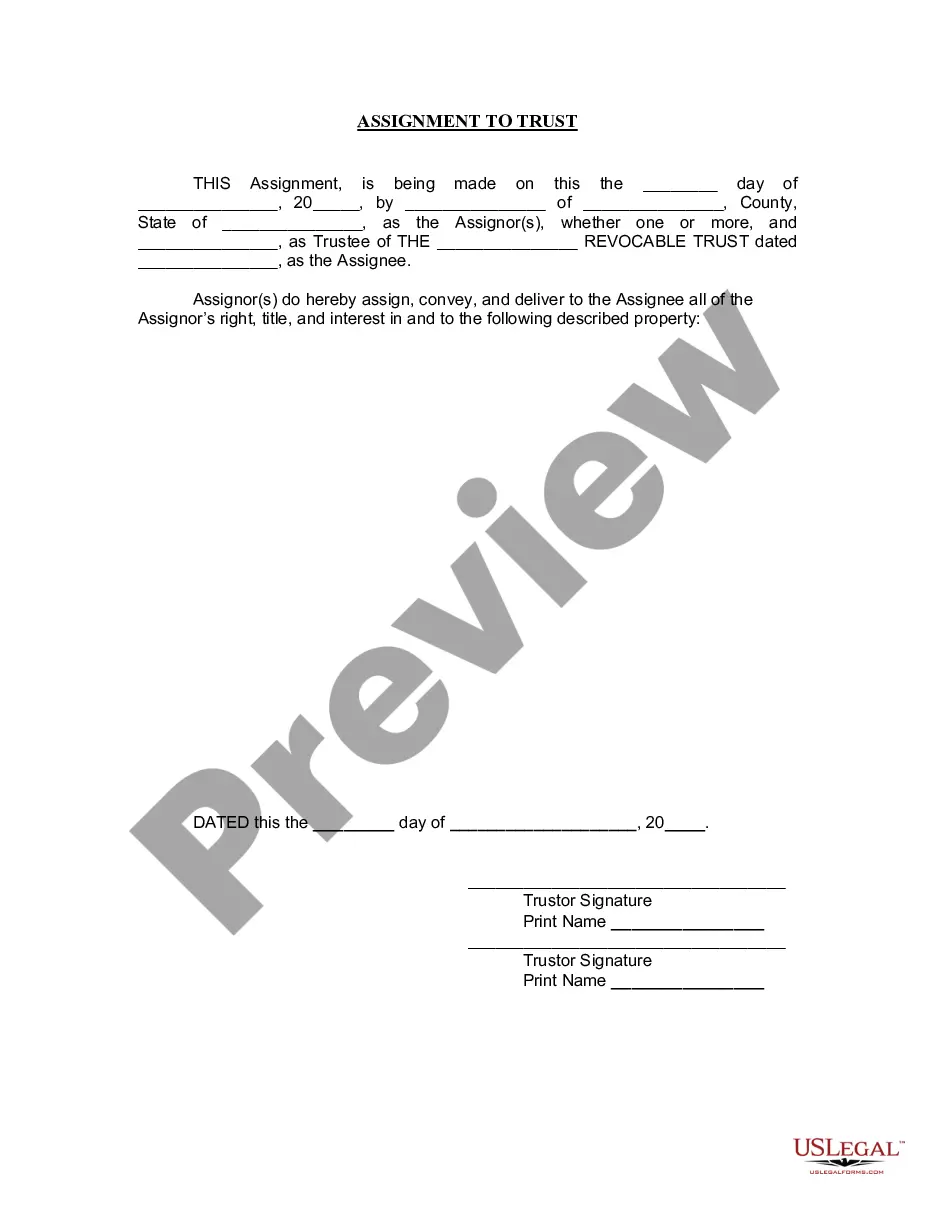

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Fort Wayne Indiana Assignment to Living Trust

Description

How to fill out Indiana Assignment To Living Trust?

In case you have previously employed our service, Log In to your account and download the Fort Wayne Indiana Assignment to Living Trust onto your device by clicking the Download button. Confirm that your subscription is active. If not, renew it according to your payment arrangement.

