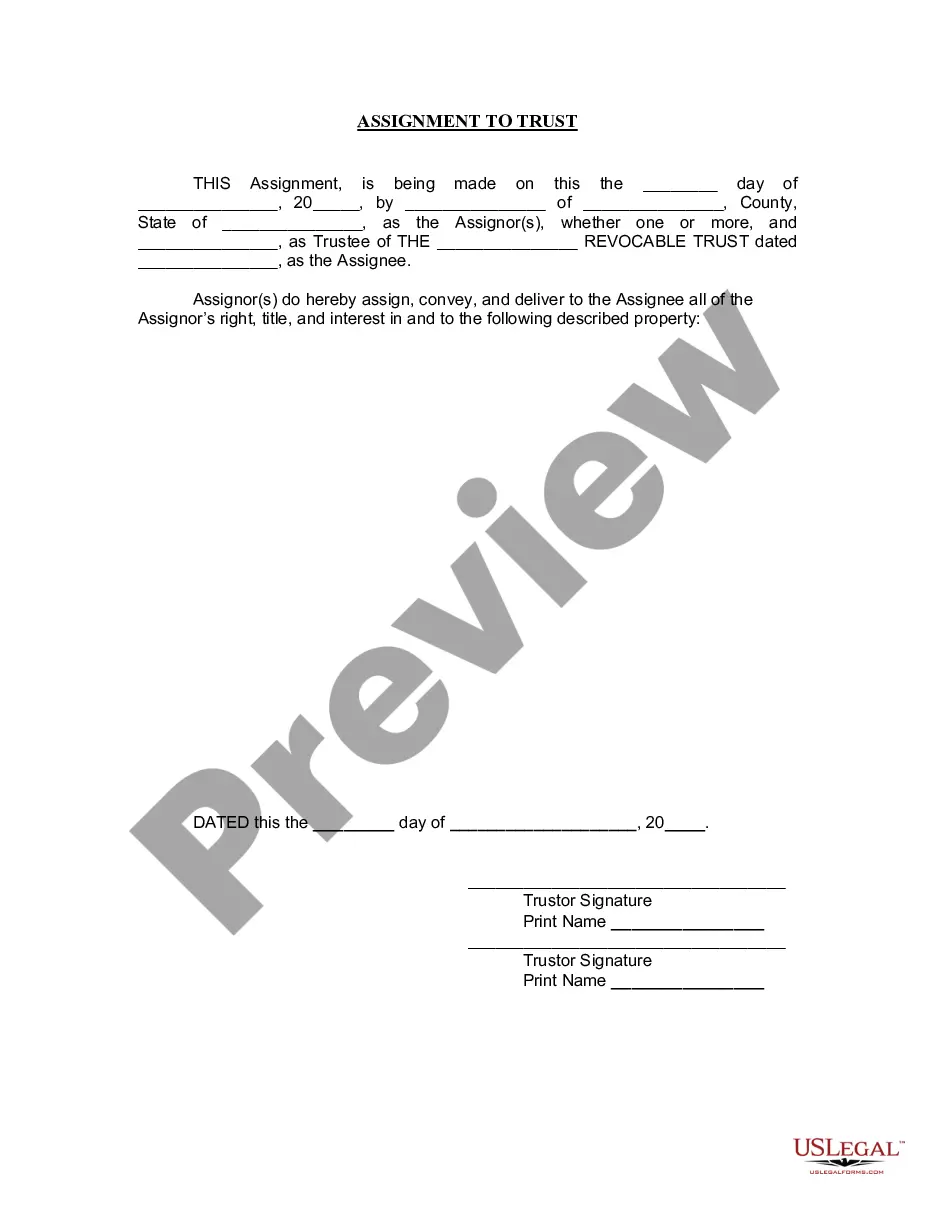

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Evansville Indiana Assignment to Living Trust is a legal process that involves transferring ownership and assets to a trust in order to ensure proper estate planning and asset management. A living trust, also known as a revocable trust, is a popular option for individuals residing in Evansville, Indiana, as it offers flexible and comprehensive solutions for preserving assets and enhancing the efficiency of the estate administration process. The assignment to living trust in Evansville, Indiana, allows individuals to designate the beneficiaries who will receive their assets upon their passing, while also providing them with control over their assets during their lifetime. By establishing a living trust, residents of Evansville can avoid probate, a time-consuming and costly legal process of distributing assets after death. There are various types of Evansville Indiana Assignment to Living Trust, tailored to meet different needs and preferences. Some common types include: 1. Revocable Living Trust: This type of trust allows the settler, the person establishing the trust, to make changes or revoke the trust during their lifetime. It provides flexibility and control over the assets held in the trust. 2. Irrevocable Living Trust: Unlike the revocable living trust, an irrevocable living trust cannot be modified or revoked by the settler once it has been established. This type of trust offers certain tax advantages and asset protection benefits, making it an attractive option for some individuals. 3. Testamentary Trust: This type of trust is created through a will and goes into effect upon the death of the individual. It allows individuals to specify how their assets will be distributed and managed after their passing, providing a useful tool for estate planning in Evansville, Indiana. 4. Special Needs Trust: This trust is designed to provide for the care and support of an individual with special needs or disabilities. It ensures that the individual's eligibility for government benefits is maintained while also providing financial support and asset management. 5. Charitable Remainder Trust: Individuals with philanthropic goals can establish a charitable remainder trust to support their favorite charitable causes while receiving income during their lifetime. This type of trust allows individuals to enjoy tax benefits while providing for their chosen charities. In conclusion, Evansville Indiana Assignment to Living Trust offers residents various options to efficiently manage and control their assets during their lifetime and after their passing. Depending on individual circumstances and goals, different types of living trusts can be established to ensure proper estate planning, asset protection, and support for charitable causes. Seeking the guidance of a qualified attorney specializing in estate planning and trust formation is essential to ensure the trust is properly established and meets the specific needs of individuals residing in Evansville, Indiana.