If this marks your initial experience with our service, adhere to these straightforward steps to acquire your document.

You will have ongoing access to every document you've purchased: you can locate it in your profile under the My documents menu whenever you wish to access it again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or business requirements!

- Make sure you've found the correct document. Review the description and utilize the Preview option, if available, to verify if it suits your needs. If it isn't suitable, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Receive your Fort Wayne Indiana Assignment to Living Trust. Choose the file format for your document and download it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Creating a Fort Wayne Indiana Assignment to Living Trust involves a few key requirements. First, the trust must have a valid purpose that complies with state laws. Additionally, you need to designate a trustee, who will manage the assets in the trust, and beneficiaries who will receive them. Finally, it’s essential to properly fund the trust by transferring assets into it, ensuring your wishes are honored in the future.

Deciding whether to place assets in a trust is a significant choice that depends on your family's unique situation. The Fort Wayne Indiana Assignment to Living Trust can provide many benefits, such as asset protection and streamlined transfer upon death. However, it's crucial for your parents to assess their financial goals and discuss their options with you. Engaging with a knowledgeable professional can provide insight into whether a trust is the right fit for your family, ensuring everyone understands the benefits and responsibilities involved.

Some negative aspects of trust funds include potential tax liabilities and restrictions on asset distribution. For instance, trust funds associated with the Fort Wayne Indiana Assignment to Living Trust may create tax situations that require careful planning. Furthermore, if the terms of the trust are too rigid, beneficiaries might face delays in receiving their share, which can lead to frustration. It is essential to structure your trust carefully to minimize these issues, and legal assistance can help ensure that your trust aligns with your expectations.

A significant downside of placing assets in a trust involves the costs associated with establishing and maintaining it. For example, the Fort Wayne Indiana Assignment to Living Trust may incur legal fees and ongoing administrative costs. Moreover, once assets are transferred to the trust, you may lose direct control over them. This loss can be concerning for individuals who prefer to manage their assets independently. Consulting with a specialist can help you make an informed decision.

While a family trust offers many advantages, one notable disadvantage is the potential for limited access to funds during your lifetime. If you set up a Fort Wayne Indiana Assignment to Living Trust, you may restrict your access to certain assets, which can be challenging if unexpected expenses arise. Additionally, family trusts can involve complex legal requirements, making management and administration cumbersome without proper advice. Working with legal professionals can clarify challenges and streamline the process.

One of the most significant mistakes parents often make when creating a trust fund is failing to communicate their intentions with their family. When parents do not involve their children in discussions about the Fort Wayne Indiana Assignment to Living Trust, it can lead to misunderstandings and conflicts later. Ensure that your family understands the purpose of the trust and its benefits to avoid confusion. Consider seeking guidance from a professional who can help convey these points clearly.

Assets are moved into a trust by officially changing their titles to the name of the trust. This step often requires paperwork specific to each asset type, such as deeds for real property or beneficiary forms for financial accounts. It’s important to complete these tasks accurately to establish your Fort Wayne Indiana Assignment to Living Trust correctly. Consider using uslegalforms to ensure you have all necessary documentation.

Transferring items to a trust involves formally changing the ownership of those items to the trust. For tangible items, like jewelry or collectibles, you can create a list identifying each item and sign it. For real estate, you would execute a deed transferring the property to your Fort Wayne Indiana Assignment to Living Trust. Using platforms like uslegalforms can help create proper documentation for smooth ownership changes.

To make an addendum to a living trust, first, identify the changes you want to incorporate. You can draft an amendment document, clearly stating what parts of the original trust are being altered. Additionally, it's advisable to consult with a professional or use a platform like uslegalforms to ensure your changes adhere to the rules of your Fort Wayne Indiana Assignment to Living Trust.

Transferring assets into a trust requires changing the title of those assets to the trust's name. This process varies depending on the asset type. For example, you may need to re-title your property deed or update your bank account information. Using a service like uslegalforms can simplify this process while ensuring a smooth transfer into your Fort Wayne Indiana Assignment to Living Trust.